UK Jobs report overview

Early Tuesday, the UK’s Office for National Statistics (ONS) will release the April month Claimant Count figures together with the Unemployment Rate in the three months to March January at 06:00 AM GMT. Although doubts over the UK’s unlock deadline and Indian variant of covid tests GBP/USD bulls, fears of easing employment optimism pose downside risk to the quote.

Also increasing the importance of today’s UK data is testimony by the Bank of England (BOE) policymakers before the House of Lords Economic Affairs Committee for a hearing on QE, beginning at 3:00 PM BST.

The UK labor market report is expected to show that the average weekly earnings, including bonuses, in the three months to March, grew from the previous 4.5% to 4.6%, while ex-bonuses, the wages are seen improving from 4.4% to 4.6% during the stated period.

Further, the ILO Unemployment Rate favors upbeat signals of the employment data as forecasts suggest sustained weakness from 5.1% during the three months ending in December to 4.9% for the period ended in March. On the contrary, the Claimant Count Change figures are expected to have jumped from 10.1K previous readouts to 25.6K.

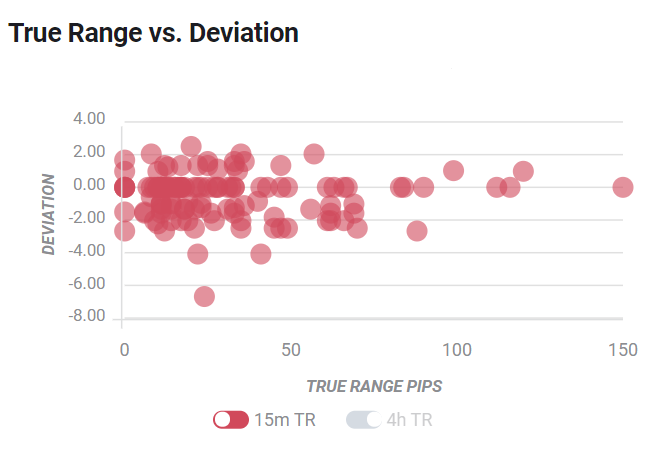

Deviation impact on GBP/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined around 20-pips in deviations up to + or -2, although in some cases, if notable enough, a deviation can fuel movements over 60-70 pips.

How could they affect GBP/USD?

GBP/USD remains bid around the three-month top, up 0.28% intraday near 1.4175, while heading into Tuesday’s London open. In doing so, the cable pair cheers the broad US dollar weakness despite concerns over the Indian strain of the coronavirus (COVID-19), Brexit and chatters concerning a delay in the unlock deadline of June 21.

Although Unemployment Rate is expected to match the BOE forecast of 4.9%, a jump in the Claimant Count Change and negative impacts of the furlough scheme may test GBP/USD bulls on data release. It should, however, be noted that the vaccine optimism in the UK and the economic pick-up can keep favoring the sterling buyers, except for extreme disappointment.

Technically, the GBP/USD pair’s sustained run-up beyond 1.4165, comprising the previous high of the month, needs to cross the February 25 high of 1.4182, as well as the 1.4200 to direct the buyers towards 1.4240-45 resistance confluence, including yearly top and monthly rising trend line.

Key notes

GBP/USD moves to a fresh high in pursuit of the 1.42 area

GBP/USD Forecast: UK reopenings underpin the pound

About UK jobs

The UK Average Earnings released by the Office for National Statistics (ONS) is a key short-term indicator of how levels of pay are changing within the UK economy. Generally speaking, the positive earnings growth anticipates positive (or bullish) for the GBP, whereas a low reading is seen as negative (or bearish).