The German IFO Business Survey Overview

The German IFO survey for July will drop in at 0800 GMT this Monday. The headline IFO Business Climate Index is expected to rise to 102.1 versus 101.8 previous.

The Current Assessment sub-index is envisioned at 101.6 this month vs. June’s 99.6 while the IFO Expectations Index – indicating firms’ projections for the next six months – is likely to arrive at 103.3 in the reported month vs. 104.0 prior.

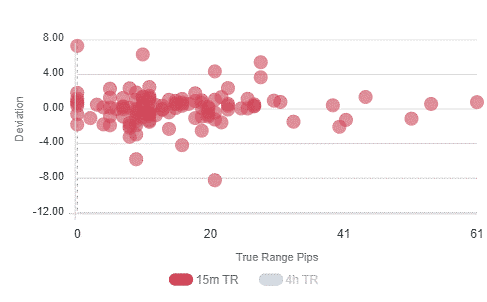

Deviation impact on EUR/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined between 3 and 30 pips in deviations up to 3.0 to -4.2, although in some cases, if notable enough, a deviation can fuel movements of up to 60 pips.

How could affect EUR/USD?

EUR/USD is defending minor bids near 1.1775, off the daily highs of 1.1785 reached in the last hour. The sentiment around the euro is underpinned by the falling US Treasury yields amid a downbeat market mood. The spot remains directed towards 1.1800, as traders remain hopeful of an upbeat headline figure.

The main currency pair faces immediate resistance at the 1.1775 – daily highs, above which the 1.1800 round number could be challenged. Alternatively, disappointing data could knock off EUR/USD back towards the multi-month lows near 1.1750. If the sellers remain in control, then a test of the 1.1700 level remains inevitable.

Key notes

EUR/USD: Daily recommendations on major

No new signals expected at FOMC meeting on Wednesday

EUR/USD Forecast: Weakness to persists ahead of Fed

About the German IFO Business Climate

This German business sentiment index released by the CESifo Group is closely watched as an early indicator of current conditions and business expectations in Germany. The Institute surveys more than 7,000 enterprises on their assessment of the business situation and their short-term planning. The positive economic growth anticipates bullish movements for the EUR, while a low reading is seen as negative (or bearish).