The German IFO Business Survey Overview

The German IFO survey for June is due for release later today at 0800 GMT. The headline IFO Business Climate Index is seen higher at 100.6 versus 99.2 previous.

The Current Assessment sub-index is expected to rise to 97.8 this month vs. 95.7 prior while the IFO Expectations Index – indicating firms’ projections for the next six months – is likely to arrive at 103.9 in the reported month vs. 102.9 last.

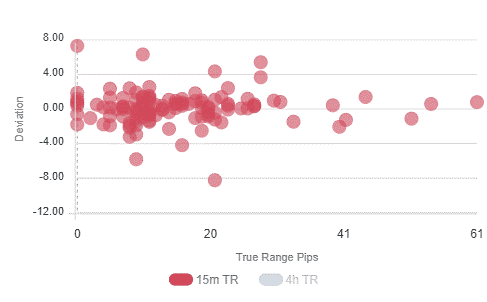

Deviation impact on EUR/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined between 3 and 30 pips in deviations up to 3.0 to -4.2, although in some cases, if notable enough, a deviation can fuel movements of up to 60 pips.

How could affect EUR/USD?

EUR/USD holds steady below 1.1950 ahead of the German data, undermined by a buoyant US dollar across the board. The spot consolidates the retreat from four-day highs of 1.1970 reached a day before.

The spot faces immediate resistance at the 1.1950 psychological level, above which Wednesday’s high will get tested. Alternatively, disappointing data could resume the corrective pullback towards 1.1900. If the selling pressure intensifies then the daily classic support at 1.1876 will come into play.

Key notes

Forex Today: Dollar’s demand resurfaces ahead of key US data, BOE set for a hawkish tilt?

EUR/USD remains depressed below 1.1950 on firmer USD, German data eyed

About the German IFO Business Climate

This German business sentiment index released by the CESifo Group is closely watched as an early indicator of current conditions and business expectations in Germany. The Institute surveys more than 7,000 enterprises on their assessment of the business situation and their short-term planning. The positive economic growth anticipates bullish movements for the EUR, while a low reading is seen as negative (or bearish).