The first indicator of issues is the TradeSimple domain. Typically, domains containing .org, .gov, .edu, and similar abbreviations are used for government and non-government organizations. Yet, here we have a broker using the said domain.

Furthermore, the company lacks transparency and provides much misguiding information. Our detailed TradeSimple review elaborated on all the red flags. Let’s begin.

In top of that, we seriously recommend you not to invest in the fake brokersAF Group,FutureProfit, andEuroInvestec.Do not trade with these unlicensed brokers if you want to save your money!

| Broker status: | Unregulated Broker |

| Regulated by: | Unlicensed Scam Brokerage |

| Scammers Websites: | tradesimple.org |

| Blacklisted as a Scam by: | N/A |

| Owned by: | Apollo MS Ltd |

| Headquarters Country: | UK (allegedly) |

| Foundation year: | 2022 |

| Supported Platforms: | N/A |

| Minimum Deposit: | 250 USD |

| Cryptocurrencies: | Available |

| Types of Assets: | Forex, commodities, indices, shares, cryptocurrencies |

| Maximum Leverage: | N/A |

| Free Demo Account: | No |

| Accepts US clients: | No |

Is TradeSimple a Regulated Broker?

TradeSimple claims to be a brand owned by Apollo MS Ltd, registered in London, UK. While this may be true, as such a company exists, here’s the issue. The firm entered the House of Companies register on the 13th of January this year. The nature of the business is registered as public relations and communication activities, advertising agencies, and media representation services.

None of the aforementioned businesses matches the company’s actual operations – providing Forex and CFD trading. For such activity, the firm would need an FCA license. And according to our research, it doesn’t have one.

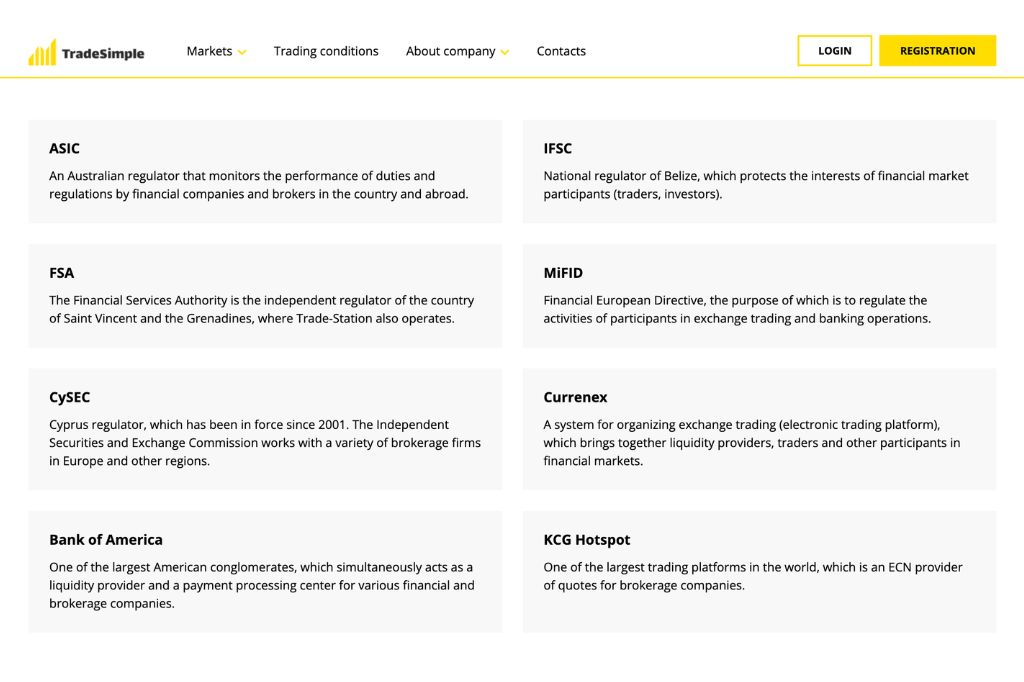

Additionally, this company falsely claims to hold licenses with ASIC, IFSC, FSA, Bank of America, and CySEC and to follow MiFID rules. FSA of SVG and Bank of America don’t issue licenses for Forex and CFD trading brokers, so it’s clear that this is a notorious lie. Upon checking the rest of the databases, we found nothing about TradeSimple.

Reasons Not to Trust an Unlicensed Broker

Unlicensed brokers often misguide their users by providing partial information or no details at all. Here, we have a broker that registered its business but didn’t apply to provide financial services. Thus, nobody directed them to obtain an FCA license.

The Financial Conduct Authority requires UK-based brokers to have minimal operational capital of 730,000 GBP and to participate in the Compensation Scheme fund with 85,000 GBP per trader. Since TradeSimple didn’t get a license, it doesn’t need to follow these rules. Therefore, you will have no right to be reimbursed.

Is TradeSimple a Legit Broker or a Scam?

TradeSimple claims to be a UK-based brokerage. Despite false claims, it has no FCA license, and there are no proofs for the claim. Combined with negative reviews, false claims strongly indicate that the broker cannot be trusted.

What Do Traders Think About TradeSimple?

TradeSimple doesn’t have traders’ trust. According to reviews, the company has scammed numerous customers and refused to approve any withdrawal requests. As per our knowledge, clients were tricked into investing thousands of dollars, and the firm blocked their access to the trading account and money.

Dealing with phony brokers always constitutes certain risks. To avoid them, the best is to find a regulated firm that follows regulatory guidelines.

TradeSimple Trading Platform – Available Trade Software

If you try registering an account with this bogus broker, you’ll see an error. There are many technical issues, making the registration and trading process far from simple. Unlike its name suggests, this firm does everything to complicate things.

According to the website, clients can get access to a WebTrader. Due to the aforementioned error, we’re unable to confirm it.

We see no reason to waste your time with this company any further. Instead, you can find a legitimate brokerage offering reliable trading tools, such as MT4 or MT5.

TradeSimple Accounts Overview

The broker offers six account types, those being:

- Basic – $250

- Bronze – $5,000

- Silver – $10,000

- Gold – $50,000

- Platinum – $100,000

- Diamond – Contact the account manager

Besides the deposit, accounts differ in access to different assets, spreads, signals, and other educational materials.

Bonuses – Ways to Limit Withdrawals

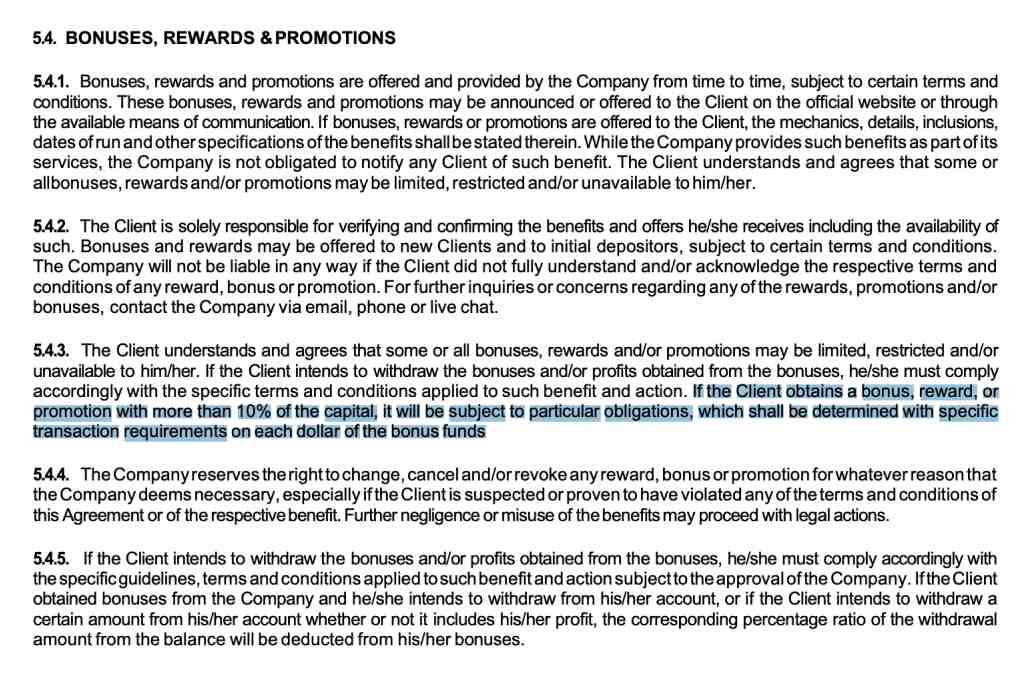

The broker offers bonuses, rewards, and promotions and advertises it as a benefit. If you read the T&C carefully, you’ll see the issue.

“If the Client obtains a bonus, reward, or promotion with more than 10% of the capital, it will be subject to particular obligations, which shall be determined with specific transaction requirements on each dollar of the bonus funds.”

Since nothing is specified, it’s probably expected from account managers to decide on terms in each particular case.

TradeSimple Broker – Countries Of Service

TradeSimple trading scam is mainly conducted in:

- UK

- Sweden

- Australia

- Canada

While these are not the only areas, they’re definitely suffering the highest monetary losses. We believe that the more people report fraud, the higher the chances of closing the website and recovering customers’ funds.

Also remember the names of theTradeBaionics,TrustGardenandMETAfmitrading scams and avoid them at all costs! Moreover, always check the background of online trading companies before investing!

TradeSimple Range of Trading Markets

While we’re unsure if any trading is possible with this technically disabled platform, here’s the overview we got from the broker’s website. Clients can invest in:

- Currency pairs – EUR/USD, GBP/CAD, USD/ILS

- Commodities – gold, natural gas, palladium

- Indices – Dow Jones, S&P500, CAC40

- Shares – Alibaba, Adidas, Bank of America

- Cryptocurrencies – BTC, LTC, USDT

What Is Known About TradeSimple’s Trading Conditions?

It’s impossible to speculate on trading conditions without access to the platform. The broker’s website is not transparent enough to disclose important things, such as leverage and spread. On the other hand, without seeing the assets, we cannot comment.

Whatever is on offer, it’s worth noting due to the broker’s unregulated status.

TradeSimple Minimum Deposit and Withdrawal Terms

The minimum deposit with TradeSimple broker is $250. Since most regulated firms allow customers to start with $100 or less, this is unfavorable.

When it comes to withdrawals, we know virtually nothing. The T&C explains withdrawal as profit, funds, and/or money transacted or taken from clients’ accounts. Yet terms remain uncovered.

Payment methods are not disclosed either. You should decline the offer if you’re asked to deposit your funds using any suspicious method, such as crypto. Otherwise, recovering your funds may be quite a challenge.

Scammed by TradeSimple Broker? – Let Us Hear Your Story

If you or someone close to you has been scammed by TradeSimple, ensure to report it. Our recovery specialists may assist you with the refund.

Instead of letting scammers run with your hard-earned money, get in touch. Our vast experience may be helpful for successful dispute resolution. Book a free consultation and let’s start the process!