Review 101Investing

https://www.101investing.com/ Headquarters in Cyprus Open Demo Account Open Live Account BEGIN item ContentsPros and ConsCrypto ProductsBankingEducationConclusion

https://www.101investing.com/ Headquarters in Cyprus Open Demo Account Open Live Account BEGIN item ContentsPros and ConsCrypto ProductsBankingEducationConclusion

Quick Look

Cryptocurrencies are the latest as set to become available to traders all around the world, and these digital assets are changing the face of investing and trading. One downside to cryptocurrencies is the fairly complex nature of holding, transferring, and trading them. In the past, hundreds of millions in cryptocurrencies have been stolen from various exchanges by hackers. That is created concerns about the cryptocurrency exchanges, which are unregulated and present uncertain security for their clients.

Fortunately investors can sidestep the complexity of cryptocurrencies and the dangers of the cryptocurrency exchanges. Existing brokers like 101investing now offer CFDs on cryptocurrencies, making the act of trading these assets both easier accessible and more flexible for the average investor.

101investing is operated by FXBFI Broker Financial Invest Ltd, regulated by the Cyprus Securities and Exchange Commission under license number 315/16. To provide security of the covered clients for any claims arising from the failure of the company to fulfill its obligations the broker is also a member of the Investor Compensation Fund.

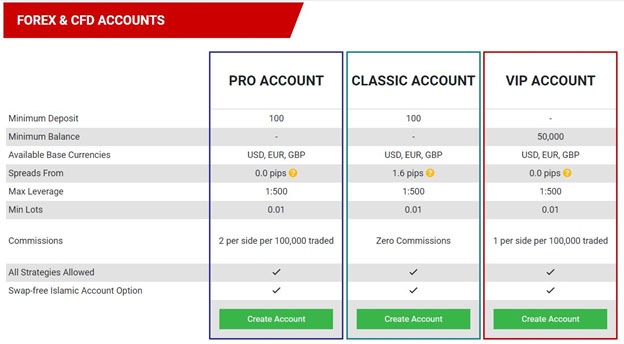

101investing offers its clients over 250+ CFD instruments, and as you can see from their landing page, they have embraced the new digital cryptocurrency assets as well. This allows clients to trade this new type of asset through CFDs within a flexible and transparent trading environment. There are four account tiers for clients to choose from, plus the broker offers Islamic swap free accounts as well as demo accounts.

Most traders will be happy to see MetaTrader 4 as the trading platform, since it is likely something any experienced trader has experience with. The award-winning MT4 platform is far more powerful in terms of both charting capabilities and order management than nearly all the cryptocurrency exchange platforms.

Clients are able to contact customer support via online form, live chat, or telephone on Mondays through Fridays from 09:00 to 23:00 GMT+3 and on weekends from 11:00 to 20:00 GMT+3.

101Investing.com Pros and Cons

Pros

Regulated brokerage for CFDs tradingWorld-class MetaTrader 4 platformMultiple account types and different deposit and withdrawal optionsExtensive educational material

Cons

U.S. citizens not accepted as clientsSpreads could be betterNo social trading availableNo daily market analysis provided

Cryptocurrency Products

It’s true that many of the dedicated cryptocurrency exchanges offer hundreds of cryptocurrency pairs, and hundreds of different cryptocurrencies, but how many traders really need access to cryptocurrencies that have little turnover and less liquidity?

At 101investing clients are able to trade CFDs on top, growing and liquid cryptocurrencies. Unlike less popular cryptocurrencies that have surged during that time larger digital assets have grown to the point that remain a choice for many investors. In the world of virtual currencies, fortunes tend to move up and down quickly. The market is dominated by high volatility above many other factors that can lead you to both market highs or high losses.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

Between 74-89 % of retail investor accounts lose money when trading CFDs.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Currently there are 13 different cryptocurrencies and 24 trading pairs to choose from. There is wide selection such us: CFDs on Bitcoin, Ethereum, Litecoin, Ripple, and many other popular cryptocurrencies. The larger coins, like Bitcoin, even have the option to trade against several fiat currencies. For example, Bitcoin has the following pairs:

BTC/USDBTC/EURBTC/GBP

That gives traders unparalleled flexibility when trading these digital currencies. And because there are no market hours for cryptocurrencies it’s possible to trade them 24 hours a day. Spreads are floating, and traders can take advantage of leverage up to 1:2 if they so choose.

Banking

101investing provides a variety of banking options for the convenience of clients. It’s possible to deposit or withdraw funds via credit/debit cards, eMerchantPay, SafeCharge, Worldpay, Skrill and others. Note that deposit/withdrawal methods can differ from country to country, and that some methods may charge withdrawal fees. There might also be transaction limits from some of the platforms.

Education

One of the strengths of 101investing is its educational materials. Even among brokers the educational portal is strong, and when you compare it with cryptocurrency brokers it is incredible since most cryptocurrency brokers have little to no educational material for traders. At 101investing you will find webinars, eBooks, video on demand, tutorials, and courses. One thing we miss though is a daily market update highlighting potential trading opportunities. To make up for that there is a trading signals package available to clients if they choose.

In Conclusion

Those folks who are looking to trade cryptocurrencies, but have either been confused by the whole process, or worried about the security of the exchanges, now have an alternative and flexible solution. 101investing’s offering cryptocurrency CFDs not only simplifies accessibility to the CFD trading markets, it also makes it more attractive by providing traders with flexible features and services. 101investing operated by FXBFI Broker Financial Invest LTD, regulated company that follows current directives and guidelines. With a solid education center, easy banking, and a wide variety of cryptocurrency pairs to choose from there’s little reason not to choose 101investing as a CFD cryptocurrency broker.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

Between 74-89 % of retail investor accounts lose money when trading CFDs.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Open Demo AccountOpen Live Account END latest_news