Review The Investment Center

https://investmentcenter.com/ Headquarters in United Kingdom Open Live Account BEGIN item ContentsPros and ConsRegulationAccount TypesTrading PlatformsAvailable AssetsEducationCustomer ServiceConclusion

https://investmentcenter.com/ Headquarters in United Kingdom Open Live Account BEGIN item ContentsPros and ConsRegulationAccount TypesTrading PlatformsAvailable AssetsEducationCustomer ServiceConclusion

The Investment Center is no newcomer to the world of trading and CFDs. Established in 2001, this broker has nearly 2 decades of experience in the industry. Recently it has undergone a revitalization, focusing its business more tightly on the over 200 assets offered as CFDs. With offices located in the center of London, the broker brings a high degree of trust and reliability to its offerings.

The Investment Center Pros and Cons

Pros

Company is located in the United KingdomNearly 20 years experienceSolid proprietary trading platform

Cons

No regulationLimited research reports and asset analysis.U.S. residents not accepted as clients

Broker Regulation

While we would prefer that The Investment Center was regulated by the Financial Conduct Authority (FCA), that is unfortunately not the case. On the other hand, it is pretty certain that a broker with nearly 20 years experience in the financial industry is trustworthy and credible. Rather than worrying about regulation The Investment Center has been worrying about treating its clients right and building its reputation in the trading community.

The broker is also focused on the security of its clients and operations. The data is protected by full SSL encryption technology, which means all incoming and outgoing data is scrambled and unreadable by any outside parties. That ensures that client’s personal information and payment data is kept fully secured.

And while the broker is not regulated, it is still located in London, which provides more security for trader accounts than some dodgy offshore location. The company must still follow the laws of the United Kingdom and clients can feel free to drop by the broker offices at 71 High Holborn, London, United Kingdom.

In looking through the terms and conditions shown on the website it is clear that there is no malicious intent from the broker. There is nothing hidden and the broker keeps all its information clearly available and transparent. Brokers trying to scam their clients will hide important information, but The Investment Center makes all its information freely available for investigation.

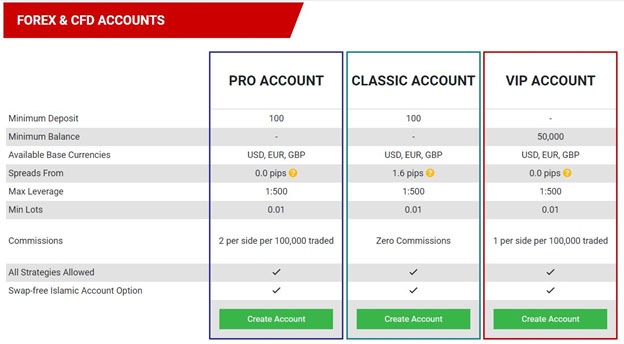

Account types

When it comes to account types The Investment Center follows the popular convention of CFD brokers to provide several levels or account tiers. Each higher tier grants additional privileges for the client, but also requires a larger investment. At The Investment Center clients can get started with a deposit that is as small as $250. And the conditions for even the lowest level account are quite generous.

Silver Account – Access to over 200 assets and market reviews, with a small minimum deposit of $250. A perfect basic starter account for any trader.

Gold Account – Intermediate level traders will likely want to upgrade to the Gold level account standard. It has a $10,000 minimum deposit, but also adds a dedicated account manager and increased leverage. Traders at this level also get partial access to the Trade Room analysis.

Platinum Account – Professional level traders will appreciate the Platinum account and should not have any problems meeting the $50,000 account minimum. Clients at the Platinum level have access to weekly webinars, special venture promotions, financial planning, and so much more.

VIP – VIP accounts are available by invitation only and include complete access to everything the broker has to offer.

Now you might think that you need to get to the highest account levels, but the truth is anyone can have a good trading experience at The Investment Center, even with the basic Silver level accounts. Of course if you continue trading with the broker and have a winning track record you can expect to upgrade naturally as your account grows in size. You do not have to meet the minimum account size through deposits, it is just as valid to grow the account to the required size by your investments.

Trading Platforms

While most of the new brokers out there use the vanilla MetaTrader 4 or MetaTrader 5 platforms, The Investment Center has had time to invest in its own proprietary investing platform. The broker has invested massive amounts of time and money into creating a platform that is created to benefit traders. While the interface is easy to grasp, the technical analysis tools are extremely powerful. Traders will appreciate the experience they have in trading with this platform, as everything is clearly laid out and easily accessible.

One downside to the platform is that it is only available as a Web Trader. Of course that is suitable for many traders, but others do appreciate having a more stable download to their PC, or a mobile version they can take along everywhere.

Available Assets

The broker offers CFD trading in over 200 specific assets, with more being added constantly. These individual assets fall under the following asset classes:

CurrenciesStocksIndicesCommoditiesCryptocurrencies

The offerings are more than sufficient to have something for everyone. Whether you like to trade fiat currencies or cryptocurrencies, stocks or indices, or even volatile commodities, there is something to trade on the platform.

Education and Research

Education is a very important part of a trader’s arsenal and The Investment Center feeds the need for knowledge with a selection of eBooks that covers technical analysis, risk and money management, strategies, and many other topics. They also have an index of assets that explains each of their offered assets in more detail. Both valuable educational materials for traders, whether they are new or more advanced.

Customer Service

The customer service staff at The Investment Center is available 24/6, which is better than many other CFD brokers these days. To get in touch with the customer service team you can use the online chat feature, email, via telephone at three global locations, or through the webform located on their site.

Phone Numbers:

Australia +61283113160United Kingdom +442382280455Canada + 1 437 8861024

Email: support@investmentcenter.com

In Conclusion

As a broker with almost 2 decades of experience, The Investment Center has plenty to offer traders, both new and advanced. They have an excellent selection of assets, including the newest asset class of cryptocurrencies. They also offer a proprietary trading platform that’s both easy to use and powerful. We would like if it had a mobile version.

While the broker is not regulated, its location in London means it has to follow all the laws of the United Kingdom and combined with its long history this should give traders plenty of confidence in the safety of the broker.

Taken all together we think the broker is a solid choice and well worth trying.

Open Live Account END latest_news