TD Ameritrade’s thinkorswim platform offers over 70 tradeable currency pairs alongside a plethora of impressive tools, research, and education. For traders in the U.S., TD Ameritrade provides the ultimate trading technology experience.

-

Minimum Deposit:

$0.00

Trust Score:

99-

Tradeable Symbols (Total) :

N/A

Visit Site

Get up to $375 and trade commission-free

TD Ameritrade pros & cons

Pros

- TD Ameritrade is publicly traded (NYSE: SCHW) and regulated in four tier-1 jurisdictions.

- TD Ameritrade is trusted by over 11 million clients, with over $1 trillion in assets.

- Part of Charles Schwab Corporation since October 2020, with a combined 28 million clients and $6 trillion in assets.

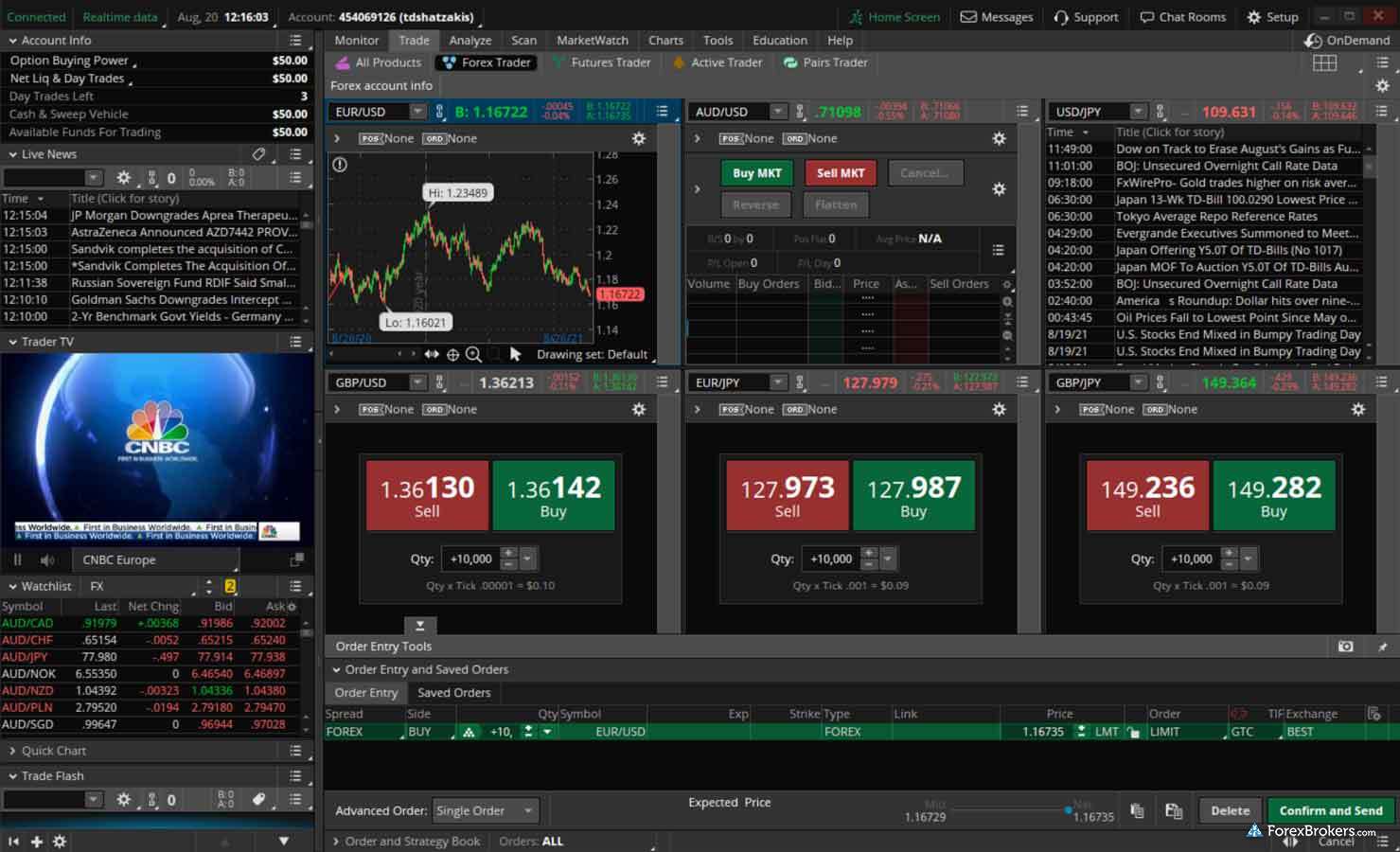

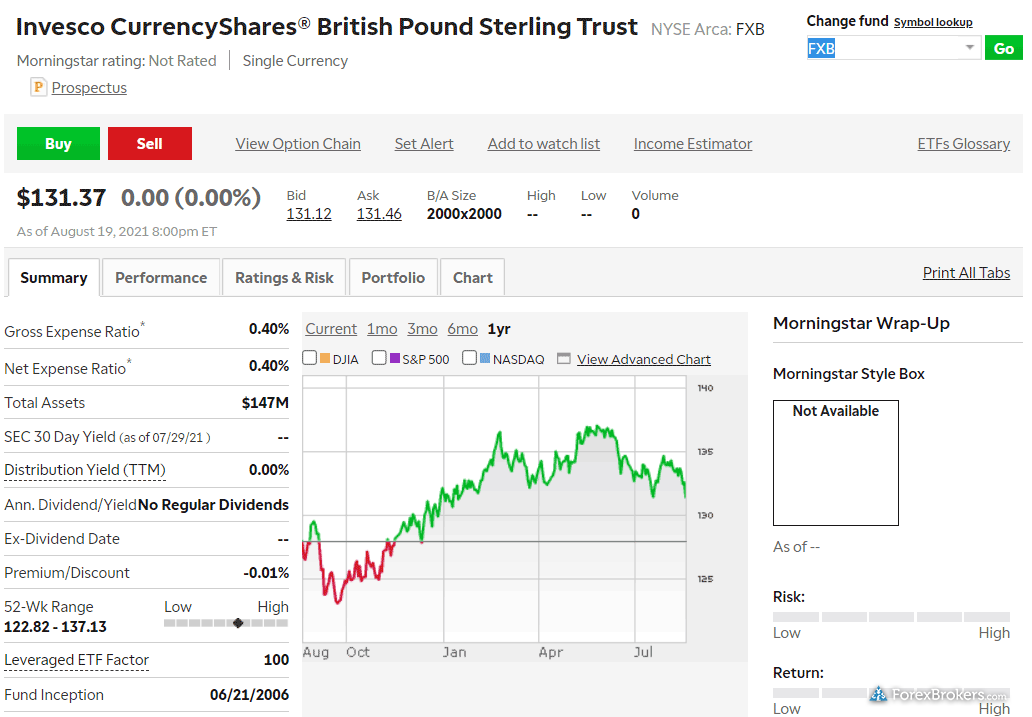

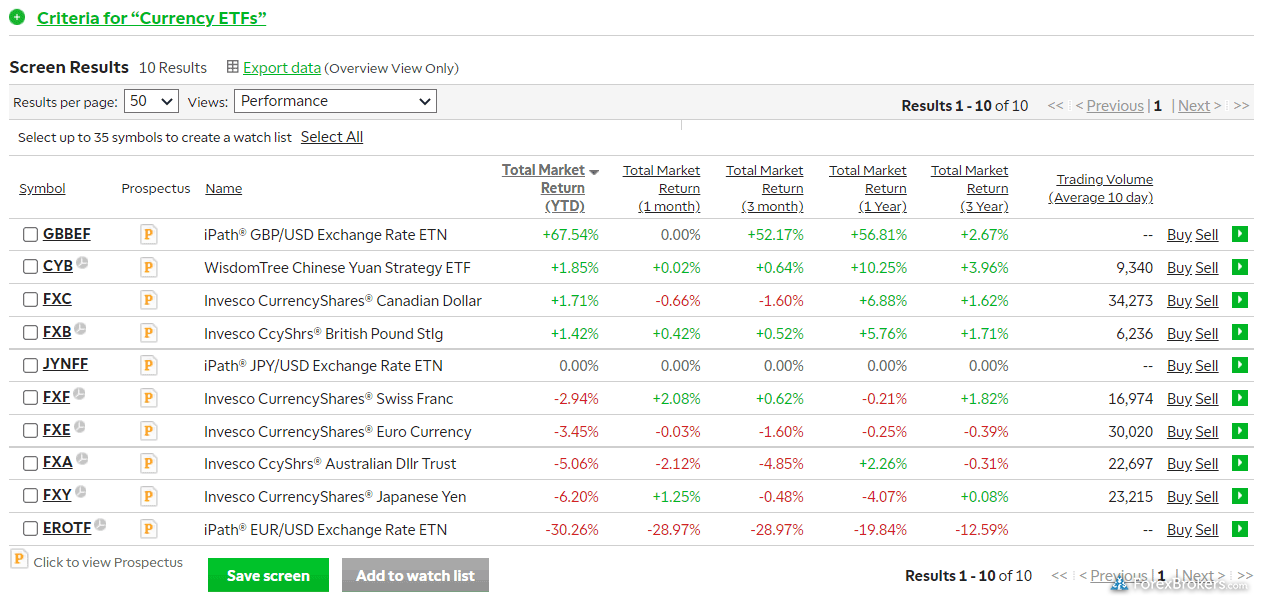

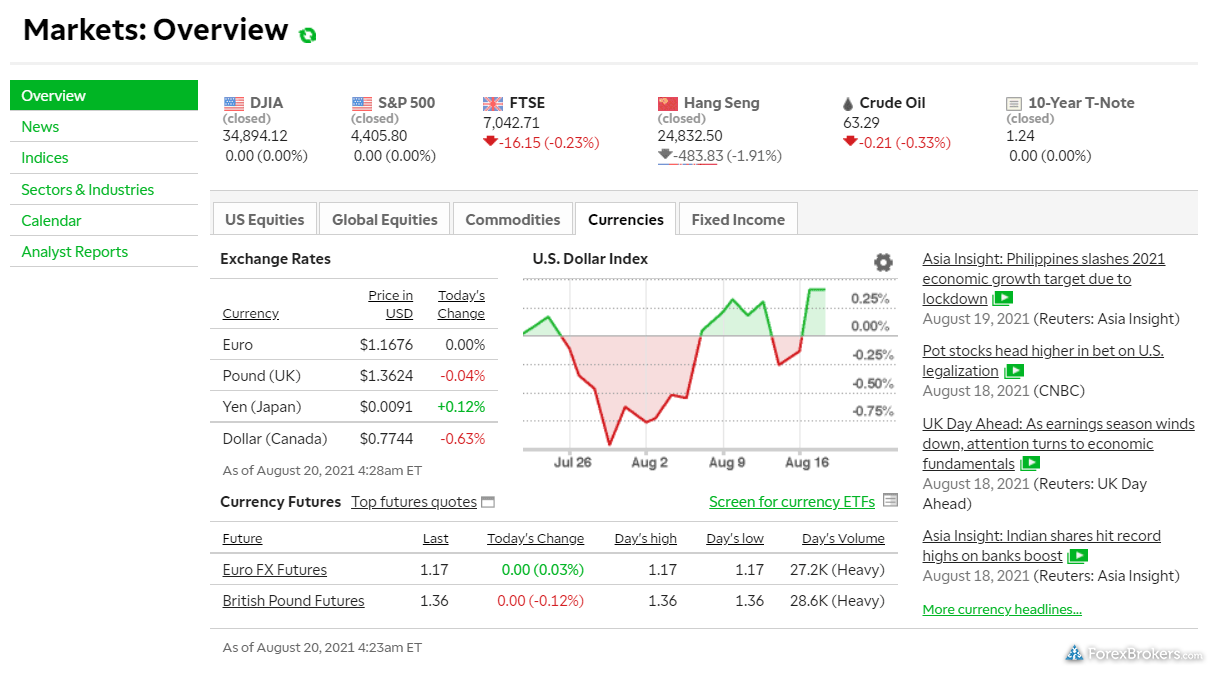

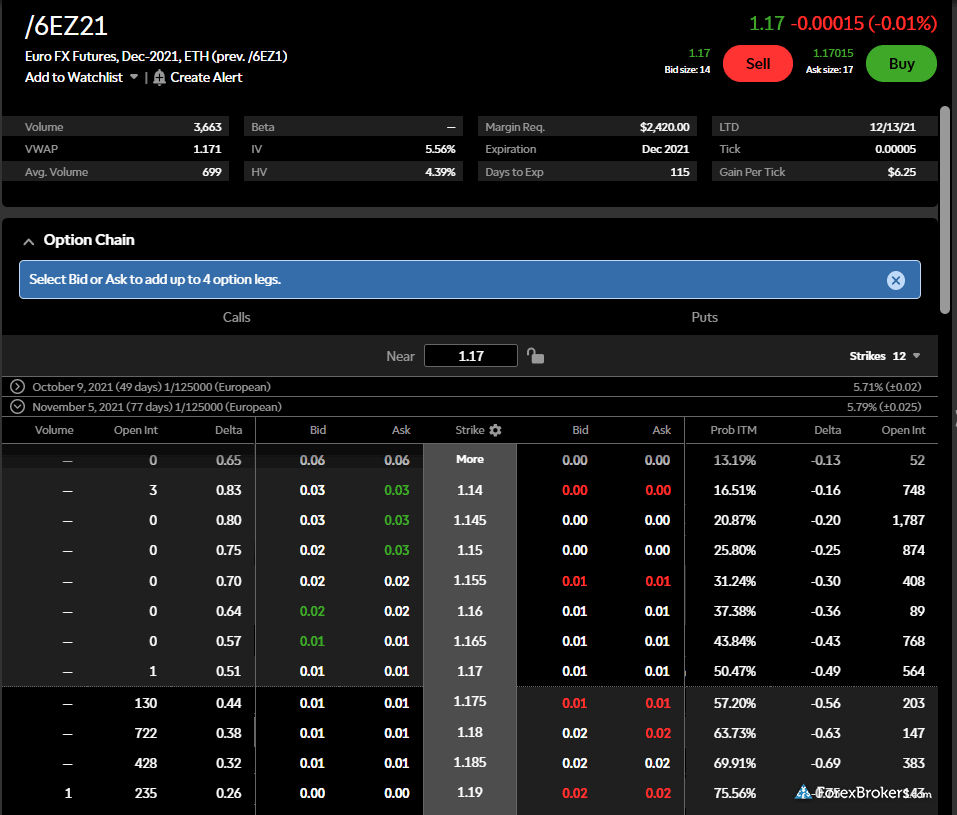

- The availability of currency ETFs, exchange-traded forex futures, and options on forex futures elevate TD Ameritrade’s already-impressive forex offering.

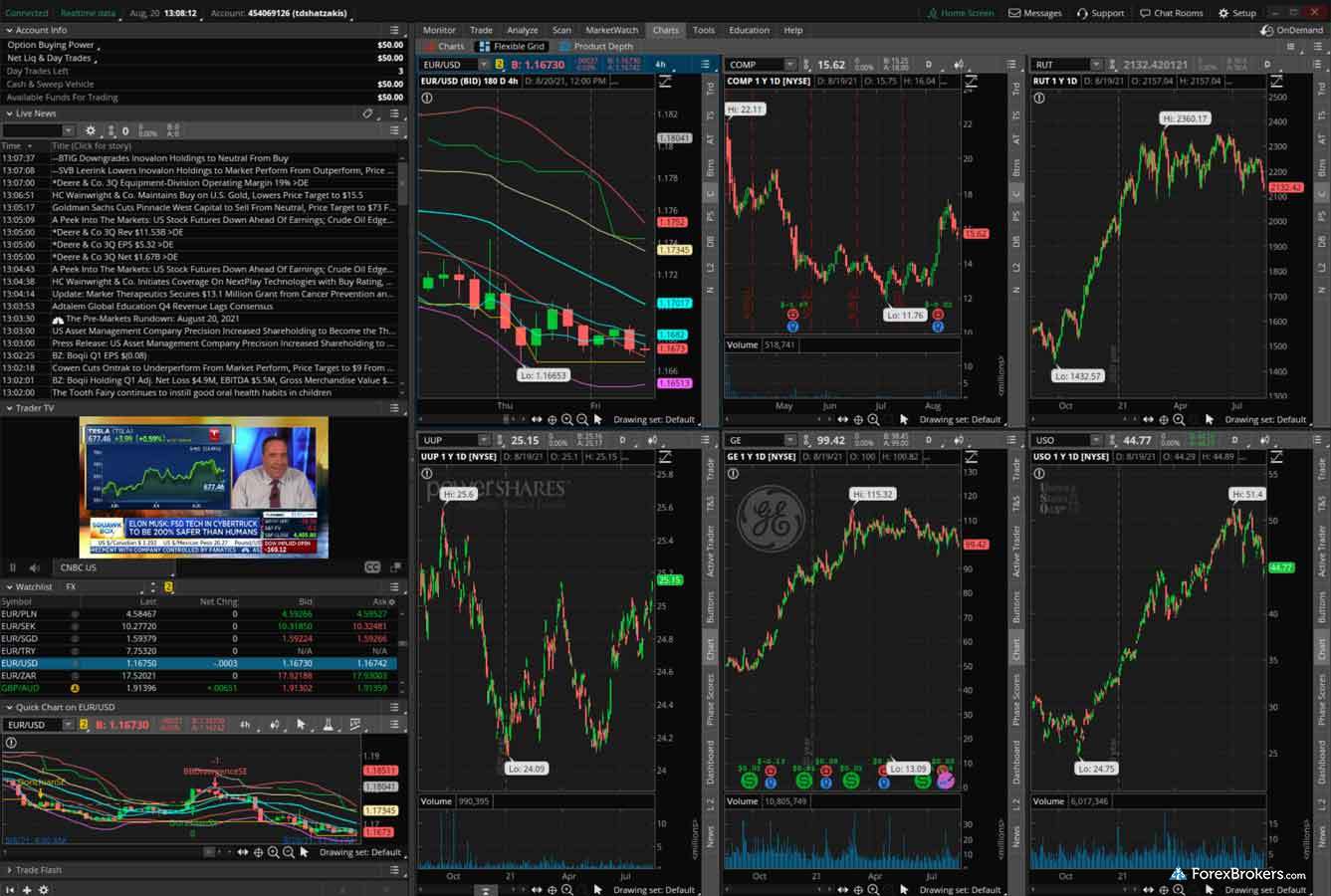

- The thinkorswim platform left us so impressed that it won our award for Best Desktop Platform for 2022.

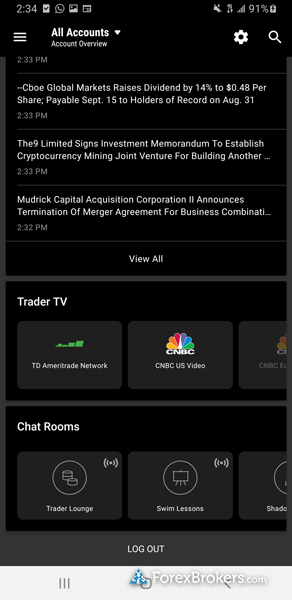

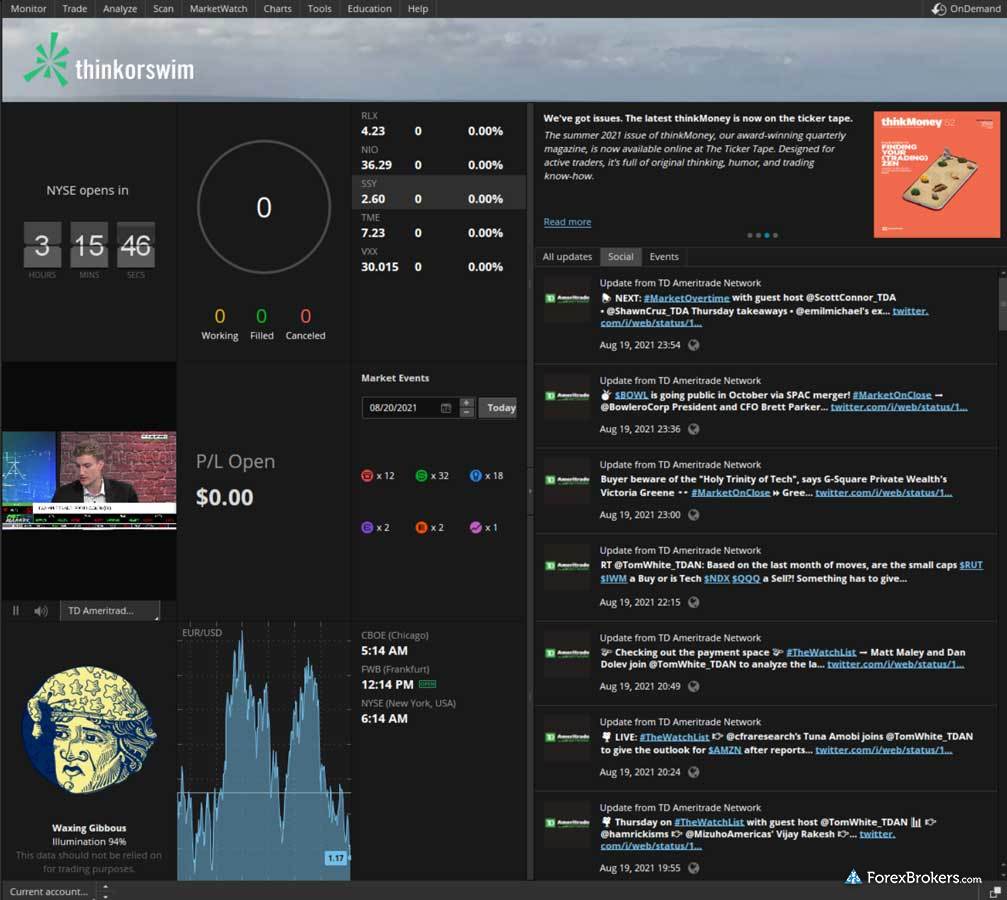

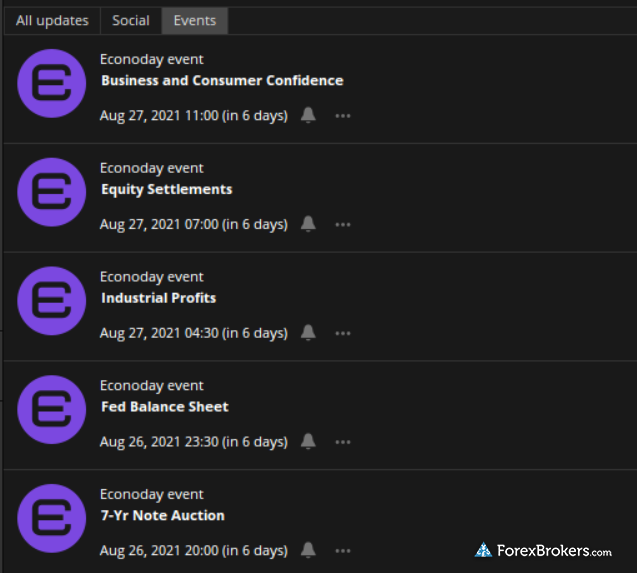

- In-house research from TD Ameritrade’s Ticker Tape hub and TD Ameritrade Network.

- Third-party market news integration from sources like CNBC, Dow Jones, Thomson Reuters, Morningstar, and FXWirePro.

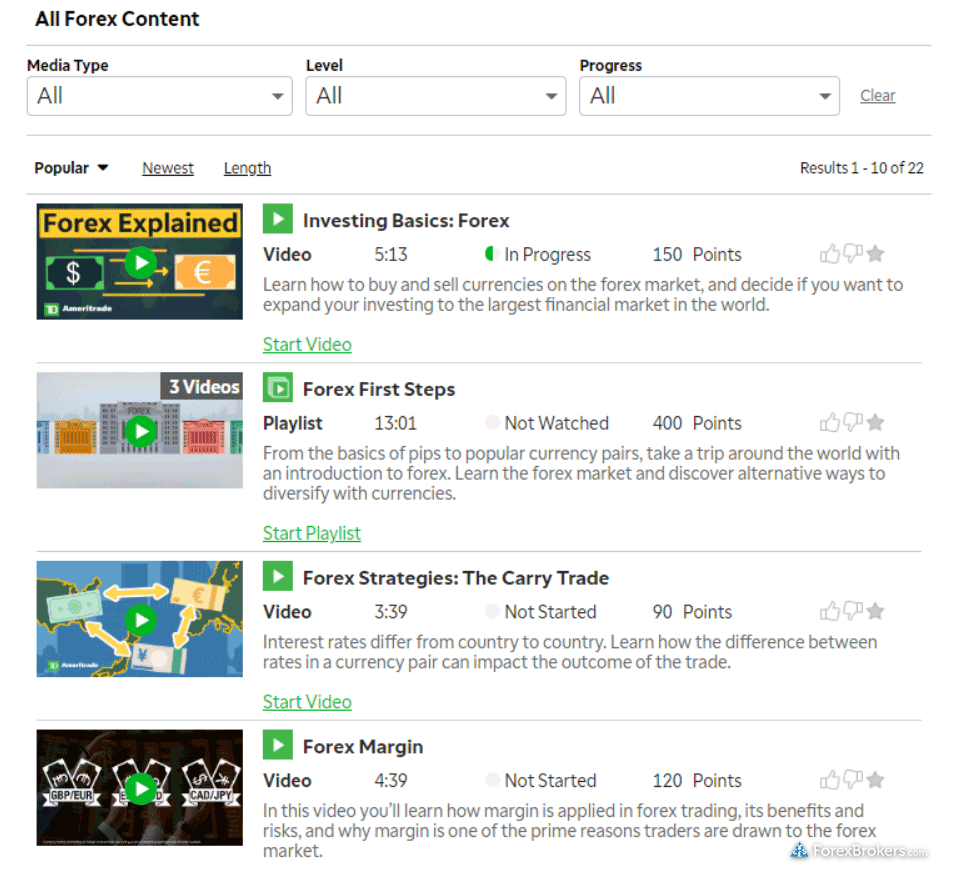

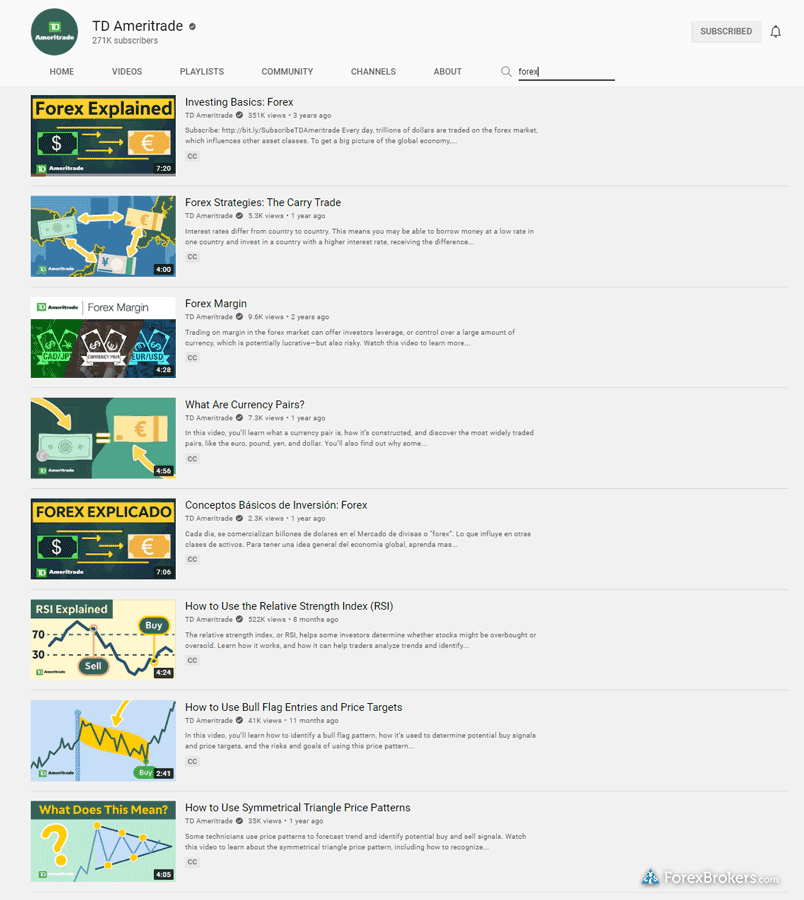

- Learning Center boasts over 400 pieces of content — both written and audio-visual — many of which are forex-related.

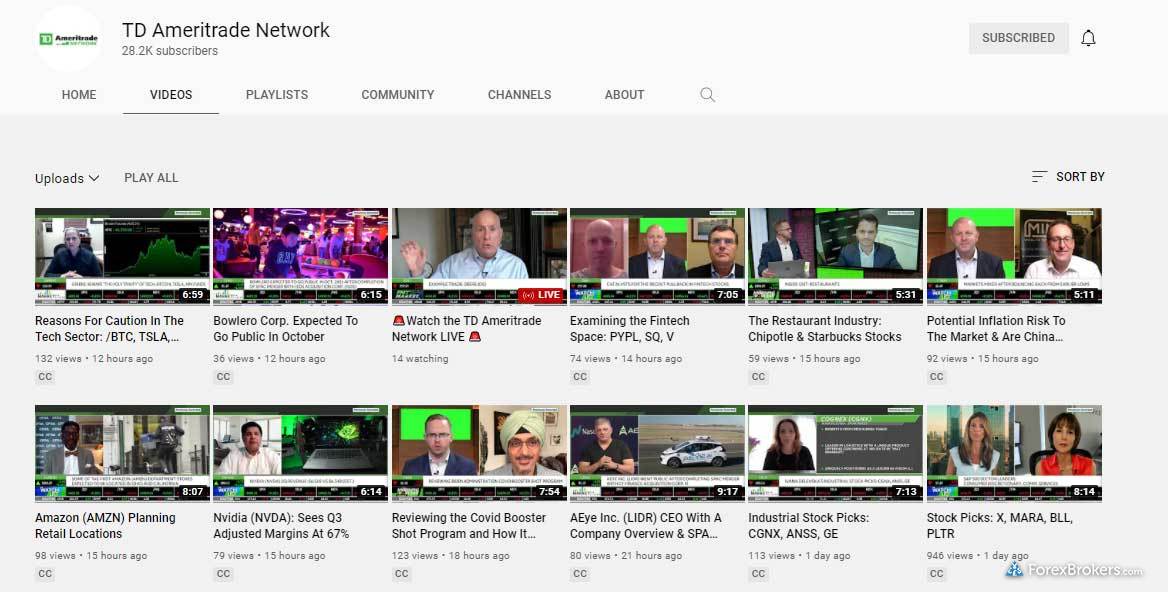

- Robust multimedia offering, including a well-maintained YouTube channel, and a catalogue of archived webinars with quality content such as its Trader Talks Webcasts.

Cons

- As a U.S.-only forex broker, TD Ameritrade does not offer copy trading or MetaTrader (MT4).

- Live video broadcasting is more focused on equities markets and futures than forex.

- With average spreads close to 1.2 pips on the EUR/USD, pricing is slightly above the industry average.

- Only available for U.S. clients (see our complete review of TD Ameritrade for U.S. traders on our sister site, StockBrokers.com).

Overall Summary

| Overall | |

| Trust Score | 99 |

| Offering of Investments | |

| Commissions & Fees | |

| Platforms & Tools | |

| Research | |

| Mobile Trading Apps | |

| Education |

Is TD Ameritrade safe?

help

99

Trust Score

TD Ameritrade is considered low-risk, with an overall Trust Score of 99 out of 99. TD Ameritrade is publicly traded, does operate a bank, and is authorised by four tier-1 regulators (high trust), zero tier-2 regulators (average trust), and zero tier-3 regulators (low trust). TD Ameritrade is authorised by the following tier-1 regulators: Securities Futures Commission (SFC), Monetary Authority of Singapore (MAS), and the Financial Conduct Authority (FCA). Learn more about Trust Score.

Regulations Comparison

| Year Founded | 1955 |

| Publicly Traded (Listed) | Yes |

| Bank | Yes |

| Tier-1 Licenses | 5 |

| Tier-2 Licenses | 0 |

| Tier-3 Licenses | 0 |

| Trust Score | 99 |

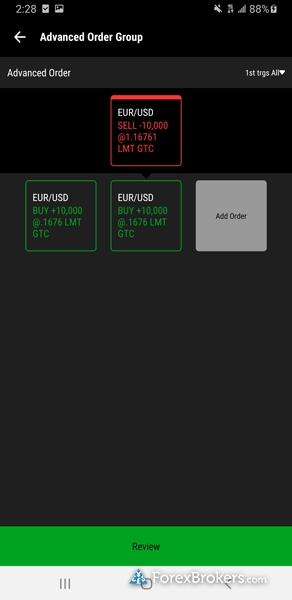

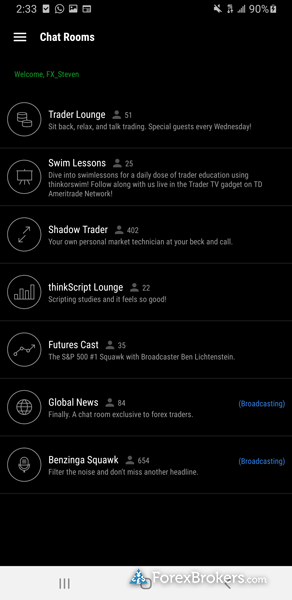

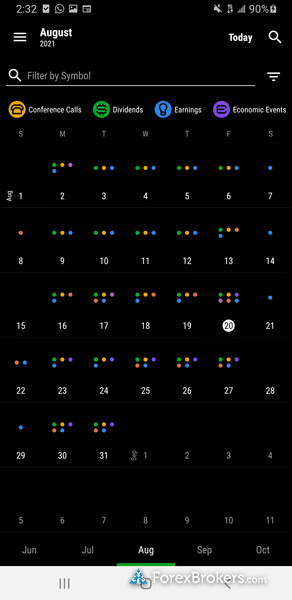

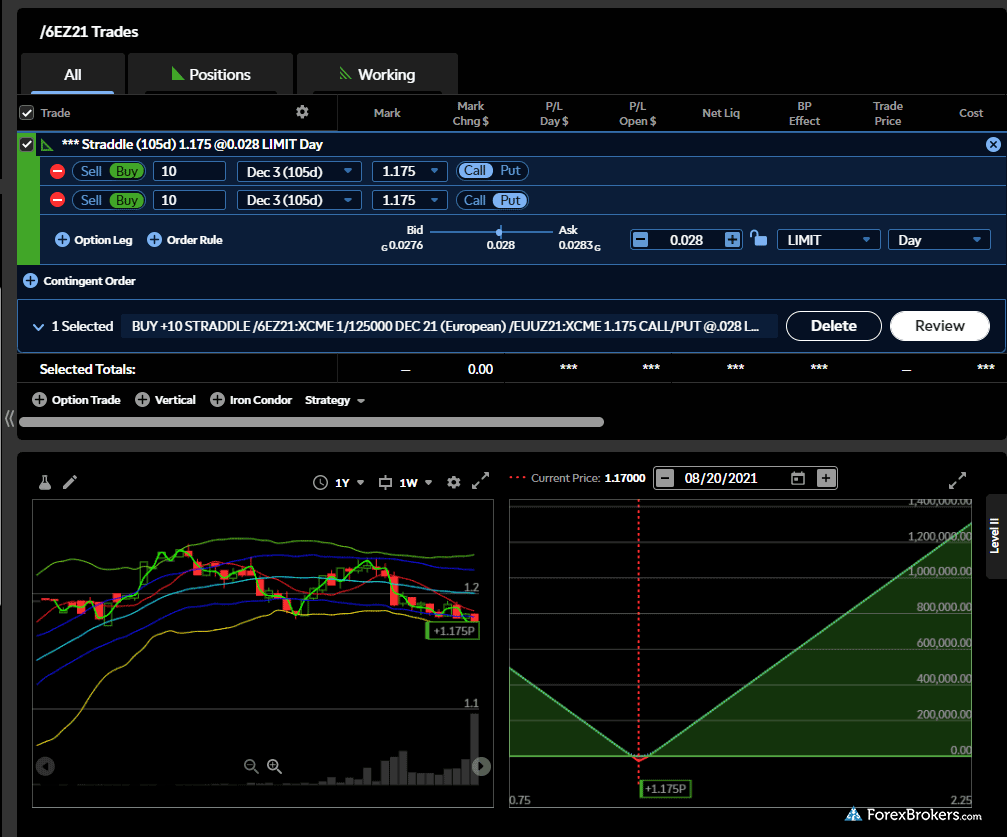

Gallery

Gallery

2022 Review Methodology

For our 2022 Forex Broker Review we assessed, rated, and ranked 39 international forex brokers over a three-month time period resulting in over 50,000 words of published research.

Each broker was graded on 113 different variables, including our proprietary Trust Score algorithm. This innovative scoring system ranks the level of trustworthiness for each broker based on factors such as licenses, regulation and corporate structure. Read about Trust Score here.

As part of our annual review process, all brokers had the opportunity to provide updates and key milestones and complete an in-depth data profile, which we hand-checked for accuracy.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Learn more about how we test.