CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 71% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. This content is intended for information and educational purposes only and should not be considered investment advice or investment recommendation.

Tickmill is a run-of-the-mill MetaTrader broker that offers a limited selection of tradeable securities. Tickmill does offer very competitive commission-based pricing for professionals through its VIP and Pro accounts.

-

Minimum Deposit:

$100.00

Trust Score:

82

Tradeable Symbols (Total) :

87

Tickmill pros & cons

Pros

- Founded in 2014, Tickmill is regulated in one tier-1 jurisdiction and two tier-2 jurisdictions, making it a safe broker (average-risk) for trading forex and CFDs.

- Tickmill makes the full MetaTrader suite available, as well as platform add-ons – putting it in close proximity with the best MetaTrader brokers.

- Pricing for Tickmill’s Pro and VIP account is highly competitive, helping the broker finish 1st overall for Commissions and Fees again for 2022.

- Offers the CQG platform for futures and options trading ($1,000 deposit required).

- Tickmill is a solid choice of platform for professional trading.

- Education from the CME, along with interactive sentiment data and website widgets from Acuity Trading help to complement research at Tickmill.

Cons

- Only a limited range of markets are available for trading.

- Pricing for Tickmill’s Classic account is not as competitive.

Overall summary

| Overall | |

| Trust Score | 82 |

| Offering of Investments | |

| Commissions & Fees | |

| Platforms & Tools | |

| Research | |

| Mobile Trading Apps | |

| Education |

Is Tickmill safe?

help

82

Trust Score

Tickmill is considered average-risk, with an overall Trust Score of 82 out of 99. Tickmill is not publicly traded and does not operate a bank. Tickmill is authorised by one tier-1 regulator (high trust), two tier-2 regulators (average trust), and zero tier-3 regulators (low trust). Tickmill is authorised by the following tier-1 regulator: Financial Conduct Authority (FCA). Learn more about Trust Score.

Regulations Comparison

| Year Founded | 2014 |

| Publicly Traded (Listed) | No |

| Bank | No |

| Tier-1 Licenses | 1 |

| Tier-2 Licenses | 2 |

| Tier-3 Licenses | 0 |

| Trust Score | 82 |

Offering of investments

Tickmill offers a total of 85 tradeable symbols encompassing CFDs on currency pairs, indices, metals, bonds, and cryptocurrencies. There are also at least 62 symbols available for futures and options trading which are all accessible through a separate dedicated account. The following table summarizes the different investment products available to Tickmill clients.

Cryptocurrency: Cryptocurrency trading at Tickmill is available through CFDs, but not available through trading the underlying asset (e.g. buying Bitcoin). Note: Crypto CFDs are not available to retail traders from any broker’s U.K. entity, nor to U.K. residents.

Tickmill offering of investments:

| Forex Trading | Yes |

| CFD Trading | Yes |

| Tradeable Symbols (Total) | 87 |

| Forex Pairs (Total) | 62 |

| US Stock Trading (Non CFD) | No |

| Int’l Stock Trading (Non CFD) | No |

| Social Trading / Copy-Trading | Yes |

| Cryptocurrency (Physical) | No |

| Cryptocurrency (CFD) | Yes |

| Crypto Disclaimer (UK) | Note: Crypto CFDs are not available to retail traders from any broker’s U.K. entity, nor to U.K. residents (except to Professional clients). |

Commissions and fees

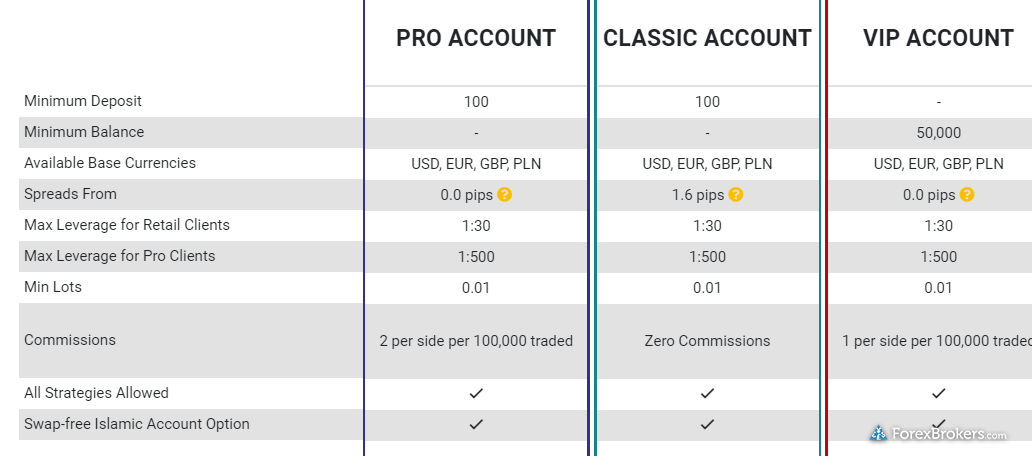

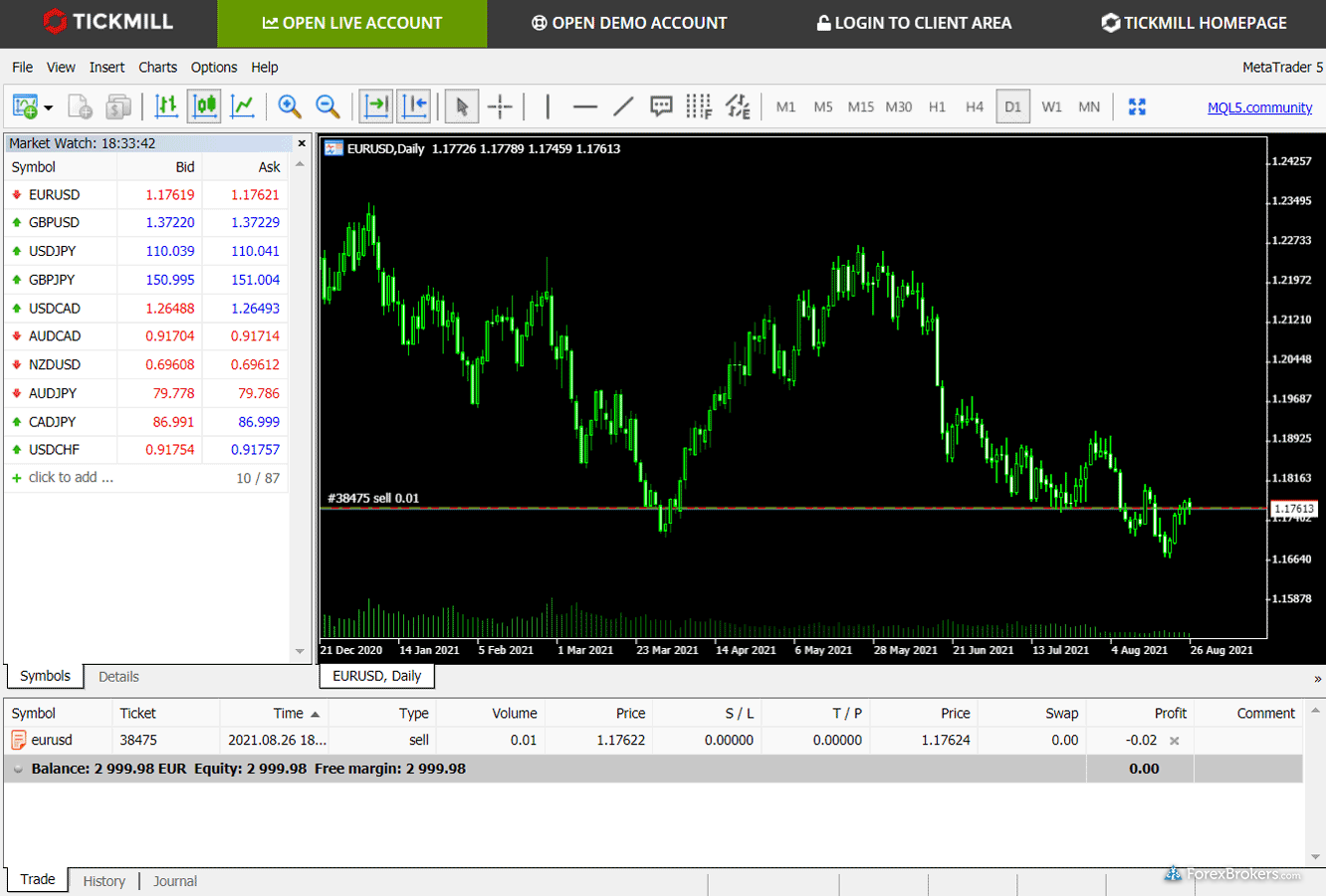

Tickmill offers three accounts: Classic, Pro, and VIP. Bottom line: Tickmill is best for active and VIP traders, who have access to pricing that competes among the lowest-cost brokers in the industry.

Classic accounts: The Classic account is entirely commission-free – traders only pay the bid/ask spread. However, average spreads for the Classic account are much higher than Tickmill’s other two account types.

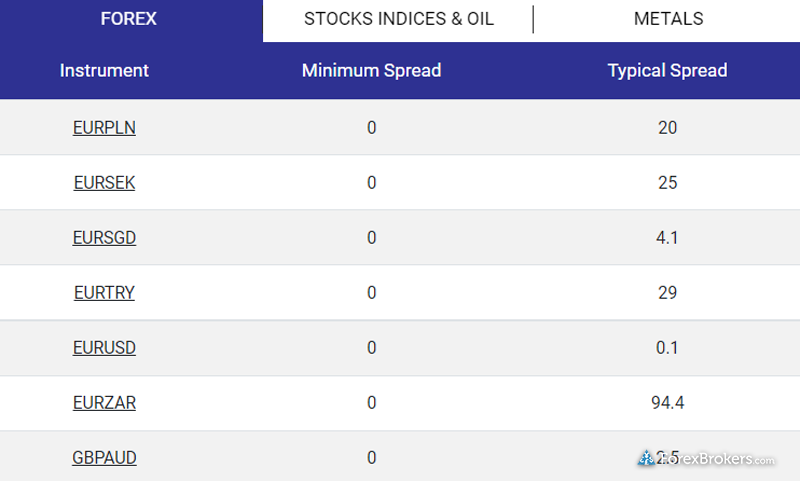

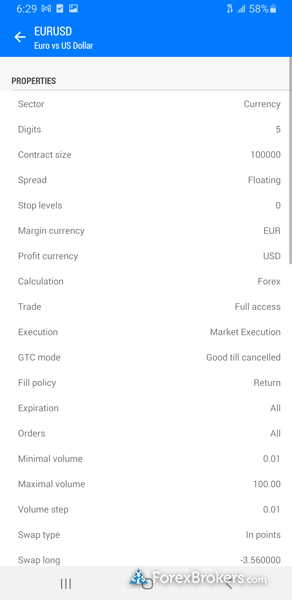

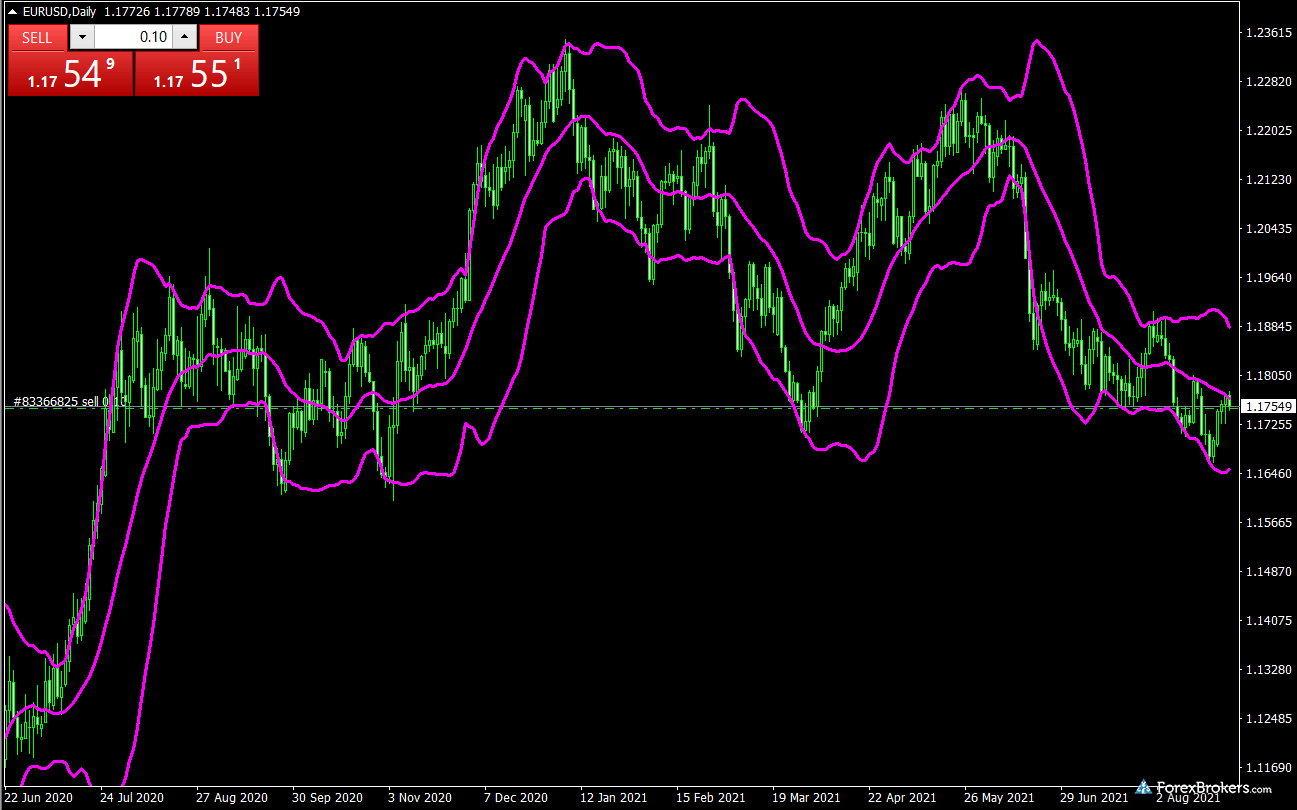

Spreads: Tickmill lists 0.07 pips as a typical spread for the EUR/USD on its Pro account for September 2021. It’s worth noting, however, that the all-in cost actually comes to 0.47 pips when factoring in the RT commission equivalent of 0.4 pips ($2 per side). It is also worth noting that Tickmill records typical spread data during normal market conditions (when spreads are narrower).

Pro account: The Pro and VIP accounts both have a per-trade commission, which is then added to lower prevailing spreads. With its low commission rate, low-cost spreads, and offering of 75 instruments and 62 currency pairs, the Pro account will be ideal for most traders.

VIP versus Pro accounts: Traders that choose Tickmill’s VIP account will need to maintain a minimum balance of $50,000, but will gain access to its low commission of $1 per standard lot (100,000 units) or $2 per Round-Turn (RT) – and effective spreads drop to 0.27 pips after commissions. The Pro account is available with just a $100 deposit, but commissions are twice as high at $4 per round-turn standard lot.

Active trader discounts: Tickmill offers three tiers for active traders, with rebates starting at $0.25 per standard lot (for up to 1,000 standard lots per month), and can go as high as $0.75 at tier-3 for those who trade more than 3,001 standard lots monthly.

Gallery

Tickmill pricing summary:

| Minimum Deposit | $100.00 |

| Average Spread EUR/USD – Standard | 0.27 (September 2021) |

| All-in Cost EUR/USD – Active | 0.47 (September 2021) |

| Active Trader or VIP Discounts | Yes |

| Execution: Agency Broker | Yes |

| Execution: Market Maker | Yes |

Mobile trading apps

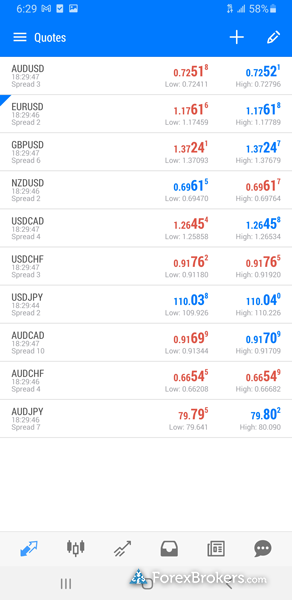

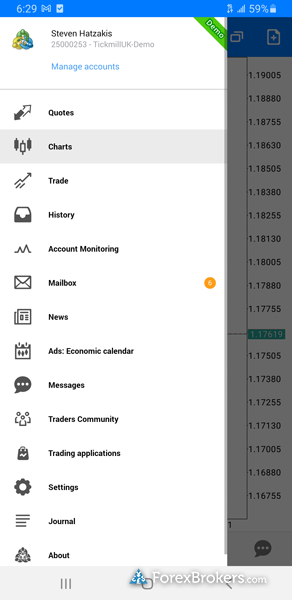

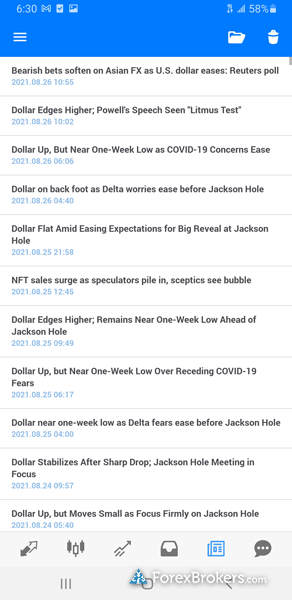

As Tickmill is a MetaTrader-only broker, iOS and Android versions of the MT4 and MT5 app (the latter in the U.K. only) come standard and are both available for download from the Apple App Store and Android Play store. It’s worth noting that Tickmill has launched a proprietary mobile app strictly for account management purposes (no trading).

Gallery

Tickmill mobile trading:

| Android App | Yes |

| Apple iOS App | Yes |

| Alerts – Basic Fields | Yes |

| Watch List | Yes |

| Watch List Syncing | No |

| Charting – Indicators / Studies | 30 |

| Charting – Draw Trendlines | Yes |

| Charting – Trendlines Moveable | No |

| Charting – Multiple Time Frames | Yes |

| Charting – Drawings Autosave | Yes |

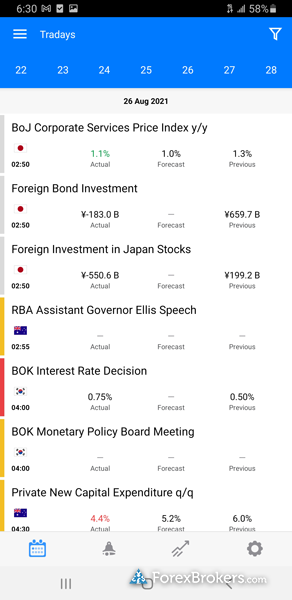

| Forex Calendar | Yes |

Other trading platforms

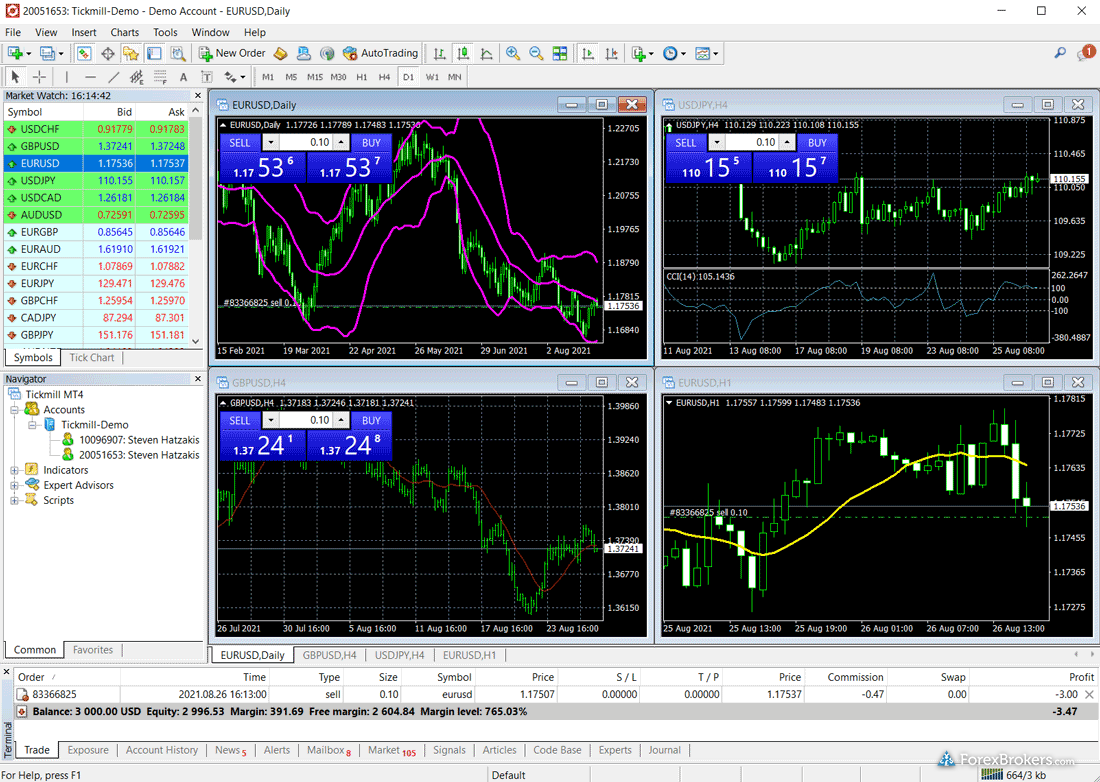

Tickmill continues to cement its status as a multiasset broker, with the launch of MT5 from its U.K. and EU entity and the addition of TradingView. Tickmill has also taken the step of including the CQG platform for futures and options trading (U.K.-only). Tickmill has made real strides in its expansion of platform offerings, putting it in competition with the brokers that lead the industry – despite its lack of a proprietary platform.

Platforms overview: Tickmill is a MetaTrader-only broker that offers the standard out-of-the-box experience for MT4 and MT5. The CQG platform is available for futures and options (for U.K. traders), while TradingView – a popular web platform known for its powerful charting – can be connected to your Tickmill account (although I was not able to do this during our testing).

Trading tools: Other notable add-ons are available from FX Blue as part of the Advanced Trading toolkit package, and Tickmill has also included Autochartist integration. VPS hosting – a useful tool for algorithmic traders – is also available at Tickmill.

Gallery

Tickmill trading platform:

| Virtual Trading (Demo) | Yes |

| Proprietary Platform | No |

| Desktop Platform (Windows) | Yes |

| Web Platform | Yes |

| Social Trading / Copy-Trading | Yes |

| MetaTrader 4 (MT4) | Yes |

| MetaTrader 5 (MT5) | Yes |

| cTrader | No |

| DupliTrade | No |

| ZuluTrade | Yes |

| Charting – Indicators / Studies (Total) | 51 |

| Charting – Drawing Tools (Total) | 31 |

| Charting – Trade From Chart | Yes |

| Watchlists – Total Fields | 7 |

| Order Type – Market | Yes |

Market research

Tickmill is competitive in its offering of market research and continues to improve in this category each year. That said, Tickmill still can’t compete with industry leaders like IG and Saxo Bank when it comes to depth, personalization, and overall quality.

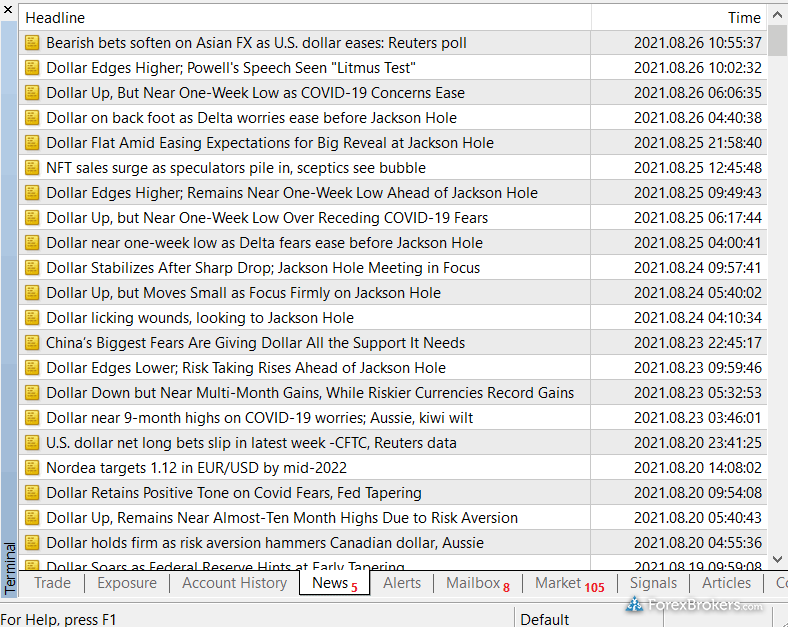

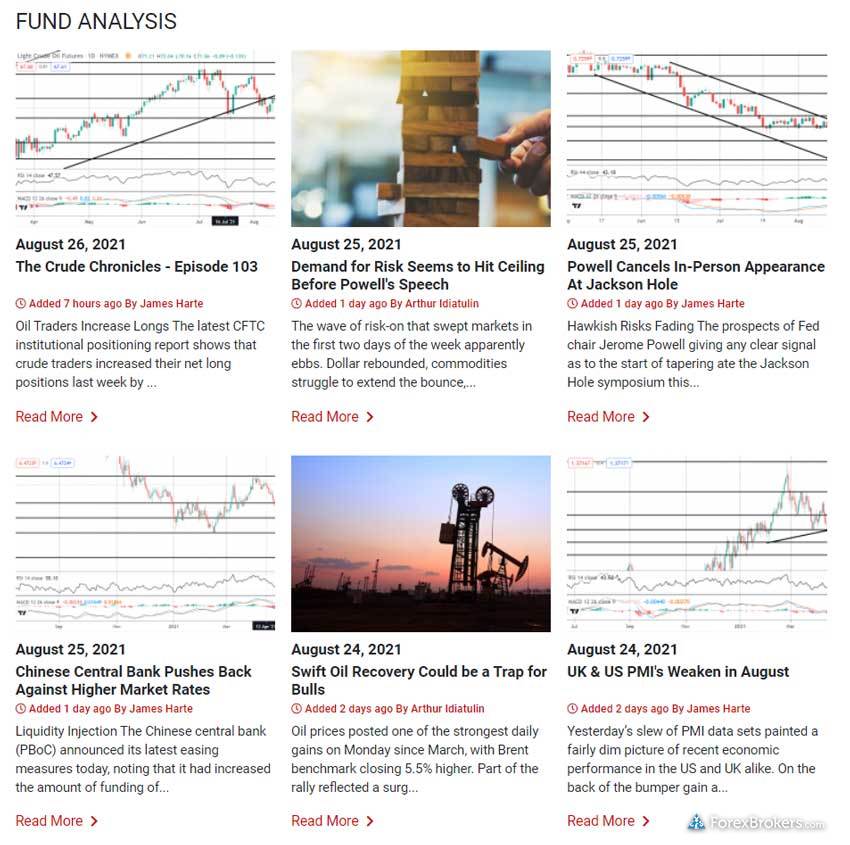

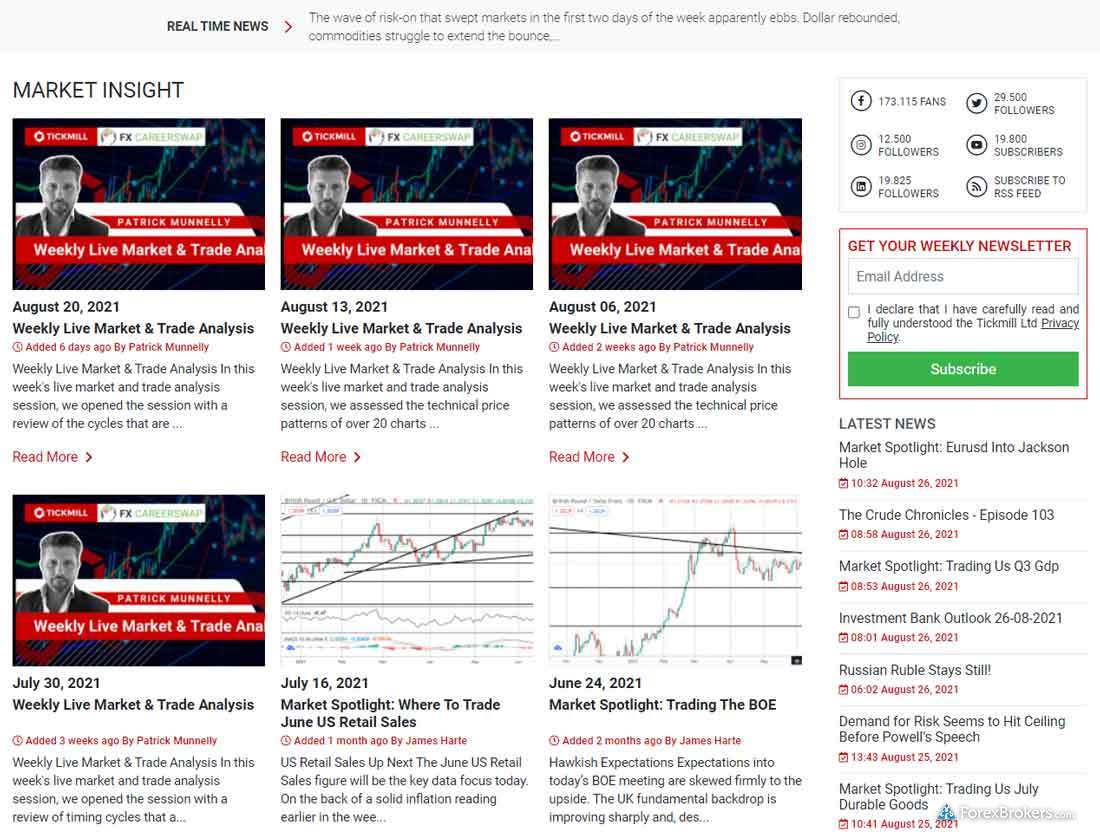

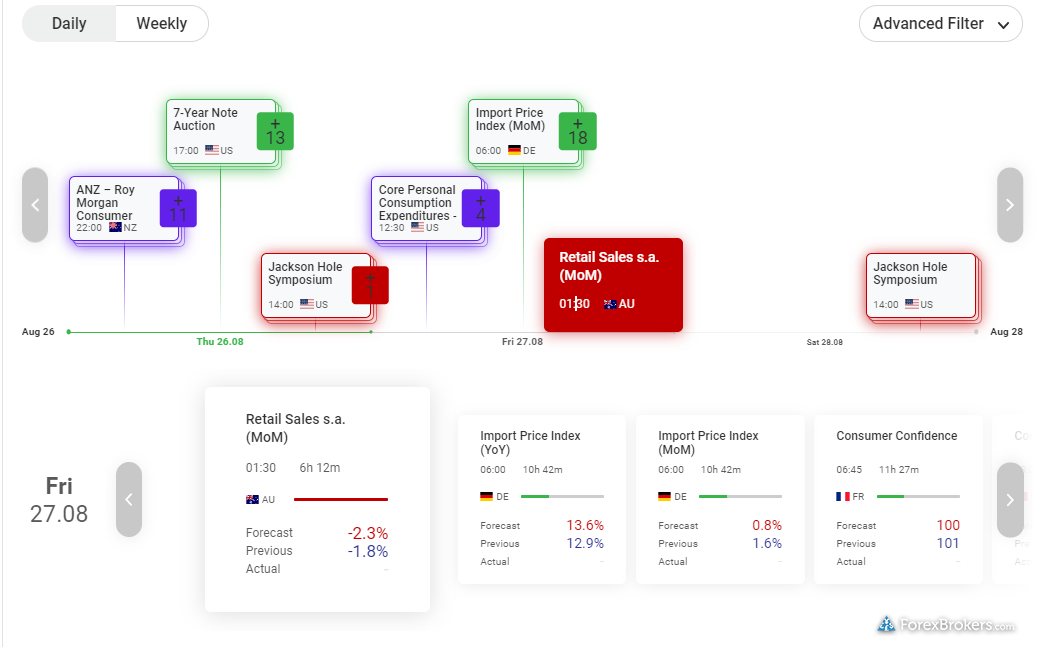

Research overview: Tickmill produces daily articles on its Expert Blog that cover technical and fundamental analysis, along with video updates published on its YouTube channel. Tickmill’s third-party research tools really shine; the Autochartist plugin allows for automated technical analysis, forex news headlines stream from Investing.com, and Myfxbook powers the broker’s economic calendar. Tickmill also delivers content across social media, such as its dedicated FaceBook group and its Telegram channel.

Market news and analysis: Tickmill does a fine job pairing solid market coverage with a good balance of research content. There are articles that focus on technical analysis, paired with offerings like the Weekly Live Markets & Trade Analysis series that analyze market fundamentals. Tickmill also offers archived webinars, technical and fundamental analysis videos, and news updates on its YouTube page – such as its daily Chart Hits series which are quick one-minute updates. Finally, there is interactive sentiment data from the CME, and integrated widgets with sentiment data from Acuity Trading on the Tickmill website.

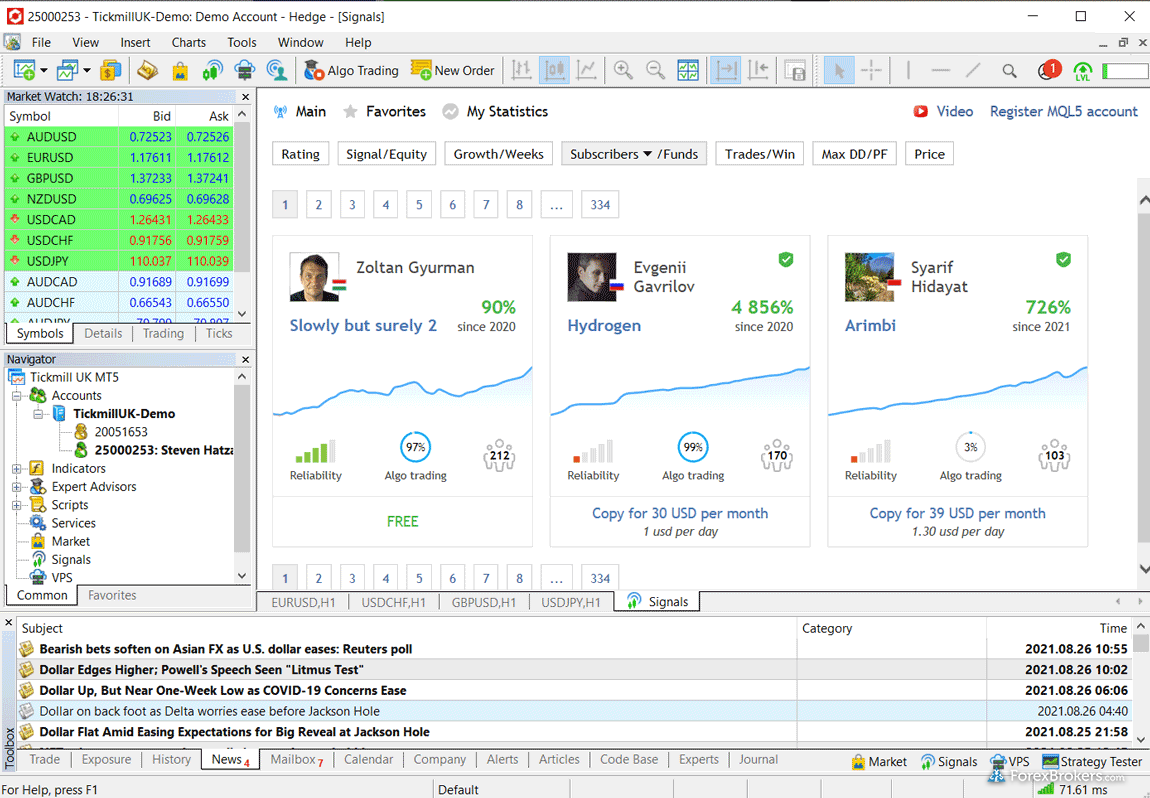

Copy trading: Besides the native Signals market available in MetaTrader, Tickmill offers three platforms for social copy-trading that connect directly to your MetaTrader account. There is Pelican Trading and the AutoTrade feature of Myfxbook but these two services are not available from the firm’s U.K. and EU branches. Though it isn’t directly advertised on Tickmill’s website, ZuluTrade is also available for copy trading.

Gallery

Tickmill research:

| Daily Market Commentary | Yes |

| Forex News (Top-Tier Sources) | Yes |

| Autochartist | Yes |

| Trading Central (Recognia) | No |

| Delkos Research | No |

| Social Sentiment – Currency Pairs | Yes |

| Economic Calendar | Yes |

Education

Tickmill’s educational content is nearly up to par with the average industry offering. It does grant access to a large catalogue of archived webinars, but Tickmill lacks a variety of educational videos and articles.

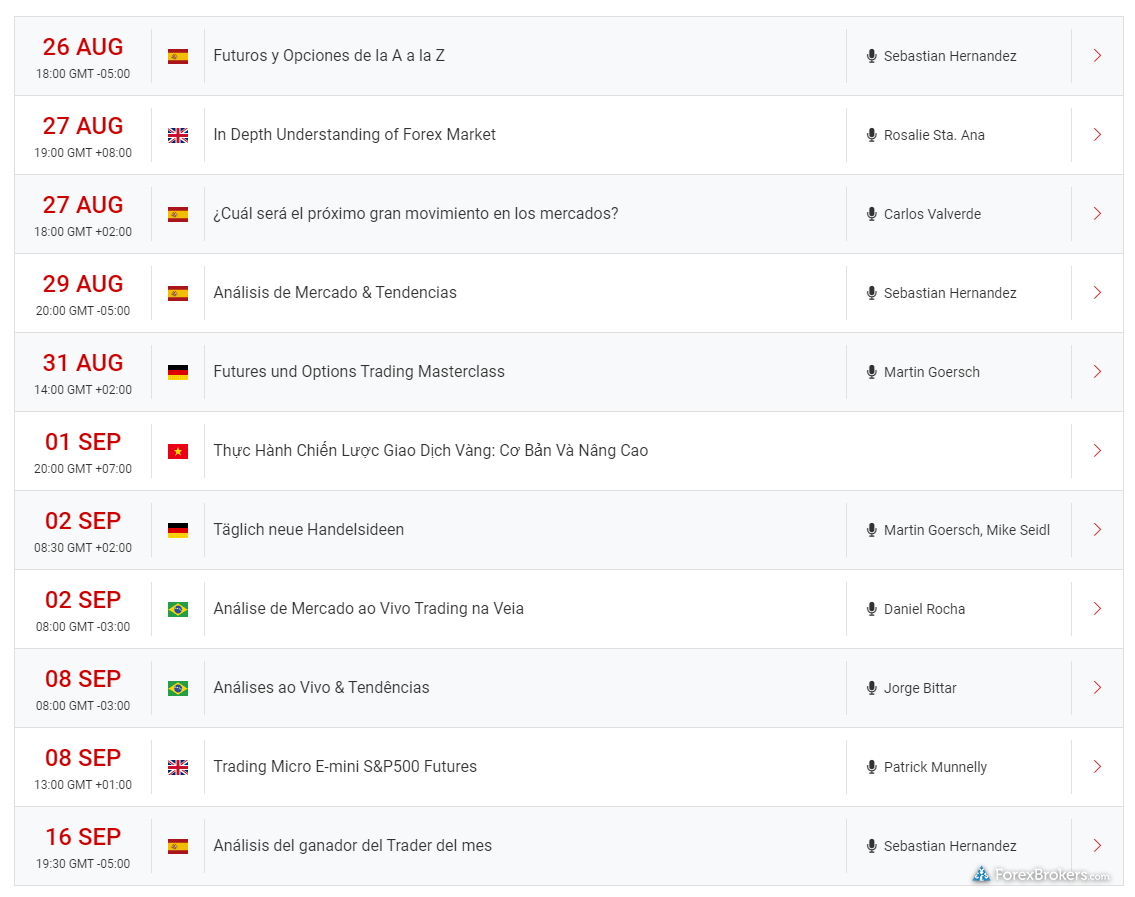

Learning center: Highlights include live educational courses, a handful of comprehensive eBooks, infographics, and weekly webinars that are hosted in various languages and archived on YouTube. There are also educational resources for learning about futures, powered by the CME available on Tickmill’s website.

Room for improvement: Tickmill continues to expand its educational offering, in both its scope of material and variety of formats. As of now, however, it suffers from a lack of video content and written articles are scarce. Introducing a dedicated educational portal that makes it possible to filter content by experience level would be a notable organizational boost. Some of the best brokers offer lesson programs, complete with quizzes and progress tracking – features that are currently absent at Tickmill.

Gallery

Tickmill education:

| Has Education – Forex or CFDs | Yes |

| Client Webinars | Yes |

| Client Webinars (Archived) | Yes |

| Videos – Beginner Trading Videos | Yes |

| Videos – Advanced Trading Videos | No |

| Investor Dictionary (Glossary) | Yes |

Final thoughts

Tickmill is most valuable to high-volume, high-balance traders who are looking to trade only the most popular forex and CFD instruments. Tickmill complements its MetaTrader offering with a good variety of copy-trading platforms, and offers multiple account options with varying pricing structures.

Drawbacks to consider are its small range of markets, limited research material, and lackluster educational content. While the VIP account does have highly competitive pricing, there are better forex brokers out there for traders to consider in 2022.

About Tickmill

Tickmill was established in 2014 after Armada Markets moved its retail clients to Tickmill’s entity in Seychelles, where it is regulated by the Financial Services Authority (FSA). Today the Tickmill brand holds regulatory status in the U.K., Cyprus, and Malaysia. According to its website, Tickmill Group has over 200 staff and more than 50,000 customers.

2022 Review Methodology

For our 2022 Forex Broker Review we assessed, rated, and ranked 39 international forex brokers over a three-month time period resulting in over 50,000 words of published research.

Each broker was graded on 113 different variables, including our proprietary Trust Score algorithm. This innovative scoring system ranks the level of trustworthiness for each broker based on factors such as licenses, regulation and corporate structure. Read about Trust Score here.

As part of our annual review process, all brokers had the opportunity to provide updates and key milestones and complete an in-depth data profile, which we hand-checked for accuracy.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Learn more about how we test.