If you want to become a successful day trader, you will need to find a reliable, flexible, and responsive trading platform that allows you to conduct your analysis and implement your trading plan in the best possible way, allowing you to make better and more informed trading decisions.

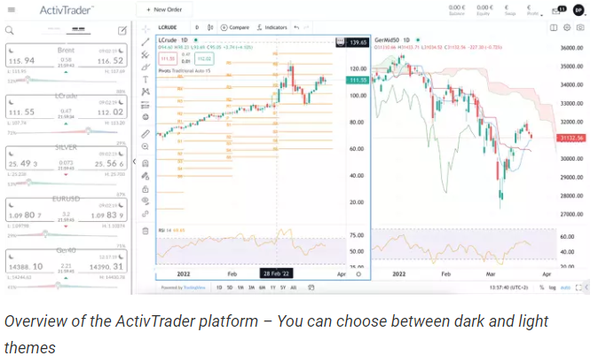

The regulated CFD and Forex broker ActivTrades offers a new online trading platform that is great for day traders of all levels – the ActivTrader platform. Lets discover why this platform is a great option if you want to get into day trading, what its best features are and how to use them.

What is day trading?

Day trading is an active trading style through which youre looking for intraday trading opportunities, from a few minutes to a few hours. You will therefore not keep any trades open overnight.

As a day trader, you will close all your positions by the end of your trading session, so then you know exactly how much you‘ve earned (or lost) for the day. You will also be able to completely disconnect from the markets when you’re done with your trading and start fresh the following day.

What do you need as a day trader?

Most day traders rely on technical analysis to spot the best opportunities and know when to enter or exit the markets. Moreover, you will need fast and precise order execution to take advantage of very short-term price changes, as timing is everything in day trading.

Therefore, you have to use a powerful and robust trading platform that uses the latest advanced technology to offer a comprehensive, professional and customizable trading environment to access the financial markets.

Why is the ActivTrader Platform ideal for day trading?

With its new platform, ActivTrades offers a viable alternative to the MetaTrader 4/5 platforms. ActivTrader has been developed as an enhanced trading environment, offering a new trading dimension with advanced features that are very useful for day traders, especially young and inexperienced traders.

Moreover, the broker offers efficient and fast execution, with no re-quotes and low latency (average execution below 0.004 seconds and over 93.60% of trading orders executed at the requested price), allowing traders to take advantage of the art trading and resilient infrastructure.

TradingView integration

Recently, ActivTrades integrated the powerful and popular charting platform and social network TradingView, meaning that most of its features and trading tools are available to ActivTrades traders. This new option allows traders to take advantage of an impressive (and growing) list of advanced and customizable trading features and analytical tools.

What are the most relevant TradingView features for day traders?

-

12 customizable chart types

-

Up to 8 charts in one layout

-

25 indicators per chart

-

Custom timeframes

-

100+ pre-built technical indicators

-

50+ drawing tools

-

100+ fundamental analysis tools

-

12 alerts conditions on price, strategies and indicators

-

Chart trading

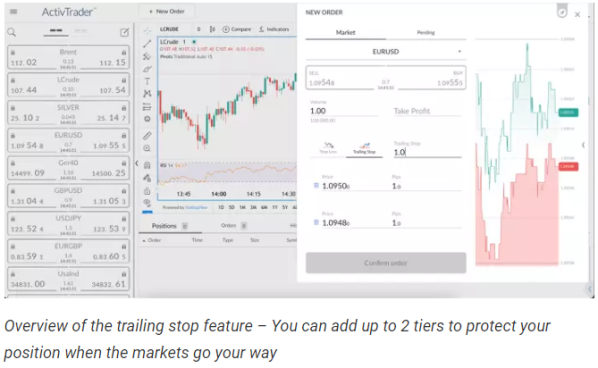

Progressive trailing stops

The ActivTrader platform offers a unique feature to better protect your profits – the progressive trailing stops. This feature gives you a chance to increase your profits by allowing you to set up 2 additional tiers that automatically modify your stop-loss distance when the markets go in your direction towards pre-determined trigger prices.

Why are progressive trailing stops a great tool for day traders?

-

This type of order can allow you to better protect your positions (especially your gains) when your preferred market scenario happens.

-

If the market doesn‘t go against you, then your progressive trailing stop doesn’t limit your profit as much as other types of protective orders, as you will stay invested as long as prices do not reach your stop-loss level, and this level will change depending on the different trigger points reached.

-

Progressive trailing stops are fully flexible, meaning that they can be used in any type of trading.

-

Emotions are taken out of your trading process with such orders, allowing you a better trading discipline.

Other money management tools

Of course, progressive trailing stops arent the only money management tools and protections offered by ActivTrades. You can set up take-profit and normal stop-loss, as well as classic trailing stop orders, use Smart Calculator to simulate different trade scenarios, easily change your leverage effect, quickly choose the size of your trading positions, and enjoy negative balance protection, among other features.

Why should day traders use money management tools?

-

They prevent losses from getting out of control.

-

They better protect your trading capital.

-

They allow you to have rules to follow to avoid emotions taking over.

-

Theyre useful to keep a good risk/reward ratio.

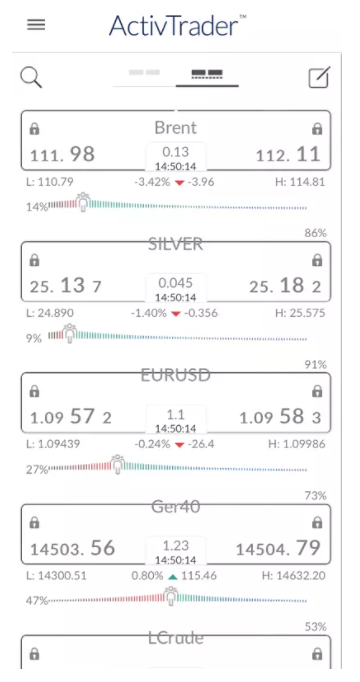

Market sentiment feature

Once you‘ve created your watch list, the sentiment indicator can quickly allow you to see if the assets you’re focusing on are mostly being sold or bought right now. This sentiment functionality, therefore, helps you determine what the general market mood is about specific assets. You can then decide to trade with the flow or against it, depending on your own analysis.

Why is a market sentiment indicator great for day traders?

-

This tool is a great market psychology-based instrument to quantify investor sentiment.

-

It helps you visualize how bullish or bearish investors are on a given asset.

-

It allows you to take into account market sentiment in your trading to forecast price movement.

-

Extreme readings can help you spot potential trend reversal.

Final word

As a day trader, the ActivTrader platform gathers all relevant and useful tools and features to take your trading to the next level and enhance your trading process for better results. Moreover, ActivTrades offers fast and reliable execution required for short-term trading.