- Chainlink price triggered a 30% upswing on March 24 as it broke out of an Adam and Eve pattern.

- A retracement to stable levels such as $15.60 seems plausible before reaching its target at $20.17.

- A four-hour candlestick close below $14.36 will invalidate the bullish thesis for LINK.

Chainlink price shows signs of exhaustion and is likely to retrace to the immediate support levels. This downswing will allow buyers to recuperate before the next leg-up.

Chainlink price scrambles for momentum

Chainlink price set up a V-shaped valley known as “Adam” followed by a rounded bottom referred to as “Eve” between February 22 and March 22. The Adam and Eve formation is a bottom reversal pattern and forecasts a 28% upswing, determined by measuring the depth of the valley.

Adding this distance to the breakout point at $15.69 reveals a target of $20.17. So far, LINK has rallied 10% but is currently facing some profit-taking, leading to a pullback. This retracement is likely to continue to a stable support level at $15.69 before a new leg-up emerges.

The resulting rally will propel Chainlink price to hit its target at $20.17.

LINK/USDT 4-hour chart

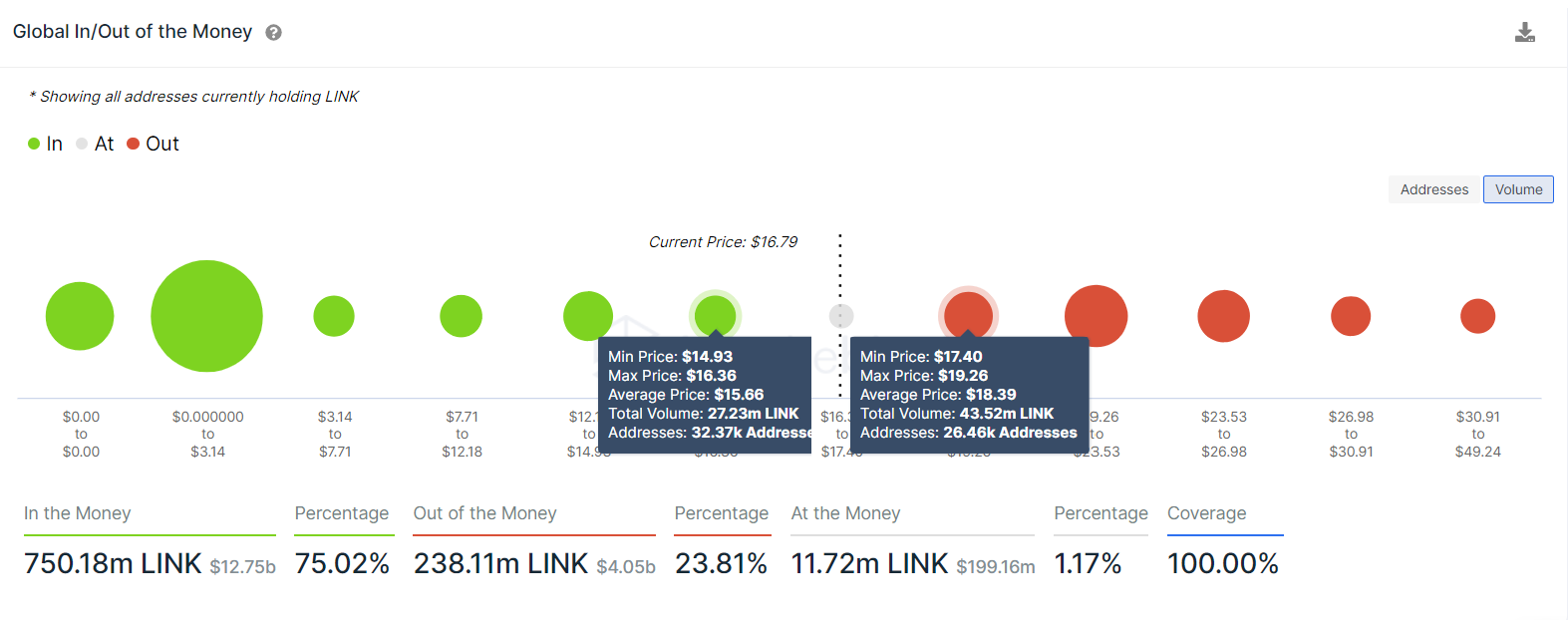

Suporting this outlook for Chainlink price is IntoTheBlock’s Global In/Out of the Money (GIOM) model. This index shows that roughly 26,000 addresses that purchased nearly 43.52 million LINK tokens at $18.39 are blocking the move higher.

Interestingly, the immediate support cluster purchased roughly 27 million LINK tokens at an average price of $15.60. Since this level coincides with the one mentioned from a technical perspective, there is a good chance the buyers will make a comeback here.

LINK GIOM.

Moreover, the Market Value to Realized Value (MVRV) model hovering at 13.5% also indicates that a downtrend is likely. This on-chain metric is used to determine the average profit/loss of investors that purchased LINK over the past month.

The 13.5% value suggests that a large chunk of the investors are in profit and are likely to trigger a sell-off if they decide to realize their gains. Additionally, the past four months have seen LINK price retrace after the 30-day MVRV hit roughly 13% to 15%, making the argument of a retracement more compelling.

[06.16.20, 30 Mar, 2022]-637842133319946949.png)

LINK 30-day MVRV

While things are looking up for Chainlink price, Bitcoin price and its directional bias have a much larger influence on altcoins like LINK due to the inherent correlation. Therefore, a flash crash in BTC could turn the optimistic outlook of the oracle token sour.

A four-hour candlestick close below $14.36 will invalidate the bullish thesis for Chainlink price and open the path for a further drop to stable support level at $13.60. Here, sidelined buyers can step in and trigger another leg-up.