- Algorand price develops a rare bullish reversal pattern.

- Short sellers start to get trapped, feeling the pressure as ALGO ticks higher.

- Downside risks are present but limited.

Algorand price has given bulls and bears an extended headache over the past three months. A series of false breakouts higher and lower have yielded a prolonged range trade that warned of some deeper moves south, but that may no longer be the case.

Algorand price forms big bear trap, 75% gain up ahead

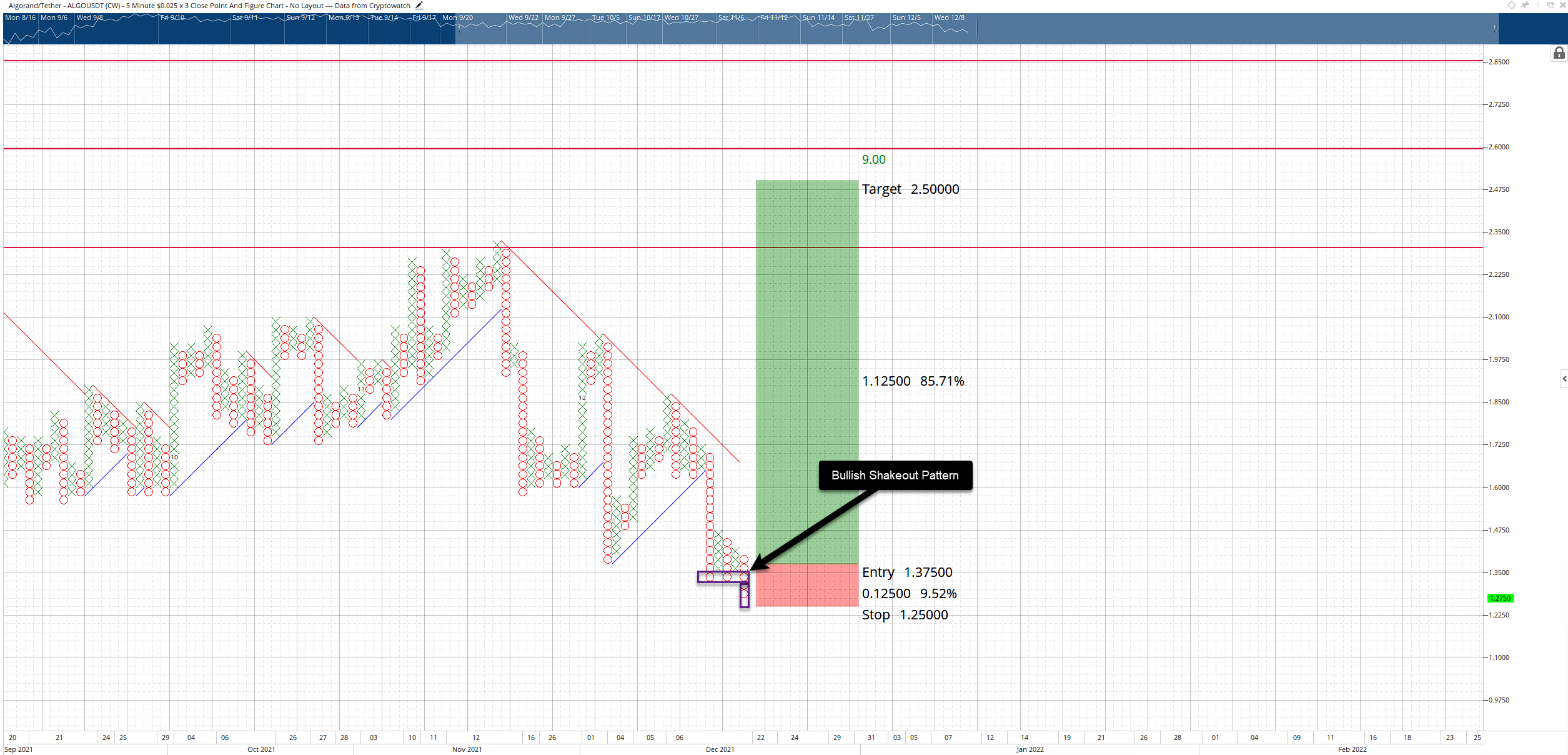

Algorand price is developing one of the rarest and most sought-after bullish reversal patterns in Point and Figure Analysis: the Bullish Shakeout. The Bullish Shakeout pattern is only valid during an uptrend and shows up near or at the bottom of a corrective move. The pattern requirements are two to three Os below a triple-bottom (minimum of two Os, maximum of three Os) at the bottom of a swing.

Adding to the strength of this pattern is how it affects short-sellers. A breakout below a triple-bottom is a potent short signal and one that many Point and Figure traders regard as the minimum of criteria for an entry. However, when the triple-bottom fails to produce a sustained move lower, short-sellers get trapped. And as prices move higher, the trapped shorts end up turning into buyers and exacerbating the buying pressure.

Algorand has fulfilled all of the conditions for a Bullish Shakeout, and because of that, a long opportunity now exists. The theoretical long entry is on the 3-box reversal with a buy stop at $1.375, a stop loss at $1.25, and a profit target at $2.50. This trade represents a 9:1 reward for the risk opportunity. A three-box trailing stop would protect any implied profit post entry.

ALGO/USDT $0.025/3-box Reversal Point and Figure Chart

As bullish as this trade setup is, its entry rules are particular. No more than three Os can develop below the triple-bottom. This means that if Algorand price moves to $1.2250 or below, the long setup is invalidated.