- King dollar reigns supreme ahead of US inflation and Fed minutes

- Stock markets wrestle with spike in short-term yields

- Earnings season kicks off, gold fights back, oil takes a breather

Dollar capitalizes on Fed bets

Dollar capitalizes on Fed bets

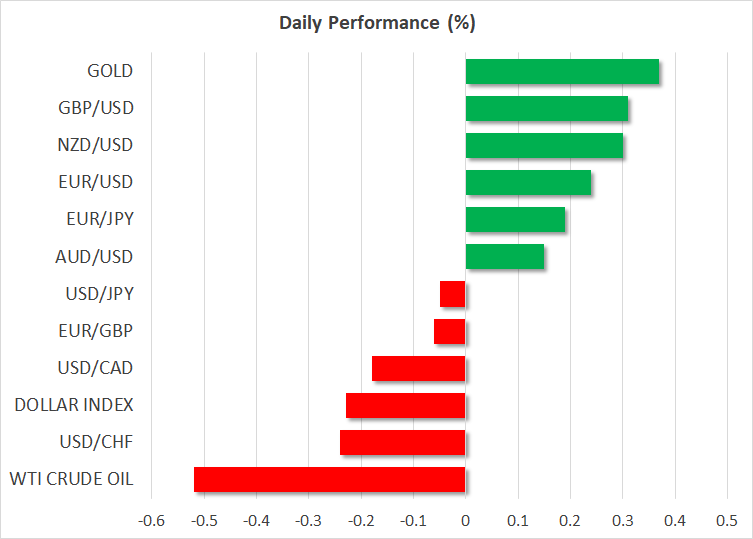

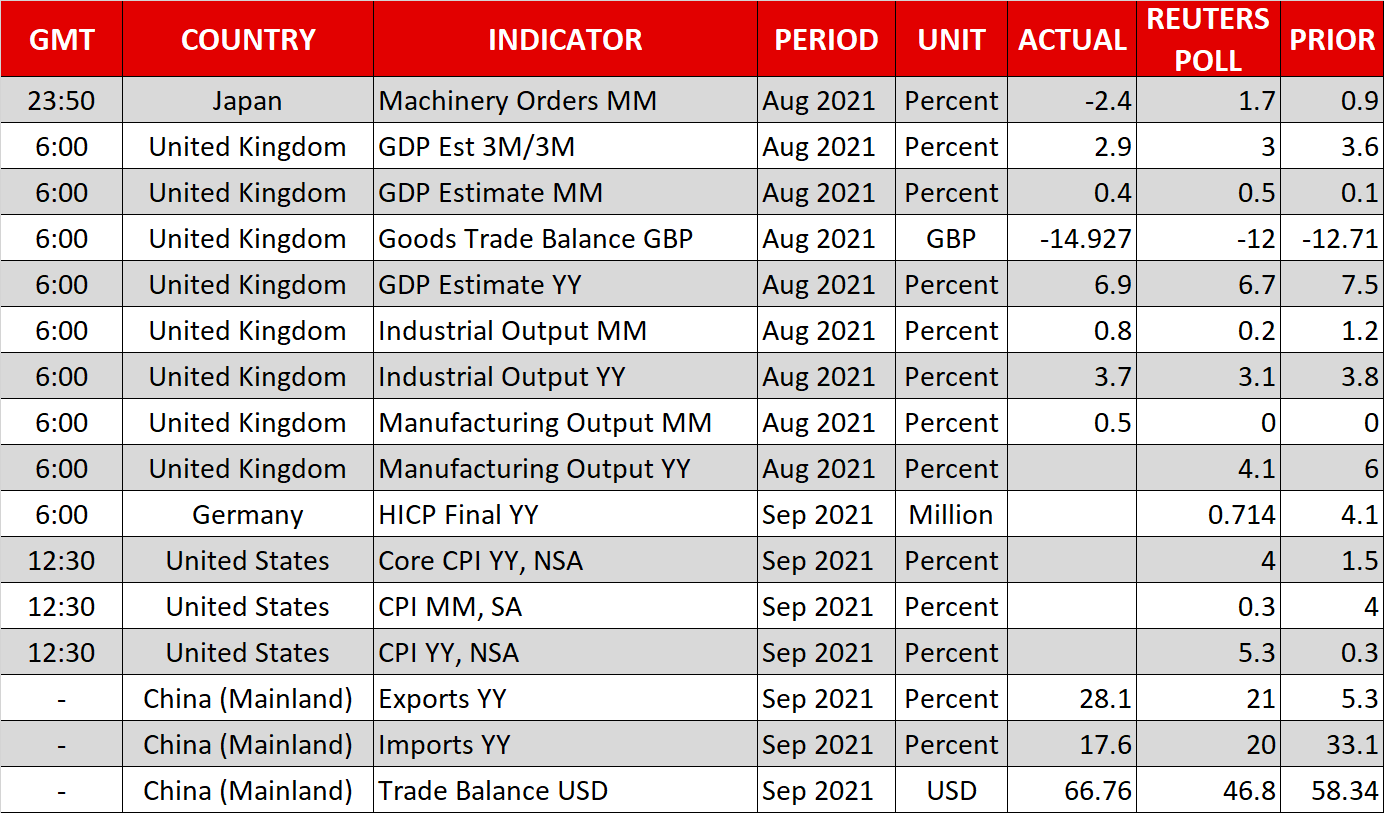

The main event today will be the release of CPI inflation numbers from America, a few hours before the minutes of the latest Fed meeting. Both the headline and core CPI rates are projected to have held steady in yearly terms, albeit at very elevated levels as the mayhem in supply chains continued to fuel inflationary forces.

Meanwhile, the minutes could provide some details about the length of the tapering process. Even more crucial will be the debate on whether inflation is transitory or persistent, as that will guide expectations around the timing of the first rate increase.

Investors are saying the transitory narrative is almost dead. With supply disruptions still raging and energy prices going bananas, US inflation expectations have stormed higher lately, cementing bets that the Fed will hike rates next year and turbocharging the dollar. Money markets are now pricing in almost a 50% probability for a rate increase by July.

The outlook for the dollar remains bright, especially against the euro and yen. The US economy is likely to escape the cataclysm in energy markets with only minor wounds thanks to its power independence and Congress could deliver another round of spending soon to juice up the recovery. A stronger US economy allows the Fed scope to raise rates to fight inflation, a luxury neither the ECB nor the BoJ can afford.

Stocks await earnings clarity

Wall Street closed a volatile session in the red yesterday as the Fed-driven spike in short-term yields played havoc with technology stocks. When markets price in faster Fed rate increases, names with stretched valuations usually get hit the hardest, and those are typically concentrated in the tech and growth sectors.

It has been a rocky few weeks for the major stock indices. Beyond rising yields, there are also concerns that a combination of slower growth but elevated costs will eat into corporate profit margins until the supply mess finally gets sorted out. The technical picture has suffered heavy damage as well, with the S&P 500 recording lower highs and lower lows lately while trading below its 100-day moving average.

The earnings season is finally here and it will hopefully provide some clarity around how quickly businesses expect supply problems to ease. Delta Airlines, Blackrock, and JP Morgan will kick things off today, which might be good news for the market as the conversation focuses on the strength in consumption and an improving landscape for financials, instead of goods shortages and delivery delays.

Gold attempts a bounce, oil steadies

In the commodity complex, gold has displayed some remarkable resilience in recent sessions, absorbing a stronger dollar and the spike in yields without much trouble. Bullion’s fortunes will hang on any surprises in the US inflation numbers today.

We are entering a period of seasonal strength for bullion that begins around November, so that may keep a floor under prices despite the broader outlook turning negative, with central banks quietly heading for the exits and the dollar slicing through its rivals.

Oil prices took a breather after reaching a fresh seven-year high this week, benefiting from the pandemonium in natural gas and coal prices that has sent power producers scrambling for any cheaper alternatives. The EU sending a top official to Iran for talks may have calmed crude prices too.

Finally, China’s latest inflation data early on Thursday will reveal whether factory prices continued to surge amid the power shortages, enabling even more inflation to be exported abroad.

Wednesday, 13 Oct, 2021 / 9:43