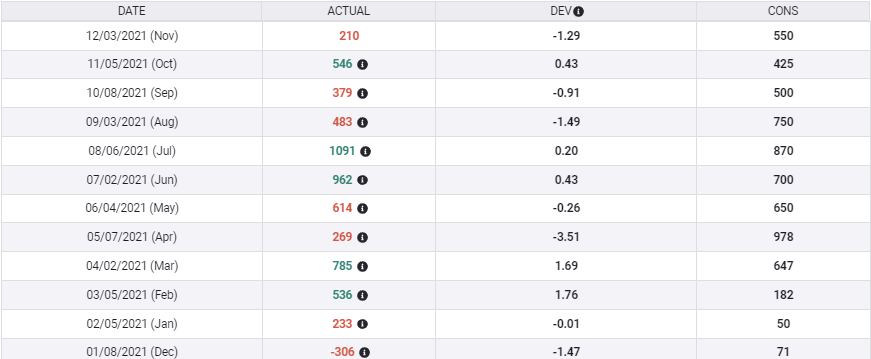

- Job creation forecast to nearly double to 400,000 from 210,000.

- ADP payrolls and labor market indicators show continuing strength in hiring.

- Federal Reserve December minutes reinforce the policy shift from employment to inflation.

- NFP likely to reinforce market impact of rising US interest rates.

The markets’ favorite US economic statistic has been dethroned. For the next several quarters, the main role of Nonfarm Payrolls will be to confirm the Federal Reserve’s new-found inflation policy. Short of an outright collapse in American job creation, monthly developments in payrolls should not deter the US central bank from its attempt to reassert control over consumer prices.

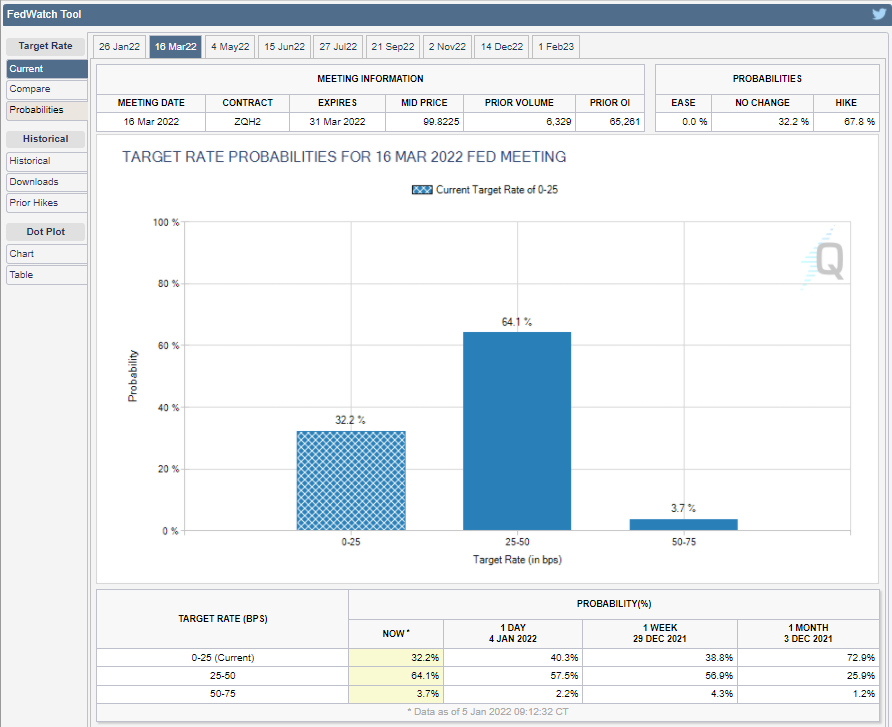

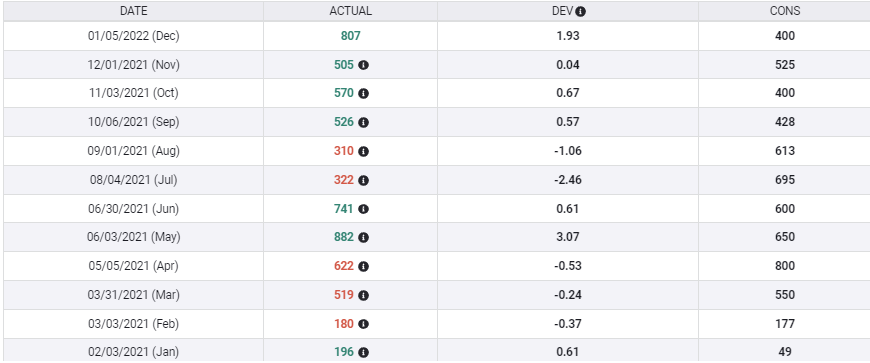

Nonfarm Payrolls are forecast to rise 400,000 in December, almost twice their 210,000 addition in November. Over the past six months payrolls have averaged 612,000, with a range from November’s low as above to 1.091 million in July. It has been the best half year of job employment gains since the initial lockdown recovery that began in May 2020.

Employment, inflation and Fed policy

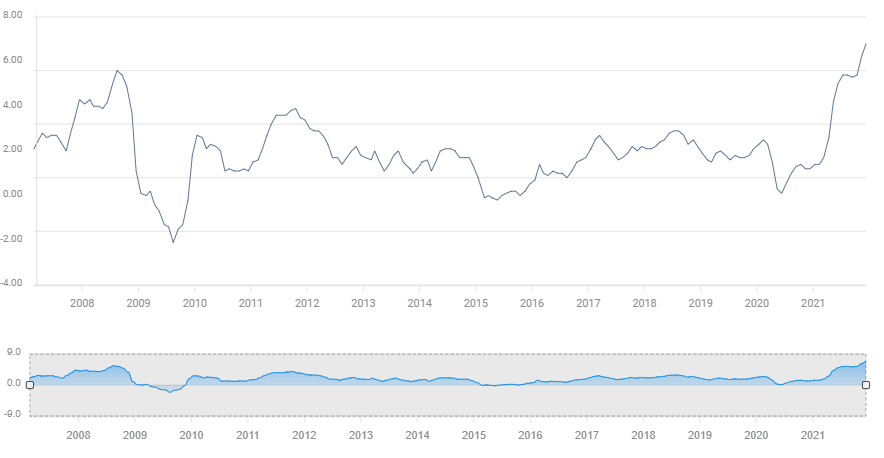

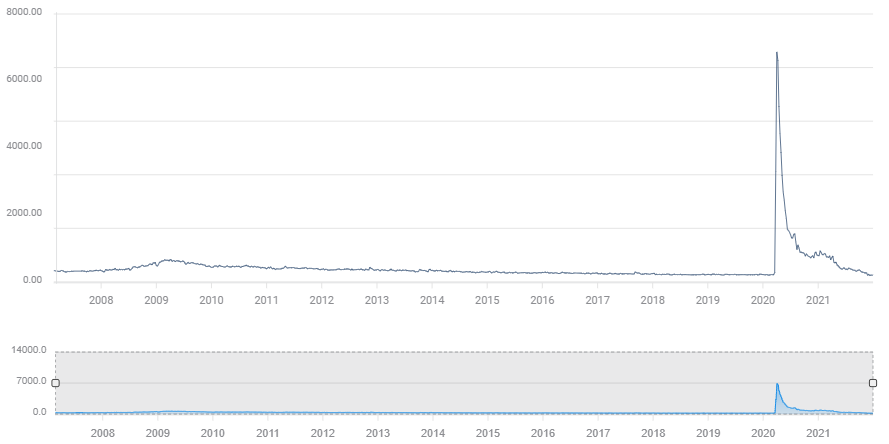

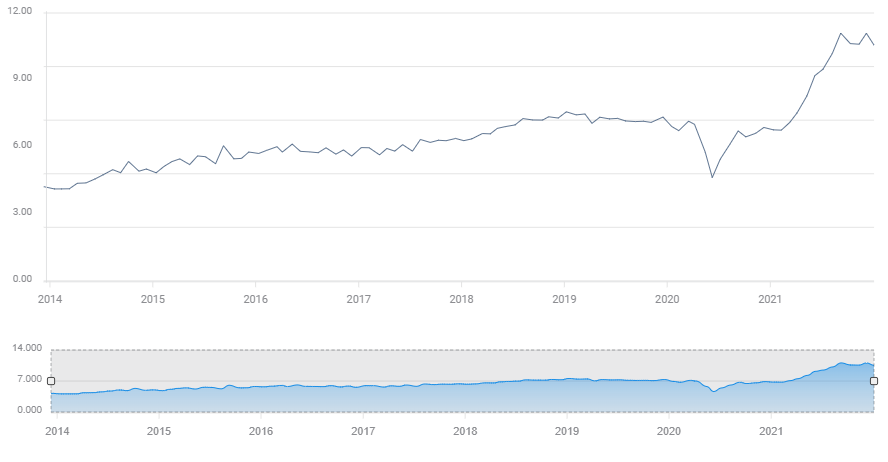

Overall consumer inflation has soared from 1.4% (YoY) in January to 6.8% in November. The Core Personal Consumption Expenditure Price Index (PCE), the Fed’s preferred measure, has more than tripled from 1.5% (YoY) at the start of the year, to 4.7% in November.

CPI

FXStreet

Manufacturing costs have climbed at record rates for three months in a row, ensuring that consumer prices in the first half of this year will continue higher. The annual Producer Price index (PPI) rose 8.6% in September, 8.8% in October and an astonishing 9.6% in November.

PPI

FXStreet

For the 21 months of the pandemic, from March 2020 to the November 3 Federal Open Market Committee (FOMC) meeting, US central bank policy had been exclusively focused on rebuilding the labor market. Chair Jerome Powell and other officials stressed, time and again, the importance of restoring employment to its excellent state before the pandemic.

The Fed governors dropped the first hint of a potential policy change in the minutes of the April FOMC meeting released on May 19. The summary noted that a few of the members thought that if the economy continued to improve, the time for considering a policy change might be approaching.

As inflation accelerated in the second half of the year, Fed rhetoric swiveled increasingly to inflation. Chair Powell said that the bank should retire the term ‘transitory’ to describe US price increases on November 30. A comment widely seen at the time as all but guaranteeing a doubling of the $15 billion monthly reduction of bond purchases at the December 15 policy meeting, ending the $120 billion program in March 2022. So it did.

Fed inflation estimates evolved even faster. On September 22 the Projection Materials predicted a 4.2% PCE inflation for 2021 and 3.7% core. The fed fund’s rate upper target at the end of 2022 was expected to be 0.3%, just above the extant 0.25% yield.

Less than three months later, at the December 15 FOMC, PCE inflation for 2021 was 5.3%, and core 4.4%. The fed funds forecast for the end of 2022 was 0.9%, nearly three full 0.25% increases. The inflation projections are more remarkable when you consider that the changes came with almost three-quarters of the year already recorded.

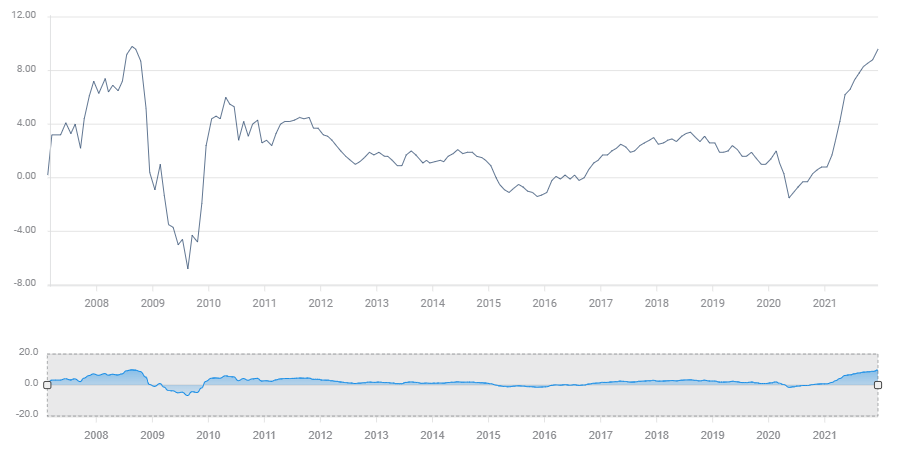

The first fed funds increase is now expected at the March 15-16 FOMC. The Chicago Board Options Exchange (CBOE) fed funds futures listed the odds of a hike at that meeting at 67.8% and a remarkable 73.4% chance for three increases by the final meeting of the year on December 14.

CBOE

ADP and NFP

Automatic Data Processing’s (ADP) National Employment Report for December was 807,000, nearly twice as strong as the 400,000 consensus forecast.

Though the ADP and NFP reports draw their data from the US labor market, the monthly correlation has been poor since the pandemic struck in March 2020. Of the 11 months this year, ADP and NFP have moved in the same direction six times and opposite the balance.

NFP

FXStreet

The ADP data is a straightforward recording of the employment changes in the firm’s 460,000 US clients, covering about 26 million workers. Payrolls are exclusively in the private sector and do not cover government employment at the local, state or federal level.

ADP

FXStreet

The Employment Situation Report from the Labor Department attempts to assess the entire US employment market. Known as the Nonfarm Payrolls (NFP) for its most famous statistic, it tracks new hires and layoffs in established companies and forecasts the number of jobs created each month by newly formed businesses. The combination of payroll changes and the projections combine for the monthly NFP number. Once a year the monthly estimates are corrected with the tax rolls, a process that has often produced gains or losses of several million jobs. By the time of the correction, in the following year, the original market impact is long forgotten.

Labor market indicators

Secondary employment data suggests that demand for workers remains robust. Layoffs are very low with unfilled jobs and voluntary work departures at historical records.

The ADP December result and the 602,000 average over the last four months, indicates that, at least in the private sector, workers are returning or finding new employment.

Initial Jobless Claims

Initial Jobless Claims dropped to 198,000 in the December 24 week. It was the third reading below 200,000 in the last six weeks. The four-week average dropped to 199,250 in the same five day period, its lowest count in 52 years, since October 25, 1969.

Claims

FXStreet

JOLTS

Unfilled positions in the Job Openings and Labor Turnover Survey (JOLTS) averaged 10.695 million from June through November after setting an all-time record of 11.098 million in July. Prior to this year, the highest one-month total had been 7.574 million in November 2019.

A record number of people left their jobs in November according to the same JOLTS report from the Bureau of Labor Statistics (BLS).

According to the BLS, 4.5 million workers voluntarily left their places in November, up from 4.2 million the previous month.

Voluntary departures, normally by workers seeking higher pay, are a sign of employment opportunities. People must feel confident that they will find a new and better job or they would not resign. The largest increases in turnovers occurred in hospitality and health care, industries hard hit by the lockdowns and pandemic.

JOLTS

FXStreet

PMI employment

Purchasing Managers’ Employment Indexes (PMI) from the Institute for Supply Management (ISM) imply that hiring has been restrained by worker shortages rather than lack of opportunities.

Comments from business managers highlight the difficulty in finding workers, particularly in the skilled trades, not the paucity of orders..

Manufacturing Employment PMI for December came in at 54.2, better than the 53.5 forecast and November's 53.3. It was the highest score since April 2020.

The services Employment PMI was 54.9 in December down from November's 56.5 but better than the 54.1 prediction.

Federal Reserve December minutes

The minutes of the December FOMC meeting, released on Wednesday, raised the stakes on Fed rate policy further.

Members discussed plans for reducing the amount of Treasuries and mortgage-backed securities the Fed holds on its balance sheet. While no date was set, the reductions in the bank’s almost $8.3 trillion in holdings could begin soon after it starts raising rates, currently expected at the March FOMC meeting.

“Almost all participants agreed that it would likely be appropriate to initiate balance sheet runoff at some point after the first increase in the target range for the federal funds rate,” the minutes said.

The process was also expected to be faster than it was in the prior instance in 2017 during the wind-down of the financial crisis quantitative easing purchases. “The appropriate pace of balance sheet runoff would likely be faster than it was during the previous normalization episode,” noted the minutes.

The Fed’s balance sheet and its bond purchases have been, as they were after the financial crisis, a key factor in keeping interest rates near historical lows.

Conclusion

The availability of employment, the extremely low level of layoffs, the desire of many workers to improve their wages to cope with soaring inflation, and the vibrant US expansion, should give Nonfarm Payrolls a good December. Given the strength of the attendant indicators and the ADP result, risk is weighted to a substantially better number than forecast.

Market responses

Market response to the Nonfarm Payrolls will continue the New Year reactions to the prospect of higher US interest rates. The Fed’s policy reversal that began at the November FOMC meeting after months of anticipation, picked-up speed in December and was enhanced by the balance sheet discussion in the minutes of that meeting.

The balance sheet topic was probably a bit unexpected for Wednesday’s markets and equities were sharply lower in response, with the Dow losing 392.54 points, 1.07% to 36,407.11 and the S&P 500 shedding 1.94%, 92,96 points to 4,007.58.

Treasury yields continued their January surge. The 10-year yield rose to 1.730% on Thursday afternoon, its highest since April 2021. It has added 22 basis points in the four days of 2022 trading since closing at 1.512% on December 31. The 30-year return was at 2.095%, up 19 basis points from its year end finish at 1.905%.

10-year Treasury yield

CNBC

Despite the recent gains Treasury yields remain well below their pre-pandemic averages.

Dollar response was mixed to Wednesday’s minutes, losing ground to the euro and the sterling but gaining versus the Canadian and Australian dollars. The Wednesday USD/JPY close at 116.12 was the highest in five years.

-637770458279057959.png)

Market direction for the first quarter has been set by the Federal Reserve’s abrupt change of interest rate policy. Nonfarm Payrolls and the American labor economy will enhance the Fed’s choice by maintaining a robust expansion. American economic growth in the fourth quarter is estimated by the Atlanta Fed to be running at a 7.4% annualized pace. There is every indication this will continue into the first half of 2022. Higher Treasury rates will support the dollar but their long-term impact on equities depends on the strength of the US expansion.

The chance of a US labor market pullback serious enough to call the Fed’s New Year policy into doubt, is, for the moment, most unlikely.