- USD/CAD bulls are losing conviction on the road to recovery.

- Defends 21-HMA resistance now support, as RSI turns flat.

- US dollar remains heavy, WTI trims losses ahead of US/Canadian jobs data.

USD/CAD is attempting a tepid bounce from four-year troughs of 1.2142, although the bulls lack a follow-through upside bias amid persistent weakness in the US dollar. The US dollar index drops 0.20% to five-day lows of 90.75 ahead of the critical US NFP release.

Monetary policy divergence between the two North American economies continues to favor the Canadian dollar. Meanwhile, the Loonie takes advantage of a pause in WTI’s decline, as black gold recovers losses to now trade at $64.65.

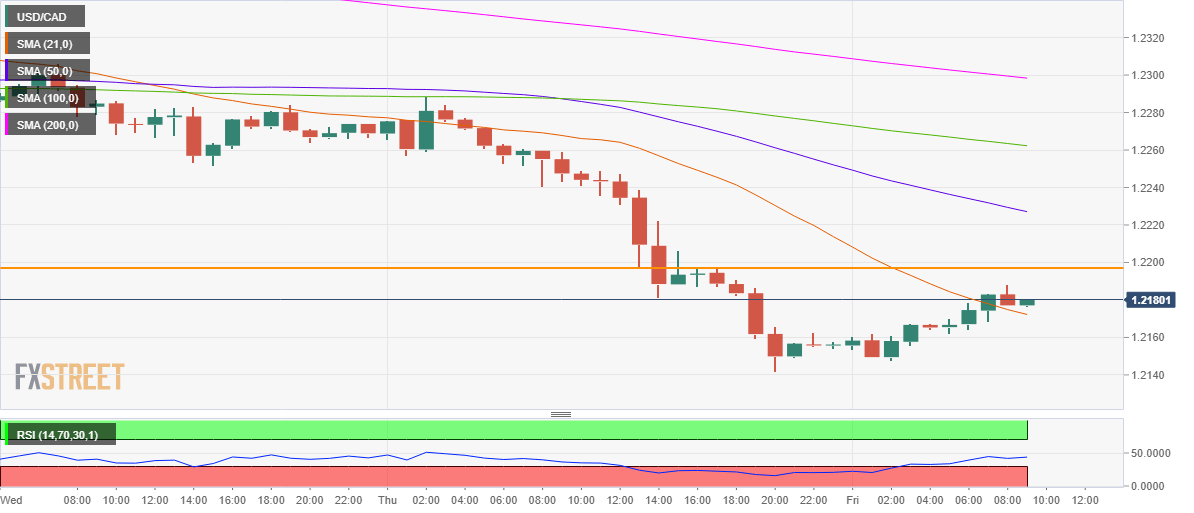

From a near-term technical perspective, USD/CAD is consolidating its rebound from multi-year troughs, having recaptured the bearish 21-hourly moving average (HMA) in early European trading.

USD/CAD: Hourly chart

The Relative Strength Index (RSI) has recovered from lower levels, turning flat at the moment, suggesting that the bulls have turned cautious once again. The indicator still holds below the midline.

A drop back below the 21-HMA support at 1.2172 will once again expose the four-year lows.

The next support is envisioned at 1.2100, the round figure.

Alternatively, the horizontal (orange) trendline resistance at 1.2197 could test the recovery momentum.

Further up, the downward-sloping 50-HMA at 1.2229 could be put to test.