Capitality broker claims to be based in Switzerland but fails to provide us with the FINMA license number. And this is just the first of many red flags. Since we received numerous complaints, we decided to check the business and confirm if your funds are safe.

Read our thorough Capitality review to find out everything.

In top of that, we seriously recommend you not to invest in the fake brokers Aiko Markets, OptiumGroup, and TheExchangeBank. Do not trade with these unlicensed brokers if you want to save your money!

| Broker status: | Offshore Broker |

| Regulated by: | Unlicensed Scam Brokerage |

| Scammers Websites: | capitality.ch |

| Blacklisted as a Scam by: | N/A |

| Owned by: | Capitality FS International LLC |

| Headquarters Country: | Switzerland / Saint Vincent and the Grenadines |

| Foundation year: | 2022 |

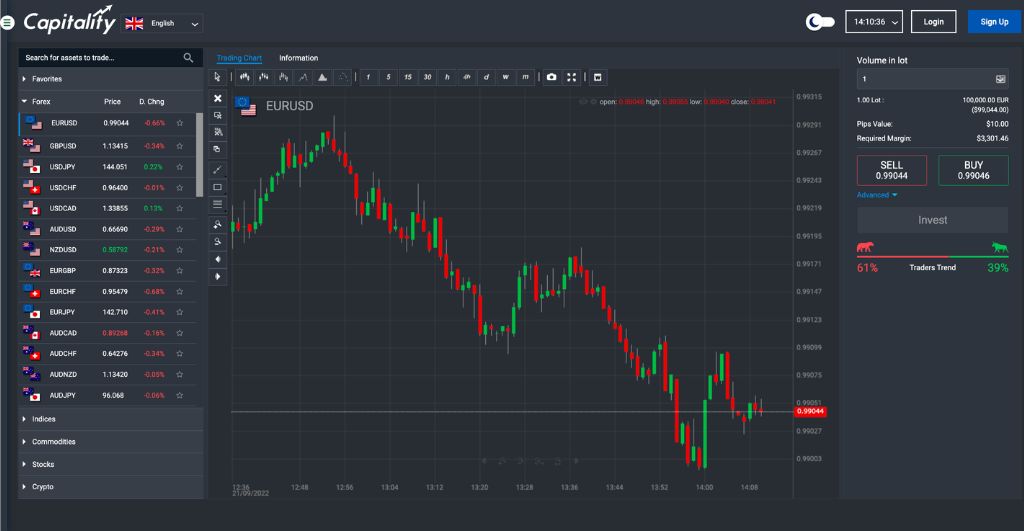

| Supported Platforms: | WebTrader, MT4 |

| Minimum Deposit: | 500 EUR |

| Cryptocurrencies: | Available – BTC, ETH, XRP |

| Types of Assets: | Forex, commodities, indices, shares, cryptocurrencies |

| Maximum Leverage: | 1:500 |

| Free Demo Account: | No |

| Accepts US clients: | No |

Is Capitality a Trustworthy And Licensed Broker?

Capitality is a brand of Capitality FS International LLC. The company was stated to be a “Swiss financial institution registered with the Financial Services Authority of Saint Vincent and the Grenadines.”

This per se is enough for us to suspect the brokerage. First, Switzerland has quite a firm regulatory body, FINMA. It ensures that firms follow strict rules, limit their leverage, provide negative balance protection, and keep clients’ funds in segregated accounts.

On the other hand, we have FSA from SVG, the register of Forex firms, but not a regulator. Thus, even if Capitality has entered FSA commercial register, it would mean nothing in terms of license and business regulations.

Reasons Not to Trust an Unlicensed Broker

As aforementioned, licensed brokers should follow the rules and have enough funds to reimburse potential victims. Offshore brokers, on the other hand, have no obligations whatsoever.

Assuming that the firm is in SVG would mean that it operates without any valid regulations. Simply put, it can vanish at any moment with your funds, and you will have nowhere to file a complaint.

How Reliable Is Capitality Broker?

Capitality is an offshore firm based in Saint Vincent and the Grenadines. As such, it doesn’t follow under any regulations. Negative reviews indicate that the firm cannot be trusted.

What Do Traders Think Of Capitality?

Capitality reviews highlight the main issues with the brokerage. The company is welcoming and supportive while customers are depositing their funds. Once they decide it is enough and request a payout, this firm freezes their access to money and trading accounts.

If this story sounds familiar, it’s time for you to file a complaint.

Capitality Offers a WebTrader and MT4 for Trading?

According to its website, Capitality offers two trading platforms – WebTrader and MT4. While web-based software is a simplified tool without any special features, MT4 brings all the benefits. Customers can access EAs and social trading and customize the platform according to their needs.

Normally, having MetaTrader would be terrific. Yet, in this case, the broker provides unregulated trading conditions, affecting the outcome of your trades.

Capitality App for IOS and Android Devices

The app enables trading from any iOS or Android-based device, whether a mobile phone or tablet. Allegedly, it contains interactive quotation charts, a full range of trading orders, and the most popular analytical tools.

Since we cannot review the app without making an initial deposit, we cannot comment further.

Capitality Accounts Overview

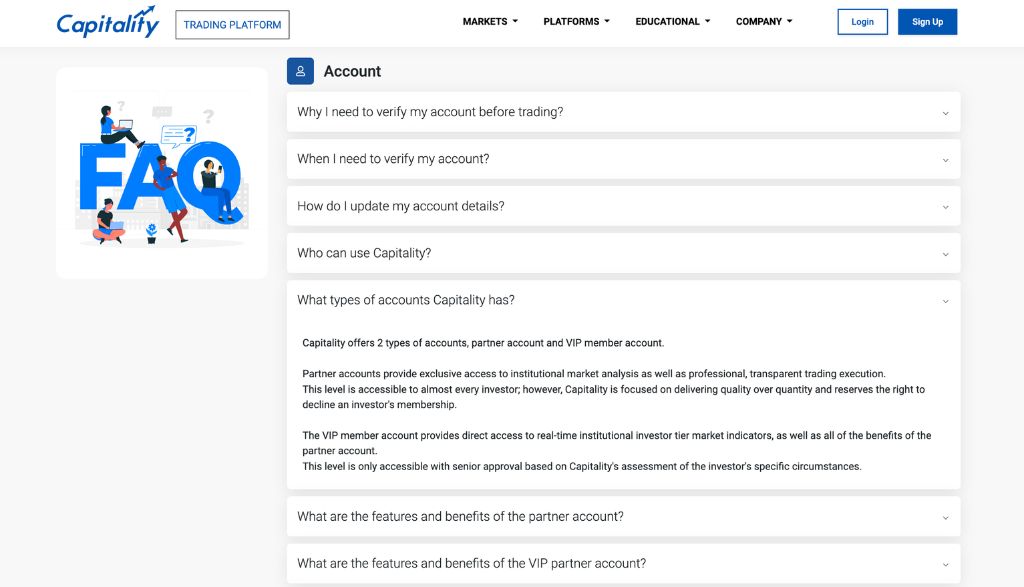

In the FAQ section, Capitality mentions two account types:

- Partner account – 10,000 EUR

- VIP member account

The first is said to be available to any investor, bringing access to institutional market analysis and transparent trading execution. VIP member status has to be earned and approved by a senior upon assessment.

Capitality Broker – Countries Of Service

According to reviews, Capitality mainly targets residents of Switzerland and Australia. However, the firm has no license and operates offshore, meaning it can provide its services anywhere.

If you see any ads regarding Capitality Forex broker, you should skip them. This company won’t bring anything but a headache and concerns about your funds.

Security Methods Provided by Capitality

Allegedly, the firm takes all the measures to prevent theft and money laundering. They operate according to KYC/AML standards and protocols. However, we haven’t been able to find any measures that they actually apply or any protocols that they follow.

It’s all just a nice display show for inexperienced investors. Don’t fall for it.

Capitality Range of Trading Markets

The broker enables access to all 5 major markets, including:

- 30+ currency pairs – EUR/USD, CHF/PLN, GBP/TRY

- 30+ indices – SPX500, US30, EUR50

- 10+ commodities – WTI, corn, gold

- 50+ cryptocurrencies – DOT, DOGE, LTC

- 2,000+ shares – MSFT, AMZN, NVDA

Also remember the names of the Broker Capitals, ProsperityFX and Crypto Lloyds trading scams and avoid them at all costs! Moreover, always check the background of online trading companies before investing!

What Is Known About Capitality’s Trading Conditions?

Since we already elaborated on the broker’s regulation, it’s easy to understand why provided trading conditions are unregulated. For instance, the leverage exceeds the regulatory limit, swaps are relatively high, starting at $3. The spread is above the industry average as well. All in all, trading with Capitality won’t be cheap or favorable.

What Is the Broker’s Leverage and Spreads?

The company enables leverage of up to 1:500 for the Forex market. In the EU and UK, this limit is set to 1:30. In Canada and US, it’s slightly higher, standing at 1:50. Capitality puts your funds at ten times higher risk than any global regulator would allow.

The spread starts at 2.3 pips for EUR/USD pairs, while the industry standard is 1.5 pips.

Capitality Minimum Deposit and Unfavorable Withdrawal Terms

Only in the FAQ can we find information about the minimum deposit and withdrawals. The company requires investors to start with at least 500 EUR, double the standard.

As per withdrawal, the company insists clients provide Withdrawal Authorization Code from the partner card. It can easily mean that you need to give them your CVV code so that they can swipe your card and take more funds.

What Payment Method Does the Broker Accept?

The company accepts:

- Debit/credit cards

- Wire transfer

- SEPA

- UnionPay

- Bitcoin

- iDEAL

Scammed by Capitality Broker? – Let Us Hear Your Story

If you were scammed by Capitality or a similar bogus broker, let us know. Our chargeback experts may be able to assist you with the refund. Don’t let scammers keep your hard-earned money. Book a free consultation, and let’s put an end to it.

But What Is A Chargeback?

A chargeback is a way for the bank to recover funds stolen from your debit/credit card. Contact us right away to explain your case in detail. We will evaluate it and find the best recovery method. Act now.