Having vast experience investigating offshore brokers, we recognize a scam immediately. Instead of you taking our word for it, ensure you read this Interactive Fund review. There’s everything you need to know to avoid becoming the next scam victim.

| Broker status: | Offshore Broker |

| Regulated by: | Unlicensed Scam Brokerage |

| Scammers Websites: | interactive-fund.com |

| Blacklisted as a Scam by: | N/A |

| Owned by: | InterActive Group Ltd |

| Headquarters Country: | Saint Vincent and the Grenadines |

| Foundation year: | 2021 |

| Supported Platforms: | MT5 |

| Minimum Deposit: | $1,000 |

| Cryptocurrencies: | Available |

| Types of Assets: | Forex, commodities, indices, shares, cryptocurrencies |

| Maximum Leverage: | 1:200 |

| Free Demo Account: | Yes |

| Accepts US clients: | Yes |

What About Interactive Fund Regulation?

Interactive Fund is a brand of InterActive Group Ltd from Saint Vincent and the Grenadines. The first issue is that this offshore island has no financial regulator for Forex and binary options firms. The FSA declared itself unauthorized and directed brokers to opt for a license in the country of service.

If an Interactive Fund broker follows this directive, it should be regulated in the Tier1 zone by the FCA, ASIC, BaFin, etc. Upon reviewing these registers, we can safely say that Interactive Fund is another offshore scheme firm.

To add to the foregoing, we strongly advise you to ignore brokers such asOctexTrade,FXrally, andProfitrade247.

Why Is It Important For A Broker To Be Licensed?

Like banks and other financial institutions need supervision since they’re dealing with large amounts of funds, so do trading brokerages. Thus, every investment firm should have an appropriate license and comply with the trading rules in the country of service. Since Interactive Fund is not regulated in any country, it creates its own rules and handles your funds the way it wants. And that’s not recommended.

Is Interactive Fund A Legitimate Broker Or A Fraud?

Interactive Fund is a scam firm. The broker is based in Saint Vincent and the Grenadines and doesn’t have a financial regulation. The consumer index is 1, indicating that this company is not recommended.

Traders Reviews About Interactive Fund

Interactive Fund has many negative reviews. Of course, since the broker is not regulated and provides unregulated trading conditions, customers filed a complaint. The majority of reviews mention withdrawals. Apparently, the broker won’t let anyone withdraw their funds, no matter what. Typical offshore scheme.

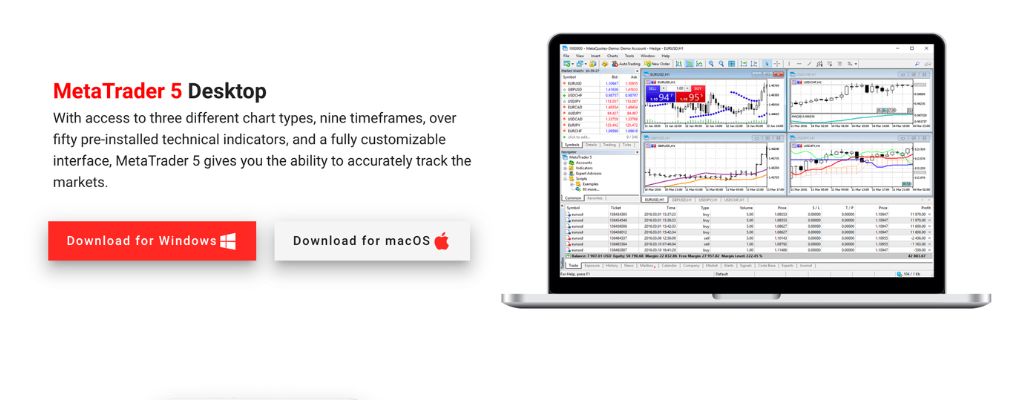

What Platforms Does Interactive Fund Offer? – Available Trade Software

Interactive Fund offers MT5. Normally, this would be terrific news. MetaTrader 5 is one of the best platforms this industry has, as well as the safest.

However, Interactive Fund is not licensed, meaning it can provide any trading conditions it wants. And that automatically means that your funds are not safe.

Never choose the broker only based on the platform, regardless of how good it may look.

Customer Support Of InteractiveFund

The broker has a well-trained customer support team. The main role of these people is to extort funds and ensure you won’t get a payout. The welcome team will pressure you to invest on the spot and transfer you to an account manager. Then, an account manager will make all kinds of financial plans and ask for more money. If you want to submit a withdrawal request, they will ask you to invest one last time before that, to double or triple your current income. Only, this last trade will ensure that you lose all of your profit.

All About Interactive Fund Accounts

Clients can choose between 5 Interactive Fund account types.

Islamic Account

The main difference between Islamic and other account types is the swap since the Islamic account is swap-free. Other accounts differ in spread, leverage, and trading education.

Demo Account

Besides Live accounts, the broker provides a Demo account where clients can test the platform. Note that usually, a Demo account is just a lure. Once you deposit real money, this is where your problems will start.

Interactive Fund Broker – Countries Of Service

Interactive Fund mainly provides its services in Canada, the US, and Singapore. However, the broker is unlicensed and operates illegally. Note that you shouldn’t be involved with such a firm wherever you reside since your funds are at risk.

Interactive Fund Range of Trading Instruments & Markets

The broker offers trading with:

- Currency pairs – EUR/USD, GBP/USD

- Commodities – oil, gas, corn

- Indices – NASDAQ, Dow Jones

- Shares – Amazon, Apple, Google

- Cryptocurrencies – BTC, ETH, XRP

Please remember the names of theIntel Trading,Global Solution, andRichmond Superand stay away from them! Before investing, always check the history of online trading organizations!

Minimum Deposit – High Initial Investment

While the industry standard is $250, Interactive Fund requires $1,000 to start trading. Compared to legitimate firms with Micro accounts starting at $10, this is a rather high initial investment. Thus, there’s absolutely no reason to risk your funds with this firm. Choose any other brokerage, and you’ll be able to start with a lower amount.

Scam Bonus Policy

The trading company has a rather confusing Bonus Policy. According to it, you cannot request a withdrawal unless you have traded the bonus amount multiplied by the bonus leverage. The bonus leverage is 35 for bonuses under 50% of the deposit amount and 40 for bonuses over 50% of the deposit.

So, suppose you have invested a minimum and got $200; you will have to have a rollover of $7,000 just to be able to submit a withdrawal request.

Interactive Fund Trading Conditions

As mentioned, this firm has no financial regulations and determines its own trading conditions. The spread starts at 3 pips, double the industry standard, while the leverage is unregulated.

High Leverage

While EU and UK regulators limit leverage to 1:30 for the Forex market, the broker provides up to 1:200. Another proof that you’re dealing with a scheme.

Interactive Fund Deposit, Withdrawal Methods, and Fees

The company accepts payments using:

- Debit/credit cards

- Wire transfer

Allegedly, all the withdrawals should be processed within 5 business days, and if not, a client has the right to require an inquiry. Of course, this inquiry is performed by the broker itself, so there’s no point in it.

There’s nothing about fees or commissions you will have to pay for any of these payment methods.

Payment Method Of Legitimate Brokers

Legitimate brokers usually enable clients to deposit using PayPal, Skrill, or a similar e-wallet. With these payment methods, clients are entitled to a refund within a certain period of time, which represents a money-back guarantee.

Scammed by Invest Interactive Fund Broker? – Let Us Hear Your Story

If you were scammed by Interactive Fund or a similar bogus broker, let us know. Our chargeback specialists may be able to help you recover your funds.

But What Is A Chargeback?

A chargeback is a way for your bank to recover the funds directly from the merchant. Contact us via online chat to book a free consultation, and let’s start the chargeback process now.