Online trading is fertile ground for numerous financial frauds. While some scheme firms are typical bogus websites with a shady background, some are presenting to be a part of legitimate financial firms hoping to lure more customers into their scams. One such company is Martyn Services, which will be the subject of our review. Keep reading and don’t miss any details.

Additionally, we strongly advise you to avoid the fraudulent brokers Fibonacci Trade, TopTrade500, and Broker Capitals.

| Broker status: | Unregulated Broker |

| Regulated by: | Unlicensed Scam Brokerage |

| Scammers Websites: | martynservice.com webtrader.martynservice.trade martynservice.net martyn-services.net |

| Blacklisted as a Scam by: | FCA |

| Owned by: | Martyn Services Limited |

| Headquarters Country: | UK (allegedly) |

| Foundation year: | 2022 |

| Supported Platforms: | 250 EUR |

| Minimum Deposit: | WebTrader |

| Cryptocurrencies: | No |

| Types of Assets: | Forex, commodities, indices, shares |

| Maximum Leverage: | 1:500 |

| Free Demo Account: | No |

| Accepts US clients: | No |

Is Martyn Services Trade a Safe Broker or a Scam?

Martyn Services broker is an example of a clone firm. As you may see from their well-designed website, the company claims to be a part of Martyn Services Limited, a UK-registered company. This, however, is not true. Upon research, we found that Martyn Services Limited does exist at the address provided on the website, but it’s a firm providing financial intermediation not elsewhere classified. In addition, it’s not subject to FCA regulations.

All this indicates that Martyn Services is an anonymous phony website, and if an issue arises, you have nowhere to file a complaint.

Reasons Not to Trust an Unlicensed Broker

There are plenty of reasons to avoid unlicensed firms, especially those pretending to be legitimate. While customers believe they are under FCA protection and entitled to the FCSC compensation fund, it’s actually the opposite. No regulator will reimburse you if you have been dealing with Martyn Services or a similar clone company.

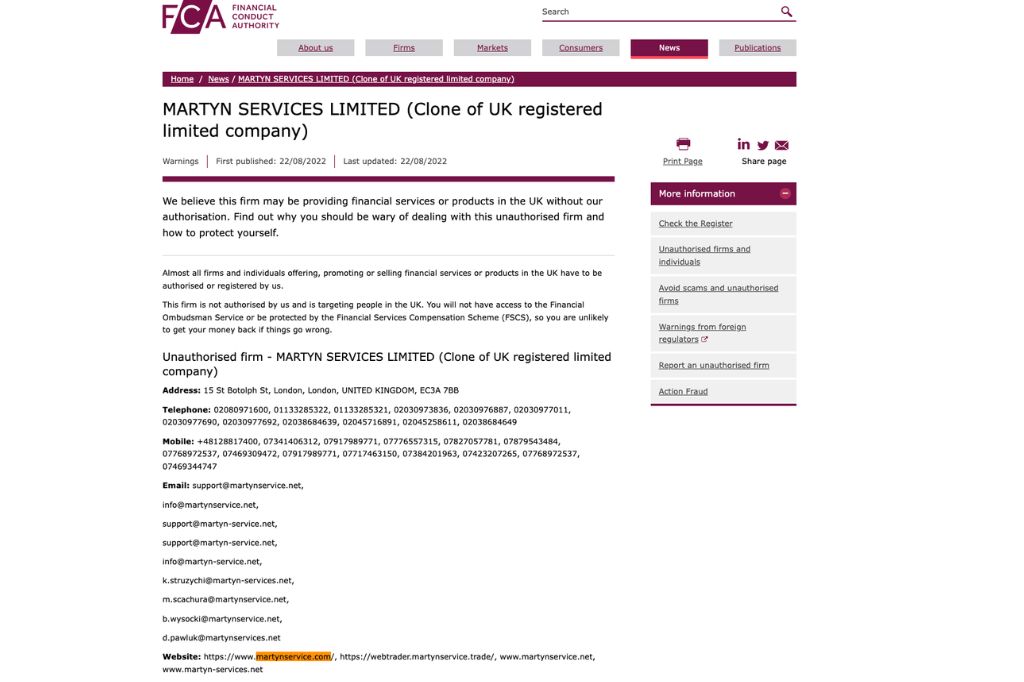

Martyn Services Warning by the UK Financial Conduct Authority

The UK regulatory body, FCA, issued a warning against Martyn Services. According to it, this

brokerage is a clone firm of UK-based Martyn Services Limited and these two are unrelated. Furthermore, the FCA warned customers that they cannot get reimbursed if dealing with this scheme firm.

If you don’t think we are onto something, you have an official confirmation.

What Do Traders Think Of Martyn Services?

As expected, traders’ reviews are mainly negative. And they’re mainly referring to the fact that this firm is not actually registered in the UK nor licensed by the FCA. According to customers, everything will be fine if you’re willing to top up your account and deposit more funds. If you decide that you want to withdraw the funds, that’s not going to happen. Broker employees will give you numerous excuses before blocking access to your trading account.

Martyn Services Webtrader – Trading Software & Tools

While the main page indicates that you can open an account and start trading on MetaTrader, it turns out it’s just a good advert. In reality, you will get access to a basic WebTrader. This internet-based trading tool has several indicators, 3 chart types, and basic features, such as trading history and pending orders. Nothing close to the real MetaTrader.

So, What Is The More Efficient Software?

Having access to MT4 or MT5 would be a better option. This software has been known as the industry standard, preferred by 80% of retail traders. Thanks to the vast number of trading features, including EAs, social trading, and more, it’s the best trading tool you can get. In addition, it’s the most secure platform for your funds.

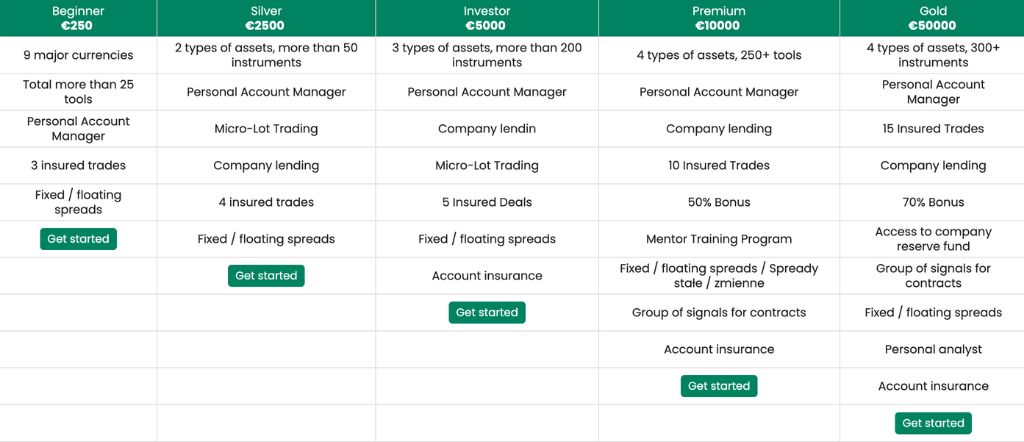

Martyn Services Accounts Overview

The broker offers access to 5 different accounts, including:

- Beginner – 250 EUR, FX trading, 3 insured trades

- Silver – 2,500 EUR, 2 types of assets, 4 insured trades

- Investor – 5,000 EUR, 3 types of assets, 5 insured trades

- Premium – 10,000 EUR, 4 types of assets, 10 insured trades

- Gold – 50,000 EUR, 4 types of assets, 15 insured trades

Besides the increasing number of insured trades, Premium and Gold account users are entitled to 50% or 70% bonus, respectively.

Also, avoid the trading frauds GF Markets, FiboTraders, and BigBitMarket at all costs! Moreover, before investing, always look into the past of internet trading firms!

Can I Try to Trade With a Demo Account?

Based on our review, there’s no Martyn Services Demo account. Instead, customers are invited to invest a minimum of 250 EUR and start with the Live account. Since the advertised platform is fake and the broker is illegal, we don’t advise you to do it. You’re exposing your funds to risk.

Martyn Services Broker – Countries Of Service

Based on complaints, we concluded that Martyn Services trading scam mainly operates in:

- UK

- Poland

- Austria

- France

However, this broker is unlicensed in any country. No matter where you reside, you should know that you have no coverage for your funds.

Bonus Terms and Conditions

While bonuses and other incentives are banned by major EU and UK regulators, this firm provides up to 70% on the initial deposit. However, there’s no Bonus Policy or any sort of T&C. This means that broker employees can decide on the necessary rollover before you’re eligible for a withdrawal. It also means they can change bonus terms at any time since nothing is written.

Martyn Services Range of Trading Markets

This trading firm offers a limited number of trading assets, depending on the account type. All assets are available only to those signed up for a Gold account. Here’s the asset overview.

- Forex – EUR/USD, AUD/CAD, GBP/CHF

- Indices – Dow Jones, NASDAQ, FTSE100

- Shares – Amazon, Facebook, Netflix

- Commodities – gold, palladium, corn

Surprisingly, cryptocurrencies are not on offer.

What Trading Terms Does Martyn Services Offer?

Regarding trading terms, Martyn Services cannot be compared to legitimate brokers. Thus, this firm offers unregulated trading conditions and doesn’t specify trading costs. All in all, there’s no reason to trust them. Let’s see what you can expect.

About Leverage and Spread

The spread starts at 0.6 pips, and customers can choose fixed or floating spreads. With fixed spreads come other commissions that have not been specified.

The leverage goes up to 1:500, which goes directly against an FCA regulation allowing up to 1:30 for retail traders or slightly higher for experienced investors.

Minimum Investment Amount

The broker is asking for a minimum deposit of 250 EUR. While this can be considered a standard, it’s a lot of money to invest in an unregulated firm. Since legitimate companies have lower requirements and are safer, we always recommend you stick with those. Also, you will know that your money is safe.

Martyn Services Deposit, Withdrawal Methods, and Fees

The firm has no Withdrawal Policy that would clarify the terms. The T&C we’re given has no details, so all the commissions and fees remain unknown. Furthermore, deposit and withdrawal methods differ, which is directly against the AML rules. This company operates illegally until the end.

Methods of Payment

Deposits can be made using the following methods:

- Debit/credit card

- E-wallet

- QIWI

- Cryptocurrencies

At the same time, withdrawals through the QIWI wallet are not possible.

Scammed by Martyn Services Broker? – Let Us Hear Your Story

If you find yourself scammed by Martyn Services, you should report it immediately. Brokers like this one tend to disappear after being exposed by regulators. You should start the chargeback procedure and get your money back. Contact us via online chat to book a free consultation with our experts.

But What Is A Chargeback?

A chargeback is a way for your bank to recover funds from the merchant. We’re here to help you file a dispute and be with you until it’s resolved. Let’s start now.