Some would confuse Supreme Capital for a UK-based brokerage based on its domain. This firm operates offshore and doesn’t follow any regulatory rules. This is why we believe that you should read this review before being involved with a scheme. Your funds are at risk.

| Broker status: | Offshore Broker |

| Regulated by: | Unlicensed Scam Brokerage |

| Scammers Websites: | supreme-capital.co.uk |

| Blacklisted as a Scam by: | N/A |

| Owned by: | N/A |

| Headquarters Country: | Saint Vincent and the Grenadines |

| Foundation year: | 2022 |

| Supported Platforms: | WebTrader |

| Minimum Deposit: | $250 |

| Cryptocurrencies: | Available |

| Types of Assets: | Forex, commodities, indices, shares, cryptocurrencies |

| Maximum Leverage: | 1:400 |

| Free Demo Account: | Yes |

| Accepts US clients: | Yes |

Is Supreme Capital a Licensed Broker?

Supreme Capital did not list a company owner or an official address. According to the Terms and Conditions, the company complies with the laws of Saint Vincent and the Grenadines. But, here’s the thing. SVG doesn’t have a valid financial regulator. As a matter of fact, there’s an FSA directive instructing brokers to opt for a license in the country of service.

Upon checking with FCA, ASIC, BaFin, etc., we have confirmed that Supreme Capital is not regulated and operates illegally.

How Unsafe Is An Unlicensed Broker?

Unlicensed brokers are dangerous since there’s no authority to supervise their activities. Legit brokers have compensation funds to reimburse potential victims. You have no such thing with unlicensed firms, meaning there’s no money-back guarantee.

What is more, we strongly advise you not to invest inHubbleBIT,ETHProfitsandBitonextfraudulent brokers.

So Is Supreme Capital a Decent Broker or a Scam?

Supreme Capital is a scam online trading brokerage. The firm operates according to the laws of Saint Vincent and the Grenadines and has no valid financial license.

Traders’ Experience With Supreme Capital

Even though the company has existed for several months, Supreme Capital reviews are already negative. Customers shared how they were pressured to invest money all the time, but nobody could get a withdrawal. Once they complained to the UK regulator, they figured the firm was offshore and unlicensed. And this is when their fight for money began.

What Platforms Does Supreme Capital Offer? – Available Trade Software

The trading company offers a proprietary WebTrader available on desktop and mobile versions. Allegedly, the platform brings “power and flexibility” to its investors. Once we accessed it, we figured it was nothing but a basic TradingView chart with the attached indicators. Customers can see a complete list of trading assets, margin level, amount of money, and open trades. But that’s all.

To start trading, find a legitimate company providing MT4 or MT5.

Mobile Trader

There’s a Supreme Capital mobile app based on WebTrader. Even these tools are not as sophisticated. However, we will give it slack. Unlike many offshore scammers, this one tried to provide its clients with iOS and Android platforms.

All About Supreme Capital Accounts

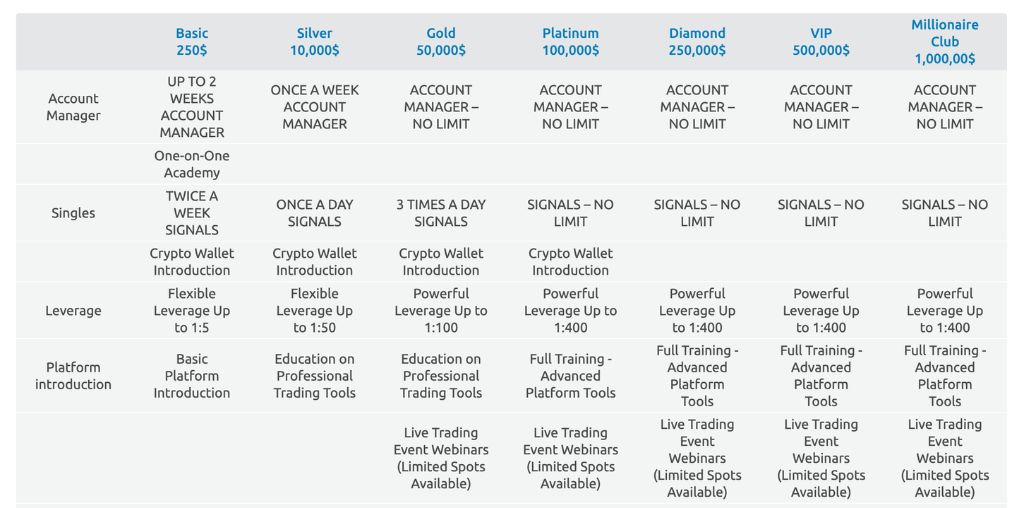

You can choose from one of the seven Supreme Capital accounts. They are:

Accounts differ in spread, leverage, number of trading signals, sessions with account managers, and more.

Does the Broker Use SSL? – Secure Socket Layer

The broker has SSL encryption on the website. However, this doesn’t mean that your funds are safe. SSL or Security Socket Layer should protect your confidential information, such as passwords and credit card numbers, from hackers. Moreover, this firm offers a proprietary WebTrader, meaning that they can access your funds and trade through the platform and change everything. You can see a significant profit or severe losses and wonder how it happened so quickly.

SSL is a fantastic tool, but only when provided by a legitimate investment brokerage.

Supreme Capital Broker – Countries Of Service

According to our research, the broker mainly operates in:

- US

- Canada

- Germany

- Australia

Supreme Capital Range of Trading Instruments & Markets

Customers can trade in all major markets, including:

- Currency pairs – EUR/USD, USD/GBP, GBP/CAD

- Commodities – oil, gold, silver

- Indices – Dow Jones, NASDAQ

- Shares – Amazon, Tesla, Google

- Cryptocurrencies – BTC, ETH, XRP

Also, remember the names of thePrimeDeltas,IB FinanzasandConcordInvesttrading scams and avoid them at all costs! Moreover, always check the background of online trading companies before investing!

What Does Trading Terms Supreme Capital Provide?

Supreme Capital has not specified a spread, so we don’t know much about trading costs. Besides, as per the leverage, it ranges from 1:5 to 1:400. In the EU and UK, regulators have a strict limit of up to 1:30, while in the US and Australia, this limit is 1:50. Likewise, if a retail trader is highly experienced, the leverage can be slightly increased.

As you can tell, the firm goes against regulatory rules and offers significantly higher leverage. Also, that could lead to major financial losses.

Supreme Capital Deposit, Withdrawal Methods, And Fees

The company accepts only one payment method – cryptocurrencies.

According to the website, there are no deposit or withdrawal fees. However, here’s the odd thing. The withdrawal processing time is 7-10 working days. Since crypto transactions are mainly instant, we’re unsure why it would take so long for the firm to return your funds. It’s probably another way to delay you and make you wait for funds you will never get.

Minimum Investment Amount

The minimum deposit with Supreme Capital is standard – $250. However, this firm is not regulated, meaning that even a penny is at risk. Regulated firms allow you to start with as low as $10 and have fewer risks than unregulated offshore fraud. Thus, there’s no reason to consider investing with a Supreme Capital broker.

Customer Support – Communication Channels

The broker’s customer support contacts clients via:

- Phone calls

- Emails

- Messages

- WhatsApp and Telegram

- Social media

They will offer you all kinds of bonuses and lure you into investing. But be careful. Because you’re dealing with offshore fraud.

Scammed by a Supreme Capital Broker? – Let Us Hear Your Story

Supreme Capital is a fraudulent broker. Falling victim is not as hard. But once you’re scammed, you shouldn’t give up. Fight for what’s rightfully yours. Let’s file a dispute for a chargeback together and let’s recover your funds before it’s too late.

But What Is A Chargeback?

A chargeback is a way for your bank to recover funds from the merchant. If you have been scammed, it’s of utmost importance to react quickly. Book your free consultation with us and let’s start the procedure.