Since we’re being all Swiss here, let’s list a few things commonly associated with Switzerland. Hm, how about the Alps, skiing, chocolate, cheese, watches and lakes? Oh, we know, banks! The majority of the concepts are the crème de la crème in their respective fields.

The Swiss are known for excellence and class and certainly not for fraud. Therefore, the SwissRoi Review will expose this joker dressed up all posh while hiding a dark secret.

Furthermore, we strongly advise you not to invest in the bogus broker’s Invest Think, Apollo Cash, and Merricks Invest. If you want to save money, don’t trade with these unlicensed brokers!

| Broker status: | Unregulated Broker |

| Regulated by: | Unlicensed Scam Brokerage |

| Scammers Websites: | swissroi.com |

| Blacklisted as a Scam by: | FCA |

| Owned by: | SWISS CRYPTO ADVISORS LONDON LIMITED |

| Headquarters Country: | United Kingdom, Switzerland, Cyprus |

| Foundation year: | N/A |

| Supported Platforms: | ProWave |

| Minimum Deposit: | $250 |

| Cryptocurrencies: | Yes – Bitcoin, Ethereum, Neo (8 in total) |

| Types of Assets: | Crypto, Forex, Indices, Shares, Commodities |

| Maximum Leverage: | 1:600 |

| Free Demo Account: | Unavailable |

| Accepts US clients: | No |

The Truth About SwissRoi Regulation

SwissRoi claims to have offices in three countries – the UK (main), Switzerland and Cyprus. More precisely, Swiss Crypto Advisors London Ltd is allegedly the head company while Swiss Asset Advisors (Cyprus) Limited and Swiss Crypto Advisors AG are subsidiaries.

That would imply that each company is registered with the local FX regulator. Bear in mind that these regulators are very strict and credible. Unfortunately, for the fraudulent broker, Swiss Crypto Advisors London Ltd used to be authorized by the UK’s FCA but the regulator revoked its license in 2020.

Why Is Trading With a Licensed Broker Preferable?

To follow up on the previous section, SwissRoi is clearly not registered with the UK’s Financial Conduct Authority (FCA) nor is it authorized to provide services by the Cyprus Securities and Exchange Commission and the Swiss Financial Market Supervisory Authority (FINMA). Trust us, we checked. So much for the ‘safety of your funds.’

Is SwissRoi a Legit Broker or a Scam?

SwissRoi claims to be a legitimate broker based in the UK, Cyprus and Switzerland that mainly targets traders from the Netherlands and Canada.

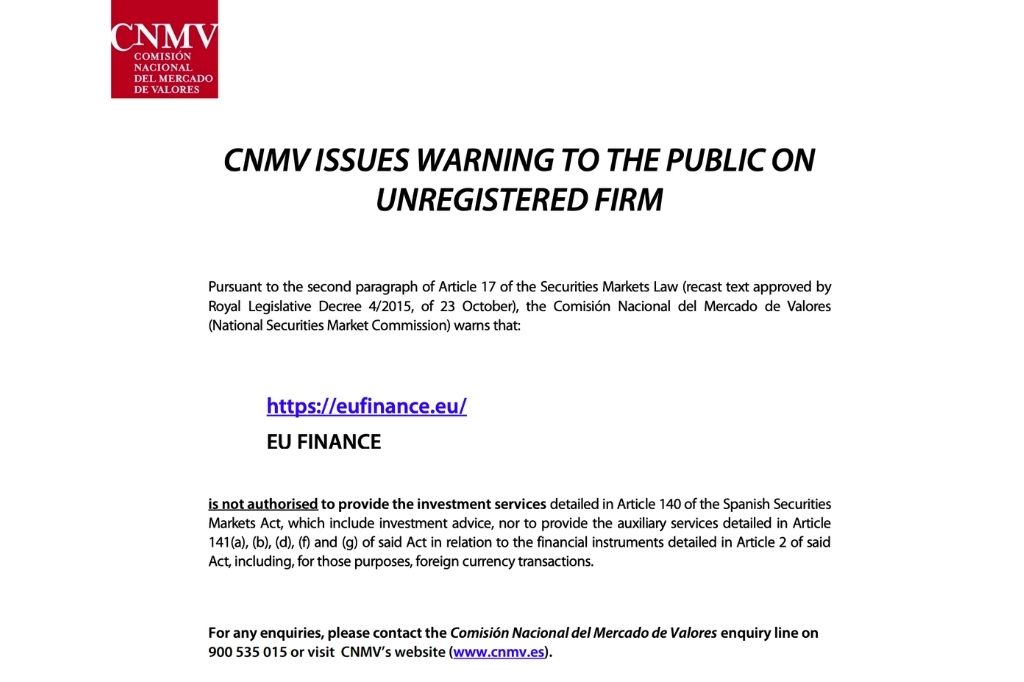

Warning From The FCA

Here’s proof that SwissRoi used to be registered with the FCA but isn’t anymore. Also, if such an authority strongly advises you not to do business with a broker, then you must listen. Otherwise, you expose yourself and your funds to great risk.

Details About The SwissRoi Trading Platform

SwissRoi states that it offers its own trading platform called ProWave. In the introduction of the platform, the fraudulent broker had nothing but words of praise. However, after opening it, we knew what was up. This so-called ProWave is basically just a WebTrader spin-off. It has some elementary features and charts but is still a far cry from a world-class platform.

What Сan Be Traded?

On this underwhelming platform, clients are offered to trade:

- Forex pairs – EUR/USD, GBP/USD, JPY/EUR…

- Indices – N25, F40, IT40…

- Shares – Walmart, Amazon, Verizon…

- Commodities – gold, sugar, coffee…

- Crypto – Bitcoin, Neo, Ripple…

The range of trading instruments is nice. Nevertheless, there’s no guarantee that you’ll be trading at all since the broker is unregulated. It can fool you into thinking that trading is happening on the platform when it’s not. Meanwhile, you’re depositing funds into the scammer’s pocket.

SwissRoi – Countries Of Service

Despite appearing Swissesque and claiming to have offices in the UK and Cyprus as well, SwissRoi actually targets traders from Canada and the Netherlands. But the broker does not accept US clients. Hence, Canadian and Dutch traders beware! SwissRoi is plotting against you.

Does the Broker Use SSL? – Secure Socket Layer

SwissRoi claims to provide clients with SSL, i. e. a Secure Socket Layer. In the simplest of terms, SSL is an encryption-based Internet security protocol. However, the version known as SSL is outdated and its updated successor is known as Transport Layer Security (TLS).

This security layer can only be implemented by websites with an SSL certificate. Upon checking the status of this certificate, we found that it was issued for free by Let’s Encrypt, which kind of puts its validity in question. Add to that the fact that SwissRoi is unregulated.

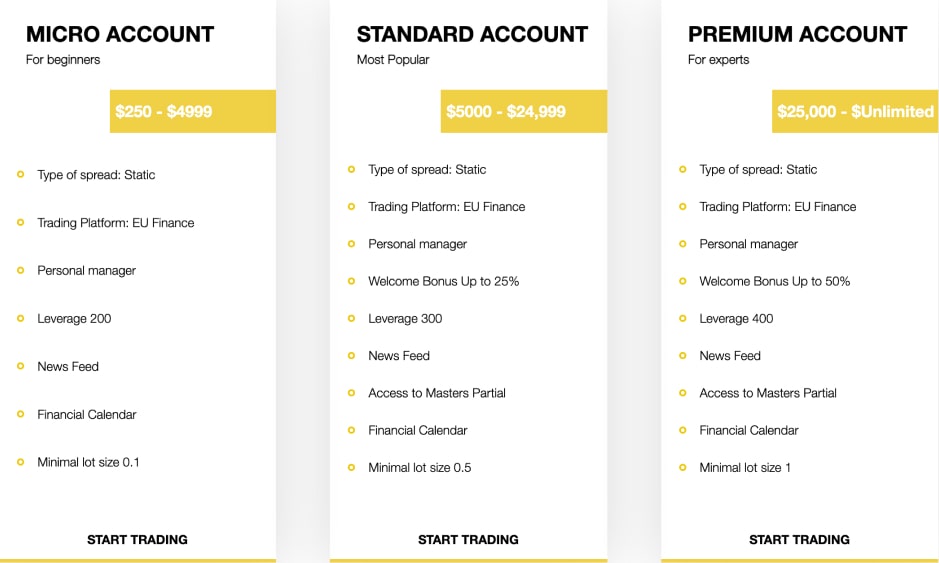

SwissRoi Account Types

As for account types, there are three of them:

- Basic – $250, a spread of 0.18 pips, leverage 1:200, 20% welcome bonus;

- Advanced – $3,000, 0.13 pips, 1:400, 30% welcome bonus;

- Premium – $25,000, 0.10 pips, 1:600, 35% welcome bonus.

The minimum deposits really make huge jumps from one type to the other. Also, the ever-controversial bonuses are there but more on that later. We need to address the leverage and spreads first.

In addition to the above, we strongly advise you not to invest in CoreGeneric Capital, BCH Advance and Shangquan fraudulent brokers.

About Leverage And Spreads

The leverage that SwissRoi offers ranges from 1:200 to 1:600. That’s pretty high, actually too high for retail clients because they’d be walking a thin line in that case. For their own safety, regulators limited leverage to 1:30.

As for spreads, the fraudster claims it starts as low as 0.18 pips for the basic account. However, when you look at the trading platform, you’ll see that it starts at 1.7 pips. That’s not the end of the world but dishonesty sucks.

Negative Balance Protection

Essentially, negative balance protection means that even if markets move rapidly against your trades, your account will not be negative. It’s easy to see why it’s included but we highly doubt that it is implemented when trading with SwissRoi. So, it’s just there to lure you.

Provides SwissRoi With Bonuses?

Ah, yes. Bonuses. As soon as you see this, know you’re dealing with a scammer. Bonuses have been banned by top regulators because scammers always use them to trick clients. You receive a bonus to trade with it but then you’re not allowed to make a withdrawal until you’ve traded up to an unrealistic amount.

High Minimum Deposit and Withdrawal Terms

According to the website, SwissRoi accepts the following payment methods: credit/debit cards, wire transfers and e-wallets (not specified which ones). The minimum deposit is $250.

Then, we stumbled upon the good-old recycled fee clause that the majority of scammers put in their T&C. It says that the broker charges $25 for card transfers, $50 for wire transfers as well as an additional 10% processing fee. Simply outrageous.

Scammed by SwissRoi Broker? – Let Us Hear Your Story

We hope you’re not pulling your hair out if you’ve been scammed. Don’t despair, it could’ve happened to anyone. What’s important now is to consider the possible methods of getting a refund. Ever heard of a chargeback or a recall?

But What Is A Chargeback And A Recall?

A chargeback is a process of reversing credit/debit card transactions. You can request it at the issuing bank within 540 days. As for wire transfers, you could reverse them via recall. However, if the transaction has been completed, the recall will surely fail. Therefore, you must act quickly.