Winvestock broker is a typical online trading scam. The firm is unregulated and provides financial services from an unknown location; the owner is not listed. Since the website is incomplete with information and looks like someone made it in a hurry to extort the money, we’ve done detailed research. Read our Winvestock review and find all the relevant details.

Additionally, we strongly advise you to avoid the fraudulent brokers RoboFXTrade, TopTrade500, and Proforbex.

| Broker status: | Unregulated Broker |

| Regulated by: | Unlicensed Scam Brokerage |

| Scammers Websites: | winvestock.com |

| Blacklisted as a Scam by: | N/A |

| Owned by: | N/A |

| Headquarters Country: | Belgium (allegedly) |

| Foundation year: | 2022 |

| Supported Platforms: | WebTrader |

| Minimum Deposit: | $250 |

| Cryptocurrencies: | Available – BTC, ETH, XRP |

| Types of Assets: | Forex, stocks, commodities, indices, cryptocurrencies |

| Maximum Leverage: | N/A |

| Free Demo Account: | No |

| Accepts US clients: | No |

Can I Trade Safely On The Winvestock Platform?

Winvestock is a shady trading business. Corporate information is missing, with the Terms and Conditions stating the following: “The following describes the terms and conditions upon which to Example-4 offers access to its web site to you the customer.”

If we forget linguistic mistakes, there’s still a big question for the company owner named Example-4. The HQ of this alleged owner is in Brussels, indicating that the owner should be regulated by the Belgian FSMA. Of course, it’s not the case.

Reasons Not to Trust an Unlicensed Broker

Unlicensed trading firms follow their own rules. Instead of ensuring fund safety by keeping your funds in segregated accounts of reputable banks and offering compensation funds, brokers like Winvestock care only about their own funds and profits. With such, you can never be safe.

So, is Winvestock a Good Broker or a Scam?

Winvestock is not a legitimate financial services provider. The company claims to be based in Belgium but has no FSMA approval. In addition, the entire website is anonymous.

What Do Traders Think Of Winvestock?

Winvestock is not the broker of the year, according to reviews. Customers are reporting severe withdrawal issues and unprofessional behavior. According to some, broker account managers go as far as to steal clients’ money through access to their devices via AnyDesk and TeamViewer. Once it happens, everyone disappears, leaving investors to seek help for a refund.

Winvestock Offers MetaTrader 4? – Available Trading Sofware

While Winvestock claims to offer the most popular trading software nowadays, MT4, the reality is a bit different. Upon registering an account, we were provided with a plain WebTrader. This internet-based platform has no advanced features such as EAs or social trading. Instead, clients can only open and close trades, view their trading history, and deposit more money.

This is yet another proof that Winvestock is nothing but a bogus fraudster.

Winvestock Accounts Overview

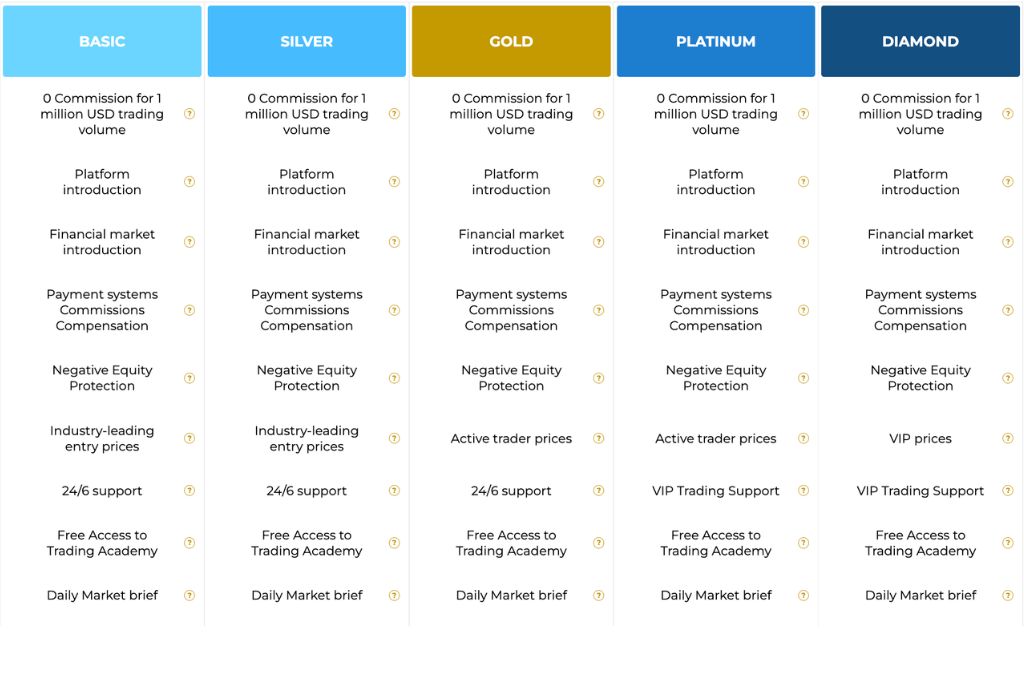

Customers can access the following five account types:

- Basic – $250

- Silver – $10,000

- Gold – $50,000

- Platinum – $100,000

- Diamond – $500,000

Accounts differ in different types of analysis provided by the firm, seniority of account managers, and discount on bonuses.

Can I Try to Trade With a Demo Account?

Winvestock Demo account is not enabled. Instead, clients have to deposit their own funds first and only then test the system. Since Winvestock has a negative reputation, we advise against it.

Educational Features – Free Education for Customers

Another tool to lure inexperienced traders into investing is alleged free education. Winvestock offers:

- Blogs

- Guides

- Technical analysis indicators and strategies

- Economic indicators

- E-book

- FAQ

While most of these tools are useless since the broker wrote them and ensured you read what they want you to read, some features, such as economic indicators, can be helpful.

Bonuses and Promo codes – A Fraudulent Methods

The company offers special bonuses and benefits. Yet, these are not free. If you accept these givings, for every traded dollar, euro, or a pound of bonus, you have to repay 0.1 lots. Just for the record, one standard lot equals 100,000 units, meaning that 0.1 lot equals 10,000 for 1 unit received.

We believe that it’s clear how bonuses and incentives are used for fraudulent purposes.

Winvestock Range of Trading Markets

Winvestock customers can trade in the following markets:

- Forex – EUR/USD, AUD/CHF, USD/ILS

- Indices – AUS200, US30, DAX30

- Shares – Asus, Nvidia, Microsoft

- Commodities – gold, silver, oil

- Cryptocurrencies

Also, avoid the trading fraudsFocus Markets,GF Markets, andCFD Capitalat all costs! Moreover, before investing, always look into the past of internet trading firms!

What Trading Terms Winvestock Offers?

While there are plenty of details about account types, trading terms are not mentioned. The broker didn’t specify the leverage, spread, swap amount, or any relevant information. If you want to know your trading costs, commissions, or risks, you won’t be able to do so before investing funds and gaining access to the broker’s platform. As we were unwilling to do it, we advise you to give up as well.

Winvestock Funding and Withdrawal Methods

The minimum deposit is $250, while the minimum withdrawal amount is $100. The broker brags about covering all the bank fees for deposits. However, withdrawals have hefty fees of 3.5%, with the maximum service fee being $3,500.

Methods of Payment

Winvestock allows using the following payment methods:

- Debit/credit cards

- Wire transfer

Both of these options can be reversed in case of an issue, which is good. However, you must undergo the examination process and submit sufficient evidence to your bank.

Scammed by Winvestock Broker? – Let Us Hear Your Story

If you have been a victim of Winvestock trading scam, let us know. Our chargeback specialists may assist you with the fund recovery. Book a free consultation, and let’s get your money back before it’s too late.

But What Is A Chargeback?

A chargeback is a way for your bank to reverse the transaction. In case you have been scammed, we can file a dispute. Since the process is time-limited, we urge you to contact us immediately.