CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. This content is intended for information and educational purposes only and should not be considered investment advice or investment recommendation.

Traders choose Swissquote for its quality research and vast multi-asset offering – as long as they are willing to pay a premium to have their brokerage account held with a Swiss bank.

Swissquote’s U.K. branch provides the best pricing out of its available account options, though it offers a smaller range of markets.

-

Minimum Deposit:

$1000.00

Trust Score:

99

Tradeable Symbols (Total) :

466

Swissquote pros & cons

Pros

- Founded in 1996, Swissquote is publicly-traded (SIX: SQN) and regulated in four tier-1 jurisdictions, making it a safe broker (low-risk) for trading forex and CFDs.

- As a forex broker that also operates two banks, Swissquote takes our top award for Best Banking Services.

- Swissquote offers the MetaTrader platform suite, along with additional add-ons such as the MetaTrader Master Edition.

- Swissquote produces excellent-quality research, including daily market analysis videos, and written articles on its Newsroom section.

- Advanced Trader web platform features TradingView charts and has been upgraded to HTML5 for a smoother user experience.

Cons

- Swissquote’s share trading is separate from its forex and CFD account offering.

- Cryptocurrency trading is only available within Swissquote’s eTrading account.

- Swissquote doesn’t publish its average forex spreads, and its minimum spreads are expensive across all account types compared to its industry peers.

- The desktop version of Swissquote’s Advanced Trader platform could use a design overhaul.

- Trading Central and Autochartist are available – but only as a plugin for MetaTrader.

Overall summary

| Overall | |

| Trust Score | 99 |

| Offering of Investments | |

| Commissions & Fees | |

| Platforms & Tools | |

| Research | |

| Mobile Trading Apps | |

| Education |

Is Swissquote safe?

help

99

Trust Score

Swissquote is considered low-risk, with an overall Trust Score of 99 out of 99. Swissquote is a publicly traded company, operates a regulated bank, and is authorised by four tier-1 regulators (high trust), one tier-2 regulator (average trust), and no tier-3 regulators (low trust). Swissquote is authorised by the following tier-1 regulators: Securities Futures Commission (SFC), Monetary Authority of Sinagpore (MAS), Swiss Financial Market Supervisory Authority (FINMA), and the Financial Conduct Authority (FCA). Learn more about Trust Score.

Regulations Comparison

| Year Founded | 1996 |

| Publicly Traded (Listed) | Yes |

| Bank | Yes |

| Tier-1 Licenses | 4 |

| Tier-2 Licenses | 1 |

| Tier-3 Licenses | 0 |

| Trust Score | 99 |

Offering of investments

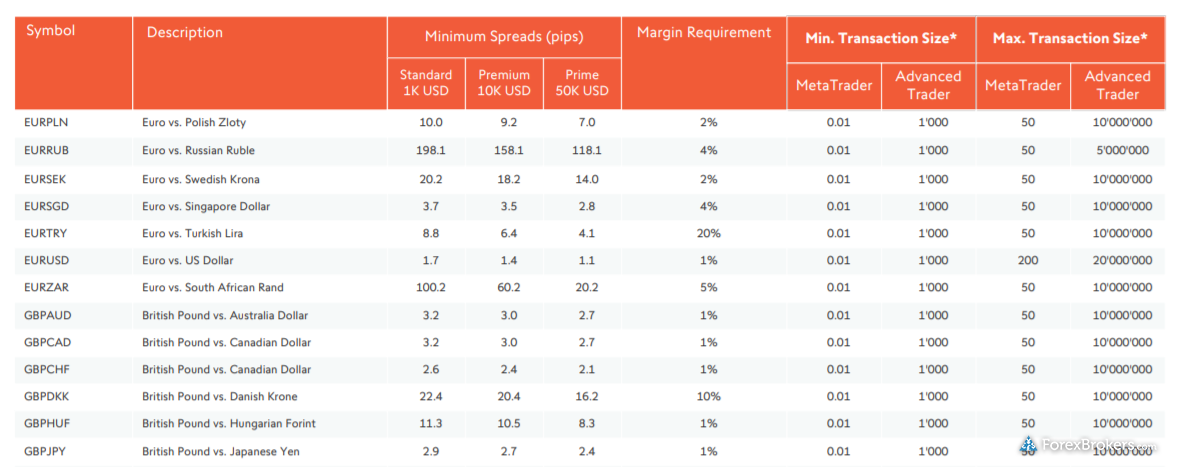

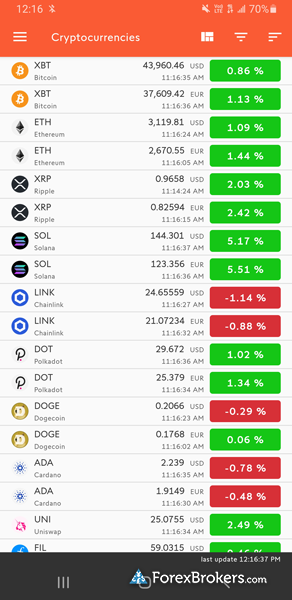

Swissquote was the first bank in the world to offer the ability to trade underlying cryptocurrencies (non-CFDs). A total of 23 cryptocurrencies are available, including Dogecoin, Polkadot, Cardano, Uniswap and other popular crypto assets. Swissquote is also preparing to launch crypto staking and lending.

eTrading vs eForex accounts: With the Swissquote eTrading account offering, clients can trade cryptocurrencies alongside a seemingly endless variety of products across 60 global market exchanges. However, traders who want to trade forex and CFDs alongside forwards and options must use Swissquote’s eForex account, which offers only 292 tradeable symbols. This is a relatively narrow selection compared to Saxo Bank and CMC Markets, which both offer over 10,000 CFDs – including forex.

Swissquote offering of investments:

Swissquote offering of investments:

| Forex Trading | Yes |

| CFD Trading | Yes |

| Tradeable Symbols (Total) | 466 |

| Forex Pairs (Total) | 78 |

| US Stock Trading (Non CFD) | Yes |

| Int’l Stock Trading (Non CFD) | Yes |

| Social Trading / Copy-Trading | Yes |

| Cryptocurrency (Physical) | Yes |

| Cryptocurrency (CFD) | No |

| Crypto Disclaimer (UK) | Note: Crypto CFDs are not available to retail traders from any broker’s U.K. entity, nor to U.K. residents (except to Professional clients). |

Commissions and fees

The primary benefit of using Swissquote is the appeal of holding an account with a Swiss banking conglomerate – and that comes at a slight premium. As such, trading costs are not Swissquote’s best feature, and can’t compete with what’s offered by the lowest-cost forex brokers.

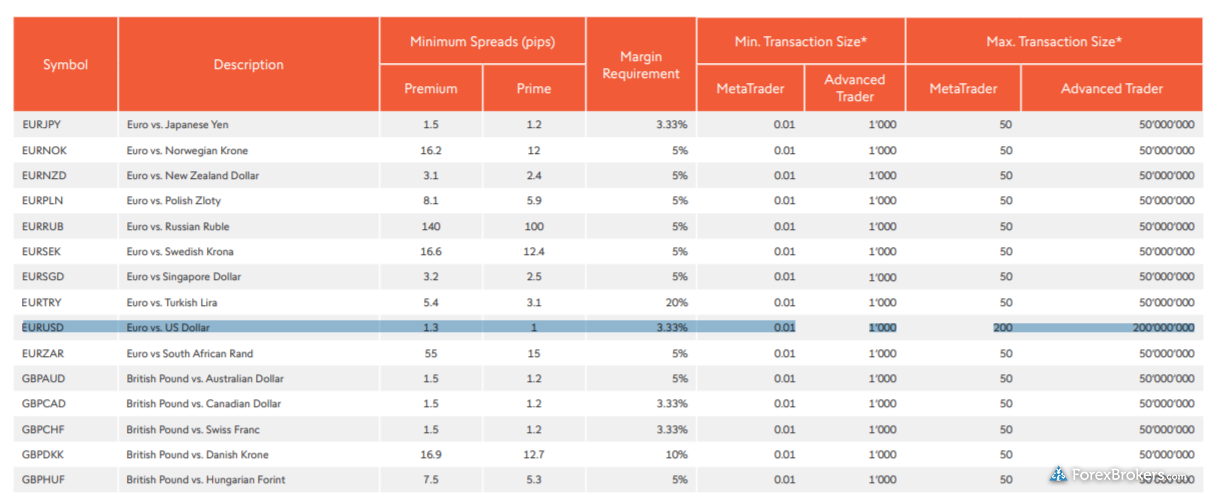

The commissions and spreads from Swissquote’s U.K. entity, Swissquote Ltd, differ from its Switzerland entity (Swissquote Bank Ltd) and Luxembourg branch (Swissquote Bank Europe SA). Between the three, the U.K.-based accounts have lower costs and lighter deposit requirements, though they feature a narrower product offering.

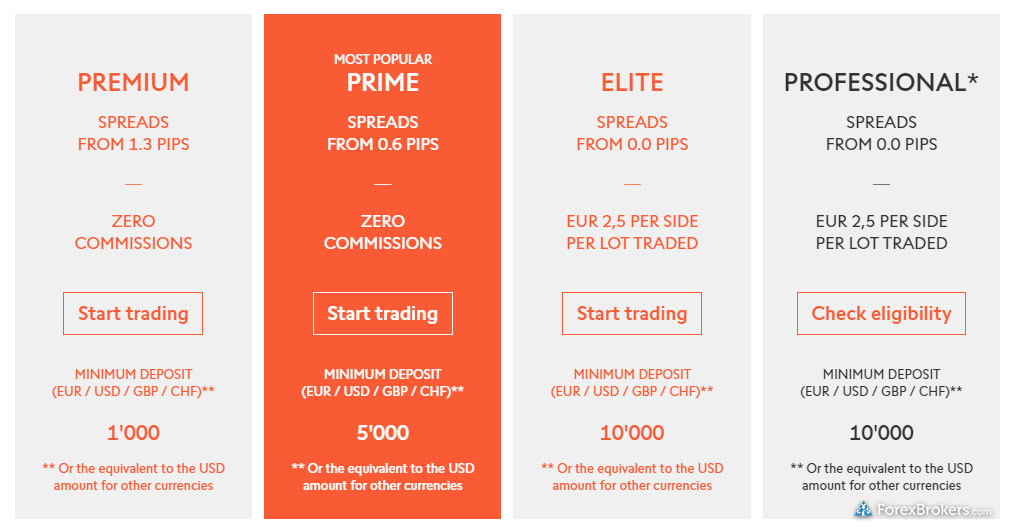

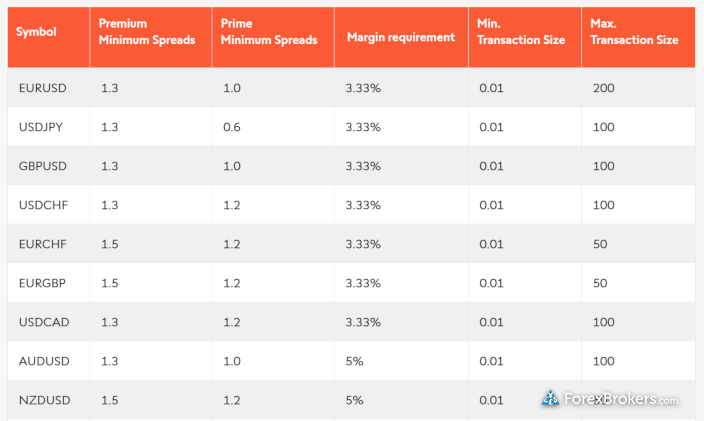

Swissquote U.K.: There are four accounts available at Swissquote’s U.K. entity. If you are an active trader and deposit at least $10,000, the commission-based Elite account’s lower spreads (and $5 charge per round-turn trade) make it the best option. Swissquote’s Professional account is nearly identical, except that the threshold for a margin call stop-out is lower.

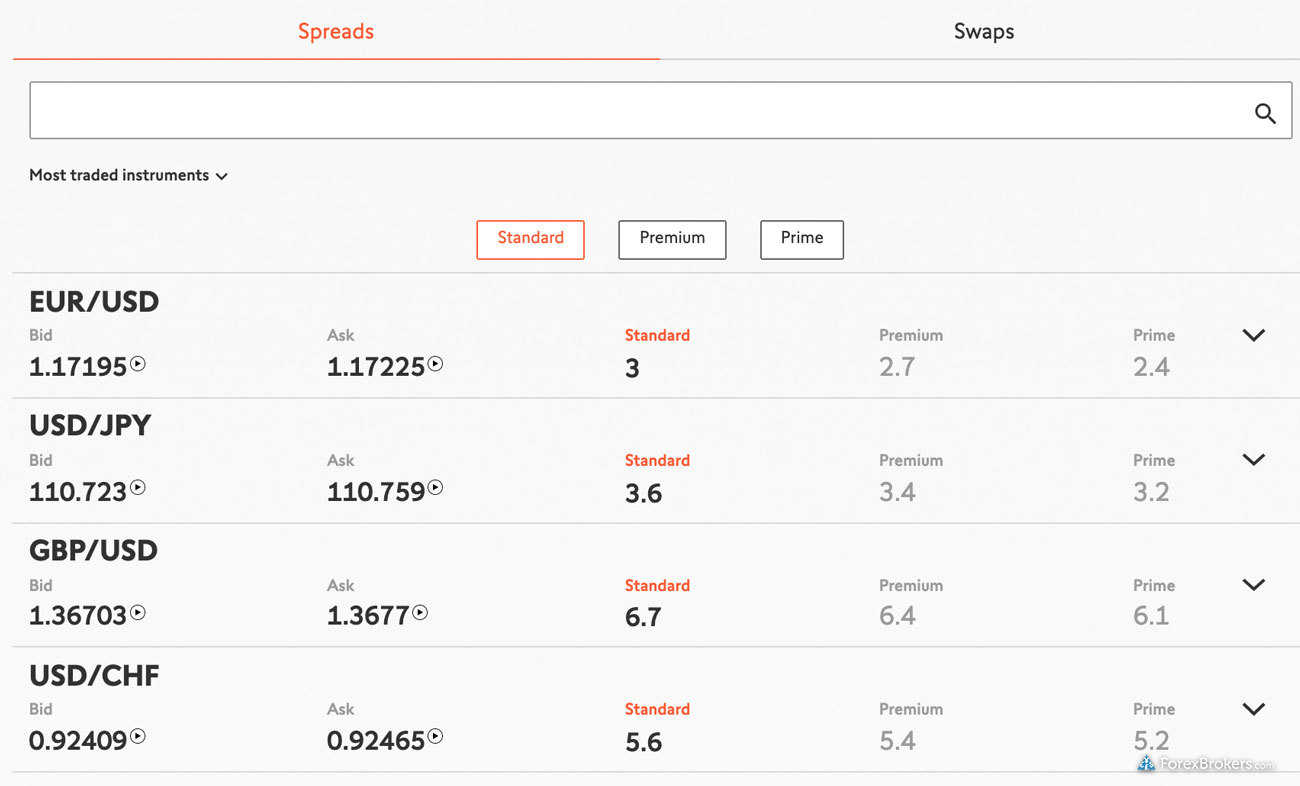

Less attractive is Swissquote’s Standard account option, with spreads on the EUR/USD starting at 1.3 pips, while the Prime account has a spread from 0.6 pips (though it’s important to note that this is a minimum spread – not an average price).

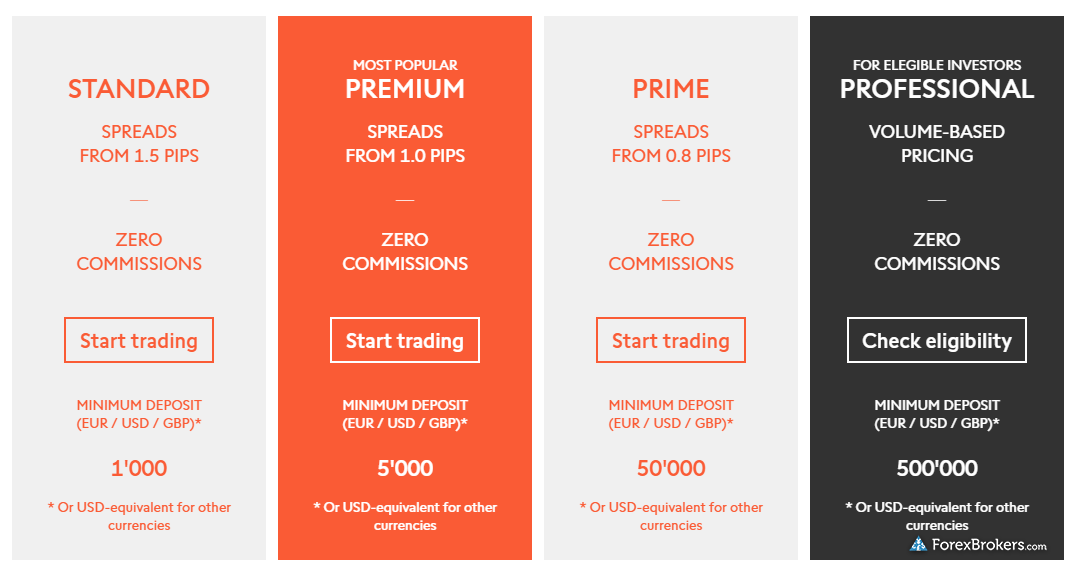

Swissquote Luxembourg: Swissquote’s Luxembourg entity also offers three account types, each with its own minimum deposit requirement: the Standard account ($1,000 minimum), Premium account ($5,000), and Prime account ($50,000). Minimum spreads range from 0.8 pips for Prime account holders to as much as 1.5 pips for Standard account holders, making the pricing similar to Swissquote’s U.K. entity.

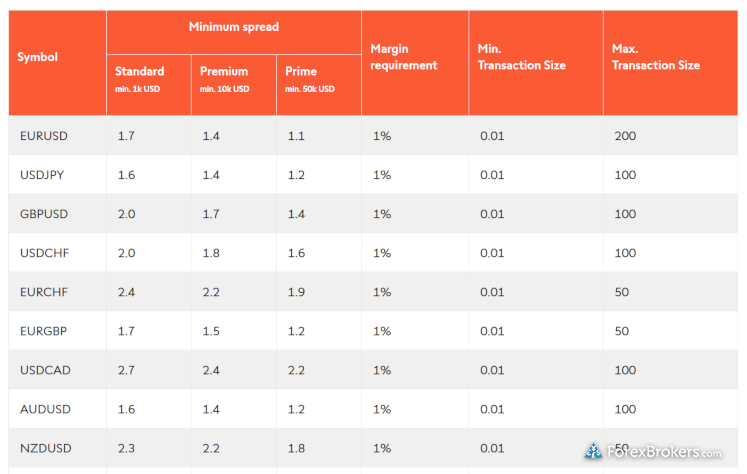

Swiss branch: Though Swissquote’s eTrading account doesn’t offer forex or CFDs, there are three primary account options available in Switzerland for Swissquote’s forex clients. The Standard account requires a $1,000 deposit and features spreads starting at 1.7 pips on the EUR/USD, while the Premium account’s spreads drop slightly to 1.4 pips, though that option requires a $10,000 deposit.

The Prime account requires a $50,000 deposit and offers spreads from 1.1 pips, which is slightly higher than the industry average. Custom pricing is available for active traders, but it is negotiated based on volume, as Swissquote does not list any related volume tiers and pricing.

Cryptocurrency trading fees: Fees for Swissquote’s eTrading account start at 1% of the cryptocurrency trade value, and drop to 0.75% for trades above CHF 10K, and then down to 0.5% for transactions worth more than CHF 50K. While there are no cryptocurrency custody fees, a $10 fee applies to deposits of less than $500.

Gallery

Swissquote pricing summary:

| Minimum Deposit | $1000.00 |

| Average Spread EUR/USD – Standard | N/A |

| All-in Cost EUR/USD – Active | N/A |

| Active Trader or VIP Discounts | Yes |

| Execution: Agency Broker | Yes |

| Execution: Market Maker | Yes |

Mobile trading apps

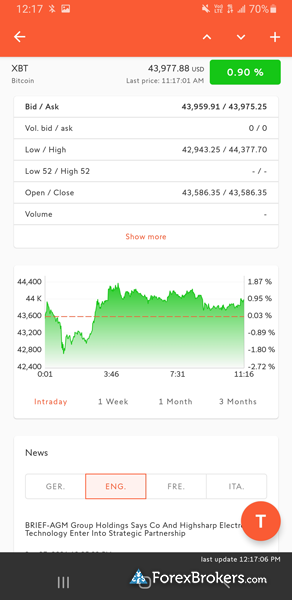

Swissquote’s Advanced Trader mobile app is easy to use and cleanly designed, with a decent number of research features and integrated educational content. However, charting is severely limited, leaving the MetaTrader suite as my recommended choice. Swissquote still needs to improve its flagship app if it wants to compete with mobile leaders Saxo Bank, CMC Markets, and TD Ameritrade (U.S. residents only).

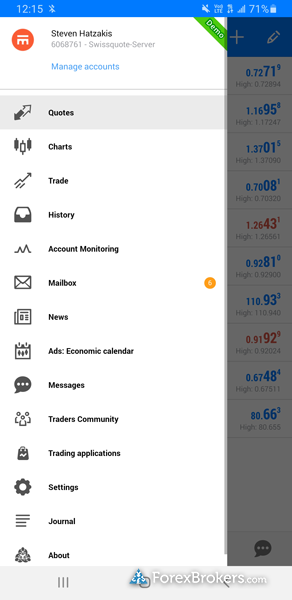

Apps overview: For forex and CFD traders, Swissquote offers its proprietary Advanced Trader app, as well as the MetaTrader suite of mobile apps (MT4 and MT5). For stock and cryptocurrency trading, the Swissquote app is available for Android, iOS devices, and Huawei smartwatches.

As part of its partnership to power PostFinance (one of the largest financial institutions in Switzerland), Swissquote offers the YUH app, which is a passive investing app for stocks and crypto.

Ease of use: MetaTrader’s MT4 and MT5 mobile apps feature charts with 30 indicators and nine selectable time frames, along with smooth panning and zooming functions. In the Advanced Trader app, there are six chart types and 11 time-frames to choose from, but there are no available indicators. It’s worth noting that its charts do not support landscape mode or the ability to zoom in and out when viewing chart data.

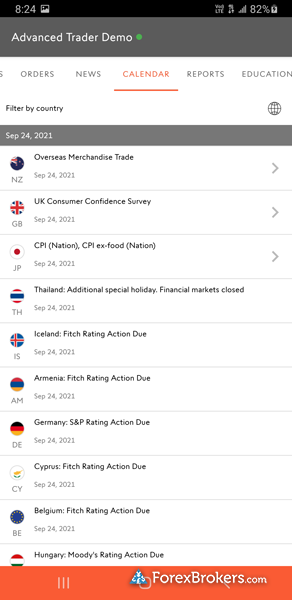

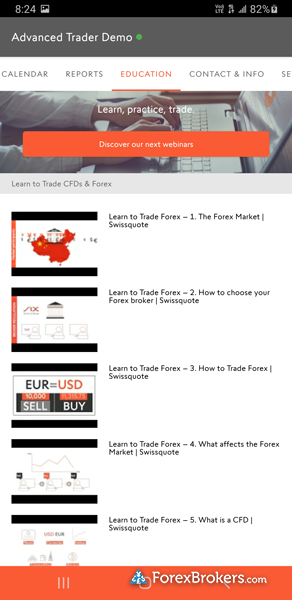

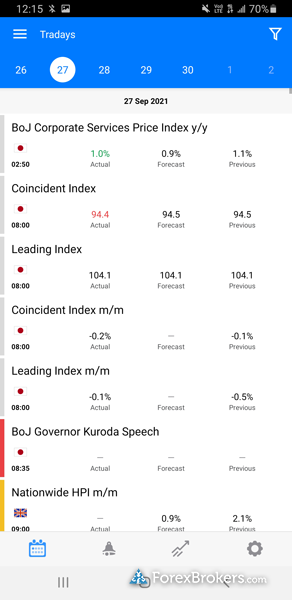

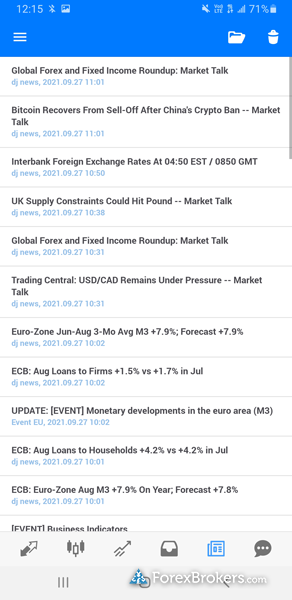

Research: For both MetaTrader and Swissquote’s Advanced Trader mobile app, research is mostly limited to an economic calendar and headlines that stream from top-tier sources including Dow Jones Newswire. It’s worth noting that Advanced Trader does feature a selection (roughly 25) of integrated educational videos.

Gallery

Swissquote mobile trading:

| Android App | Yes |

| Apple iOS App | Yes |

| Alerts – Basic Fields | Yes |

| Watch List | Yes |

| Watch List Syncing | No |

| Charting – Indicators / Studies | 30 |

| Charting – Draw Trendlines | Yes |

| Charting – Trendlines Moveable | No |

| Charting – Multiple Time Frames | Yes |

| Charting – Drawings Autosave | Yes |

| Forex Calendar | Yes |

Other trading platforms

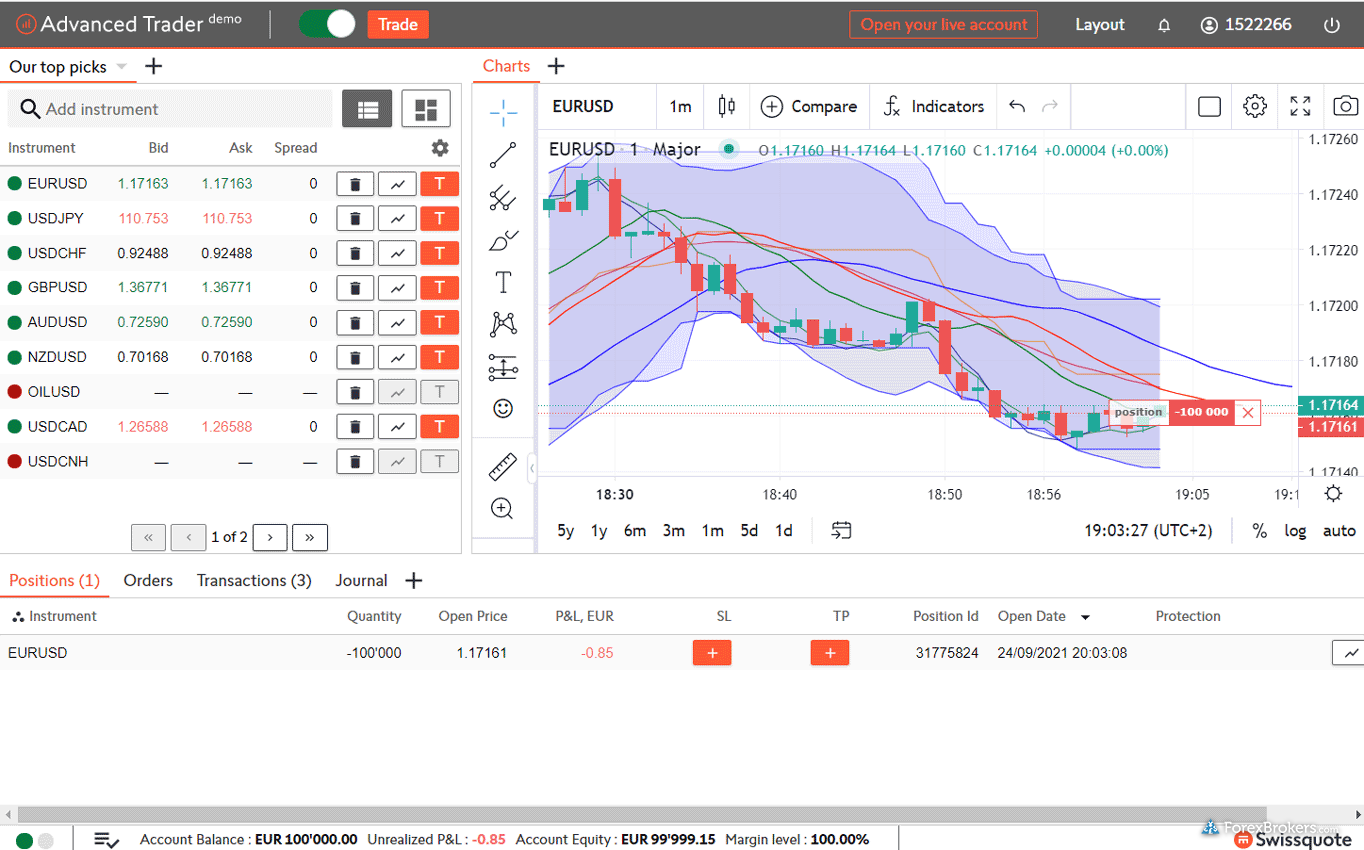

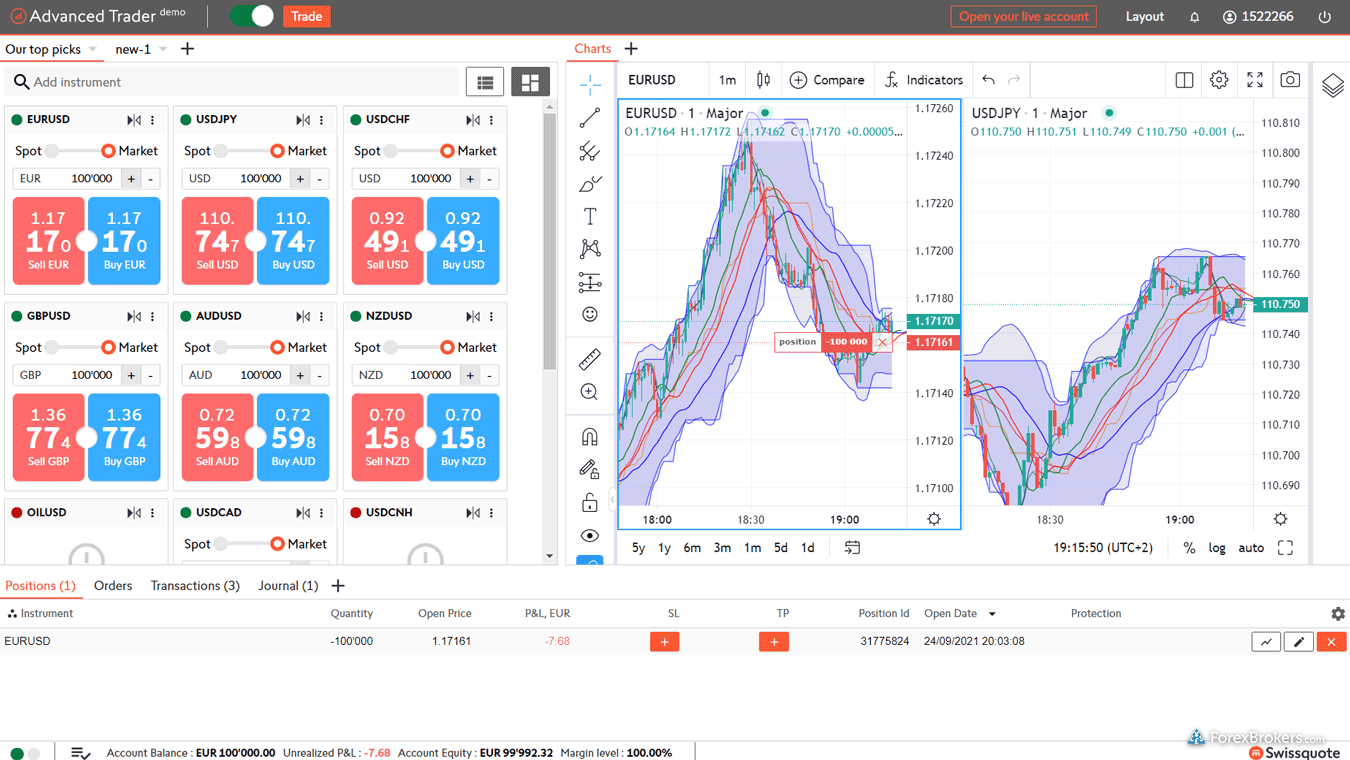

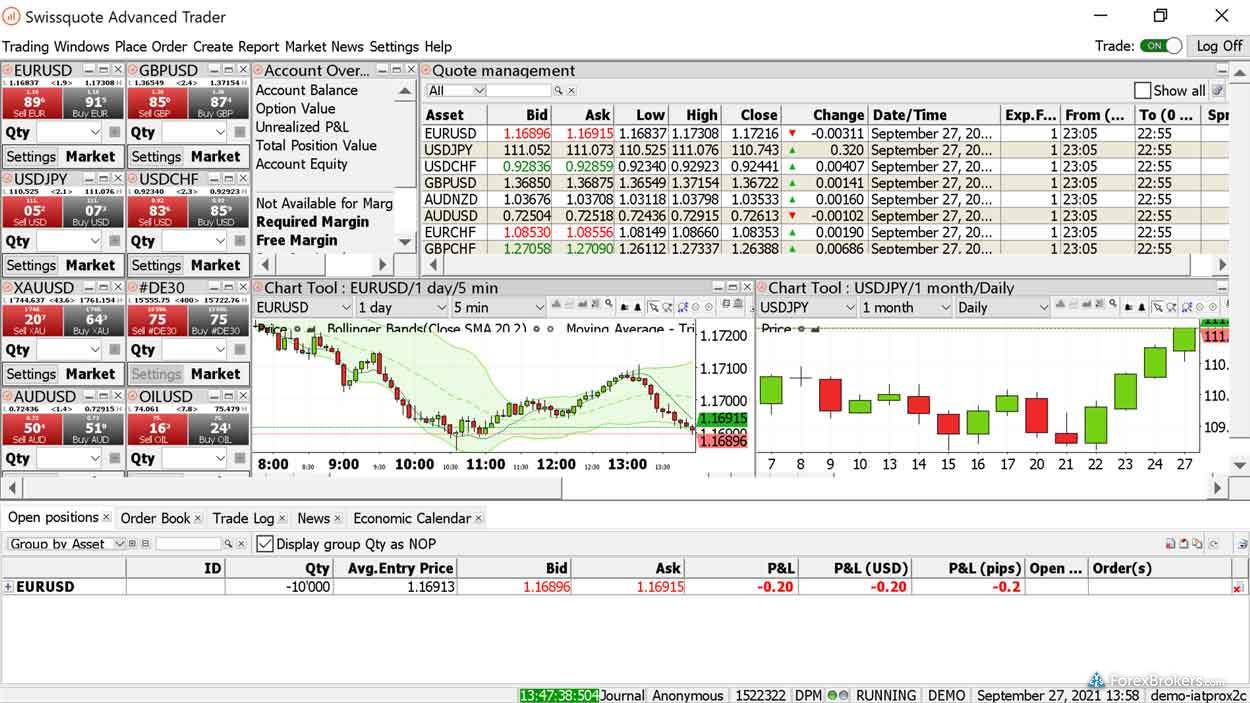

Swissquote’s Advanced Trader platform suite, available for desktop and web, continues to evolve – yet not enough to match industry leaders like IG and CMC Markets. That said, the full MetaTrader suite is available as a reliable alternative.

Platforms overview: Swissquote’s flagship platform suite, Advanced Trader, is available for web and desktop across all major operating systems. The Swissquote website acts as the platform login for its eTrading account, but doesn’t support forex and CFDs (only crypto and shares).

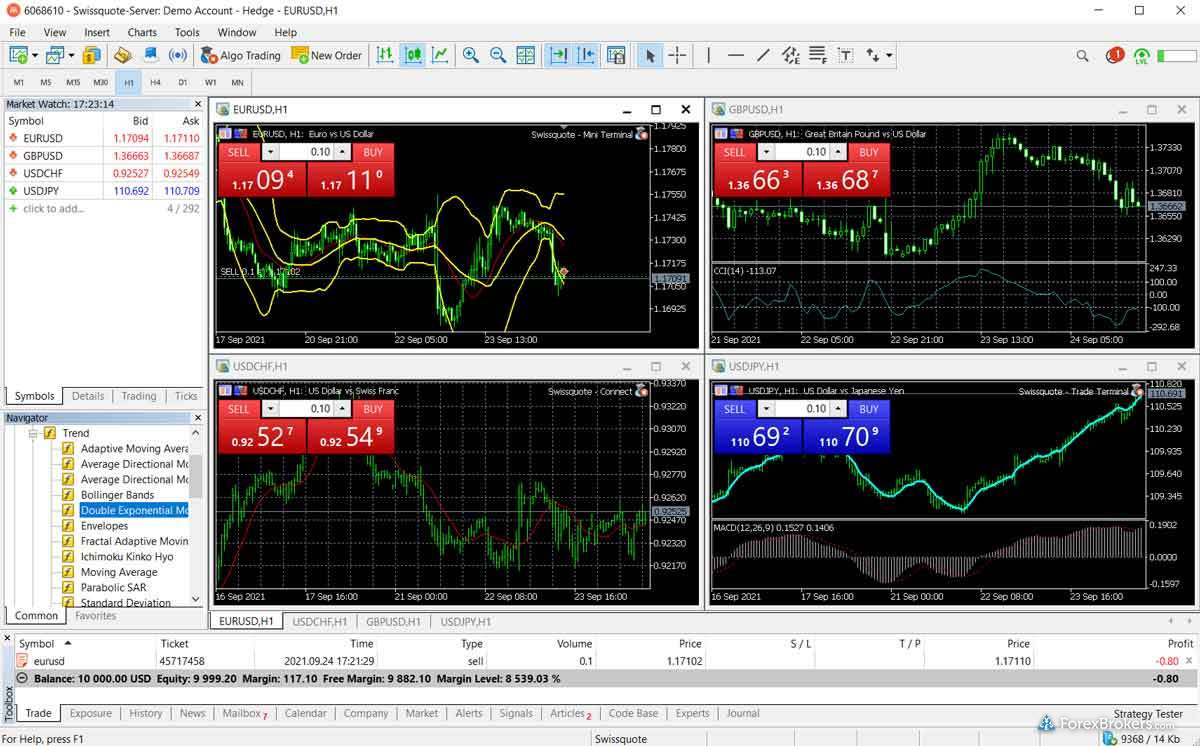

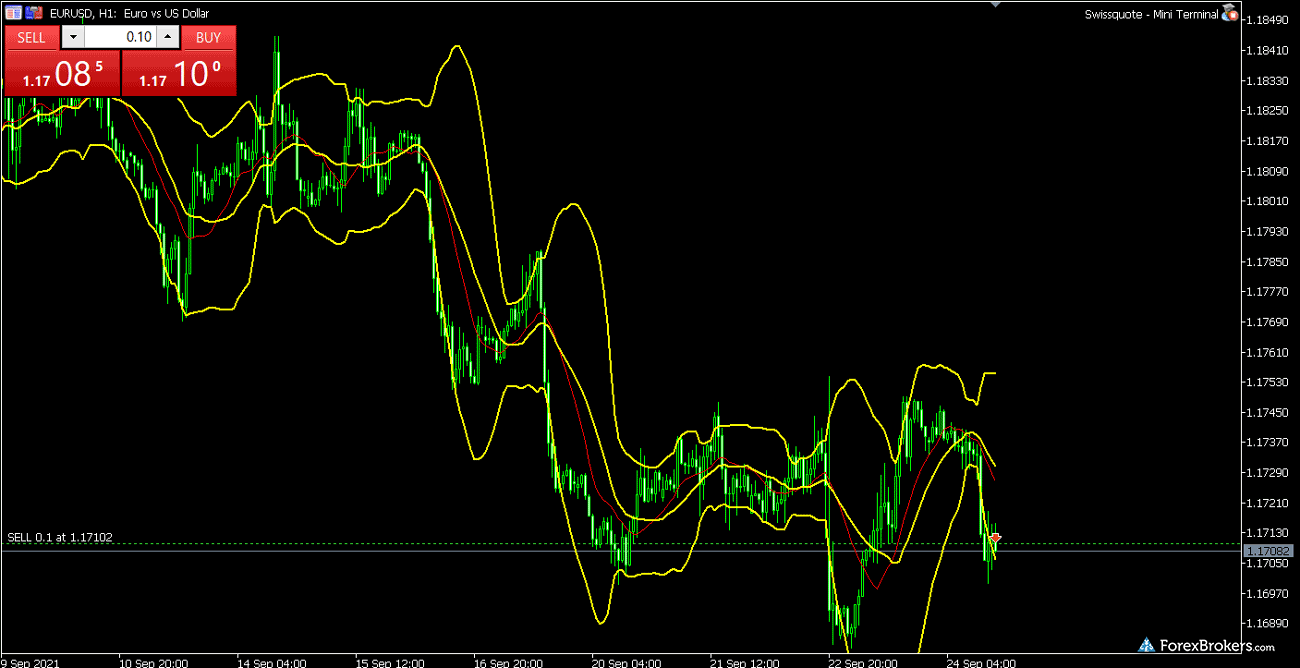

Swissquote also provides access to the popular MetaTrader platform suites (MT4 and MT5) developed by MetaQuotes Software Corporation. To enhance the default MetaTrader desktop platform experience, Swissquote offers the MetaTrader Master Edition suite of tools, developed by FX Blue LLP, along with support for Trading Central and Autochartist plugins.

Charting: The web-based version of Advanced Trader was recently upgraded to HTML5, and now incorporates TradingView charts – features that are welcome enhancements to the platform. Charts in the desktop version of Advanced Trader are not as smooth as the web version, although they feature a respectable 49 indicators.

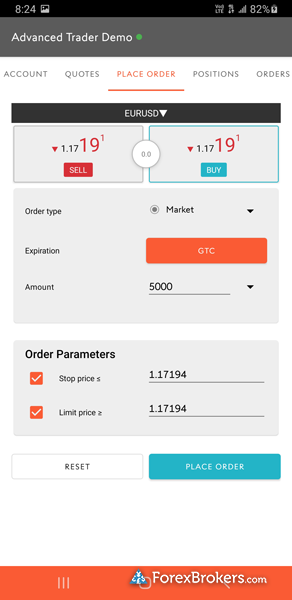

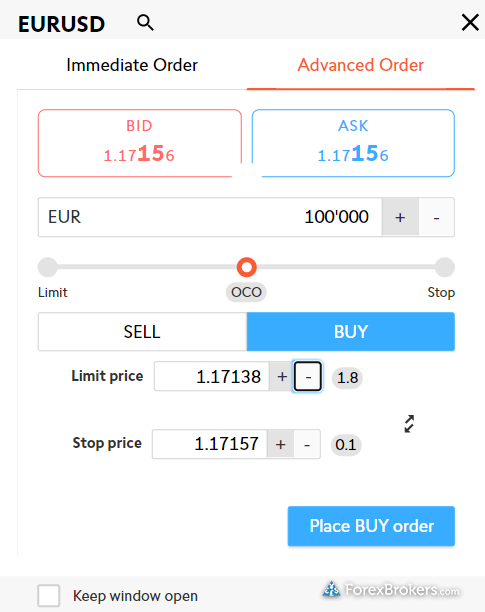

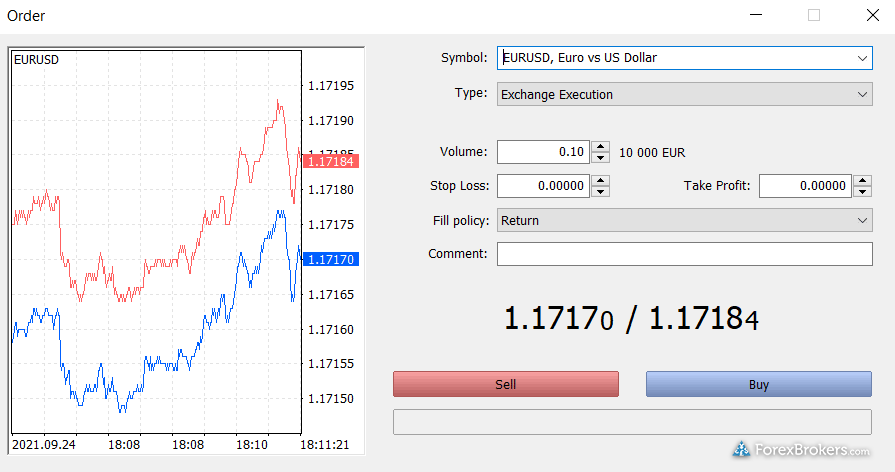

Trading tools: Advanced Trader’s desktop platform could use a design overhaul to give it a more modern touch, and bring it in line with well-designed platforms like Saxo Bank’s SaxoTraderPRO. For example, the lack of an automated resizing tool for Advanced Trader’s various window modules led to a very tedious manual process during my testing. Drawbacks aside, Advantage Trader does include robust charting and complex order types, and supports forex options-trading on 45 pairs – on a Request for Quote (RFQ) basis.

Gallery

Swissquote trading platform:

| Virtual Trading (Demo) | Yes |

| Proprietary Platform | Yes |

| Desktop Platform (Windows) | Yes |

| Web Platform | Yes |

| Social Trading / Copy-Trading | Yes |

| MetaTrader 4 (MT4) | Yes |

| MetaTrader 5 (MT5) | Yes |

| cTrader | No |

| DupliTrade | No |

| ZuluTrade | No |

| Charting – Indicators / Studies (Total) | 51 |

| Charting – Drawing Tools (Total) | 31 |

| Charting – Trade From Chart | Yes |

| Watchlists – Total Fields | 7 |

| Order Type – Market | Yes |

Market research

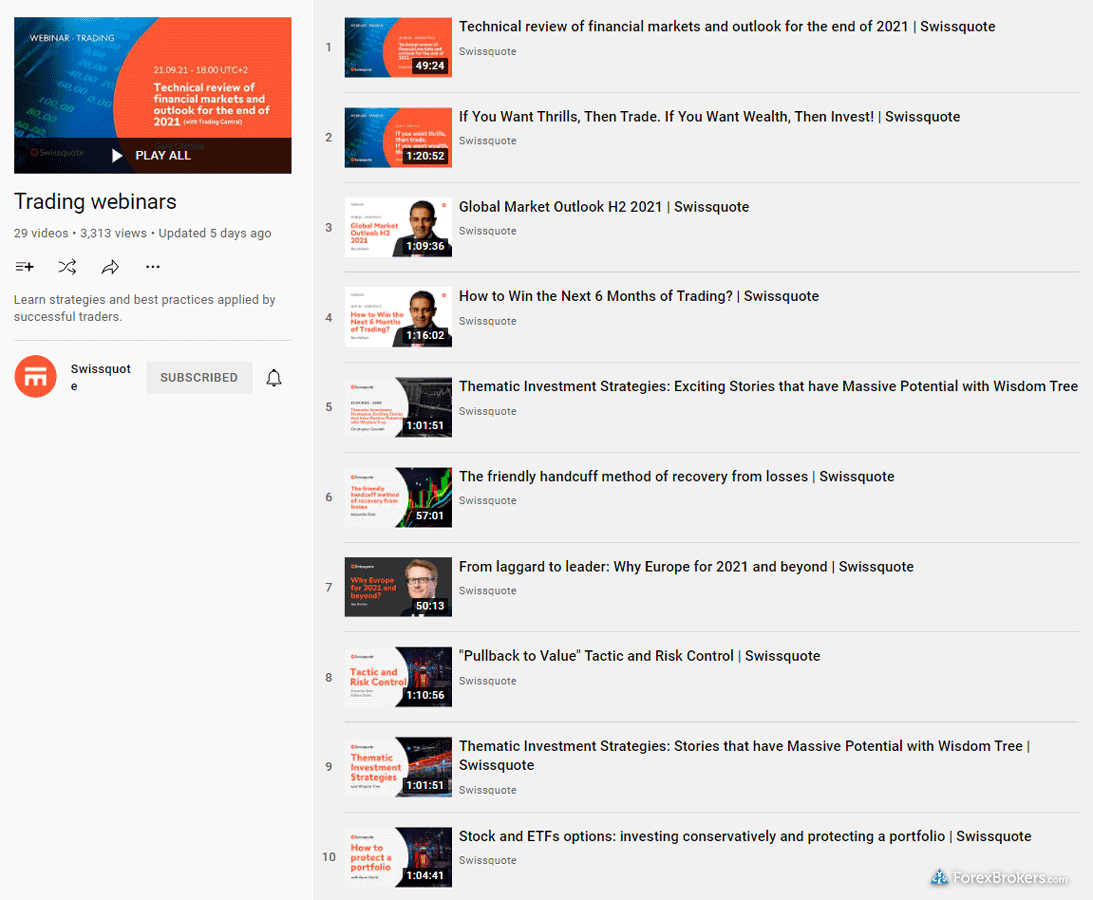

Swissquote provides a good variety of research content, including streaming news headlines, economic calendars, blog commentary and webinars. Swissquote differentiates itself from its competitors with the quality of its research, which is above and beyond the industry average.

Research overview: Swissquote provides daily written articles via its Morning News series from the Newsroom section of its website, along with Themes Trading articles and a high-quality bimonthly magazine with nearly 80 pages of technology-rich content spanning global markets. Swissquote’s quantitative research team also helps structure some of its products, such as the exchange-traded certificate for crypto, with its latest one added in 2020.

Market news and analysis: Swissquote provides traders with access to Trading Central, which consists of automated chart pattern analysis and analyst commentary. AutoChartist, a similar service, is also available as a plugin for MetaTrader. Across all Swissquote platforms, headlines stream from Dow Jones Newswire and other top-tier providers, and traders receive free reports from Morningstar. Swissquote’s in-house Market Talk series includes daily videos and podcast recordings that cover fundamental and technical analysis.

Video format: Swissquote has a Daily Market Analysis series on its YouTube channel, available in multiple languages (including English), along with 60 archived webinars conveniently arranged as playlists.

Gallery

Swissquote research:

| Daily Market Commentary | Yes |

| Forex News (Top-Tier Sources) | Yes |

| Autochartist | Yes |

| Trading Central (Recognia) | Yes |

| Delkos Research | No |

| Social Sentiment – Currency Pairs | No |

| Economic Calendar | Yes |

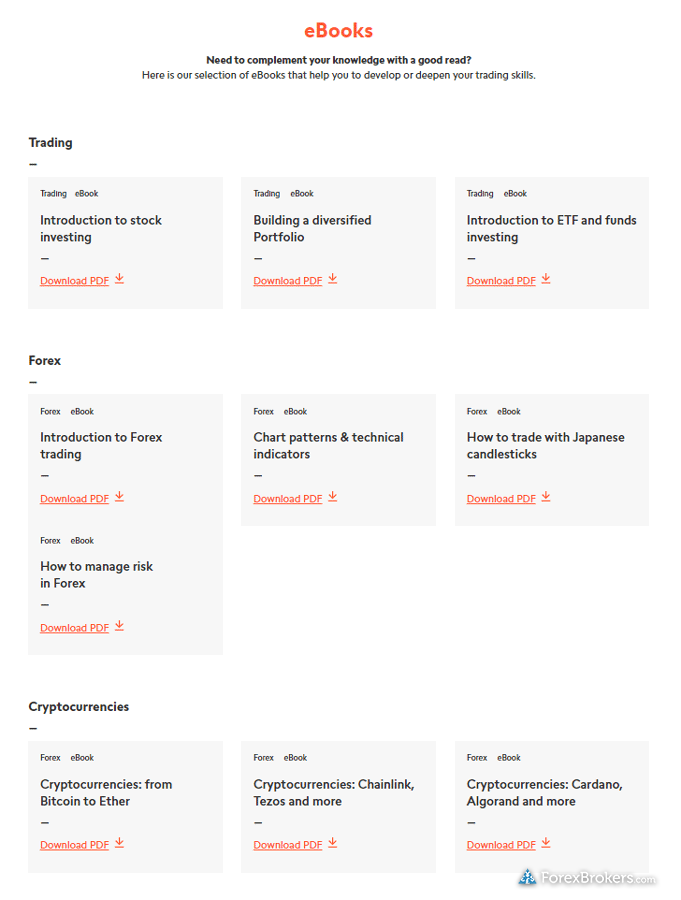

Education

Swissquote’s strength in this category is its video content, with dozens of educational videos and webinars available on its YouTube channel. That said, its bare-bones written content and absence of interactive lesson programs make for an unremarkable educational experience that simply can’t compete with the best forex brokers for education.

Learning center: Swissquote’s learning center provides ten eBooks and 31 videos as part of its forex and CFD educational courses. I was glad to see that at least 15 instructional videos are also available within the Advanced Trader mobile app, along with a selection of platform tutorials.

Room for improvement: Expanding Swissquote’s educational content to include a greater variety of written articles, incorporating quizzes and progress tracking, and adding the ability to filter by experience level would help lift Swissquote’s ranking in this category.

Gallery

Swissquote education:

| Has Education – Forex or CFDs | Yes |

| Client Webinars | Yes |

| Client Webinars (Archived) | Yes |

| Videos – Beginner Trading Videos | Yes |

| Videos – Advanced Trading Videos | No |

| Investor Dictionary (Glossary) | Yes |

Final thoughts

Swissquote is a trusted global brand that finished among our Best in Class for Crypto Trading and Trust Score, and won our award for #1 Banking Services for 2022.

The best all-around forex trading experience at Swissquote can be found through the firm’s U.K. entity, by way of the MetaTrader platform.

The Swiss-based offering of forex and CFDs, on the other hand, is a bit of a mixed bag due to the absence of forex or CFD trading within its otherwise vast multi-asset offering.

About Swissquote

Swissquote (SIX: SQN) was founded in 1996 and was publicly listed in 2000 on the SIX Swiss stock exchange and has since grown to be an established banking group. As of its H1 2021 report, Swissquote has 410,000 client accounts, and CHF 50.2 billion across its subsidiaries that are regulated in Europe and Asia.

With its headquarters in Switzerland, Swissquote Bank offers traders access to over two and a half million products, including shares, ETFs, funds, bonds, warrants, futures, forex, options, and other securities. In addition, Swissquote offers comprehensive wealth management and advisory services. Read more on Wikipedia about Swissquote.

2022 Review Methodology

For our 2022 Forex Broker Review we assessed, rated, and ranked 39 international forex brokers over a three-month time period resulting in over 50,000 words of published research.

Each broker was graded on 113 different variables, including our proprietary Trust Score algorithm. This innovative scoring system ranks the level of trustworthiness for each broker based on factors such as licenses, regulation and corporate structure. Read about Trust Score here.

As part of our annual review process, all brokers had the opportunity to provide updates and key milestones and complete an in-depth data profile, which we hand-checked for accuracy.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Learn more about how we test.