- AUD/USD bears taking over following mitigation of inefficiency.

- A bearish case is building up for a long-term perspective.

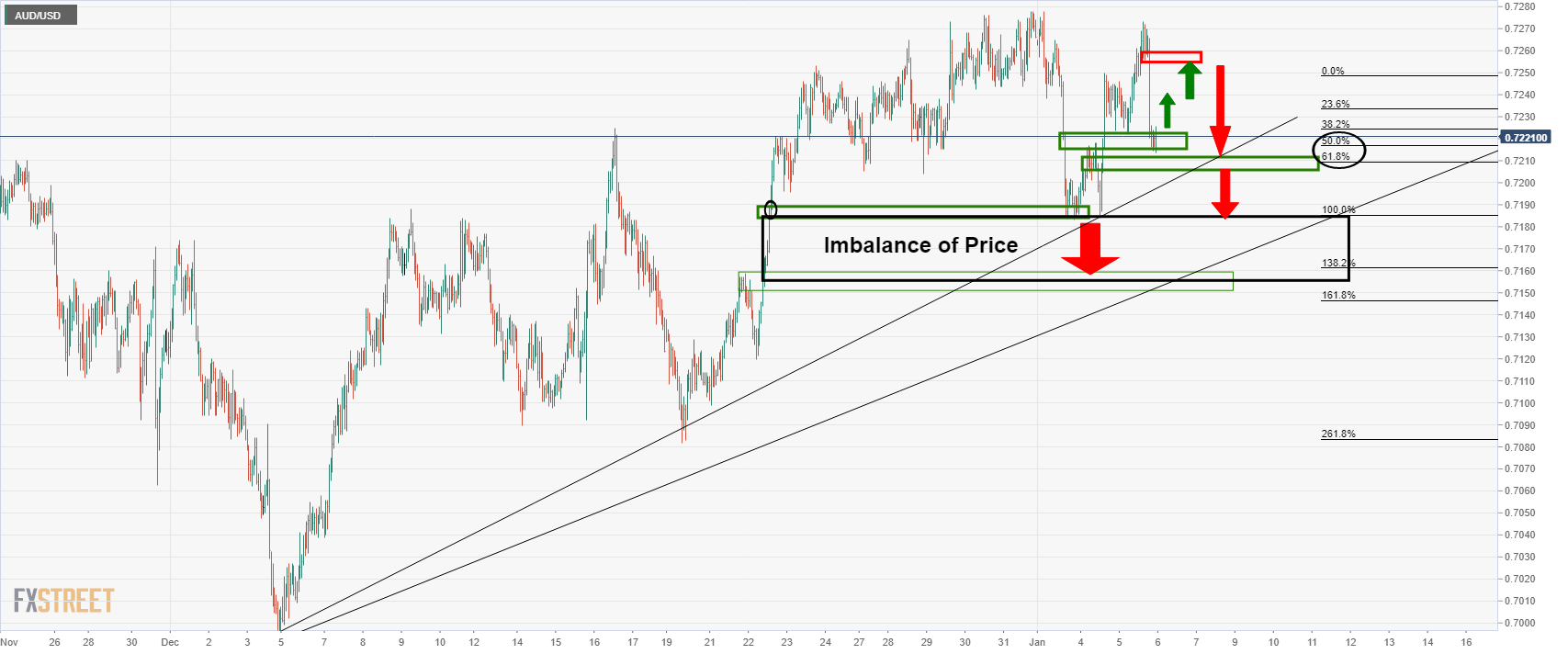

As per the prior analysis, AUD/USD Price Analysis: Bulls may have run their course, 0.7180, 0.7150 and 0.7100 eyed, the bulls have indeed thrown in the towel following some final mitigation of the inefficiency of price as explained in the above article and as follows:

AUD/USD H1 chart, prior analysis

While the article was biased towards a bearish outlook, the imbalance of price to the upside was pointed out and a last-minute push to the upside was expected in order to mitigate the inefficiency. This played out as follows:

Meanwhile, the price has met what is expected to remain as a support structure and subsequent bids could drive the price higher to mitigate the bearish impulse's inefficiency of price as follows, prior to bears moving in again in what could play out to be a period of short term distribution:

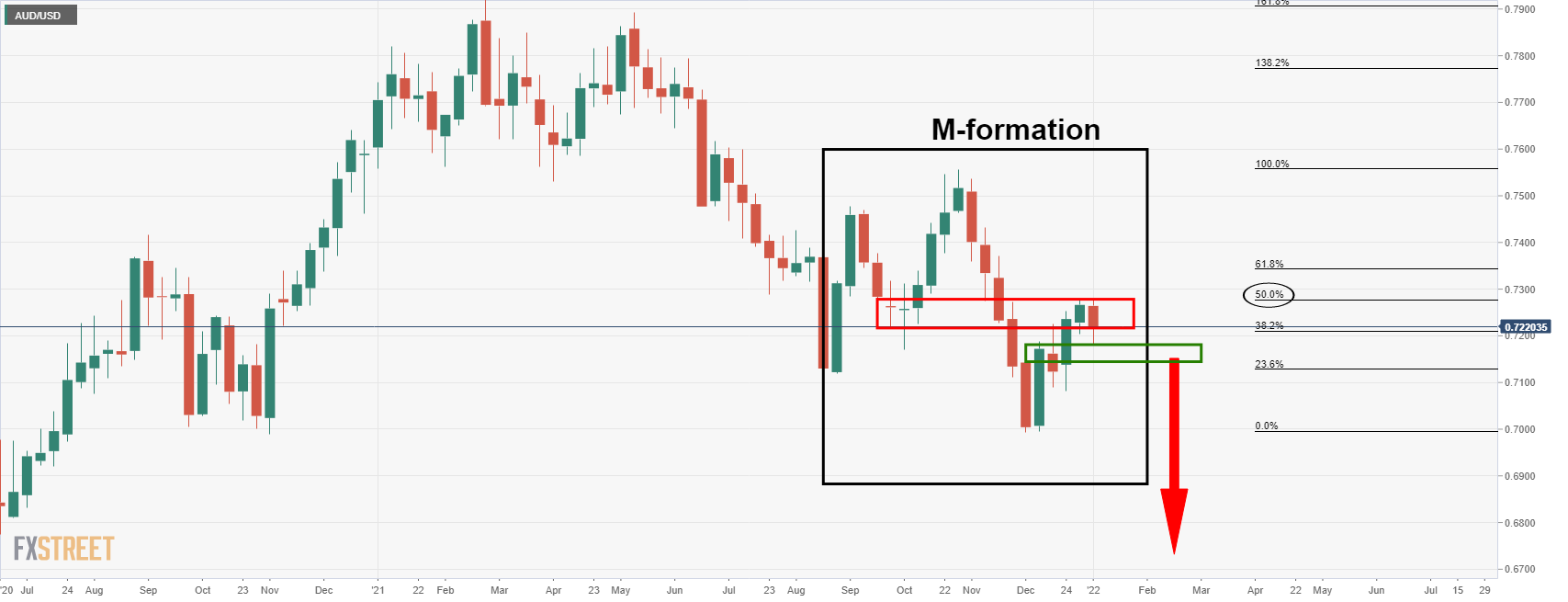

Overall, the bearish perspective for the price is based on the following longer-term chart analysis:

The price has met the M-formation's neckline which is currently acting as a resistance near the 50% mean reversion of the weekly bearish impulse. On a break of weekly support, near 0.7150, the prospect of a downside continuation will be in play.