- AVAX price has fallen nearly 10% during the Tuesday trading session.

- Key Ichimoku levels are currently acting as resistance and support.

- Downside risks below the $100 exist, but a return to $125 is more probable.

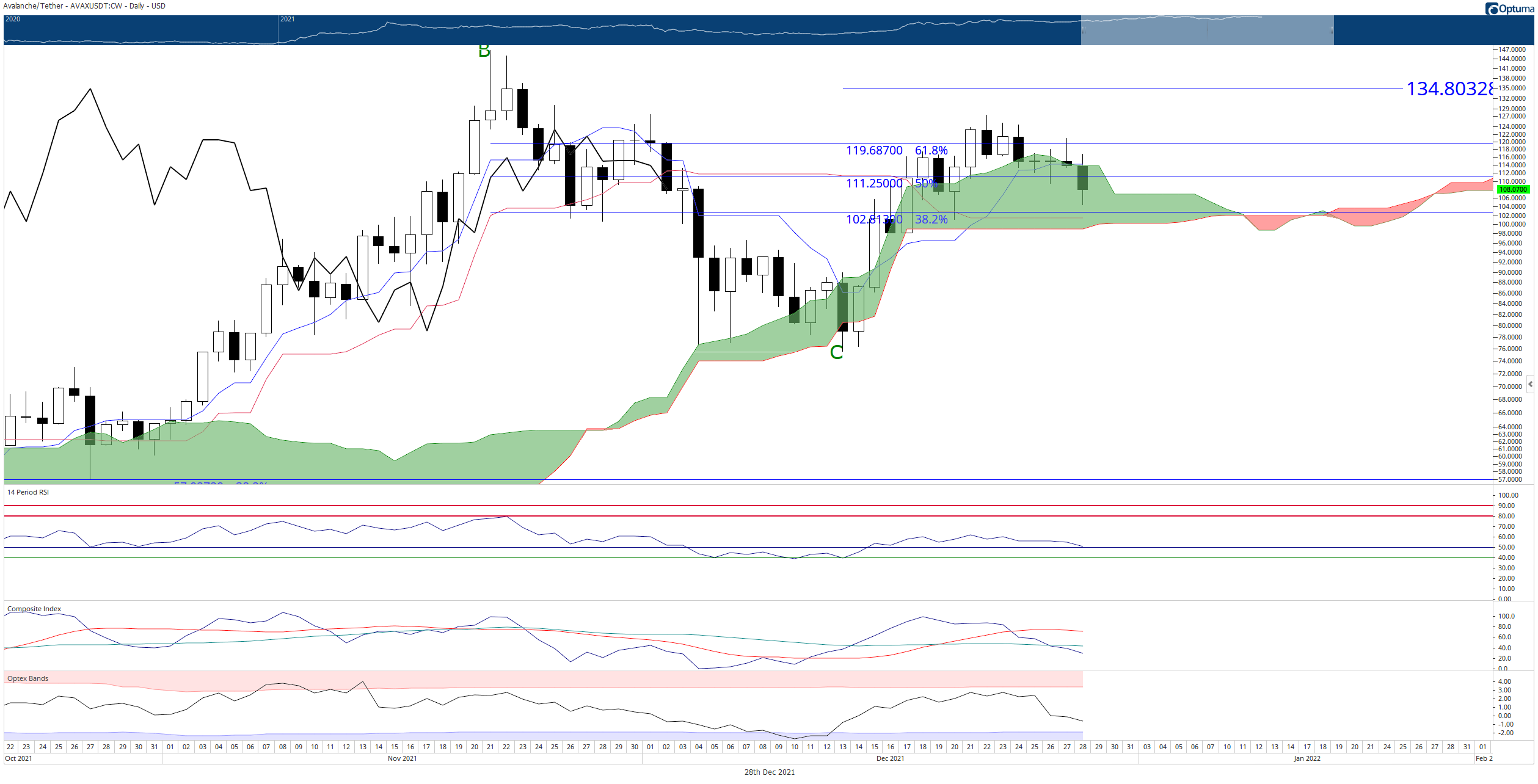

AVAX price action has seen its series of whipsaws for December, another occurring today. Since December 23, AVAX has been bound to the inside of the Ichimoku Cloud – a behavior that is likely to continue until a clear breakout occurs.

AVAX price to test $100 as support

AVAX price has a significant support zone near the $100 value area. $100 is not just a crucial psychological level, but it contains the 38.2% Fibonacci retracement ($102.81), the daily Kijun-Sen ($101.14), and the bottom of the Cloud (Senkou Span B, $99.02). The oscillators support AVAX holding $100 as its primary support level.

The Relative Strength Index is currently just above the first oversold level in a bull market (50). If buyers show a strong rejection of lower prices, then any hook pointing in the RSI would likely indicate a bottom has been found. Additionally, the Optex Bands oscillator is just above the extreme oversold levels and warns that selling is likely overdone at the present value area.

Conservative buyers should look for a condition where AVAX price is positioned for an Ideal Ichimoku Breakout entry. This would occur when AVAX has a daily close above the Cloud and when the Chikou Span is in open space. The earliest entry opportunity on the daily chart would be a daily close at or above $114 on the close of the daily candlestick for December 28 or December 29. By December 30, that threshold drops to a daily close at or above $110.

AVAX/USDT Daily Ichimoku Chart

However, AVAX price and other cryptocurrencies involved in the metaverse or gaming token space have been at extreme levels for quite some time. A rotation of capital out of those assets into other cryptocurrencies that have more substantial gains ahead is very likely. Traders will want to watch for any daily close below the $95 value area as that could trigger moves towards the $60 price range.