- Bitcoin price reveals the possibility of a move to $42,748 as it recovered from a Russia-induced flash crash.

- The MRI indicates a potential buy signal could follow soon, adding credence to the recovery rally.

- On-chain metrics suggest that the overall health of the BTC market is recovering quickly.

Bitcoin price suffered a fatal crash to a crucial support level after news of Russia attacking Ukraine spread. This downswing caused the crypto market to crumble, but the recovery seems to be going well and suggests that BTC could be due for a relief rally.

Bitcoin price awaits a go signal

Bitcoin price crashed roughly 23% in almost a week and set a swing low at $34,337. The weekly support level at $34,752 was a significant reason why BTC failed to explore lower levels. Interestingly, this recovery pushed BTC to produce a daily candlestick close above the $36,398 to $38,895 demand zone’s lower limit.

This decisive close prevented a crash to $30,000 or lower and gave bulls something to hold on to.

Going forward, investors can expect BTC to continue recovering and to make a run at the recently flipped resistance barrier at $39,481 and the 50-day Simple Moving Average (SMA) at $40,417. The Momentum Reversal Indicator (MRI) has flashed a yellow up arrow suggesting that a continuation of the upturned will lead to a buy signal in the form of a green “one” candlestick on the daily chart. This formation forecasts that BTC will now likely witness one to four green candlesticks.

Market participants can, therefore, expect Bitcoin price to make a run for the weekly resistance barrier at $42,748 – a likely place for upside to be capped. However, if the bid orders pile up, there is a good chance BTC might extend the rally to the yearly open at $46,198, roughly coinciding with the 100-day SMA.

BTC/USDT 1-day chart

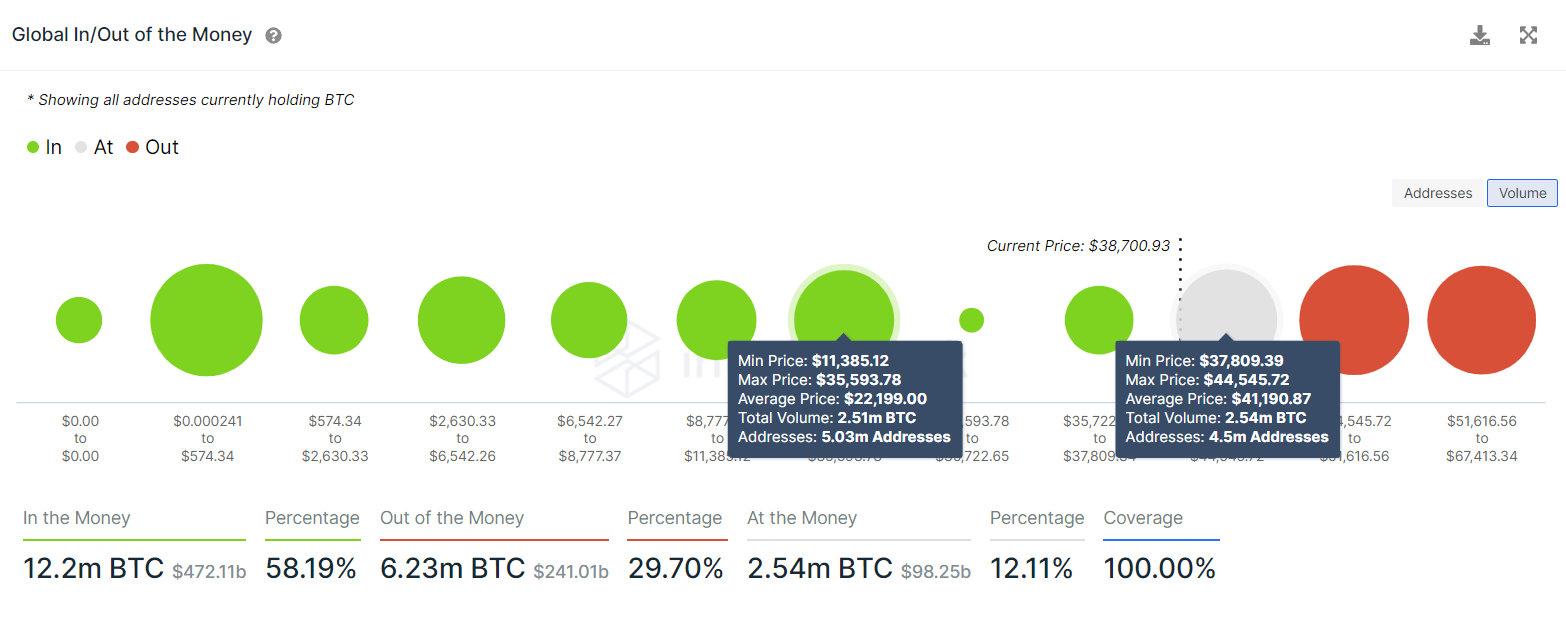

The IntoTheBlock’s Global In/Out of the Money (GIOM) model shows that roughly 4.50 million addresses that purchased 2.54 million BTC at an average price of $41,190 are “At the Money.” This level coincides with the target obtained from a technical perspective, adding a tailwind to the bullish thesis.

BTC GIOM

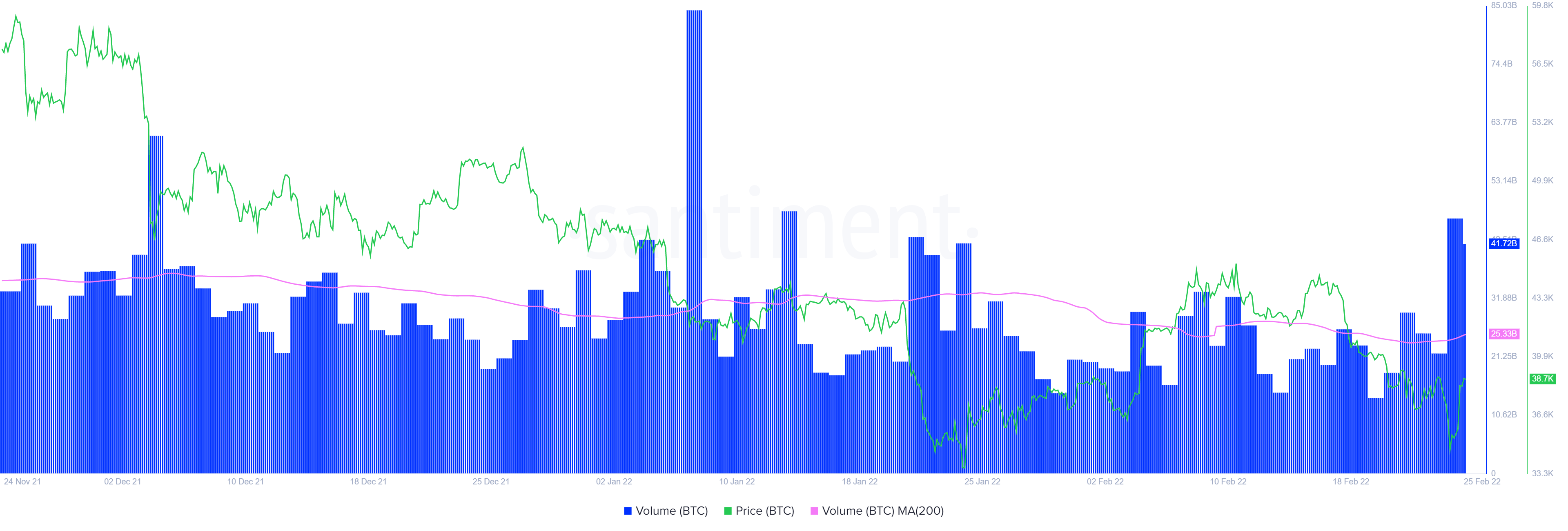

While the February 25 flash crash caught many investors off-guard, the on-chain volume of BTC saw a massive spike to 46.38 billion BTC, which was well above the 200-day Moving Average (MA).

Similar drops in price have coincided with massive spikes in on-chain volume in the past, hinting that investors could be buying the dips, aka accumulating. Therefore, despite the recent crash, the uptick in on-chain volume suggests that the relief rally is likely to continue, aligning with the technical perspective.

BTC on-chain volume

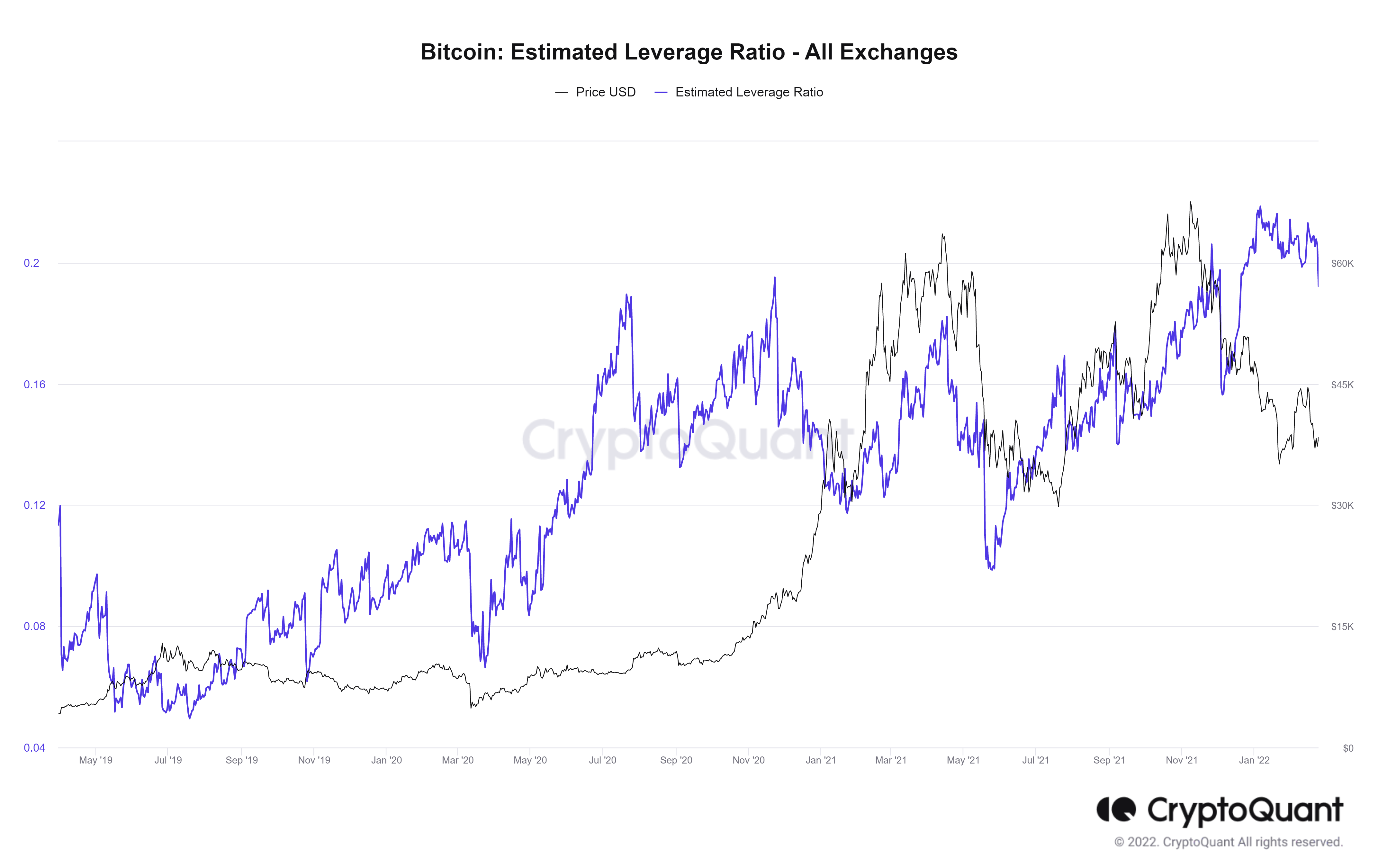

Further implying a short-term uptrend is possible due to the recent slump in the estimated leverage ratio of Bitcoin price from an all-time high of 0.218 to 0.192. This 12% downtrend suggests that the market is less coiled after the flash crash and that bulls can now take over.

BTC estimated leverage ratio

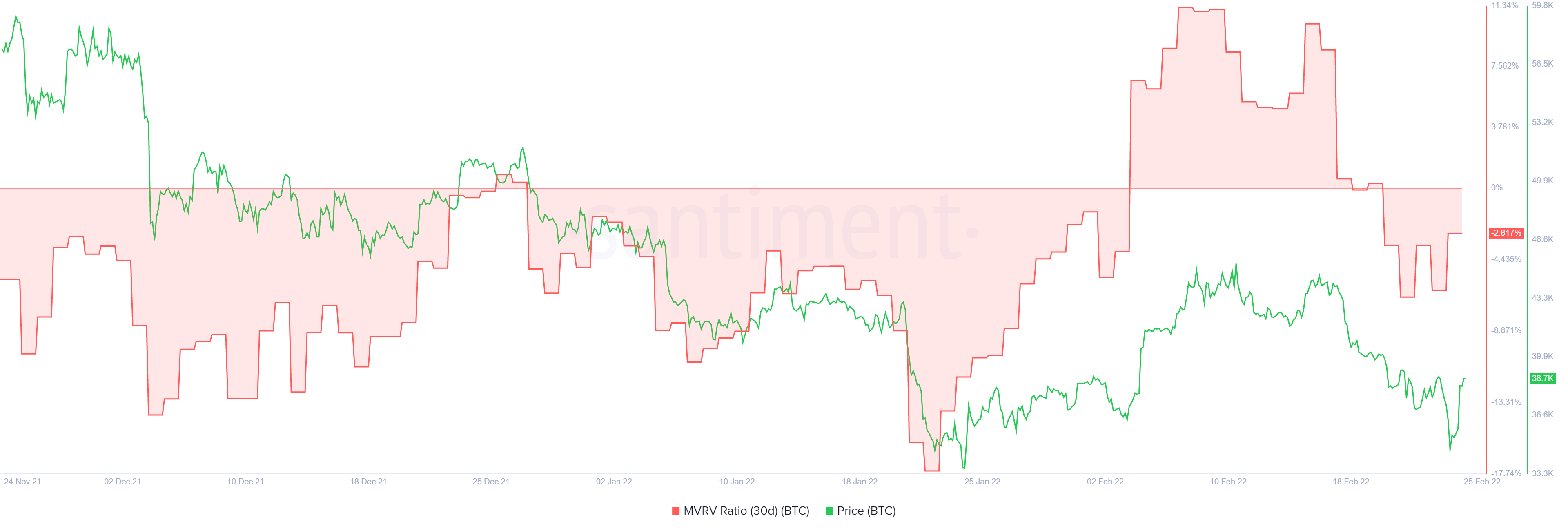

The short-term bullish thesis gains credence because the 30-day Market Value to Realized Value (MVRV) model has risen from -6.8% to -2.8% over the past three days. This on-chain metric shows the average profit/loss of investors that purchased BTC over the past month.

Despite the recent crash, the 30-day MVRV is close to the zero line indicating that many investors could have bought the dip and profited from it, implying that a short-term rally is on the horizon.

BTC 30-day MVRV

While a bullish outlook is reasonable, Bitcoin price needs to hold above the immediate demand zone, extending from $36,398 to $38,895. A daily candlestick close below $36,398 will invalidate the demand zone and forecast a move down to the weekly support level at $34,752.

If BTC fails to hold above this barrier, it will invalidate the bullish thesis and hint at a potential crash to $29,100. This move could also sweep below the aforementioned level to collect the sell-stop liquidity resting below it.