- Bitcoin price is on a second attempt to retest $42,451 and breach it.

- The BTC mining industry seems to have stabilized as players continue to flourish.

- On-chain metrics support the bullish thesis, which might push the flagship cryptocurrency to $44,750.

Bitcoin price witnessed an exponential growth after weeks of downtrend or consolidation. This move retested the range high and retraced momentarily. However, the recent upswing is most likely to push through the said resistance level and tag a crucial supply zone resting above it.

The mining industry comes anew

Due to the Chinese laws around digital currency mining, the miner exodus had a major impact on the Bitcoin hash rate, miners, and the mining equipment producers. However, after weeks of migration to mining-friendly countries, Bitcoin miners are making a comeback.

In this direction, The9, a Shanghai-based mining firm, said on August 4 that its subsidiary NBTC Ltd. had partnered with Kazakhstani mining partner KazDigital to build a 100 megawatt mining facility by 2022.

On a similar note, Stronghold, a Pennsylvania-based Bitcoin mining company, reported on August 3 its plans to acquire the 33-acre Panther Creek Plant. This development shows that the mining players are optimistic about the future and plan to capitalize on the power vacuum after Chinese miners shut down their rigs.

HIVE Blockchain, a publicly-traded company, announced on August 3 that it placed orders for 4,000 machines from China’s mining equipment manufacturer Canaan. This move from the company comes as it plans to upgrade its hash rate from 925 petahash per second (PH/s) to 1 exahash per second (EH/s) by August.

From a Bitcoin adoption standpoint, Bakkt partnered with fast-food chain Quiznos to test and accept BTC by mid-August.

Speaking about this partnership, Sheela Zemlin, the Chief Revenue Officer at Bakkt, stated,

We are introducing unique experiences to Quiznos customers by enabling them to take advantage of new ways to interact with digital assets and bringing bitcoin utility to the mainstream consumer market.

NCR Corporation is acquiring the US Bitcoin ATM and kiosk operator LibertyX. Tim Vanderham, Chief Technology Officer at NCR, added that this decision comes as the company plans to address the growing consumer demand for digital currencies. Additionally, NCR wants to provide its users with the,

ability to buy and sell cryptocurrency, conduct cross-border remittance and accept digital currency payments across digital and physical channels.

Bitcoin price takes another jab at restarting the second leg-up

Bitcoin price rallied 46% from July 20 to August 1 and tagged $42,451 to set up a swing high at $42,599.

Since this upswing, BTC has retraced 12% and is attempting another run-up that shatters the range high at $42,451. If this were to occur, it would open up the path to retesting the supply zone that extends from $43,150 to $45,321.

Interestingly, this resistance area coincides with the 50% Fibonacci retracement level of the May 10 to May 19 crash at $44,750.

Therefore, investors can expect the run-up from the current position to tag $44,750, which would represent a 10% climb from the $40,550 support level.

BTC/USDT 12-hour chart

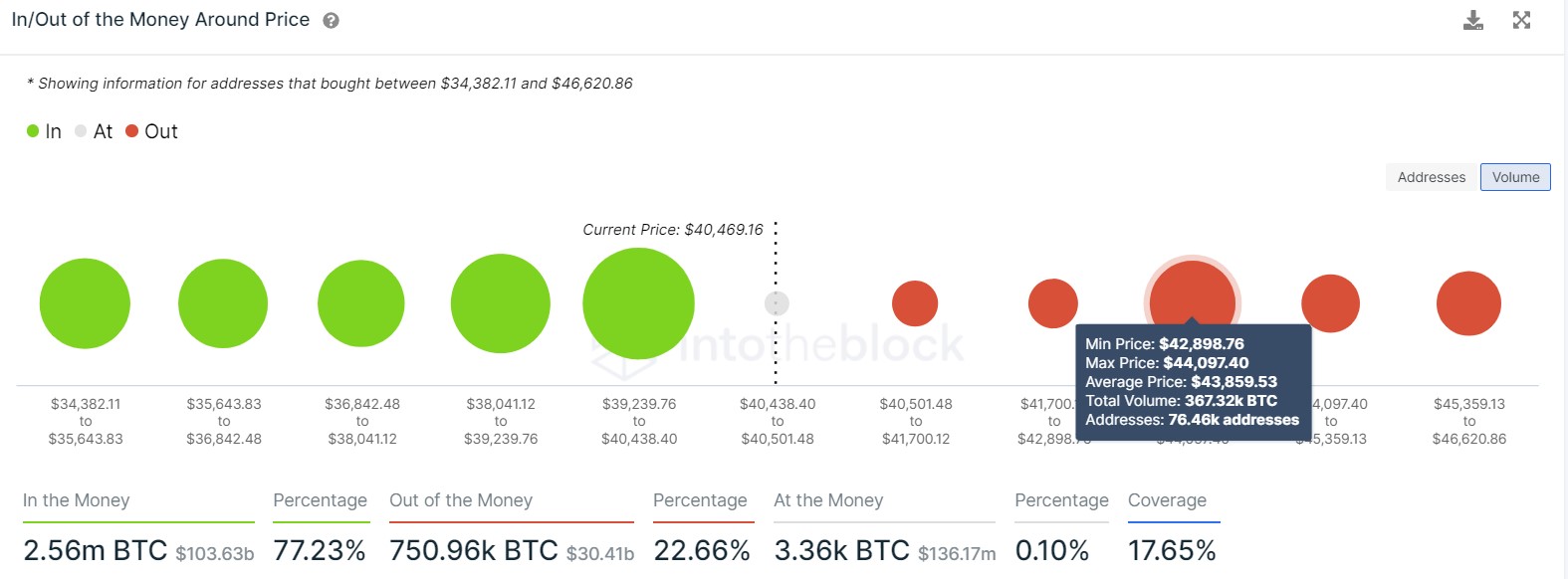

Supporting this uptrend is IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model, which shows a significant resistance level around $43,859. Here roughly 76,460 addresses purchased nearly 367,000 BTC.

BTC IOMAP chart

Moreover, the supply of BTC held on exchange has dropped dramatically over the past 11 days. This metric dropped from 2.58 million to 2.46 million, suggesting that roughly 120,000 BTC have left centralized entities, effectively reducing potential sell-side pressure.

BTC supply on exchanges chart

However, investors should note that the 30-day Market Value to Realized Value (MVRV) model hovers around 8.16% and might reset to zero before heading higher, triggering a pullback. Therefore, market participants need to watch out for a retracement before the upswing is confirmed.

BTC 30-day MVRV chart

While things seem to be going well for Bitcoin price, the correction mentioned above could ruin the moment for bulls if it produces a swing low below $37,241. This move would set up a lower low, indicating a shift in trend favoring the bears.

However, a decisive 12-hour candlestick close below $35,618 would invalidate the bullish thesis as it would confirm the lack of buying pressure and might also catalyze a downswing to $34,666.