- CPI cruises to 9.1% annually in June, topping 8.7% estimate.

- Core inflation slips to 5.9% from 6.0%, forecast was 5.7%.

- Treasury futures odds for a 100 basis point hike this month reach majority.

- Real hourly wages drop 1% on the month, 3.6% for the year.

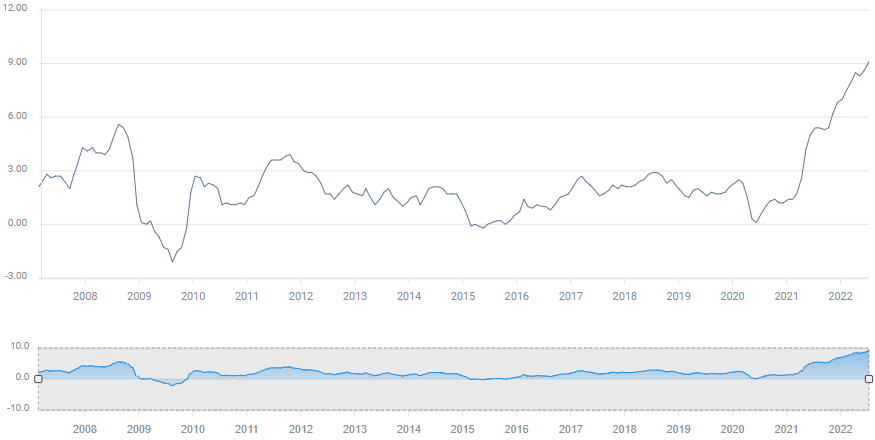

Inflation tightened its grip on American consumers in June as prices vaulted to the highest annual pace since November 1981. The Consumer Price Index (CPI) climbed 9.1% from a year ago, reported the Bureau of Labor Statistics (BLS) on Wednesday, far more than the 8.8% forecast and up from 8.6% in May.

Core prices, leaving out energy and food costs, came in hot as well, slipping to 5.9% from 6.0% instead of the 5.7% predicted. Monthly gains were 1.3% for the overall index, up from 1.0% in May and 0.7% for core, rising on 0.6% from May. Consensus estimates had been 1.1% and 0.5% respectively. Annual core inflation peaked at 6.5% in March but the headline rate has set a new four-decade record in six of the last seven months.

CPI

FXStreet

Previous speculation that inflation had peaked with the March core rate and the 0.2% April dip in overall CPI to 8.3% has been disproved. Price gains were widespread, led by the gasoline, shelter and food indexes but including, autos, clothing and most domestic goods and services.

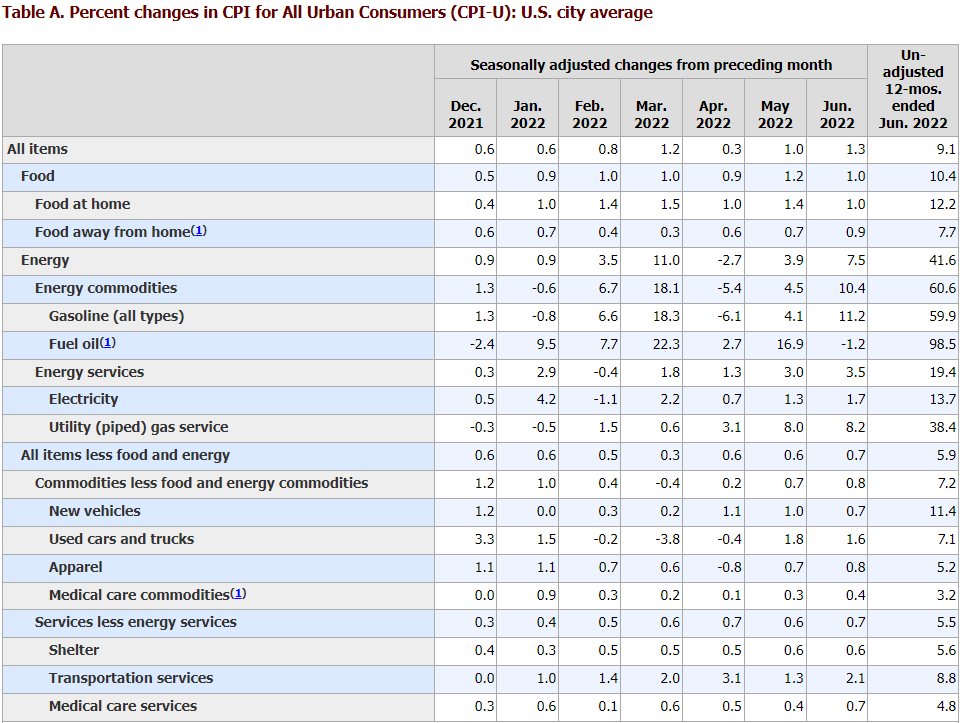

Inflation distribution and real income

Energy prices climbed 7.5% in June and contributed about half of the general increase. The gasoline index rose 11.2% and natural gas added 8.2%. For the year auto fuel costs are 60% higher and piped natural gas has climbed 38.2%. Electricity costs rose 1.7% in June, 13.7% in the last year. Fuel oil is 98.5% pricier than 12 months ago.

Food was 1% higher for the month and 10.4% on the year, the largest annual increase since February 1981. Food for home consumption, the largest category, jumped 1.0% in June and has soared 12.2% in 12 months.

The shelter index, which encompasses ownership and rentals, rose 0.6% in June and contributed about one-third of the CPI increase. For the year shelter expenses are 5.6% higher. New cars were up 0.7% in June, 11.4% for the year.

The cost of an airline ticket fell 1.8%, one of the few declining categories, though fares are up 34.1% from June 2020. The prices of meat, poultry, fish and eggs also slipped 0.4% for the month but are 11.7% higher on the year.

Worker compensation fell again in June. Real hourly earnings, adjusted for inflation, a separate release from BLS, dropped 1% in June and are down 3.6% for the year.

BLS

Markets

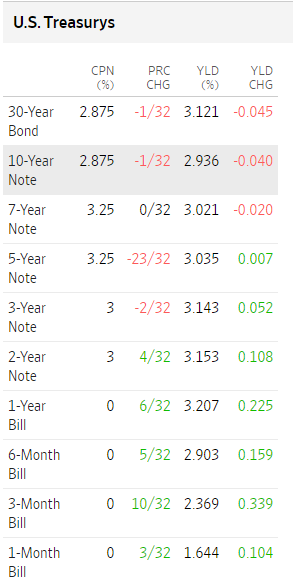

Markets initially responded to the higher inflation numbers by pushing Treasury rates sharply positive, at one point the 10-year note had gained more than 10 basis point of yield.

Currency markets and equities followed the credit lead with the US dollar, at first, gaining in every major pair. Equity futures tumbled and then, an hour later after stocks opened prices moved lower.

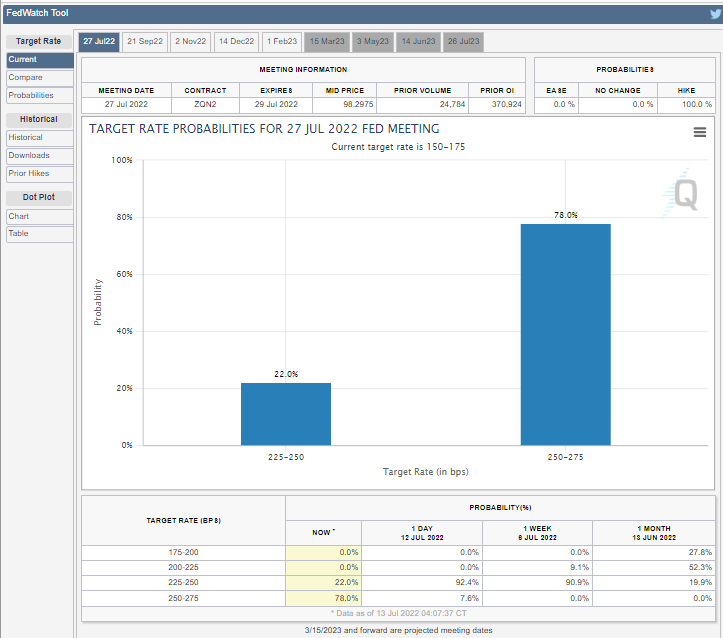

Treasury futures, tentatively then decisively, endorsed a 100 basis point hike at the July 27 Federal Open Market Committee (FOMC) meeting. At first blush the futures listed the odds of a 100 point increase at 51.3%, the first majority for the larger increase. By the end of Wednesday trading, the CME Treasury futures rated the odds of a 1.0% hike in two weeks at 78.0% with 22.0% voting for a 0.75% increase.

CME

As the session proceeded stocks gyrated between gains and losses with all three major indexes moving between red and green. Equities closed uniformly lower with the Dow down 208.54 points, 0.67% to 30,772.79. The S&P 500 lost 17.02 points, 0.45% to 3,801.78 and the NASDAQ shed 17.15 points to 11,247.58.

In a major change of heart, Treasury yields reversed at the longer end of the curve, with the 30-year, 10-year and 7-year issues losing points and the rest, down to the one-month bill increasing their returns. The 2-10 spread widened to 21.7 basis point favoring the shorter duration.

WSJ

At the close, the dollar retained a small gain against the yen but lost against all other majors. The Dollar Canada fell the most, finishing at 1.2975 as the Bank of Canada (BoC) opted for a 100 point increase, raising its base rate to 2.5%.

-637933468424628683.png)

The credit market's future is complicated. In the immediate term, the Fed will increase rates as long as it can, likely until a recession strikes. Beyond the near horizon, the rate future is hazy. Can the Fed continue its rate campaign if the economy begins to contract?

The twin economic threats of an inflation-defensive consumer spending pullback and the impact of the Fed’s rapid rate increases could easily send the weak expansion into reverse.

The inverted yield curve, even as Treasury futures foresee a 100 basis point hike in two weeks, illustrates the economic risks. It is going to be an unsettled third quarter.