Crypto futures racked up more than $1 billion in liquidations in the past 24 hours amid weak market sentiment and major assets losing pivotal support levels.

Bitcoin (BTC) fell as much as 8% in the past 24 hours. Ether (ETH), BNB Chain’s BNB, and XRP saw similar losses. Terra’s LUNA fell 50% as its UST stablecoin lost its peg with U.S. dollar, while memecoin dogecoin (DOGE) fared relatively better than the market with just a 6% drop.

Bitcoin temporarily fell under $30,000 in early Asian hours, buoyed by a weak broader market. U.S. technology index Nasdaq ended Monday 4.29% lower, while Asian markets began Tuesday over 1% lower.

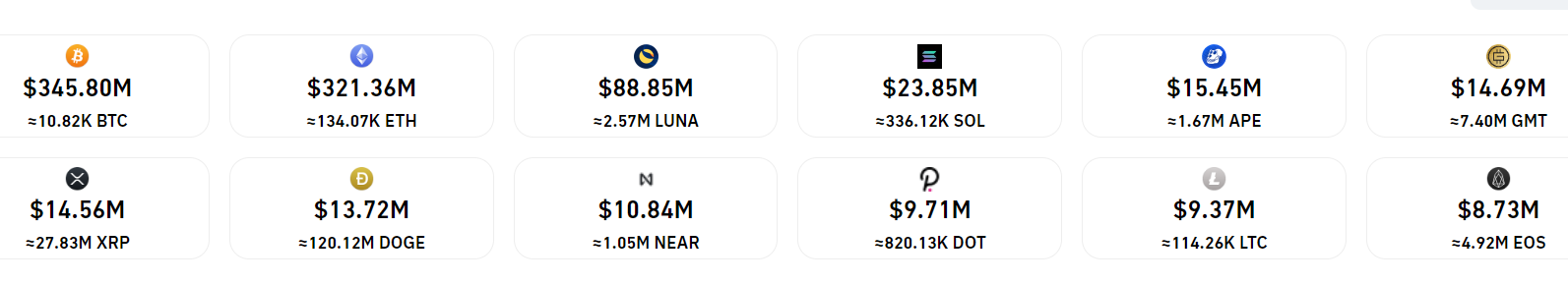

Such price action led to this year’s biggest liquidations losses so far. Data shows traders of bitcoin futures lost $346 million, ether futures lost $321 million, while LUNA futures $87 million – a higher-than-usual figure for traders of that asset.

Crypto futures racked up $1 billion in losses. (Coinglass)

More than $793 million of the total liquidations arose from long traders, or those betting on higher prices, which represented 74% of the futures trades. Some $257 million of that occurred on crypto exchange OKX, followed by Binance at $181 million and FTX at $102 million.

Open interest, or the amount of outstanding derivative contracts that have not been settled, fell 5.6%, implying traders closed their positions in anticipation of a further drop. As such, the crypto market lost nearly 8% of its overall capitalization in the past 24 hours.

Markets seemed to gradually recover at writing time. Bitcoin traded above $31,800, while ether regained the $2,800 level. An extended recovery would depend on how broader equity markets trade this week, however, as market observers previously pointed out.