What will happen?

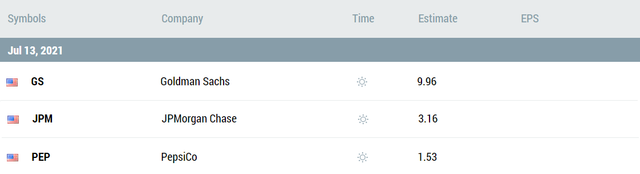

The much-awaited earnings season is about to start! The first companies that will deliver their financial results for the second quarter will be Goldman Sachs, JPMorgan Chase, and PepsiCo.

Check economic calendar

Goldman Sachs and JPMorgan Chase are American multinational investment banks. They are going to deliver their Q2 financial results on July 13 at 14:30 and 15:30 GMT+3, respectively. The GS’s forecast is $9.96 earnings per share. The JPM’s forecast is $3.16 earnings per share. Last time, the banks beat the estimates due to the rise in wealth and consumer banking revenues after the Covid-19 crisis. However, this time, the result may be weaker than expected as Wall Street analysts have predicted trading revenue at top US banks slumped by 28%.

If Goldman Sachs reveals better-than-expected EPS, it may break above the psychological mark of $380.00, which will open the doors towards the high of June 4 at $390.00. Support levels are the low of June 8 at $360.00 and the 100-day moving average of $350.00.

JPMorgan is getting closer to the key resistance level at the 50-day moving average of $158.00. If the Q2 earnings are strong, it may jump above $158.00, clearing the way up to the all-time high of $167.00. On the flip side, the drop below the low of July 8 at $150.00 will push the stock down to the next support at $147.00.

PepsiCo, the giant beverage company, will reveal its Q2 earnings on July 13 at 13.00 GMT+3. The market expects the company to deliver earnings of $1.53 per share. Most analysts are optimistic about Pepsi’s earnings. Indeed, the coronavirus-related costs should be reduced due to a successful vaccine rollout in the US, which accounts for roughly 2/3 of total Pepsi’s profits.

If PepsiCo reveals strong financial data, its stock price may jump above the $150.00 psychological mark, which will open the doors to the next round number of $155.00. Support levels are the 50-day moving average of $147.00 and the low of June 24 at $146.00.

Don’t know how to trade stocks with FBS? Here are some simple steps.

- First of all, be sure you’ve downloadedFBS Trader apporMetatrader 5.FBS allows you to trade stocks only through this software.

- Openan account inFBS Traderorthe MT5 account in yourpersonal area.

- Start trading!

FBS Review

Tuesday, 13 Jul, 2021 / 7:52