- EUR/USD holds in positive territory into the closing bell on Wall Street.

- The ECB came as expected and the euro has attracted a bid.

EUR/USD is struggling to extend gains made in Thursday's North American session, capped at a high of 1.1841 and trading mid-range near 1.1830.

The euro is holding onto small daily gains following the European Central Bank meeting whereby it said it will trim emergency bond purchases over the coming quarter.

This is seen as the central banks first small step towards unwinding the emergency aid as the nation's inflation readings head towards their highest in nearly a decade.

“The ECB is delivering mainly as expected today,” analysts at TD Securities said in a report on Thursday. “Looking ahead, the focus will be on how the ECB defines "moderately" – anything less than €60bn/mo could be bearish.”

Meanwhile, the ECB's governor, Christine Lagarde, came with an upbeat assessment of the nation's economic progress.

She explained that there has been a strong recovery in employment, business investment and said that there is ample scope for private consumption to rise further.

The central bank has raised its growth and inflation forecasts for this year although the 2023 forecasts provide a better assessment of where the ECB expects the economy to be over its forecast horizon.

''That is what is critical for monetary policy,'' analysts at ANZ Bank argued.

The ECB left, however, its 2023 Gross Domestic Product projection unchanged at 2.1% and inflation was tweaked to 1.5% vs 1.4%, well below the 2.0% target.

''That predicted path implies the ECB will withdraw stimulus very cautiously and that interest rate rises remain a long way off. The focus in coming months will be on how to address the anticipated ending of PEPP next March (a temporary, pandemic facility). To end it abruptly risks a sudden tightening in monetary conditions that could undermine growth and inflation expectations,'' the analysts explained.

''We, therefore, expect some expansion of the APP programme (currently EUR20bn per month) and/or a new envelope of QE purchases. The ECB will announce more in December.''

Meanwhile, investors are also focused on when the US Federal Reserve is likely to begin paring bond purchases.

The US dollar has managed to find demand on the notion that the global economy is no better off than the US's recovery and despite last week's dismal jobs print, the nation remains on solid foundations.

The Fed. however, is unlikely to make a move until at least later after the weaker than expected jobs report on Friday.

That being said, we had four Fed officials on Wednesday saying that the central bank needs to make a move, though some cautioned a final decision requires more data.

As for Us data on Thursday, it has shown that the number of Americans filing new claims for jobless benefits continues to fall.

Last week, the claims fell to the lowest level in nearly 18 months, offering more evidence that job growth was being hindered by labour shortages rather than cooling demand for workers.

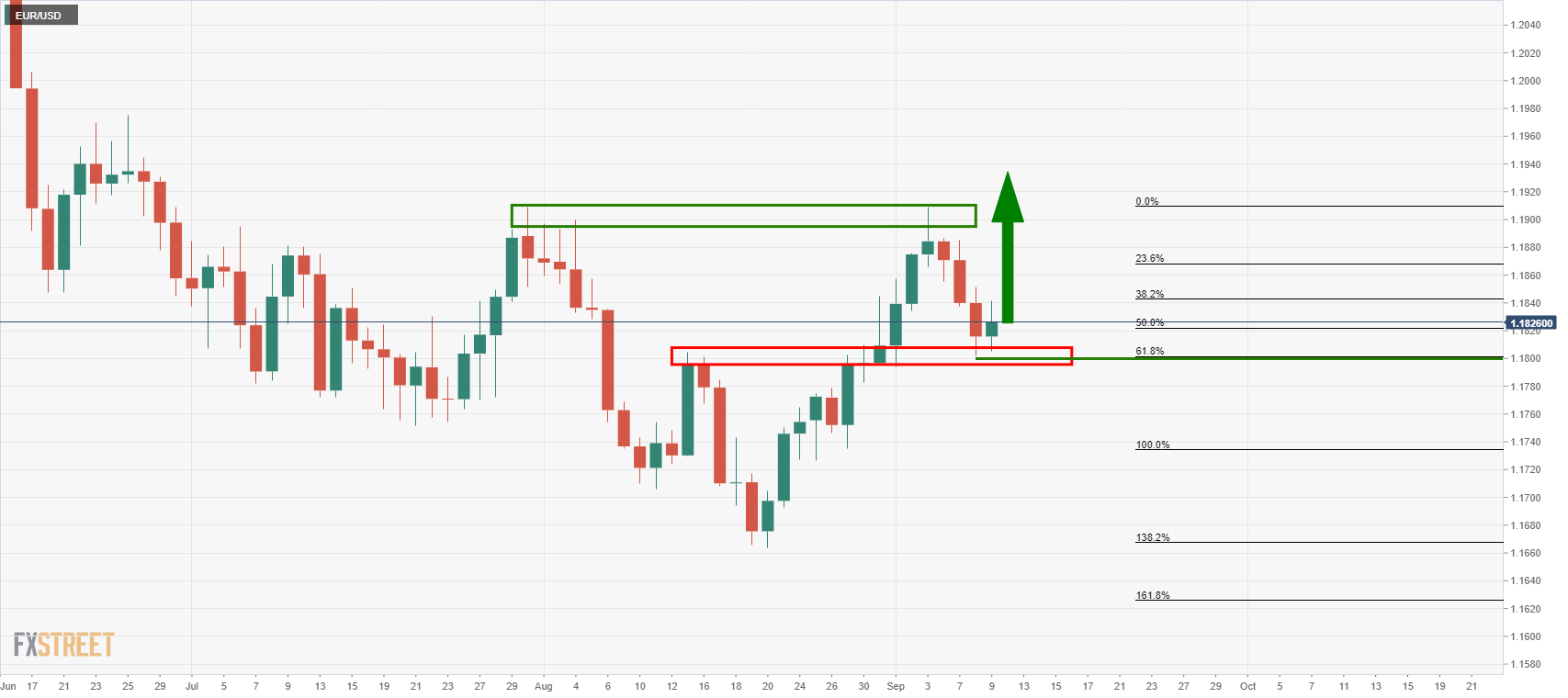

EUR/USD technical analysis

The price is supported at the 61.8% Fibonacci retracement and could be on the verge of a move to the upside to test prior highs for the possibility of an upside extension in the coming days.