- EURUSD remains under pressure near parity.

- The dollar looks cautious ahead of key releases.

- Markets attention will be on US inflation figures.

EURUSD price keeps navigating the lower end of the recent range near the crucial parity zone, always amidst the broad-based weakness in place since late June. The pair has therefore entered the third consecutive week with losses, including a drop to 0.9999 (July 12) for the first time since October 2002.

Persistent recession talks in both the US and the Euroland have been weighing on the investors’ sentiment in past weeks and prompted the re-emergence of the risk-off mood, which in turn morphed into extra inflows into the greenback. The stronger demand for the buck pushed the US Dollar Index (DXY) to the area north of 108.00 the figure, levels last traded back in December 2002.

Hand in hand with market chatter surrounding a slowdown in the global economy comes the prospects of further tightening by the Federal Reserve, which is expected to hike the Fed Funds Target Range (FFTR) by 75 bps at the July 27 gathering. On this, and according to CME Group’s FedWatch Tool, the probability of such a raise now surpasses 90% from just above 9% a month ago.

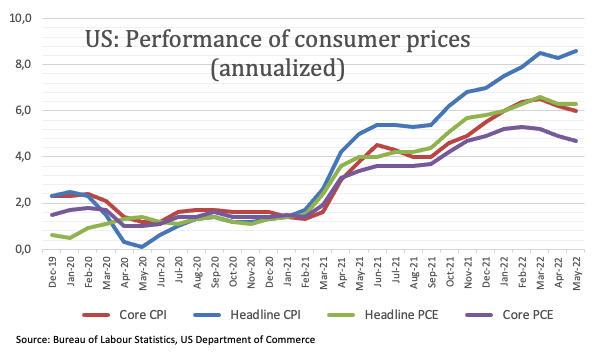

It will be key for the above the release of the US Inflation Rate later on Wednesday, where consensus expects consumer prices to have risen at an annualized 8.8% in June and 5.7% when it comes to the Core CPI, from May’s 8.6% and 6.0%, respectively.

A key role in the sharp depreciation of the single currency in past weeks has been the inaction of the ECB when it comes to unveil plans to design an anti-fragmentation tool, especially as markets get closer to the July event, where the central bank is forecast to start the hiking cycle by 25 bps. ECB’s rate-setters have also been very vocal in advocating for a larger hike in September (75 bps?), although the impact on the FX space, and particularly the euro, has been non-existent.

EURUSD Price Short-Term Technical Outlook

The pair remains well under pressure and a breach of the parity level should not be ruled out just yet. However, a sustained drop below the latter seems difficult to envisage.

The break below 1.0000 should expose a probable test of the December 2002 low at 0.9859 prior to the October 2002 low at 0.9685. Not much it can be said on the upside for the time being, where bulls should meet the initial hurdle at the temporary 55-day SMA, today at 1.0506. Beyond this level emerges the 5-month resistance line at around 1.0560, which, if cleared, it should mitigate the downside pressure somewhat and help spot to challenge the weekly high at 1.0617 (June 27).

Furthermore, current oversold conditions, as per the daily RSI around 27, could spark a corrective upside, although this is expected to be short-lived and could also be deemed as selling opportunities.