A number of crypto observers have viewed Bitcoin as ushering in a new era of financial sovereignty amid growing uncertainty about long-term U.S. economic dominance globally, but many countries are still investing in gold and U.S. treasury bills.

Good morning. Here’s what’s happening:

Prices: Bitcoin and other cryptocurrencies rose again.

Insights: Many economic powers in the Asia Pacific region remain confident about T-bills and gold as investments.

Technician's take: BTC's momentum turned positive for the first time since July, although a significant price rally could be delayed.

Prices

Bitcoin (BTC): $47,551 +1.9%

Ether (ETH): $3,371 +3%

Top Gainers

| Asset | Ticker | Returns | Sector |

|---|---|---|---|

| Filecoin | FIL | +16.4% | Computing |

| EOS | EOS | +11.2% | Smart Contract Platform |

| XRP | XRP | +4.6% | Currency |

Top Losers

| Asset | Ticker | Returns | Sector |

|---|---|---|---|

| Algorand | ALGO | −0.9% | Smart Contract Platform |

Bitcoin continues climbing; cracks 2022 $47.2K break-even point

Bitcoin continued its upward march, rising for the seventh consecutive day even as equity markets tread water and macroeconomic uncertainty continued.

The largest cryptocurrency by market capitalization was recently trading just under $47,650, a nearly 2% gain over the past 24 hours. Ether, the second-largest crypto was changing hands under $3,400, a roughly 3% increase for the same period. Almost other major cryptos in the CoinDesk top 20 for market cap spent much of Monday well into the green.

Bitcoin cracked the 2022 yearly break-even point of $47,201 early afternoon Asia time, and has risen more than 15% over the past week. Ether is up more than 16% for the same timeframe.

"What we're looking at basically is a general improvement in market sentiment," Noelle Acheson, head of market insights at Genesis Global Trading, told CoinDesk TV's "First Mover" program, adding that the digital currency prime broker's trading desks started seeing "a more bullish tone" last week.

"Some derivative market metrics started flashing some signals," she said. Genesis, like CoinDesk, is owned by Digital Currency Group.

The weekend price spike among bitcoin and other cryptos had puzzled some observers. Stocks in U.S. markets, whose gains have correlated with those of crypto prices in recent months, have been roughly flat over the last two trading days. The tech-focused Nasdaq rose 1.3% on Monday. The S&P 500 and DJIA increased by less than a percentage point.

Acheson noted that rising interest among institutional investors over the past two weeks, including financial service giants BlackRock (BLK) and Goldman Sachs (GS), has buoyed crypto markets. They have made statements "that crypto markets are worth dedicating more resources to," she said.

She highlighted the purchase over the past six days of $1.3 billion in bitcoin by the Singapore non-profit Luna Foundation Guard (LFG) as a reserve asset. The foundation is delivering on its month-old promise to add BTC as an additional layer of security for UST, which is Terra's decentralized dollar-pegged stablecoin. LFG has committed to purchasing at least $3 billion in bitcoin as reserves.

Acheson also spoke of a growing awareness – spurred partly by the ongoing conflict in Ukraine – of bitcoin as a "seizure-resistant store of value." "What we are seeing in our headlines almost every day now (is) cases when this does matter to people," she said.

Markets

S&P 500: 4,575 +0.7%

DJIA: 34,955 +0.2%

Nasdaq: 14,354 +1.3%

Gold: $1,921 -1.8%

Insights

Intrigued by bitcoin but still confident in T-bills, gold

El Salvador’s "Bitcoin Bond" was supposed to be the first chapter of the next era of sovereign finance.

But the project seems to be in disarray, and analysis of the bond’s structure shows that it's not really a great deal for investors.

Bitcoin was marketed as the next major asset class for the balance sheet of the sovereign because of the questions surrounding the longevity of U.S. hegemony and the petrodollar that powers it.

Meanwhile, nations are still expressing confidence in U.S. Treasury bills as stores of value for their treasury. Some countries are even opting for these T-bill over gold, even while protesting against a U.S.-led, globalized world.

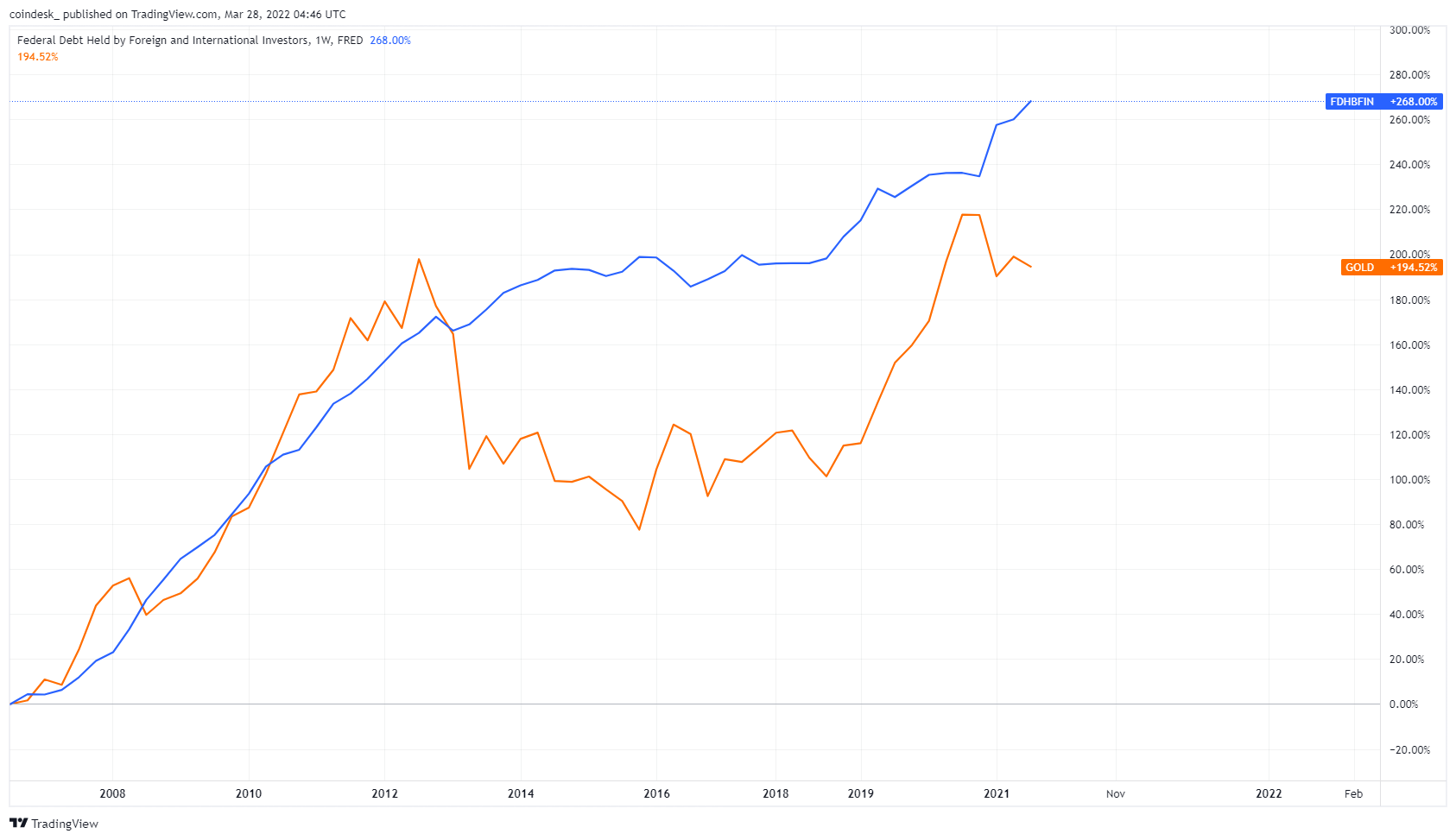

Data shows that since 2008, federal debt held by foreign and international investors has outpaced the price of gold. While there was a slowdown during the mid-2010s, it climbed back up as the decade came to a close and skyrocketed during Covid.

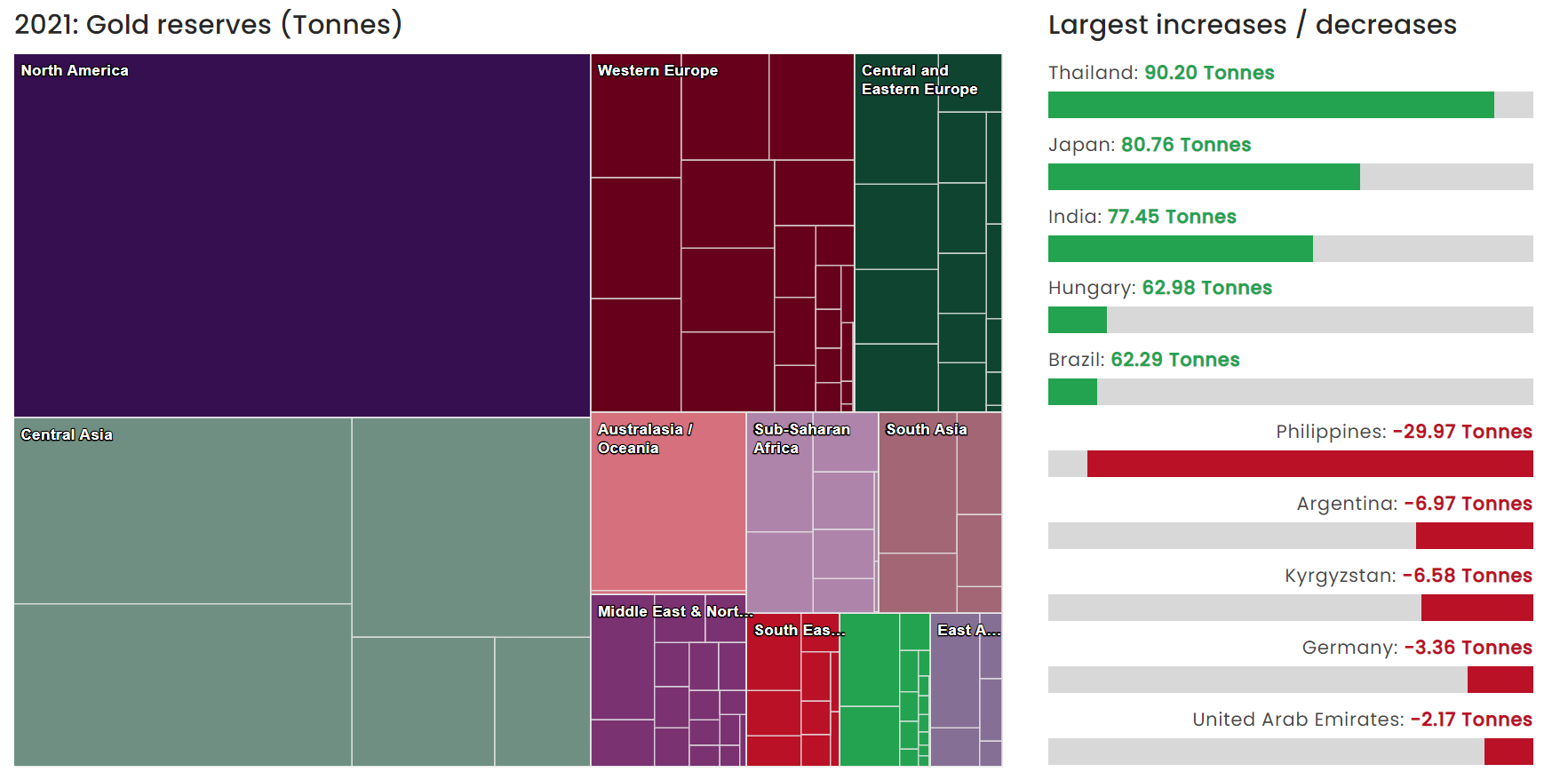

It’s not to say that many countries did not have an interest in gold. Far from it, many states hit hard by COVID-19 lined their balance sheets with the precious metal. Thailand, Japan and India all had double-digit increases of their gold holdings throughout 2021.

El Salvador’s leadership claimed the bitcoin bond would provide the country a new way to finance debt that wasn’t tied to the International Monetary Fund and dollars. It would also be an asset that grows in value on the balance sheet, allowing for ambitious projects like a city powered by a volcano’s geothermal power. All this is possible, provided that bitcoin hits $1 million within the next five years.

And there’s one more caveat. The bond itself will not be issued by the El Salvadorian government, but by LaGeo, a subsidiary of the state-owned electricity company CEL. El Salvador says this is only a technicality; it’s still a debt of the sovereign.

With all the complications involved and bitcoin’s fragile price, this has been a terrible sales pitch for other nations. The reality is, data suggests nations don't really want anything aside from what they already have: low-yielding but safe Treasury bills, and some gold. Even China, which always threatens to dump its holdings, keeps a healthy supply on the books despite trimming the count.

Nayib Bukele’s plan to create an alternative to state-level financing, bypassing the IMF via bitcoin, isn’t without its merits. The IMF has long been criticized as a global loan shark and a lender of last resort. If the plan works, Bukele gets financing at a rate preferential to the IMF. Bitcoin-washing debt, like the green washing of the past, might be the hip new thing for developing countries if there really is $500 million in commitments already lined up.

But states are conservative creatures. Especially in Asia, where bureaucracies can be slow-moving, and the memory of the Asian financial crisis is still fresh. Despite the dollar doomers and those that think America is on the verge of shattering into 50 pieces, Treasury bills are still in demand – and not even gold can usurp it. Good luck to bitcoin.

Technician's take

Bitcoin Breaks Above $46K, Resistance at $48K-$51K

Bitcoin daily price chart shows support/resistance (Damanick Dantes/CoinDesk, TradingView)

Bitcoin (BTC) buying activity accelerated over the weekend as momentum signals turned positive.

The cryptocurrency broke above initial resistance at $46,000, although stronger resistance at the 200-day moving average, which is now at $48,289, could stall the relief rally.

The relative strength index (RSI) on the daily chart is approaching overbought territory, similar to what occurred in October, which preceded a sell-off. This time, however, buyers appear to be targeting a 50% reversal of the four-month-long downtrend, which would yield additional upside toward $50,966.

Momentum signals on the weekly chart have significantly improved, which was previously seen at around the July low of $29,400. Still, momentum remains negative on the monthly chart, which could delay a significant price rally in the short term.

Important events

8:30 a.m. HKT/SGT(12:30 a.m. UTC): Australia retail sales (Feb. MoM)

2:45 p.m. HKT/SGT(6:45 a.m. UTC): France consumer confidence (March)

4:30 p.m. HKT/SGT(8:30 a.m. UTC): U.K. M4 money supply (Feb. MoM/YoY)

9 p.m. HKT/SGT (1 p.m. UTC): Speech by New York Federal Reserve President John Williams