PAMM is an abbreviation for Percentage Allocation Management Module, which is a percentage distribution management mechanism between investors and money managers. To put it simply, investors and money managers put their money into a pool and they both agree in advance on a mutually beneficial profit distribution method. The percentages of profit distribution may vary depending on various factors, such as the initial capital invested, term of investing, chosen account types, and more. Then, the money managers will be trading those funds actively to generate profits for a monthly or fortnightly profit sharing.

PAMM accounts often involve three main parties:

(1) a forex broker which provides the trading platform

(2) money managers (also known as traders) who would be actively trading the pool of funds

(3) investors that deposit the funds

Supposedly there are three investors, Brandon, Brad, and Tom, who are interested in Forex trading, but they either do not have the time or have little trading expertise to be consistently profitable. One day, they have the chance to meet 2 specialized money managers, Marcus and Mathew, who are actively managing clients' funds along with their own capital and they are trading with ABC Forex Broker. These three investors in question signed a relatively limited power of attorney with Marcus and Matthew. The most important elements of the contract included the investor's handing over of funds to the chosen money manager, allowing such money manager to apply the combined funds following his trading strategies, and ensuring that the relative risk level of the forex trading transactions was clearly understood. The contract also requires the money manager to show the percentage of profit deducted for this service. Then, these 3 investors are also required to open their accounts with ABC Forex Broker to start using the PAMM services.

How does a Forex investor select a PAMM money manager?

Traders can choose a PAMM money manager based on a variety of methods. Usually, the broker that offers this service will present to the investors some information to have a better understanding of a specific money manager, including a detailed biography, credentials, past trading performance, the amount of funds under management, the total number of investors they have worked with, any positive and negative reviews. There are also many outside traders

Investors:

In general, investors can only select forex trading properties presented by the money manager. If the money manager only offers gold trading, investors are unable to make him switch to trading GBP/JPY. Investors risk losing money due to the trading activities of the money manager, but they also profit as long as the chosen money manager can perform optimally.

Money managers:

They can only use the funds that are put in the pool as per agreement with the participating investor. However, they cannot manipulate other funds which belong to the investor's individual trading account. For example, Brandon has $9,000 in his account, but he assigns only $4,000 to Marcus for trading, then the other $5,000 in the account is not available for Marcus' access by any means.

In short, PAMM is a simple one-stop trading service program. Under this type of account, investors can get a profit without investing too much money. However, PAMM accounts also have the risk of losing money, which depends on the trading expertise and strategy of the money manager.

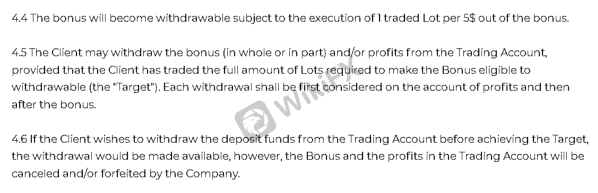

In some cases, there are also fraudulent forex brokers that use PAMM as fake advertising to attract their victims. When the pool of funds gets big enough to feed their greed, they stop or delay clients' withdrawals, and disappear with the funds. This is similar to the collapse of a Ponzi scheme. Therefore, investors must conduct thorough research on the forex broker before engaging in any PAMM services.

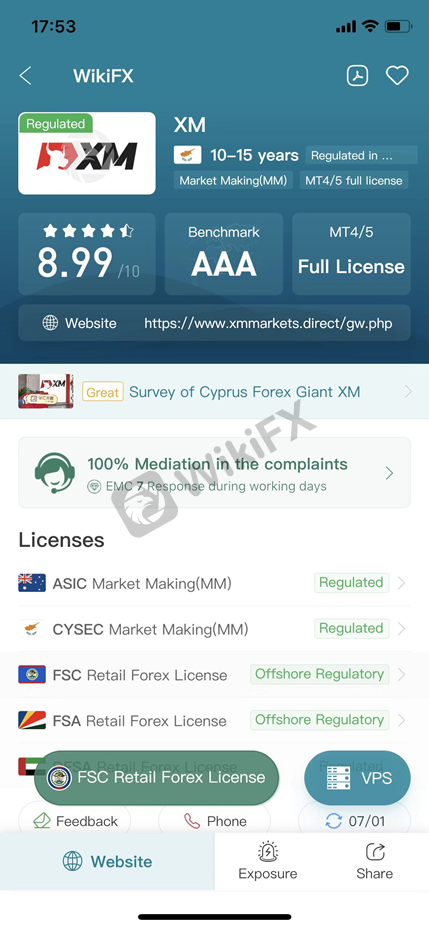

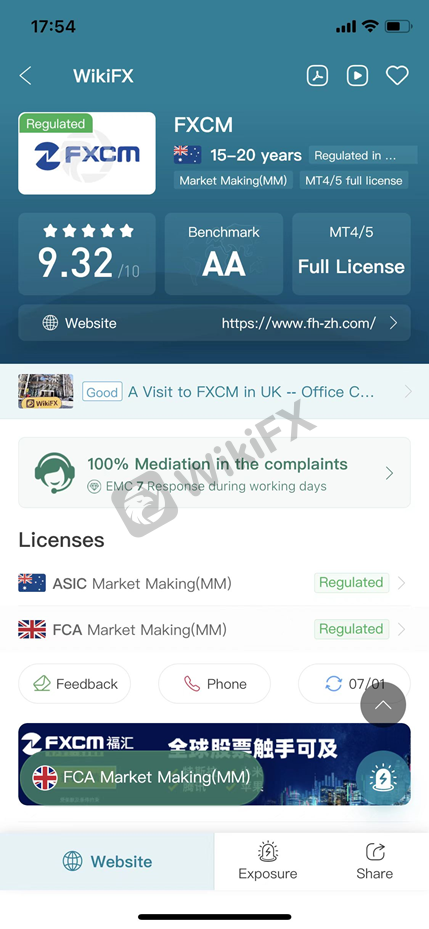

To do this, all you need to do is download the free WikiFX app and type the name of the forex broker in question into the search bar. It is important to look at that broker's WikiFX score and benchmark rating, as well as its regulatory status, licenses held, and Exposure pieces.