MARKET TONE

Currency market volatility jumped to its highest levels since the pandemic following the Russian invasion of Ukraine in late February. Indeed, volatility across all major asset classes rose significantly as market participants pondered how war on the European Union‘s eastern fringes, and the response from Europe, the US and other allies to it, would impact the global economy. Europe’s reliance on Russian energy, Russia and Ukraine‘s status as major suppliers of wheat, metals and other key raw materials as well as the sanctions unveiled in response to the Russian invasion were all factors in the market’s initial reaction to the conflict. Tentative signs of de-escalation have emerged recently, which may or may not be related to the fact that Russia has clearly failed to achieve its objective of a swift submission and now needs to pivot. This may allow some of the more over-extended moves in currency and commodity markets to moderate or correct but we doubt there will be a rapid return to normalcy. The longer run implications of the war remain to be determined. But we can certainly imagine that issues such as energy insecurity and broader supply chain disruptions, the potential for renewed “Cold War”-like relations between the West and Russia and a realignment of global strategic relationships are factors investors will have to consider moving forward. We have adjusted some of our forecasts on account of the more abrupt moves seen in the market over the past month or so but our broader thesis of continued USD strength remains intact.

Indeed, to a certain extent, the war in Ukraine amplified some of the key market trends—rising commodity prices, higher interest rates and a broadly firmer US dollar (USD)—that were developing prior to the outbreak of hostilities. But the jump in raw materials prices and energy especially has fueled concerns that inflationary pressures are poised to extend and persist while central bank policymakers have waited too long to react. US interest rates surged higher in March and the yield curve flattened around the widely expected Fed policy lift off. Comments from Fed officials following last month‘s decision to lift the Fed Funds Target Rate 25 bps have reflected more urgency regarding the need to tighten in the coming months. Markets are already pricing in a strong chance of 50 bps hikes at the May and June FOMC decisions and around 125 bps of additional tightening over the balance of the year. Scotia’s hawkish Fed outlook outlined a just a few weeks ago has become consensus. Although significantly tighter Fed policy is largely priced into the short end of the yield curve, we think aggressive Fed tightening moves in the coming weeks and months will keep the USD well-supported generally.

We remain bullish on the outlook for the Canadian dollar (CAD), however. Price action around the early stages of the Ukraine war was CAD-negative despite surging metals, agricultural and energy prices, which boosted Canada‘s terms of trade. The CAD failed to benefit in a similar manner to other commodity currencies, such as the Australian (AUD) and New Zealand (NZD) dollars. Rather, higher market volatility weighed on the CAD’s performance. The CAD has improved more recently but still needs to “catch up” to some extent to strengthening terms of trade, we believe. Also, swaps pricing reflects the view that the Bank of Canada‘s willingness to be “forceful” on additional interest rate hikes after lifting the Overnight Target Rate 25 bps at the start of March bolsters the risk of a 50 bps hike this month. The economy is strong, tracking growth in excess of 5% in Q1, the labour market is tight and inflation is, in policymakers’ own words, “too high”. We expect the CAD to nudge back towards the 1.20 area later this year, with the help of rising rates and firm commodity prices.

For the other major currencies, we expect FX performance in Q2 will be broadly shaped by “haves” and “have nots”. Those currencies that have yield support from active central bank policy making (the USD, CAD) should outperform those where central bank rate hikes are likely to remain more limited. Sterling (GBP) appears somewhat at risk from “overpriced” market expectations about how far the Bank of England can tighten rates in the coming months. The euro (EUR) is clearly prone to disappointing economic outcomes—and only very cautious European Central Bank (ECB) rate hikes at best. The Bank of Japans (BoJ) decision to buy unlimited amounts of 10Y bonds to cap domestic yields last month underscored the clear divergence between monetary prospects at home and abroad; the yen (JPY) fell sharply and is likely to remain relatively weak in the months ahead. The “haves” and “have nots” issue also relates to resources. Currencies of commodity producers and exporters which are benefiting from positive terms of trade effects from rising raw material prices should outperform the currencies of commodity importers where negative terms of trade effects will tend to amplify stagflationary conditions. Among the majors, this should mean strength for the AUD, CAD and NZD versus the EUR and JPY.

Pacific Alliance currencies have emerged from the recent volatility with mixed performances despite strong growth and rising interest rates across the region. Tighter monetary policy and firmer energy prices are supporting the Mexican (MXN) and Colombian (COP) pesos, with the latter the best performing emerging market currency alongside the Brazilian real (BRL) since the Ukraine invasion despite uncertainty surrounding the outcome of the presidential election at the end of May. The Peruvian sol (PEN) is well-supported near its best levels against the USD since last May as rising local rates and firm copper prices provide support although S&Ps ratings downgrade may curb PEN gains. The Chilean peso (CLP) is only marginally higher since the outbreak of hostilities but the broader downtrend in USDCLP since the late 2021 peak remains intact. Robust growth, the prospect of more rate hikes and elevated commodity prices suggest scope for gradual CLP gains in the short run but recession concerns are starting to build on the horizon.

Asian currencies have been generally soft since the start of the conflict in Ukraine as JPY weakness has spilled across the broader regional FX complex. COVID-19 lockdowns and rising commodity prices are weighing on Chinese growth prospects which is a restraint on the Chinese yuan (CNY) and represents another headwind for regional currencies.

Scotiabank Economics forecasts a 50 bps hike by the FOMC on May 4th. Our present forecast anticipates ending 2022 at a policy rate of 2.25% with a terminal rate in 2023 at or slightly above the FOMCs estimated 2½% neutral policy rate.

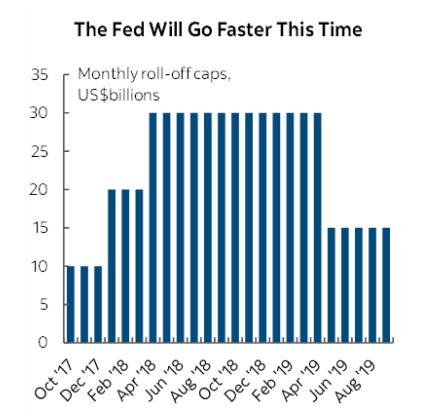

We also anticipate a more aggressive pace of unwinding the SOMA portfolio of holdings of Treasuries, MBS, TIPS and t-bills. This may have a significant impact upon longer-maturity yields. The pace of roll-off that the Fed pursued from late 2017 to September 2019 is shown in the accompanying chart. This time is expected to increase the prior starting pace of $10 billion per month by multiple orders of magnitude. This is because the SOMA portfolio is entering the QT phase more than twice as large as in 2017 and because of the very different inflation context and the different nature of the pandemic shock.

Key will be the rate equivalence effect of how the Fed manages roll-off. Over about the first year of the prior QT period the yield on US 10-year Treasuries initially climbed by well over 100 bps while the estimated 10-year term premium held little changed before the yield began its descent along with the term premium into 2019. Chair Powell thinks this time the rate equivalence to shrinking the balance sheet may be like another quarter-point equivalence to hiking the Fed funds target rate which is less than former Chair Yellen had estimated in her communications at the time. It may also be less than reality if the FOMC really goes aggressively toward shrinking the balance sheet.

BANK OF CANADA—FIFTY AND ZERO

Scotiabank Economics led consensus in calling for a 50 bps hike on April 13th accompanied by ending reinvestment of maturing Government of Canada bond holdings with no roll-off caps. This probably wont be the last of the fifty moves on the front-loaded path to what we forecast will be a terminal rate overshoot of the estimated 2¼% nominal neutral policy rate that is reflective of where the policy rate should rest in the Canadian economy if it were at full equilibrium. The BoC lost the flexibility to pursue more gradual and measured adjustments by reacting too late to rising inflation.

We don‘t expect policy rate adjustments to be accompanied by much rate equivalence derived from the pace at which the Bank of Canada’s balance sheet is expected to contract independent of other factors. In theory, providing more net supply of bonds on the open market may be expected to lower their price and raise their expected yield, but the forces dominating Canadas bond market overwhelm this tendency. In fact, Bank of Canada research has estimated that the announcement effect of the purchase program way back in March 2020 was a minor -10bps on the 10-year yield and that the flow effect of recurring purchases since then was even smaller and disappeared within a few trading days. Furthermore, Canadian yields relative to the US did not materially budge over the period during which the BoC was shutting down its purchase program while the Federal Reserve kept buying by the truckload.