Stock markets across Europe are firmer this morning with the major bourses notching +1% gains in early trade following a solid session in Asia and a third straight positive day for Wall Street. Autos, energy and tech are the leaders on the Stoxx 600. The dollar is taking a breather, pulling back slightly from its 20-year highs; oil is firmer, while gold remains on the defensive but off yesterday’s lows as Treasury yields rise. Boris clings on but the resignations keep on coming and even that great political heavyweight and giant intellect (!) Zahawi has called for him to go only two days after being made chancellor. It’s over for sure.

FOMC minutes were clear and unambiguous: the Fed will do whatever it takes to tame inflation. Ninety times was ‘inflation’ mentioned in the minutes, while mentions of ‘recession’ struck out at zero. The University of Michigan survey (consumer sentiment and inflation expectations) came up three times. But the starkest message was that policymakers recognised that “an even more restrictive stance could be appropriate if elevated inflation pressures were to persist”. Participants judged that an increase of 50 or 75 basis points would likely be appropriate at the next meeting this month.

The Fed is getting worried – many policymakers warned that “elevated inflation could become entrenched if the public began to question the resolve of the Committee to adjust the stance of policy as warranted” A clear message here for the ECB: “On this matter, participants stressed that appropriate firming of monetary policy, together with clear and effective communications, would be essential in restoring price stability.” ECB meeting minutes are due later but really it’s getting too late for Lagarde and co to salvage this as the euro heads to parity with the dollar, further entrenching and importing inflation…time for an emergency inter-meeting hike and new communication. It feels like the ECB is waiting for the recession to kill demand rather than getting a handle on inflation, it has become supine and totally ineffective.

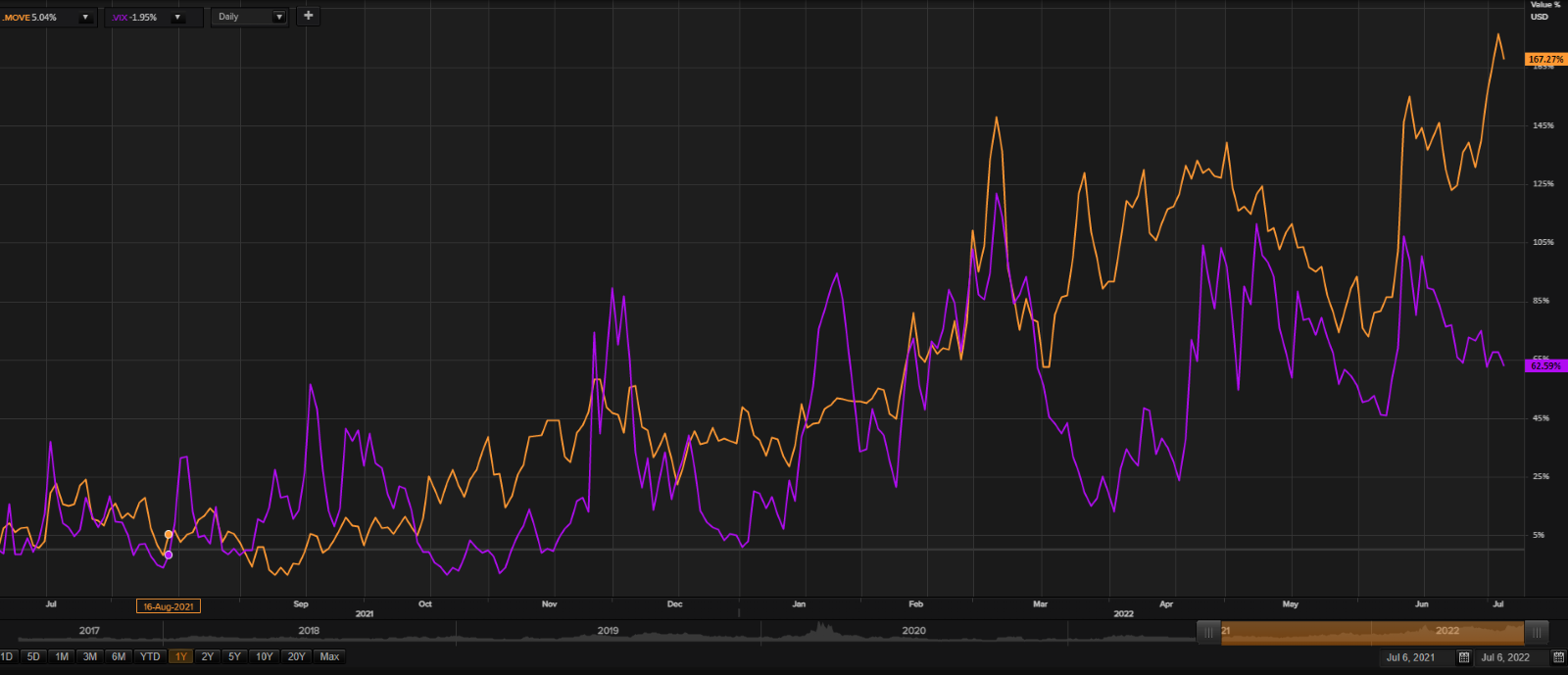

US 10yr yields are firmer, back to around 2.95% this morning, but the 2s10s curve remains inverted with the 2yr Treasury yield a whisker under 3%. Yesterday the 30yr dipped below 3% for the first time since May. Bond volatility is extremely elevated whilst the stock market’s gauge of volatility, the VIX, has been resolutely anchored under 30. SO what gives? Well probably the VIX, as the bond market leads the stock market. The stock market does not lead the bond market….still waiting for that blow up in the Vix to signal the bottom but it’s not coming soon as positioning is not there…still a way to go before the bottom is found but for now bears are at risk of short, sharp rallies.

Sterling made a new 2-year low versus the dollar yesterday but has pulled off its lows at 1.1875 back to around 1.1950 this morning. Markets have not been massively perturbed by the political machinations – there is not a deep political risk here to UK assets. But I would stress that the outcome from the moves to oust Johnson mean tax cuts are more likely, whoever is in Number 10 at the end of the month. Looser fiscal policy are the likely result of political pressures – the ‘cost of living crisis’ looms large – which would only makes it harder to tame inflation; all of which is likely weighing on the pound. Options markets indicated traders are increasingly positioned for further losses. Three’s a crowd in any marriage: weak politics, weak economy and weak central banks make for unhappy bedfellows that engender higher-for-longer inflation…Britzuela. For Boris is clinging on to whatever power he has left.

More on that Citi oil call: "In a recession scenario, we would see oil prices falling to $65/bbl by year end and potentially to $45/bbl by end-2023, absent intervention by OPEC+ and a decline in short-cycle oil investment" After dipping to $95 yesterday, its weakest since mid-April, front month WTI rose above $99 this morning. There is something unusual about the recent move in oil – more like a book blowing up than fundamentals reasserting themselves. Backwardation is now steeper in the futures market, which usually indicates tighter supply.