- Tesla reported better than expected earnings on Wednesday.

- TSLA stock rose sharply as Bitcoin was sold to beat EPS.

- Revenue was in line for Tesla, but this led to a relief rally.

Tesla (TSLA) stock rallied sharply on Thursday as earnings after the close on Wednesday sparked a relief rally with the market growing more certain that the automaker can continue to deliver on its strong growth metrics.

Tesla stock news

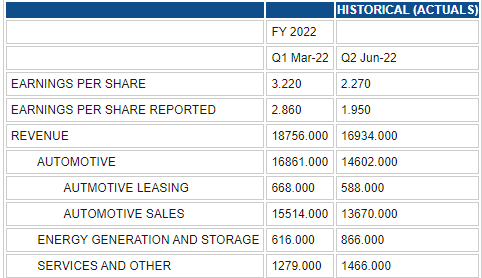

Earnings per share (EPS) beat estimates at $2.27 versus the $1.80 expected. However, a lot of this beat can be attributed to Tesla selling a large portion of its holding in Bitcoin. Revenues were strong, albeit growth is slowing. With concerns over the effects in China from both a factory shutdown at Giga Shanghai and lowered demand, the overall revenue figures came as something of a relief to investors who had been bracing for worse than expected numbers.

Tesla stock forecast

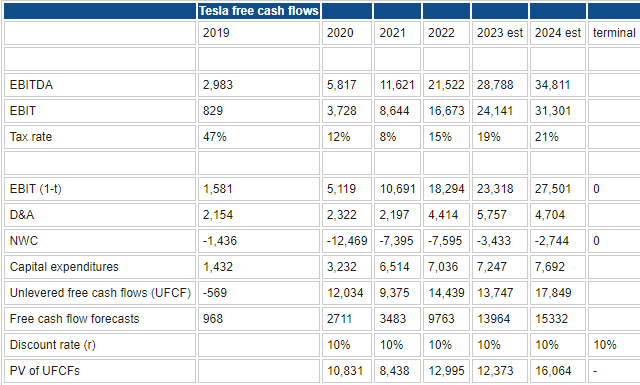

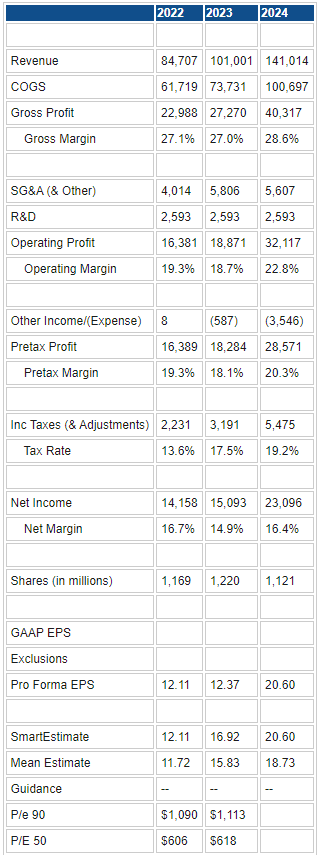

We have updated our models and our 13-month price target to $508 based on this better-than-expected number. Also of reassurance to us was the maintained guidance for deliveries for the remainder of 2022. We outline below our amended DCF (discounted cash flow) valuation with our $508 price target. This reflects slightly higher revenues flowing through.

Source: Refinitiv and FXStreet calculations

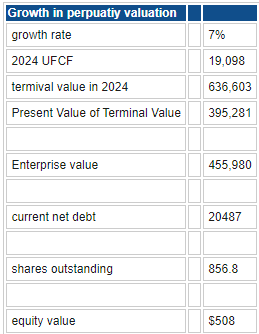

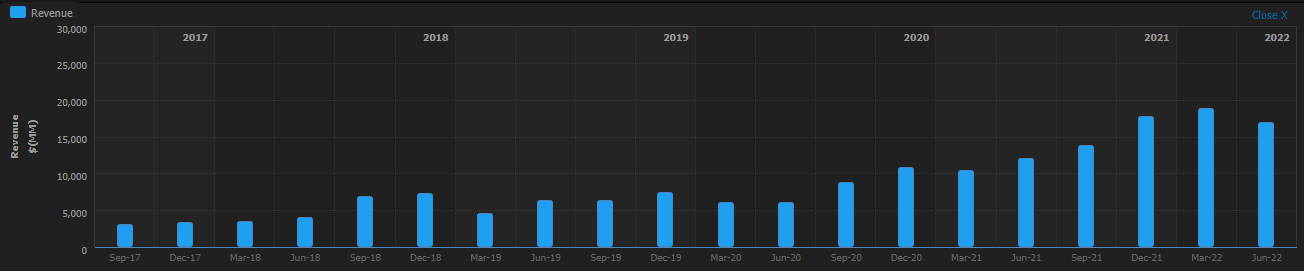

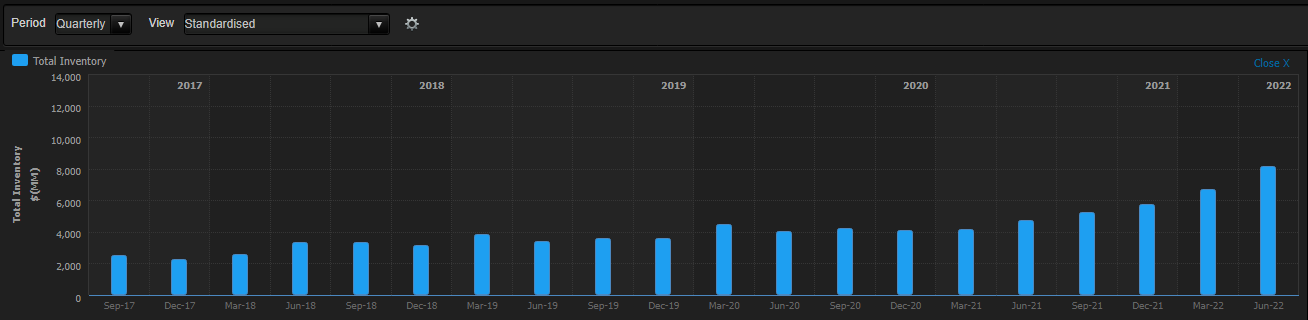

However, we note below the first quarter of lowered revenue, so this is an area of concern going forward with net income also posting its first quarterly decline.

Source: Refinitiv

Source: Refinitiv

Our comparative valuation remains bullish, and we have tweaked our numbers here too resulting in a more bullish estimate. We believe this estimate is too high based on Tesla having a very high P/E rating of 90. We are forecasting this to lower to nearer 50 as equities remain in a bear market and the US enters a recession. Historically, P/E ratios decline by about 25% in a recession, the higher P/Es usually tend to see the greatest reduction. Also once companies move from a high growth phase to a more moderate growth level, P/E ratios decline. As we can see above, revenue growth is already slowing. Also of note and perhaps overlooked by many is a large portion of revenue growth has come from areas other than EV sales. Energy generation and storage increased, while automotive revenue actually declined from $16,861 to $14,602 quarter on quarter.

Source: Refinitiv

Overall, this makes us move our price target from $400 to $550 for the next 12-month period.

Technically, Tesla's (TSLA) stock has broken out of its recent range, and a move higher toward the next resistance at $975 cannot be ruled out. The long-term term bearish trend remains in place. $620 is the key support level to watch. Tesla remains below its 200-day moving average and so remains in a longer-term downtrend. We do not see this changing despite recent impressive results. The impact of an impending US and perhaps global recession will see multiples move lower despite Tesla likely outperforming on deliveries as EV adoption speeds up.

Tesla (TSLA) chart, daily