We may be familiar with the notion of buying art to both decorate our homes and use the unique pieces as a store of value, but according to Australian Bitcoin multimillionaire Daniel Maegaard, we’ll soon be “displaying digital art, in digital apartments, wearing digital clothing which we’ve purchased from Gucci.” Could digital art really change the world? Or is it simply a passing fad?

According to Maegaard, NFTs (non-fungible tokens) are the future of money. This can seem a little strange to people who operate outside of the complex world of blockchain technology and cryptocurrencies, but the fever surrounding NFTs has gathered plenty of momentum over the course of 2021.

In March, Superchief gallery opened a New York space that’s been recognised by some as the world’s first physical NFT gallery. The gallery displays the work of 300 artists on high-resolution screens in accordance with NFT drops online.

At the same time, Atlanta’s ABV gallery launched a collaboration with the NFT marketplace Nifty Gateway and Outfront Media to present Chain Reaction, an event showcasing the world of crypto artists of 20 digital displays within the gallery and on public displays across Atlanta and Boston.

NFTs have also been listed for auction, with a piece by crypto artist Beeple called Everydays: The First 5000 Days selling at Christie’s auction house for an eye-watering $69.3 million. The price of the digital piece makes it approximately $3 million more expensive than Vincent Van Gogh’s L'Allee des Alyscamps, which sold for $66.3 million in 2015.

Such significant prices mean you could be forgiven for believing that the NFT market is in a bubble ready to burst. After all, how could a work of art that owners are unable to touch become so sought after? The answer is that NFTs find practical applications where traditional art can’t possibly operate.

What are NFTs?

Before we look into the longevity of the NFT craze, let’s first define what they are. An NFT is the digital certification of ownership of a work of art and other collectibles. This form of ownership is similar to what we take on when we buy a house, as title deeds denote ownership of a specific property.

The term ‘fungible’ means identical. In this sense that the NFT somebody buys is unique in a way that’s different to other assets like stocks or bank notes. An NFT signifies ownership of the artist’s authorship of a specific work, carrying an encryption of their signature based on a smart contract that can even include royalty payments whenever the work is traded.

Here, it’s probably worth signifying that art and NFTs are wildly different. Digital artworks are generated, or ‘minted’, on a marketplace like MakersPlace or SuperRare and an NFT is issued. While the artworks are traded on the marketplace, their NFTs are created on a blockchain which is usually Ethereum-based.

This means that the artwork itself is free. This means that in the case of Everydays: The First 5000 Days, in which the artist combines thousands of digital pictures taken over the space of 13 and a half years, anybody can download the art from MakersPlace in the same way that the NFT owner downloads it.

“This is a very unusual paradigm for people to understand,” explains Robert Norton, founder and CEO of Verisart, a company that provides blockchain certification for physical and digital art. “The experience of owning the artwork and not owning it are interchangeable. The value is in the smart contract – the owner can sell and the viewer can’t.”

The Lure of the NFT

Some believe that NFTs will help to transform the arts as we know it. They can act as a form of digital transformation that didn’t seem possible just a decade ago. For instance, we can take a look at trading cards in sports or Pokemon. Just as paper money is being retired in favour of a cashless society, NFTs are already working to replace card-based collectibles. After all, what’s the point in carrying playing cards when you can open an app to see your entire interactive collection on your smartphone?

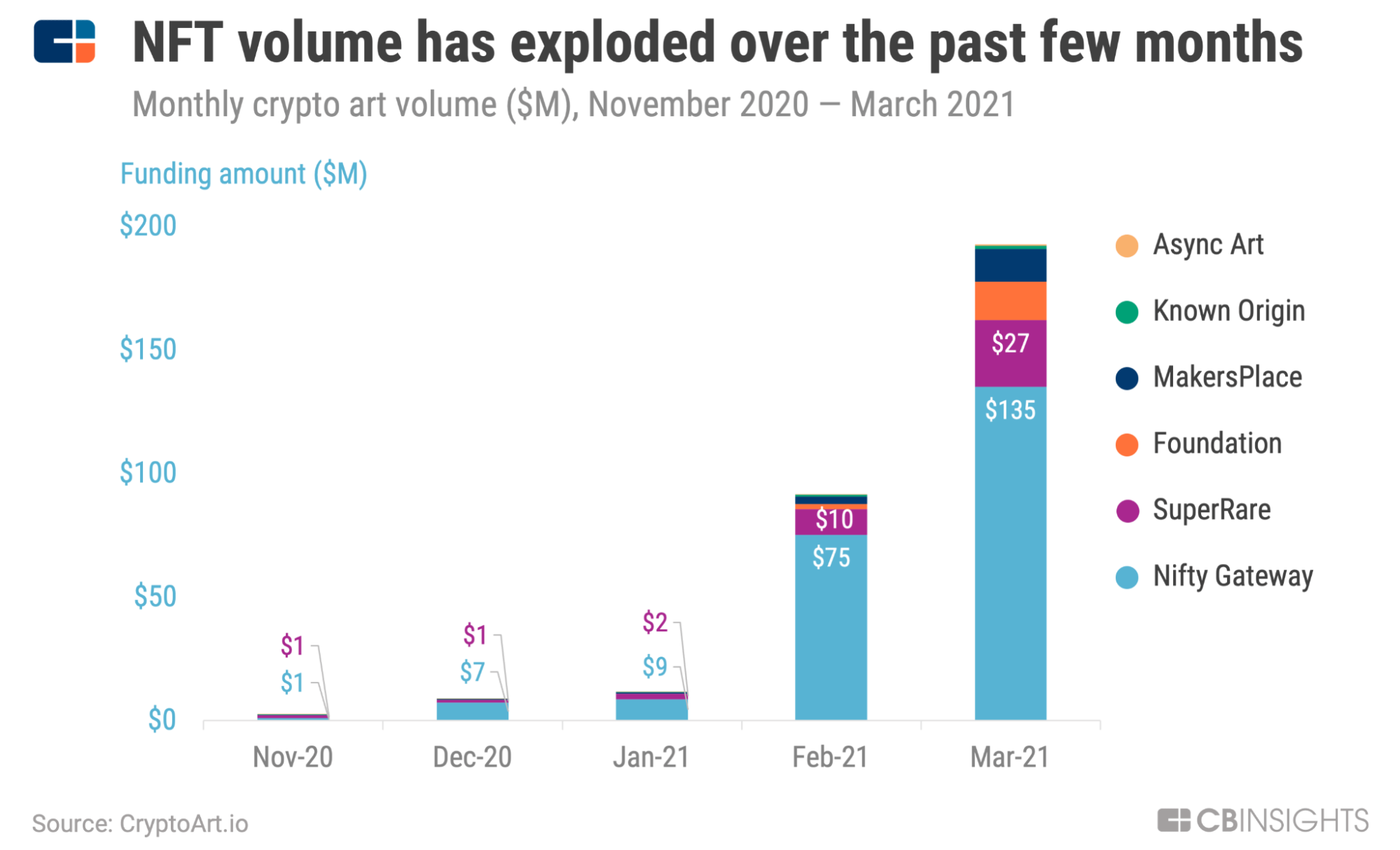

(Image: CB Insights)

As CB Insights data shows, NFT volume over Q1 of 2021 exploded to $200 million in funding per month – a seismic increase on the $2 million recorded in November 2020.

The appeal of non-fungible tokens stretches to other areas of life. For instance, if we can possess immutable ownership of digital art, why can’t we send things like passports paperless? Blockchains issued by governments could securely verify our identification just like Apple Pay securely facilitates payments from our banks.

Although it’s worth taking into account the fact that NFT’s reliance on cryptocurrencies means that the industry is likely to only grow as each platform’s native coin grows. As Maxim Manturov, head of investment research at Freedom Finance Europe, highlights, this may run into problems. “The crypto market lacks stability and can start being regulated any time, which actually already happened in China. In June, the Chinese government banned banks and payment systems from using Bitcoin, which led to a temporary collapse of the flagship crypto's price.”

Further regulation may negatively impact the growth of the NFT market and cause some collectible digital artworks to depreciate quickly.

Collectibles With a Purpose

Perhaps most significantly of all is the fact that digital art can potentially be more purposeful than their physical counterparts. One argument against NFT artwork and collectibles is that owners miss out on physically holding their assets, but being digital opens the door to many more potential use cases.

For instance, let’s take a look at Sorare, an Ethereum-based fantasy football game. The game releases NFTs that are similar to the physical sports cards that we’re familiar with. There are rookie cards for younger players and varying levels of rarity to collect. However, these NFTs aren’t just for show.

Each card can be assorted into teams that score points based on each player’s real-life performances, which can result in crypto prizes and free cards. So sought after are the elite players within the Sorare ecosystem that a ‘unique’ edition Cristiano Ronaldo card recently sold for $290,000 in an auction.

There’s even talk of Sorare integrating with video game developers to add an extra layer of usability for its NFTs and it’s not the only example of a practical game using NFT collectibles.

While the concept of an NFT work of digital art hanging in your house may seem a little alien, non-fungible tokens have the potential to change the way we understand and interact with art. With so many possibilities for the industry, it’s fair to say that although the future of NFTs may be difficult to predict, it seems certain that they’ll continue to grow in some form or another.