- Uniswap price maintains support in the $15 – $16 value area.

- Price action suggests a drop is incoming, but the oscillators hint at a move higher.

- Opportunities exist for bulls and bears.

Uniswap price action has remained stable enough to keep a prior long setup valid – a positive event given the bearish volatility affecting most of the altcoin market. Two trade setups with strong cases for each now exist for Uniswap.

Uniswap price leans bullish despite bearish near-term price action; a return to the $24 price level is expected

Uniswap price has been disappointing for many bulls, especially those who bought last Thursday and today. From the January 7, 2022 open to the swing high found on January 16, UNI gained a respectable 22% over those seven days. Fast forward to Wednesday, Uniswap has retraced more than that entire move in under three trading days. As bearish as that price action is, it doesn’t mean bears are in total control yet. There is a case for the bulls to take over.

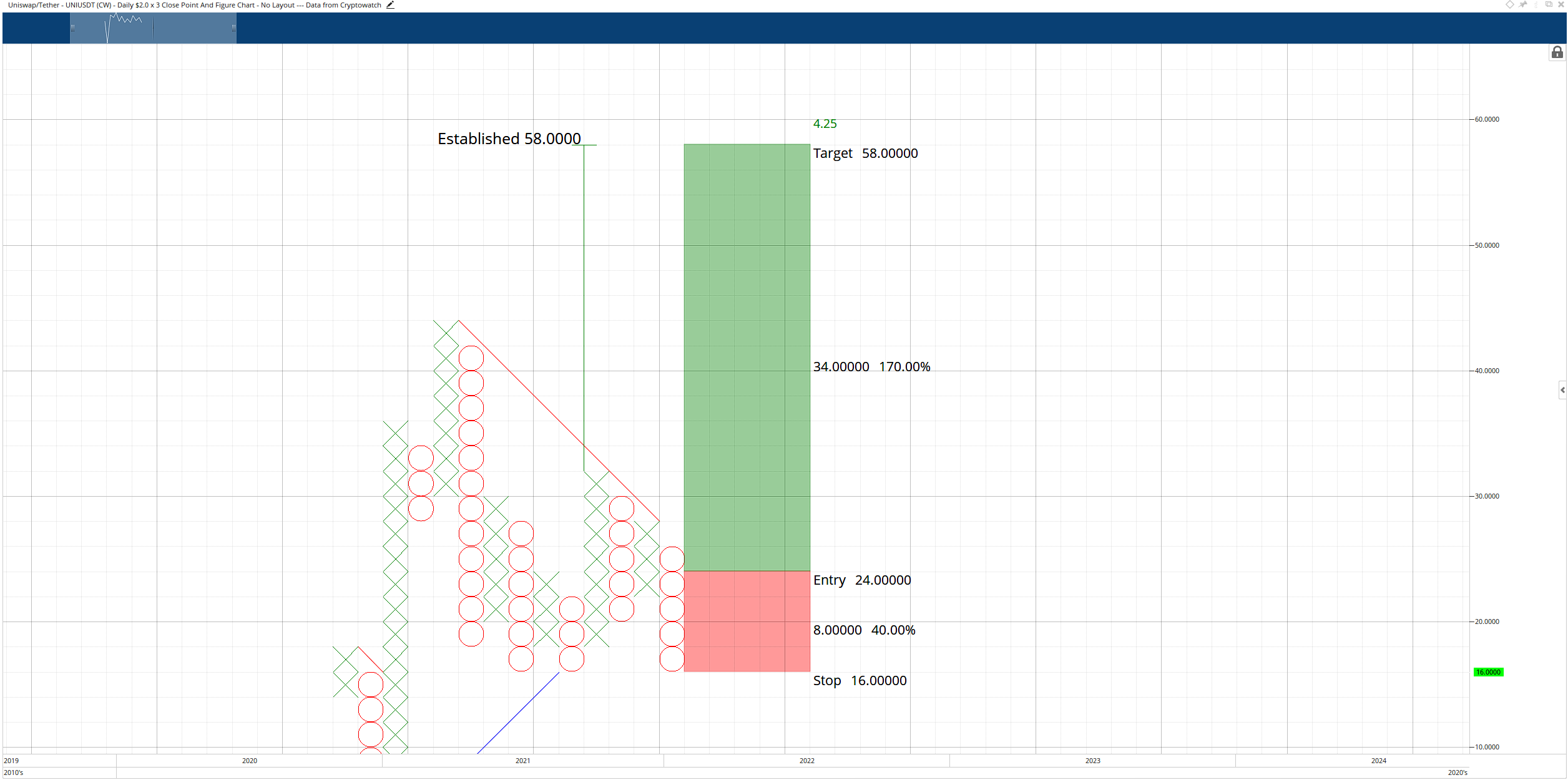

On the long side of the market, a hypothetical long entry exists with a buy stop order at $24, a stop loss at $16, and profit target at $58. This trade is based on a bearish fakeout setup that simultaneously converts the $2.00/3-box Point and Figure chart into a bull market if the entry is triggered. In addition, a two-box trailing stop would help protect any profit generated after the entry.

UNI/USD $2.00/3-box Reversal Point and Figure Chart

The hypothetical long setup is invalidated if Uniswap price drops to $14.

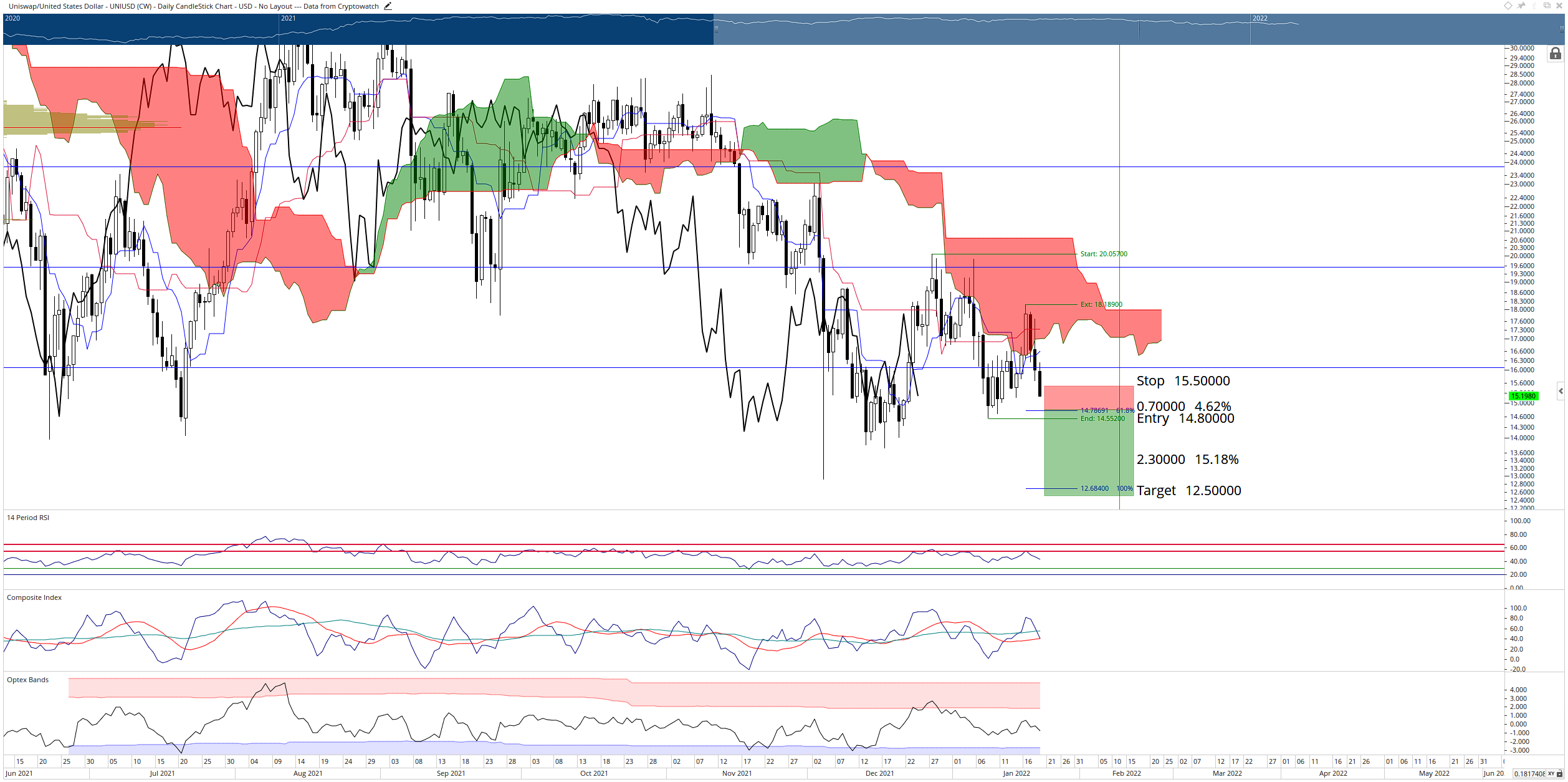

There is an entry opportunity on the short side of the market on the daily Ichimoku chart. A close at or slightly below the 61.8% Fibonacci expansion at $14.78 would position Uniswap price at the lowest close since December 19, 2021. The profit target would be slightly below the 100% Fibonacci expansion level at $12.50. The stop loss is at $15.50. The trade represents a 3.3:1 reward/risk setup with an implied profit target of 15% from the entry.

UNI/USD Daily Ichimoku Kinko Hyo Chart

However, given the current pattern structure in the Composite Index, the short setup may not occur. An inverse head-and-shoulders pattern is present on the Composite Index and could surprise many traders looking to exit longs or enter new short positions. Abrupt and sudden support may appear near the identified short idea’s entry, so sellers may want to pay close attention to how Uniswap price responds near the $14.50 to $14.75 zone.