- Uniswap price is currently retesting the 3-day demand zone, extending from $7.31 to $9.69.

- A quick recovery could push UNI to $10.31 before contemplating a directional bias.

- A breakdown of this barrier is likely to result in a 25% crash to $5.61.

Uniswap price and many altcoins have experienced a massive crash due to the drop in Bitcoin price. UNI is currently tagging a vital and wide support area that is preventing it from crashing lower for the time being.

Uniswap price contemplates directional bias

Uniswap price has dropped 26% in nearly six days after failing to move past the monthly open at $11.77. This downswing, however, has allowed UNI to retest a 3-day demand zone, ranging from $7.31 to $9.69.

This barrier is pivotal in preventing Uniswap price from crashing lower. Assuming Bitcoin price stabilizes and embarks on a quick uptrend, UNI will likely recover and make a run for the immediate resistance barrier at $10.30. This move would constitute a 20% ascent from the current position – $8.55.

UNI/USDT 4-hour chart

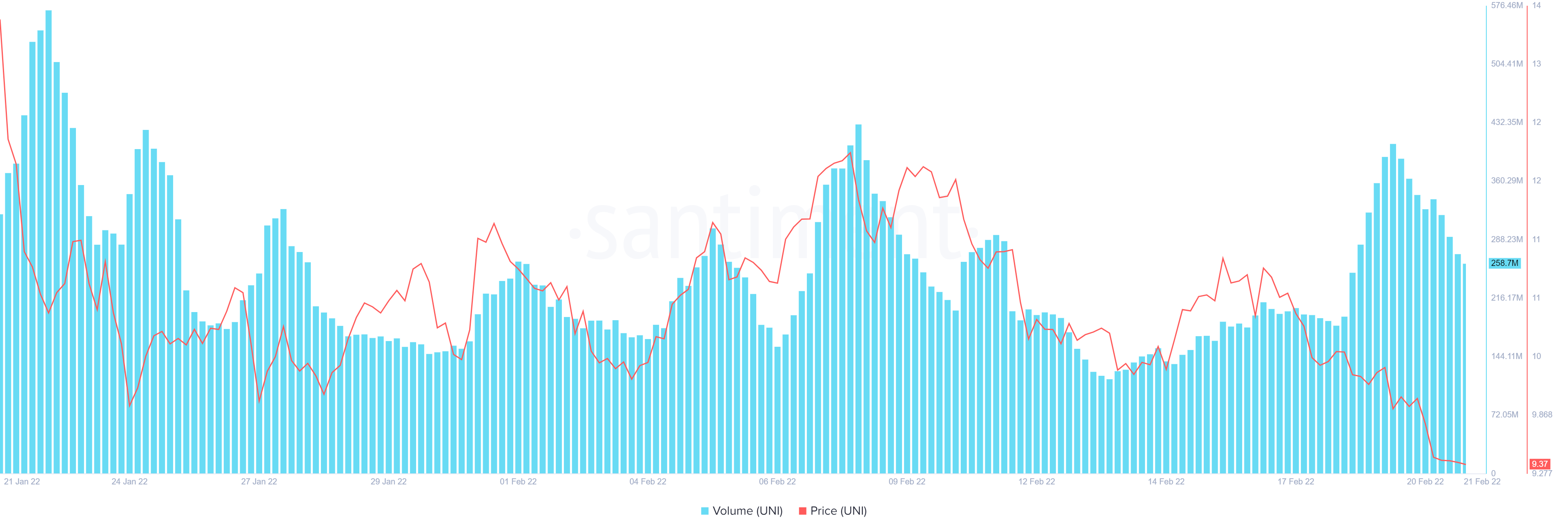

Supporting this outlook for Uniswap price is the uptick in on-chain volume since February 13 from 116.51 million to 406.25 million on February 19. Interestingly, UNI price has declined during this period, signaling a divergence and forecasting a quick run-up.

UNI on-chain volume

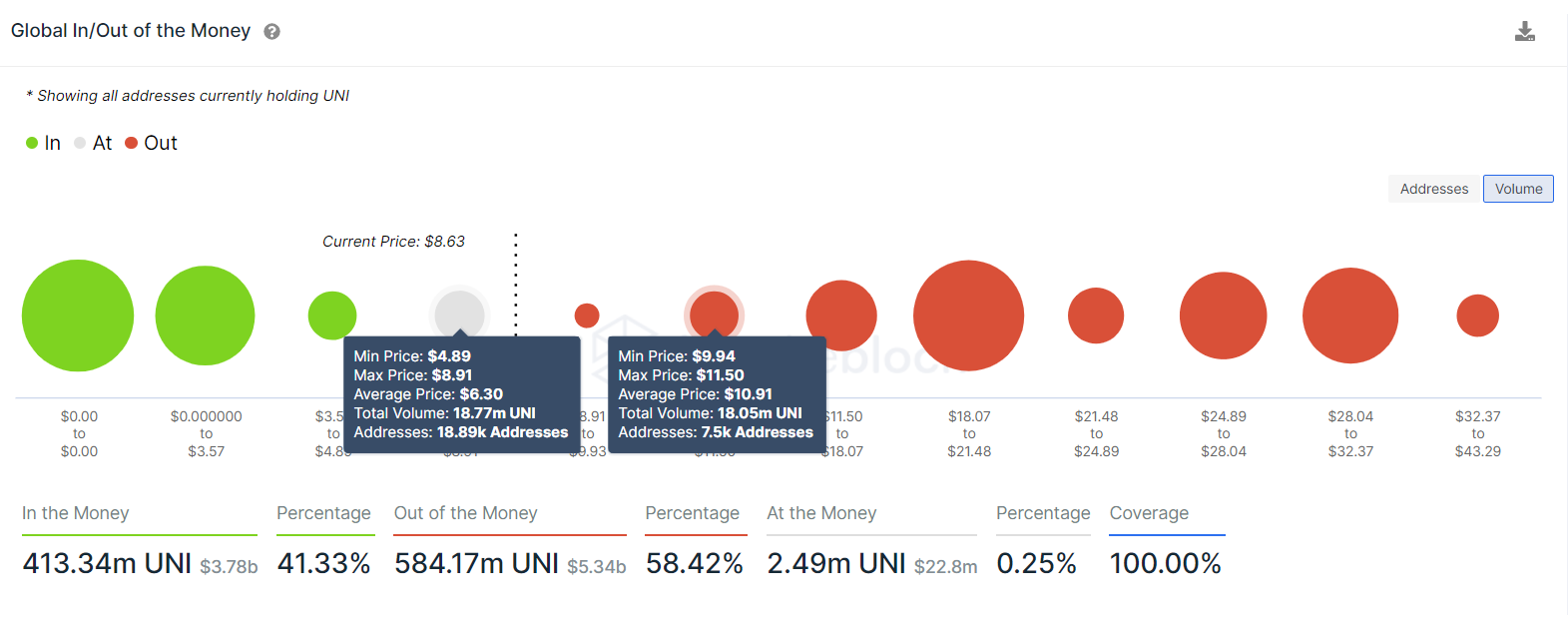

IntoTheBlock’s Global In/Out of the Money (GIOM) model further supports the move to $10.31. This on-chain index shows that the immediate support level, ranging from $4.89 to $8.91 is relatively stronger.

Interestingly, this support area overlaps with the 3-day demand zone mentioned above. Therefore, investors can expect Uniswap price to make a run for the $10.91 resistance barrier, where roughly 7,500 addresses that purchased nearly 18.05 million UNI tokens are underwater.

UNI GIOM

The technical perspective assumes that Uniswap price will see a resurgence of bullish momentum due to a recovery in Bitcoin. However, a failure to pull through due to increased sell-side pressure could see Uniswap price drop lower.

If Uniswap price produces a twelve-hour candlestick close below $7.31, it wil invalidate the bullish thesis and push UNI to the 3-day support level at $5.61.