- Axie Infinity price has an extended impulse.

- Volume indicates a bullish undertone.

- Invalidation of the bullish uptrend breach and close below $14.80.

Axie Infinity price displays reasons to believe in further momentum to the upside. Traders should approach the digital asset with relative caution, looking for one more fake-out before the rally occurs.

Axie Infinity price due for a massive recovery

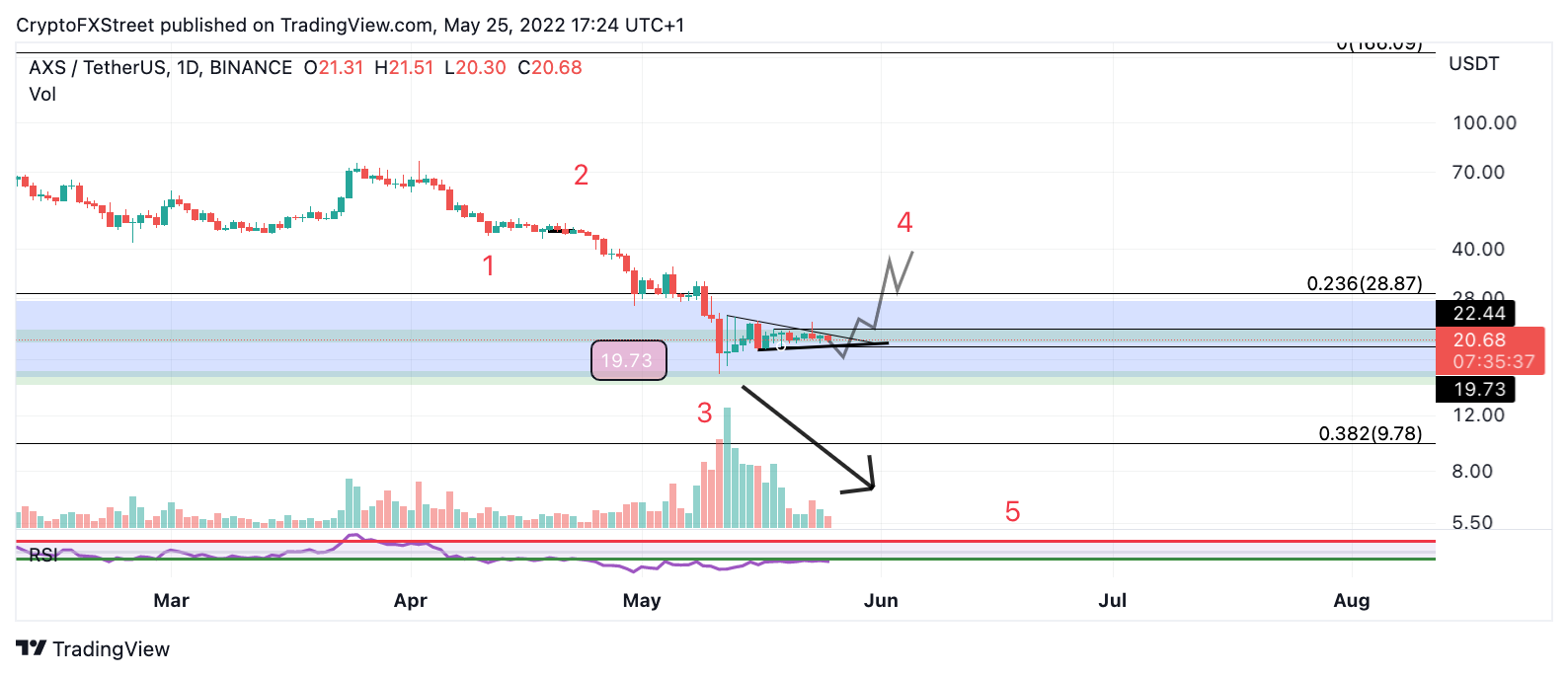

Axie Infinity price appears to be unfolding as an extended impulse wave down. The bearish downtrend has yet to retrace 50% of a bearish trend day. If AXS price follows Elliott Wave’s rule of alteration, then a deep retracement is inevitable for the popular gaming token.

Axie Infinity price also provides further bullish confluence using the volume indicator. The tapering effect can be viewed as bearish exhaustion amidst the steep decline. The AXS price could rally as high as $40 to counterbalance the steep decline. The coiling triangle pattern is likely a wave B which will induce a sharp zig-zag rally in the coming days.

AXS/USDT 1-Day Chart

Still, an invalidation is necessary for traders to maintain the right side of the trend. The bulls should not be able to close below $14.80. If a close below $14.80 were to occur, the AXS price could continue south towards $10, resulting in a 50% decrease from the current Axie Infinity price.