Eurozone Preliminary CPIs and GDP overview

Eurostat will publish the first estimate of Eurozone inflation and growth figures for April and Q1 2021 respectively at 0900 GMT on Friday.

The headline CPI is anticipated to rise to 1.6% YoY while the core inflation is seen steady at 0.9% YoY in the reported month.

On an annualized basis, the bloc’s economy is likely to shrink 2% in Q1 while inter-quarter the GDP rate is expected to contract by 0.8% vs. -0.7% prior.

Deviation impact on EUR/USD

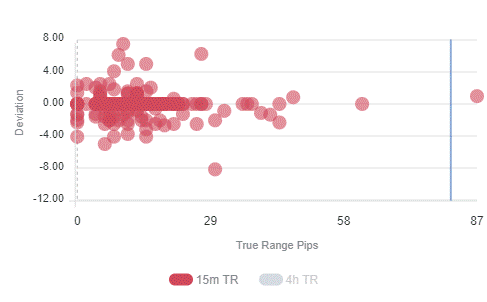

Readers can find FX Street's proprietary deviation impact map of the CPI below. As observed the reaction is likely to remain confined between 10 and 20 pips in deviations up to 3 to -4, although in some cases, if notable enough, a deviation can fuel movements of up to 30-45 pips.

How could affect EUR/USD?

Haresh Menghani, FXStreet's Analyst, notes important technical levels ahead of the key release, “from a technical perspective, acceptance above the 1.2100 mark, representing the 61.8% Fibonacci level of the 1.2345-1.1704 recent leg down, favous bullish traders. A subsequent strength beyond the overnight swing highs, around mid-1.2100s, will reaffirm the positive outlook and assist bulls to aim to reclaim the 1.2200 mark. On the flip side, sustained weakness below the 1.2100 mark might prompt some long-unwinding and drag the pair towards weekly lows, around the 1.2055 region.”

Key notes

EUR/USD nears 1.2100 on firmer US Treasury yields ahead of German, Eurozone GDP

German GDP Forecast: Is it really so bad? Low expectations open the door to EUR/USD gains

Forex Today: Dollar bounces ahead of busy end to April, eurozone GDP, US inflation data stand out

About Eurozone Preliminary CPIs and GDP estimate

The Euro Zone CPI released by Eurostat captures the changes in the price of goods and services. The CPI is a significant way to measure changes in purchasing trends and inflation in the Euro Zone. Generally, a high reading anticipates a hawkish attitude which will be positive (or bullish) for the EUR, while a low reading is seen as negative (or bearish).

The Gross Domestic Product released by the Eurostat is a measure of the total value of all goods and services produced by the Eurozone. The GDP is considered as a broad measure of the Eurozone economic activity and health. Usually, a rising trend has a positive effect on the EUR, while a falling trend is seen as negative (or bearish).