- Decentraland price is forming a cup-and-handle pattern, suggesting a 50% upswing to $5.5.

- Due to the inherent nature of MANA, its share of the Metaverse is likely to increase.

- A breakdown of the $3.6 support level will invalidate the bullish thesis.

Decentraland and other metaverse tokens have seen massive growth due to the recent rebranding of Facebook. These tokens are showing strength despite the overall market showing a sightly bearish outlook. MANA, on the other hand, shows signs that a short-term upswing is likely. From a fundamental perspective, it also stands to capture a massive share of the metaverse market.

Decentraland and its role in the metaverse

After witnessing a 555% rally in just two days on the back of the Facebook rebranding, Decentraland is currently cooling off, eyeing another leg-up. But what is Decentraland or MANA?

Decentraland is a blockchain-based, fully immersive 3D metaverse that allows users to customize their avatar and purchase land in the virtual world. MANA, much like many utility tokens, is used as a currency in this metaverse.

While there are a plethora of projects in this sector, MANA takes a special place due to two reasons.

The Metaverse hype: After Facebook’s rebranding to Meta on October 28, plenty of investors like SoftBank and others allocated capital or set up funds to projects in the same genre. Even after almost a month, these tokens seem to be pumping even when the general market structure has weakened.

At the time of writing, SAND was in the price discovery phase, with MANA and ENJ closely following the trend.

Coming back to Decentraland, the token is backed by major players like Digital Currency Group, Genesis One Capital, and Fundamental Labs, all of whom have invested in the project. Digital Currency Group’s Grayscale Investment company holds 18.4 million MANA tokens worth $71.6 million.

This suggests that these investors are in it for the long haul, pointing to the fact that this sector has more room to grow. As a result, MANA could see a further spike in its market value.

-637732561913565755.jpg)

MANA Grayscale holdings chart

Working product: What sets Decentraland apart from other competitors like Axie Infinity or Sandbox is that it is the only project that is fully immersive and provides a 3D experience for its users. In contrast, other top projects are either 2D or do not have a working prototype.

While there are a plethora of projects that claim to be in the Metaverse ecosystem, they consist in just a 2D game that allows users to trade cards with their NFT collections. Take Axie Infinity, for example; the game has a total revenue of $185 million within a 2D metaverse, which is significantly underwhelming considering the scope of the burgeoning ecosystem.

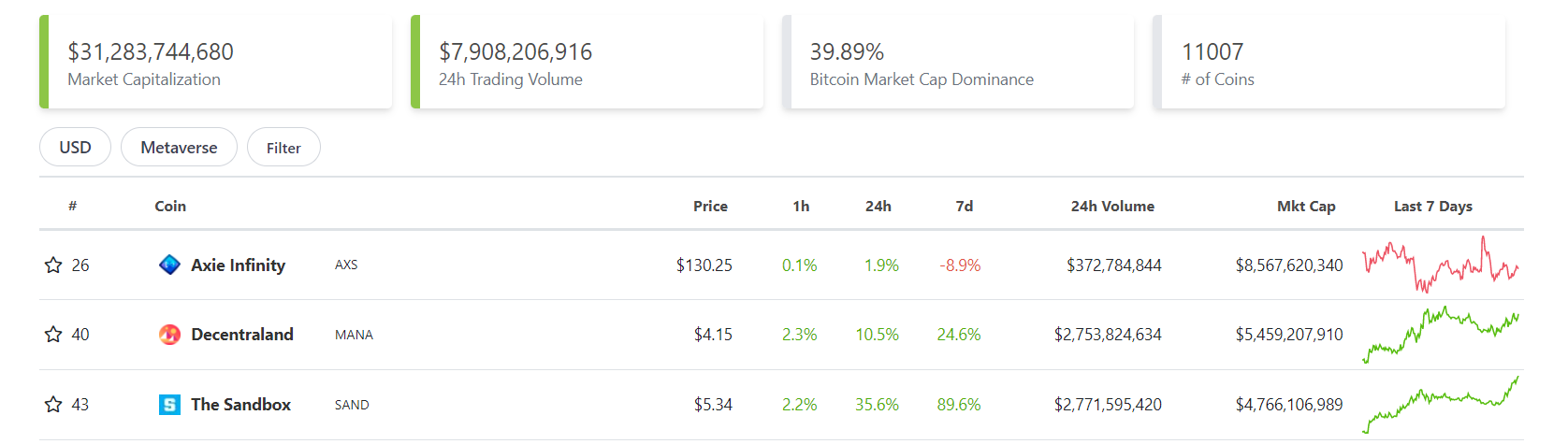

Metaverse rank chart

With a market capitalization of $8.56 billion, CoinGecko puts AXS at the top of their Metaverse coin list. At third place is The Sandbox, whose token SAND has rallied 665% although it is yet to launch a working product.

MANA, on the other hand, constitutes 17.45% of the Metaverse market capitalization share and has a 3D universe with a working model that allows users to buy land, customize it and explore the virtual landscape actively.

Due to these reasons, Decentraland is likely to capture a larger share of the Metaverse and perhaps overtake Axie Infinity for the number one spot.

MANA price looks ready for a higher high

MANA price set up a cup-and-handle pattern between October 30 and November 18. This technical formation contains two rounded bottoms. The one on the left has a steeper swing low and is known as “cup,” while the other is called “handle.”

The setup forecasts a 48% upswing to $5.49, obtained by measuring the distance between the cup’s swing low and the horizontal trend line connecting swing points of the rounded bottoms at $3.70 and adding it to the breakout point.

Decentraland breached this barrier on November 19, signaling a breakout. Since then, MANA has rallied 16% but recently retested the $3.70 support level. Going forward, investors can expect this altcoin to rally 32% from its current position at $4.11 to reach its intended target at $5.49.

Investors need to keep an eye out for a potential increase in buying pressure that might extend the upswing to the 261.8% Fibonacci extension level at nearly $7.

MANA/USDT 4-hour chart

While things are looking up for decentraland, a downswing that pushes MANA to retest the $3.70 support level will indicate a loss of buyer enthusiasm. If the bearish momentum pushes the altcoin to produce a daily candlestick close below this barrier, it will invalidate the bullish thesis by creating a lower low. In this situation, MANA price might revisit the $3.13 foothold.