Forex trading is indeed a profitable business in the financial market. However, not everyone can make money on forex trading many people suffer a heavy financial loss in the forex market. When seeking a forex broker, one of the key factors that traders need to keep in mind is risk management.

A good broker can have a strong ability in risk management. Which will help you avoid the loss.

Scoring Criteria

WikiFX gives brokers a score from 0 to 10. The higher the score is, the more reliable the broker is.

| The Scoring Criteria of Brokers on WikiFX |

| License index: reliability and value of licenses |

| Regulatory index: license regulatory strength |

| Business index: enterprise stability and operational capability |

| Software index: trading platform, instruments, etc |

| Risk Management index: the degree of asset security |

What is Risk Management in the forex market?

Risk Management is the practice of protecting your account and assets. Risk management includes the measurement, assessment, and contingency strategy of risk. Ideally, risk management is a series of prioritized events. WikiFX can give a certain broker a low score for its risk management if this broker does not have enough capital and good strategies to secure clients assets when an emergency occurs.

The case of Zeus Capital Markets

Sometimes, one broker has decent WikiFX scores, but it still has a lot of complaints. It is usually relevant to its capability of risk management.

Zeus Capital Markets is a typical example. Zeus Capital Markets is an online forex broker founded in 2021, it is a South African-based online forex broker that offers clients more than 60 trading products, including forex, precious metals, global indexes, and oil. According to WikiFX, it has a decent score of 6.10/10. However, recently WikiFX has received too many complaints against this broker. And we found that Zeus Capital Markets has a 0 score on its risk management.

(Source: WikiFX)

According to the above, this broker seems not to have enough capital and good strategies to secure clients assets when an emergency occurs. If you want to know more about this broker, please click this link https://www.wikifx.com/en/newsdetail/202207121754127116.html

Leverage

Choosing suitable leverage can significantly reduce the possibility of losing money. Understanding and controlling the leverage is the fundamental thing for your trading success. Some brokers, such as Exness, offer traders extremely high leverage of up to 1:Unlimited. And some other brokers, such as HotForex, offers leverage up to 1:1000. Those brokers with high leverage are not suitable for inexperienced traders and newbies to invest in. Traders need to keep in mind that high leverage can amplify the benefit as well as loss. if they want to avoid the potential risks.

Stop-Loss Orders

Stop-loss orders can protect your accounts and funds by minimizing loss. You need to use stop-loss orders when trading. When you realize that the trading process is abnormal, you need to cut the loss immediately. Because an unexpected emegency could have the market ripping against you rather quickly, it is necessary for traders to use stop-loss order.

Choose an appropriate broker

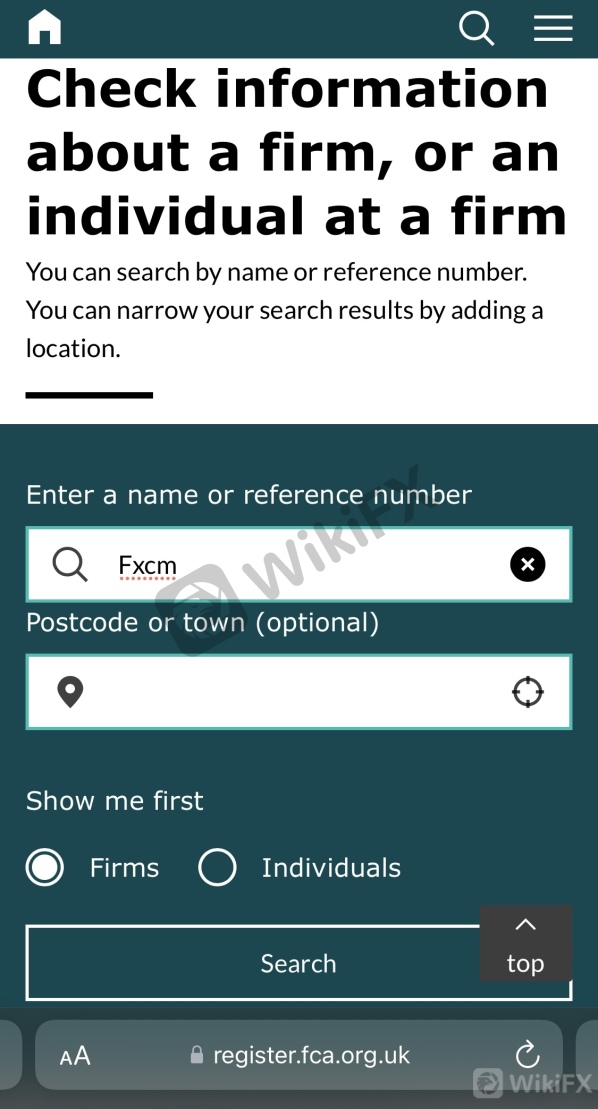

When we seek a broker on WikiFX. We need to check if this broker is regulated. You can mitigate the risk by choosing a regulated broker with a good reputation. Usually, the broker that has a high WikiFX score is more trustworthy than those that have low scores. However, it is also important for traders to check if there are complaints related to this broker by clicking the “Exposure” button. After all, the feedback from other traders is an excellent reflection of this brokers reputation.

Conclusion

You can open the website of WikiFX(https://www.WikiFX.com/en) or download the WikiFX app(https://www.wikifx.com/en/download.html) to check certain brokers Scoring Criteria by yourself. WikiFX gives you a direct view of what one certain broker looks like. After all, WikiFX can help you find a good broker that has a strong ability in risk management. which will help you avoid the loss significantly.