- XRP price looks to rally 30% to $0.784 after a 34% crash on June 21 and 22.

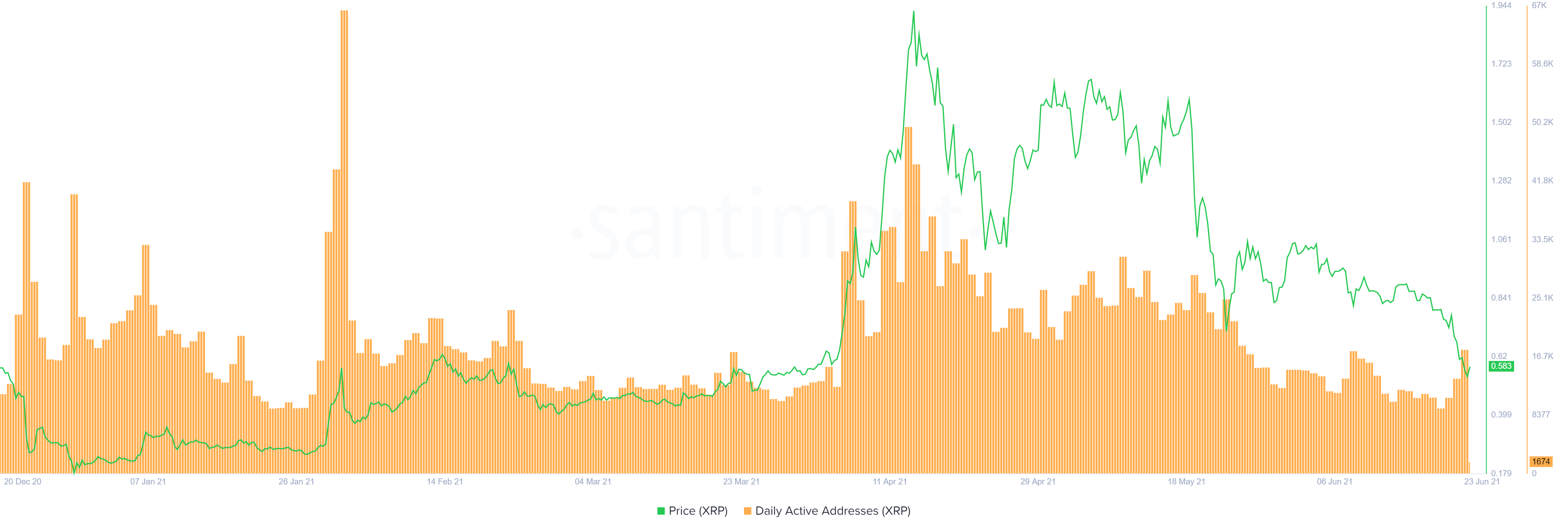

- An increase in daily active addresses paints a bullish picture, adding a tailwind to the bullish thesis.

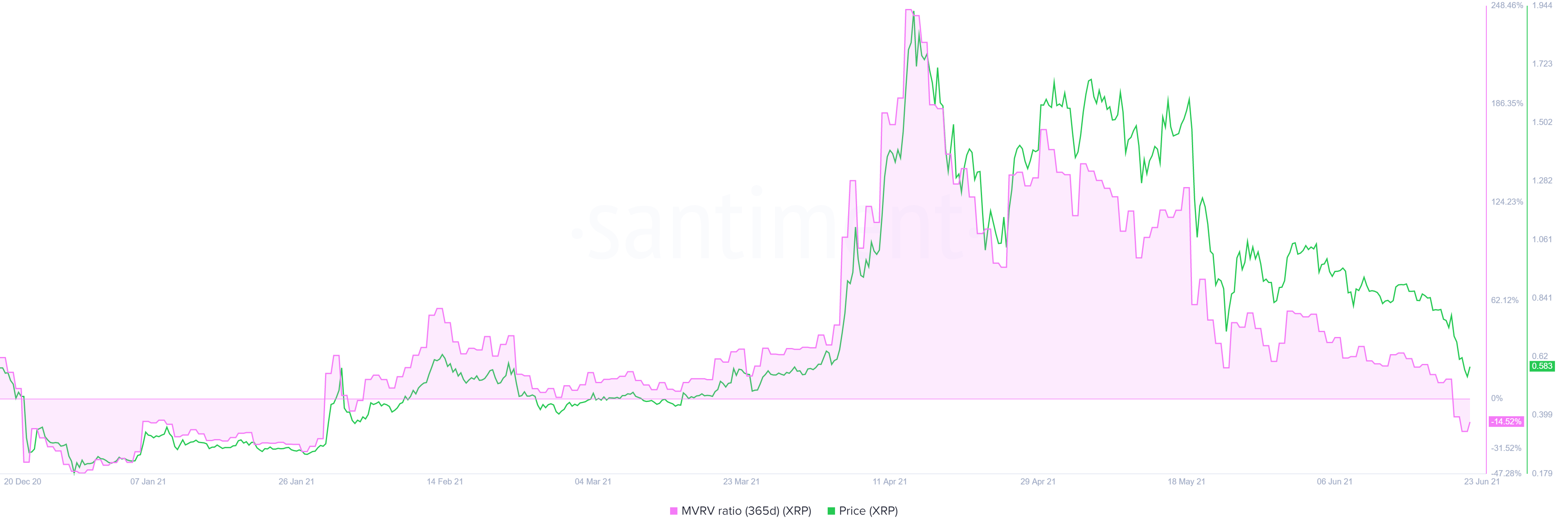

- The reset of 365-day MVRV further strengthens the uptrend narrative.

XRP price witnessed a massive sell-off as Bitcoin price retested the May 19 sell-off. After setting up a bottom on June 22, Ripple looks to rally to a crucial resistance level.

XRP price attempts an upswing

XRP price crashed roughly 40%, breaking through the May 23 swing low at $0.703. This massive sell-off formed a bottom at $0.509 on June 22 and has pushed Ripple up by 17% so far. This uptrend is likely to continue to $0.784, nearly a 30% gain from the current position, $0.593.

The immediate resistance barrier at $0.643 will be the first significant blockade that has to be overcome for a persistent rally. Breaching this level will propel XRP price to its intended target at $0.784.

XRP/USDT 4-hour chart

Supporting this bullish thesis is the increase in daily active addresses from 9,355 to 17,743 from June 19 to June 22. This 90% uptick represents that investors interacting with the XRP blockchain increased, indicating a potential “buy the dip” mentality.

XRP daily active addresses chart

Further adding a tailwind to the potential upswing is the 365-day Market Value to Realized Value (MVRV) model, which has dipped below the zero-level after 138 days. This fundamental index is used to measure the average profit/loss of investors who purchased XRP in the past year.

Currently, the 365-day MVRV is at -13.54%, suggesting that the short-term traders are selling, allowing the long-term holders to accumulate. Since XRP is moving to strong hands, this transfer is an optimistic sign.

XRP 365-day MVRV chart

While the two on-chain metrics described above point to a bullish outlook, failing to slice through the resistance level at $0.643 will indicate weak bulls and might trigger a bearish outlook.

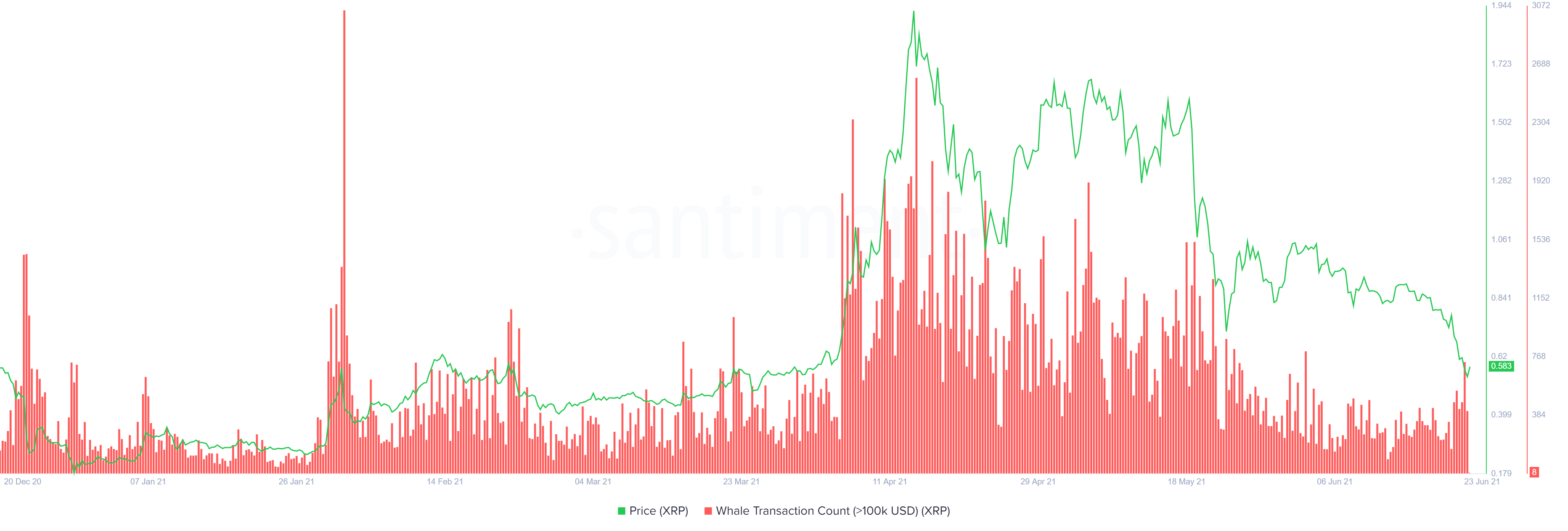

Adding credence to a potential bearish outlook are large transactions worth $100,000 or more, which rose from 722 to 1,615 between June 20 to June 22.

This 123% increase suggests that whales might be looking to reallocate their funds or book profits, which is a grim outlook for the resurgence of XRP price.

XRP large transactions chart

Therefore, a rejection at $0.643, followed by a breakdown of the recent swing low at $0.509, will invalidate the bullish thesis. In such a case, XRP price is likely to slide 6% to the immediate support level at $0.475.