Axiance is an online trading brokerage owned by ICC Intercertus Capital Ltd, based in Cyprus, holding a CySEC license. This, per se, gives traders some sort of security for their funds.

However, the firm has recently established two offshore entities in Seychelles and Mauritius. This is a bit concerning, knowing that offshore jurisdiction has loose regulators belonging to the Tier3 zone. Therefore, we have done a detailed Axiance review to inform you what you can expect.

To add to the foregoing, we strongly advise you to ignore brokers such as Proforbex, Gamma Capitals, and Martyn Services.

| Broker status: | Regulated Broker |

| Regulated by: | CySEC, FSA Seychelles, FSC Mauritius |

| Scammers Websites: | axianceeu.com axiance.com |

| Blacklisted as a Scam by: | N/A |

| Owned by: | ICC Intercertus Capital Ltd Aerarium Limited |

| Headquarters Country: | Cyprus Seychelles Mauritius |

| Foundation year: | 2016 |

| Supported Platforms: | MT4, MT5 |

| Minimum Deposit: | 100 USD |

| Cryptocurrencies: | Available – BTC, ETH, XRP |

| Types of Assets: | Forex, commodities, indices, shares, cryptocurrencies, futures |

| Maximum Leverage: | 1:500 |

| Free Demo Account: | Available |

| Accepts US clients: | No |

Is Axiance a Regulated Broker or Offshore?

Long story short, Axiance is both a regulated and an offshore broker. The main company was registered in Cyprus in 2016 and holds a CySEC license. It means that EU clients are entitled to ICF – compensation fund covering up to 20,000 EUR if a company goes bankrupt or any other issue arises. In addition, there’s negative balance protection; the company keeps customers’ funds in segregated accounts, etc.

However, the brokerage has two offshore entities under Aerarium Limited, registered in Seychelles and Mauritius. While these islands have regulators, FSA and FSC provide loose protection. There are no compensation funds, negative balance protection is not guaranteed, and other risk management tools, such as leverage limits, do not apply.

On top, the UK FCA ordered EverFX (the previous name of Axiance broker) to stop offering services to UK residents. Maybe this was the reason for rebranding and name change?

Since the company has a discretionary right to assign customers to any entity, we consider opening an account with Axiance a risk.

What Do Traders Think Of Axiance?

The majority of Axiance reviews show positive experiences with this trading firm. However, the negative reviews refer to offshore entities and the issues clients have faced with them. Since there’s no way for them to seek assistance from the FSA or FSC, these customers have nothing left but to try to get their funds back by dragging attention by writing reviews.

If you experience any issues with the firm, ensure to report them immediately.

Is Axiance a Trustable Broker?

Axiance is a Forex and CFD trading provider registered in Cyprus and licensed by CySEC. In addition, the firm has two offshore entities, regulated and registered in Seychelles and Mauritius.

Axiance Offers MetaTrader4 and MetaTrader5 – Available Trade Software

One great thing about Axiance broker is certainly what their trading platform offers. Customers can choose between MT4 and its successor, MT5. Both software have terrific features, support social trading and automated trading, and enable the application of any trading strategy. The interface is fully customizable, and one can really enjoy their trading experience with MetaTrader.

Regardless of the platform, there are still concerns regarding Axiance and its offshore entities.

Trading Platforms For Mobile

Both MetaTrader platforms come with a dedicated mobile app for Android and iOS. This is a great feature, as you can check your trades on the go. The link to download both versions can be found on the broker’s website.

Axiance Accounts Overview

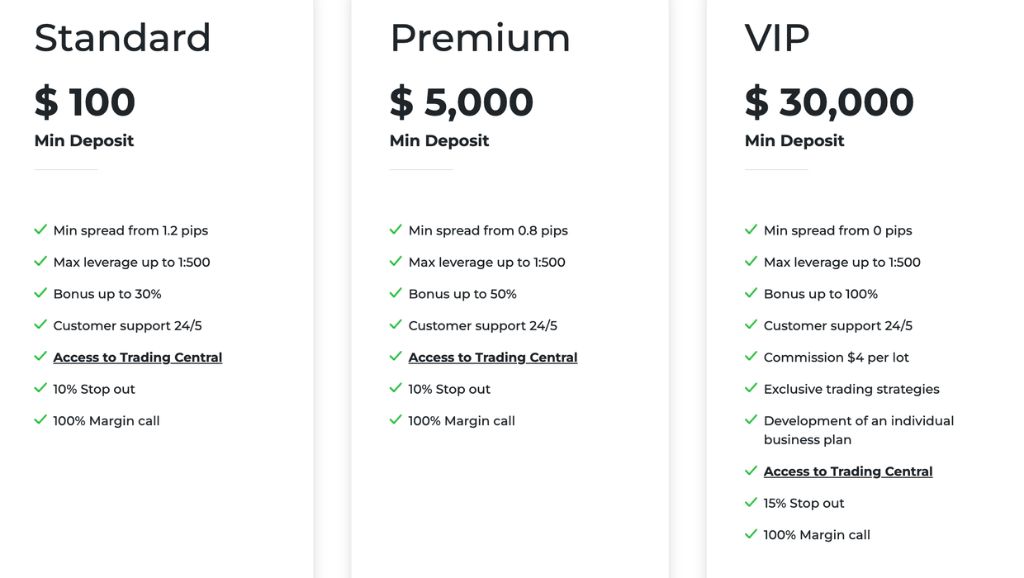

Axiance offers a rather poor choice, with only 3 account types.

While bonuses are banned in the EU and other jurisdictions, Axiance offers them. We’re unsure whether it’s only for an offshore entity or both, but you should suspect any incentives as they never come free.

Please remember the names of the HubbleBIT, Fx24trade, and CryptoHold and stay away from them! Before investing, always check the history of online trading organizations!

Can I Try to Trade With a Demo Account?

Axiance Demo account is enabled for all who want to test the broker system. However, there’s a slight issue. You need to speak to broker employees to get access to a Demo account. They will most likely work on persuading you to invest instead, which is never a good option.

Axiance Broker – Countries Of Service

The broker is mainly present in:

- UK

- Spain

- Germany

As we have already explained, the company has been ordered to stop operating in the UK, so this raises a red flag.

Axiance Range of Trading Markets

Customers can choose between a wide range of trading instruments, including:

- Forex – EUR/USD, AUD/CAD, GBP/CHF

- Commodities – natural gas, oil, gold

- Indices – AUS200, DAX30, CAC40

- Shares – Amazon, Tesla, Alibaba

- Cryptocurrencies – ADA, MATIC, SOL

- Futures – Dow Jones, NASDAQ, US30

What Trading Terms Does Axiance Offer?

Here we come to the main issue in regards to entities. Trading terms differ based on the fact whether you’re registered with a CySEC-regulated part of the company or an offshore one. The leverage is significantly higher with the offshore entity, making your trading risky. Here’s what you can get.

About Leverage, Spread, and Swaps

The spread starts at 1.2 pips for the Standard account and can be considered quite solid. The swap starts from $0.6 per lot. The leverage goes up to 1:500 for offshore entities and 1:30 for Cyprus-based. It means that those assigned to an offshore branch have no risk management or any kind of protection.

Axiance Funding and Withdrawal Methods

Axiance’s minimum deposit is $100, which is quite solid. The minimum withdrawal amount is $50, and withdrawals are fee-free. According to the T&C, processing the request takes one business day. However, we were the most shocked by the clause in the Costs&Charges Policy. According to it, the company has the right to charge a $150 investigation fee if a customer requests a chargeback. We’re sure this is far from legitimate in any jurisdiction.

Methods of Payment

The only accepted payment method is credit/debit cards. Customers can deposit a maximum of $30,000 per transaction, and the same amount stands for withdrawals.

For a regulated broker, this is a relatively poor choice. Typically, licensed companies ensure they offer a wide range of methods, including wire transfer, PayPal, Skrill, and Neteller.

What Should I Do If I Lose Money With Axiance Broker?

You can contact our chargeback specialists if you lose funds due to issues with Axiance broker. They will be happy to look into your case and determine whether you can file a dispute. Book your free consultation today to ensure the best service.

But What Is A Chargeback?

This is a way for your bank to recover the funds directly from the merchant. To do so, you need to provide sufficient evidence. Contact us via online chat, and let’s start the process.