If you saw that Focus Markets is ASIC-regulated and thought you’re in the right place, it’s time for you to learn the truth. This bogus trading firm has a nice, deceiving website but cannot hide the facts. We will present all the information about the firm in our detailed Focus Markets review.

In top of that, we seriously recommend you not to invest in the fake brokersGarantio Finance,Geneticrypto, andGreen Capitalz.Do not trade with these unlicensed brokers if you want to save your money!

| Broker status: | Unregulated Broker |

| Regulated by: | Unlicensed Scam Brokerage |

| Scammers Websites: | focusmarkets.com |

| Blacklisted as a Scam by: | N/A |

| Owned by: | Focus Markets LLC |

| Headquarters Country: | Saint Vincent and the Grenadines |

| Foundation year: | 2021 |

| Supported Platforms: | MT4, MT5 |

| Minimum Deposit: | N/A |

| Cryptocurrencies: | Available |

| Types of Assets: | Forex, commodities, indices, shares, cryptocurrencies |

| Maximum Leverage: | 1:1000 |

| Free Demo Account: | Yes |

| Accepts US clients: | Yes |

Is Focus Markets a Licensed Broker?

Focus Markets claims to be a brand of Focus Markets Pty Ltd, registered and regulated in Australia. In addition, the broker said to have an offshore entity in Saint Vincent and the Grenadines, owned by Focus Markets LLC. Since we know this notorious company as an owner of Place a Trade scam, we suspected Focus Markets’ information honesty.

Upon checking the ASIC website, we discovered that Focus Markets Pty Ltd operates under two business names – Place a Trade Group and Anzo Capital Group. Both of these firms have offshore clones, one of them being owned by the same owner, Focus Markets LLC, and blacklisted in Spain, Italy, and Belgium.

Now it’s clear that Focus Markets is nothing but a bogus attempt of an investment firm.

How Unsafe Is An Unlicensed Broker?

Unlicensed brokers, especially those pretending to be legitimate, are pretty dangerous. A customer believes in dealing with a legal trading broker until the firm shuts down the domain and vanishes with funds.

Is Focus Markets a Trustable Broker?

Focus Markets is not a legitimate trading firm. Despite false claims, this is an offshore brokerage whose owner is blacklisted in Spain, Belgium, and Italy for fraudulent activities.

Traders’ Experiences With Focus Markets

Reviews about brokers mostly negative, focusing on the broker’s unregulated status. Numerous traders learned too late that they have been dealing with offshore fraud and that they’re not protected by any compensation fund.

If you have withdrawal problems with the trading company, let us know immediately.

Trading With Focus Markets on MetaTrader 4 and MetaTrader 5

Allegedly, the firm offers to trade on MT4 and MT5. If it’s true, it’s terrific. However, this information is impossible to confirm. Once you try to register an account, you will be left to wait for approval from the company’s employees, then make an initial deposit. Only then will you be given access to a trading platform. Or so you’re told.

Since we are unsure if there is a trading platform and which one it is, we advise you to stay away from Focus Markets trading fraud.

Focus Markets Accounts Overview

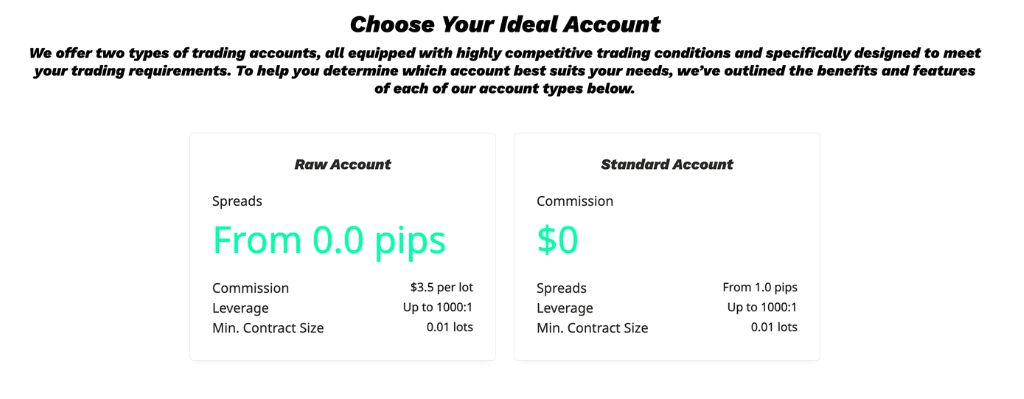

The firm offers 2 accounts:

- Raw Account

- Standard Account

As you can guess, the main difference is spread starting from 0 pips on the Raw account and 1.0 pips on the Standard one. Besides, the Raw account has a commission of $3.5, while both accounts have the same leverage of 1:1000. The minimum deposit is not disclosed for any of the account types.

Focus Markets Broker – Countries Of Service

According to our research, the broker mainly operates in:

- US

- Australia

- Japan

- UK

- Germany

- Canada

Also remember the names of theBullCFDs,Invest Union LTDandInvesting Dreamtrading scams and avoid them at all costs! Moreover, always check the background of online trading companies before investing!

Focus Markets Range of Trading Instruments & Markets

The broker customers can trade in all major markets, including:

- Forex – EUR/USD, GBP/USD, JPY/CAD

- Commodities – gold, silver, oil

- Indices – Dow Jones, NASDAQ, FTSE100

- Shares – Amazon, Apple, Google

- Cryptocurrencies – BTC, XRP, ETH

Note that this information cannot be verified without access to the platform.

What Trading Terms Focus Markets Provide?

Trading terms mainly depend on the account type. If you choose the Raw account, you will have no spread but a $3.5 per lot commission. On the other hand, the Standard account brings 1.0 pips spread and no commissions.

About Leverage

As aforementioned, both account types have a leverage of up to 1:1000. This is another proof that the broker is unregulated. According to ASIC, the maximum trading leverage is 1:50, with the exception of experienced retail traders. However, even they are not entitled to 1:1000 since it’s highly risky.

Deposit, Withdrawal Methods, And High Fees

According to T&C, customers can deposit using:

- Debit/credit cards

- BitWallet

- POLi

- Wire transfer

However, the website is full of explaining the pros of crypto investing. Digital coins are a favorite tool of scheme brokers. Crypto transactions are virtually untraceable, and you cannot request a chargeback, so they have numerous benefits for fraudulent firms.

In addition, the company charges some hefty fees for withdrawals, 50 units for wire transfers, and 25 units for cards and e-wallets.

Welcome and Сredit Bonuses – A Fraudulent Method

Once you look at the website, you will notice an ad stating that you can get up to a 50% deposit bonus or $2,000 credit. This is just a lure to prevent you from withdrawals. The T&C don’t give precise information about the minimum trading volume before you’re eligible for a withdrawal, meaning that broker employees can decide on it and constantly change their requirements.

You should know that major regulators, among which ASIC, prohibited bonuses and other incentives.

Scammed by Focus Markets Broker? – Let Us Hear Your Story

If you fall victim to the Focus Markets trading scam, it’s not the end. Our chargeback specialists may be able to assist you with recovering your funds.

But What Is A Chargeback?

This is a way for your bank to get the money back directly from the merchant. Contact us via online chat to book a free consultation, and let’s see if we can help you get your hard-earned money back before the firm vanishes.