Do not let the polished and comprehensive website fool you! There’s a lot of trickery behind it and the TIQ FX Review plans to expose all of it. We’re dealing with a dangerous broker that hides far away on an island along with an entire flock of scammers. Let’s not waste any more time!

On top of that, we seriously recommend you not to invest in the fake brokers Capital Whale, Gain Trade, and Forex Treasures. Do not trade with these unlicensed brokers if you want to save your money!

| Broker status: | Unregulated Broker |

| Regulated by: | Unlicensed Scam Brokerage |

| Scammers Websites: | tiqfx.com |

| Blacklisted as a Scam by: | N/A |

| Owned by: | TIQ FX LLC |

| Headquarters Country: | St. Vincent and the Grenadines |

| Foundation year: | 2021 |

| Supported Platforms: | MT5, WebTrader |

| Minimum Deposit: | 250 USD |

| Cryptocurrencies: | Yes – Bitcoin, Litecoin, Ethereum (10 in total) |

| Types of Assets: | Forex, Metals, Indices, Stocks, Commodities, Crypto |

| Maximum Leverage: | 1:500 |

| Free Demo Account: | Available |

| Accepts US clients: | No |

The Truth About Regulation TIQ FX

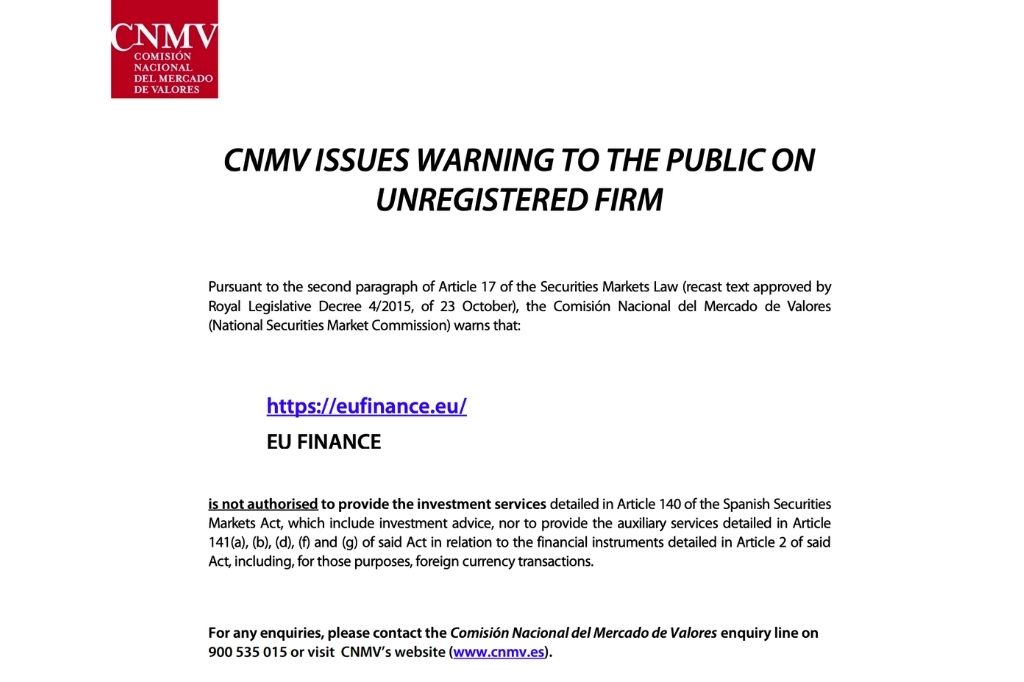

A lot of falsehoods and lies were told on the website of our unscrupulous broker known as TIQ FX. The foregrounded lie is that the broker is regulated. Allow us to explain.

The fraudster claims to be owned by TIQFX LLC, based in St. Vincent and the Grenadines (SVG) and licensed by the International Financial Services Commission (IFSC). However, the jurisdiction of the IFSC is Belize, also located in the Caribbean Sea. It seems TIQ FX really likes its neighbor.

Furthermore, SVG is an infamous scam haven because of its favorable laws and tax system. This den of thieves does have a financial market regulator, the Financial Service Authority (FSA) but the institution unambiguously stated it does not license Forex trading.

All that being said, it’s clear as day that we’ve got ourselves an unauthorized offshore broker that wants nothing more than to defraud you and steal your money.

Why Is Trading On a Licensed Broker’s Platform Preferable?

We warned you about TIQ FX but the same applies to most offshore providers. Instead, find a trustworthy broker that is regulated by Tier 1 authorities such as the FCA, ASIC and BaFin. We checked the websites of these regulators and found nothing on our shady entity.

So Is TIQ FX a Decent Broker or a Scam?

TIQ FX is an unregulated offshore provider based in SVG. The broker has no license and everything it offers from the trading platform to conditions is risky.

What Platform Does TIQ FX Provide?

This is where the fraudulent broker could get the upper hand and that’s why it’s crucial to address this. TIQ FX claims to offer Meta Trader 5, the best trading software in the world, and surprisingly, it does.

However, this is to be taken with a pinch of salt because scammers can indeed get their hands on this platform. Due to the lack of regulation, there’s no guarantee that this software is not being manipulated. A legit trading platform goes hand in hand with a true license but without it, it is meaningless.

Furthermore, the broker also offers WebTrader. Yet, the demo account for it belongs to another provider, Exclusive Capital.

Trade on Mobile – Mobile App For iOS and Android

There are links to mobile versions of MT5 but they lead you to the Google Play online store. It seems that TIQ FX wanted to confuse people with this. Judging by the reviews and comments on that page, MT5 has not quite adapted to mobile trading so that’s another thing to keep in mind.

TIQ FX – Countries Of Service

After doing extensive research, we’ve gathered key information that could alert potential victims before TIQ FX strikes. The financial swindler mainly targets people from

- Netherlands

- Germany

- Cyprus.

The latter two have very strict regulations in place that would never allow such shady conduct. So, beware of this awful scheme!

What is more, we strongly advise you not to invest in GP Finance, ProgresiveTrade and Bullden fraudulent brokers.

TIQ FX Trade Range of Trading Markets

According to the website, here’s what TIQ FX says it offers:

- Forex pairs – EUR/USD, GBP/USD…

- Metals – gold & silver;

- Indices – AUS200, UK100, EU50…

- Commodities – natural gas, brent oil, coffee…

- Crypto – Bitcoin, Ethereum, Litecoin…

- Stocks – Google, Apple, Amazon…

That’s all nice but we found the exact same table on more than one website. Namely, it seems it’s a common table that SVG providers use. Therefore, nobody guarantees that you’ll get to trade all that.

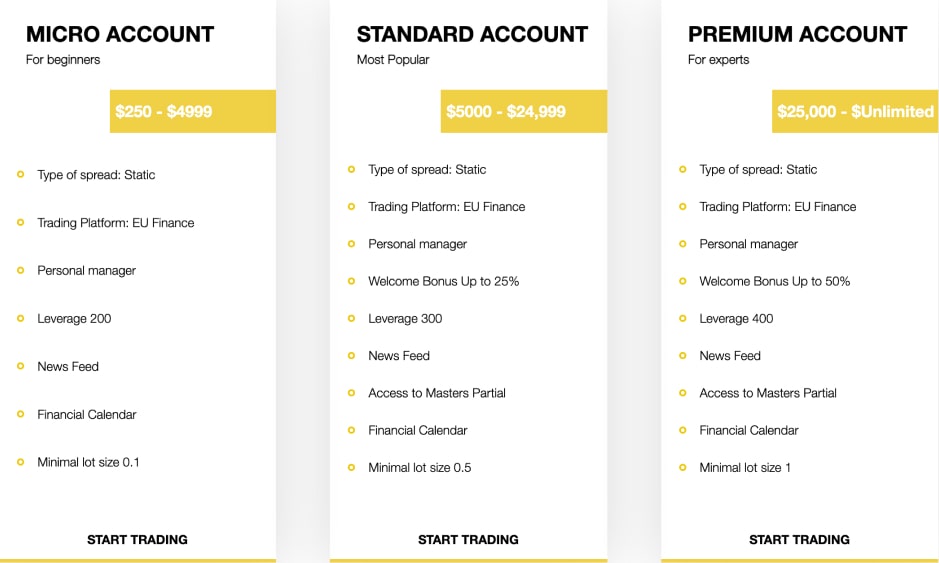

What Do We Know About TIQ FX Account Types, Leverage and Spreads?

There are three available account types:

- Gold – $250, a spread of 1.7 pips, leverage up to 1:100;

- Diamond – $2,500, 0.0 pips, 1:500;

- Ruby – $10,000, 0.0 pips, 1:500;

As you can see, the leverage is pretty high. If you climb Mount Everest, you’ll gain glory but you risk a lot more in the process and could lose big time. The same applies to leverage. Reputable regulators limited the leverage for retail clients to 1:30. Also, 1.7 pips is unlikely to bring you any profits, it’s too wide.

Minimum Deposit, Withdrawal Terms and Fees

The payment methods that TIQ FX accepts for deposits, as well as withdrawals, include credit cards, wire transfers and a series of cryptocurrencies (Bitcoin, Ethereum, Litecoin, etc.). The minimum deposit is $250. Both deposits and withdrawals are supposedly instant. Scammers are known for preferring crypto payments because it allows them to remain anonymous.

What Bonuses Does TIQ FX Broker Offer?

First of all, top-tier regulators prohibited brokers to issue bonuses to clients. Thus, if you are offered a bonus, know you’re dealing with a fraudster. While TIQ FX does not explicitly say it offers bonuses, it does claim that you can “benefit from a high-end product with a retail price of 60 Euro per month for free by signing up and depositing with us.” Close enough.

There’s also a referral program that promises you “$1,200 for every new customer you refer,” i. e. drag into this devious scheme.

Scammed by TIQ FX Broker? – Let Us Hear Your Story

We can imagine your pain. It’s not fun at all, certainly. But it wouldn’t be right to just console you without telling you about three possible methods of getting your money back. Ever heard of a chargeback, a recall or crypto tracing?

How Do Those Methods Work?

A chargeback can reverse credit/debit card transactions. You can request it at the issuing bank within 540 days. For wire transfers, you ought to demand a recall. However, it’s only possible if the payment is pending. Thus, you must act at once!

Crypto payments can be traced to a wallet in an exchange. Once that’s done, you can request a refund from the exchange. It’s a long shot but it’s worth trying.