The strategy to be described today is the Bollinger band swing trading system. The system was designed for use on the daily charts. However, it can be used on lower time frames, provided that the candles have enough liquidity for the price-formation mechanisms to work properly.

Indicators

The indicators to be used for this strategy are:

- A) Bollinger bands indicator. This is a native trend indicator which can be deployed by clicking Insert => Indicators => Trend => Bollinger bands. There are three bands in the indicator: upper, middle and lower bands. The middle band is a 20-period moving average.

- B) A volume Indicator known as the Intraday intensity indicator. Created by David Bostian, it works like an accumulation-distribution indicator to show the balance of the market between buyers and sellers and measures accumulation and distribution between the institutional traders. The indicator has a formula, which when calculated, gives a vertical range that spans from 1 (high of the range) to 0 (middle of the range) and finally -1 (low end of the range).

Let us now see how this strategy works.

Strategy Description

How does the strategy work?

Rule 1: The Intraday Intensity indicator can be run as an oscillator.

When run as an oscillator, the Intraday Intensity indicator works as a divergence indicator as well as an overbought/oversold indicator, in which the most overbought market value is +1 and the most oversold market value is -1. The midpoint is 0. Therefore, you tend to see positive values that are above 0 and up to +1 when there is a bullish market, and you will see negative values that are below 0 and -1 when sellers are dominating the market.

The divergence trade setups are fewer to find, but more accurate.

Rule 2: The trades are done in reversal fashion

What this means is that you will look to sell the currency pairs when the price action candles have touched off the upper Bollinger band, at the time that the Intraday Intensity indicator is showing a divergence signal.

In the same vein, you look for a bounce of price action candles on the lower Bollinger band when the Intraday Intensity indicator is oversold, to produce a buy reversal signal.

In both instances, the presence of reversal candle signals at both ends of the Bollinger bands usually strengthens the signals and reduces the fake signals and error rates that could lead to trade failure. The following candlestick reversal patterns include:

- Engulfing candlesticks

- Inside day candlesticks

- Morning/evening star patterns

- Dark cloud cover/piercing patterns

Now that the rules are in place, let is look at the trade scenarios.

Long Trade

The long trade setup is as follows:

- A) Price candles touch the lower Bollinger band. Ideally, we need to see a two-candlestick reversal pattern such as a bullish engulfing, morning star, piercing pattern or inside day candlestick pattern.

- B) At the same time, the modified Intraday Intensity histogram is showing a positive divergence, i.e. showing higher lows when the price is showing lower lows.

- C) The buy entry is made once the double candlestick reversal setup is complete i.e. at the open of the candle that follows the reversal candlestick pattern.

- D) Set the stop loss below the low of the candlestick pattern, and the TP can be at the middle band initially, or extended to the upper band. If the previous resistance was at the upper band, this is more likely to be a good spot to set the profit target. However, use a trailing stop once the price action breaks beyond the middle Bollinger band.

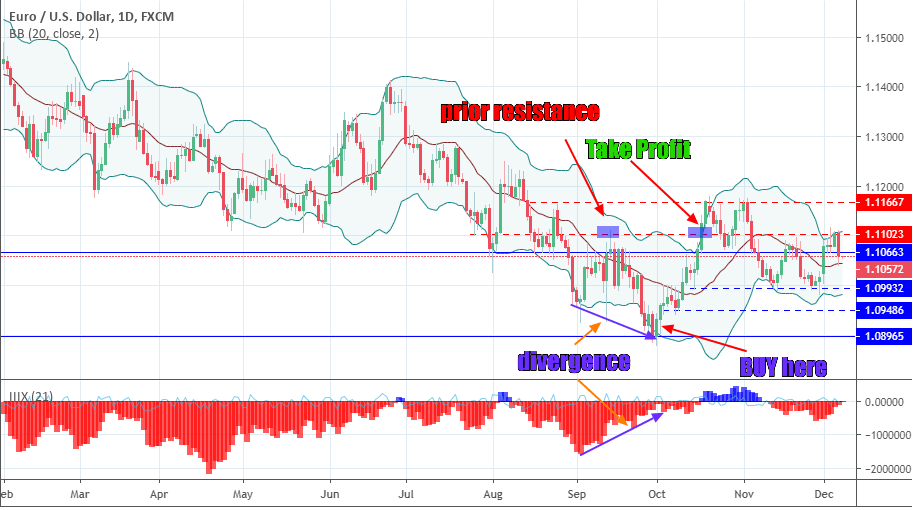

Here is the chart snapshot showing this setup.

Bollinger swing strategy: Buy Setup

Here, we can see that there was a divergence area where price was showing lower lows at the same time that the Intraday Intensity indicator was showing higher lows. The reversal candlestick pattern on the lower band was a piercing pattern. The buy trade triggered on the daily chart made it to the upper Bollinger and stalled at 1.1023. This price is where price had earlier found resistance, making it a good place to exit the trade.

Short Trade

The short trade setup is as follows:

- A) The two-candlestick reversal pattern such as a bearish engulfing, evening star, dark cloud cover pattern or inside day candlestick pattern touches the upper Bollinger band.

- B) At the same time, the modified Intraday Intensity histogram is showing a negative divergence, i.e. showing lower highs when the price is showing higher highs.

- C) The sell entry is made once the double candlestick reversal setup is complete i.e. at the open of the candle that follows the reversal candlestick pattern.

- D) Set the stop loss above the high of the candlestick pattern, and the TP can be at the middle band initially, or extended to the lower band. If a prior support was at the lower band, this is more likely to be a good spot to set the profit target. However, use a trailing stop once the price action breaks below the middle Bollinger band.

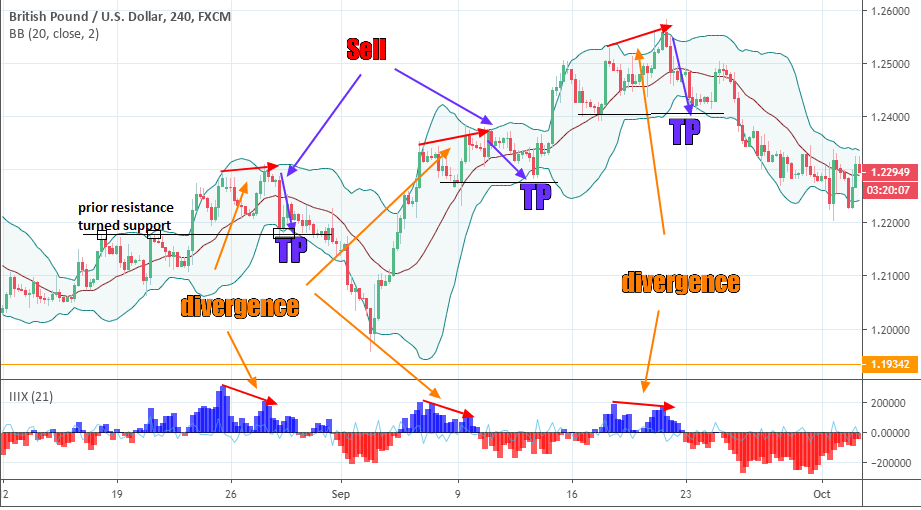

Here is the chart snapshot showing this setup.

Bollinger swing strategy: Sell Setup

This is a 4-hour chart, which shows three trade setups over the course of several days. The candlestick reversal patterns were an inside day candle (twice) and a dark cloud cover. In each of these cases, price action was able to touch off the lower Bollinger band, which in all cases, marked points of previous resistance turned support (1st entry) or prior support areas.

This strategy typically delivers 10-30 pips at a time, which is an achievable daily target considering the number of currency pairs listed on a forex platform at any given time. Practice this strategy and perfect your understanding of the setup so you can start using it to profit immediately.

Closing Note

The Intraday Intensity indicator can be found on Tradingview charts and used there with the Bollinger bands.