- At the end of May 2022, public wallets of miners held about $1.5 billion in Bitcoin.

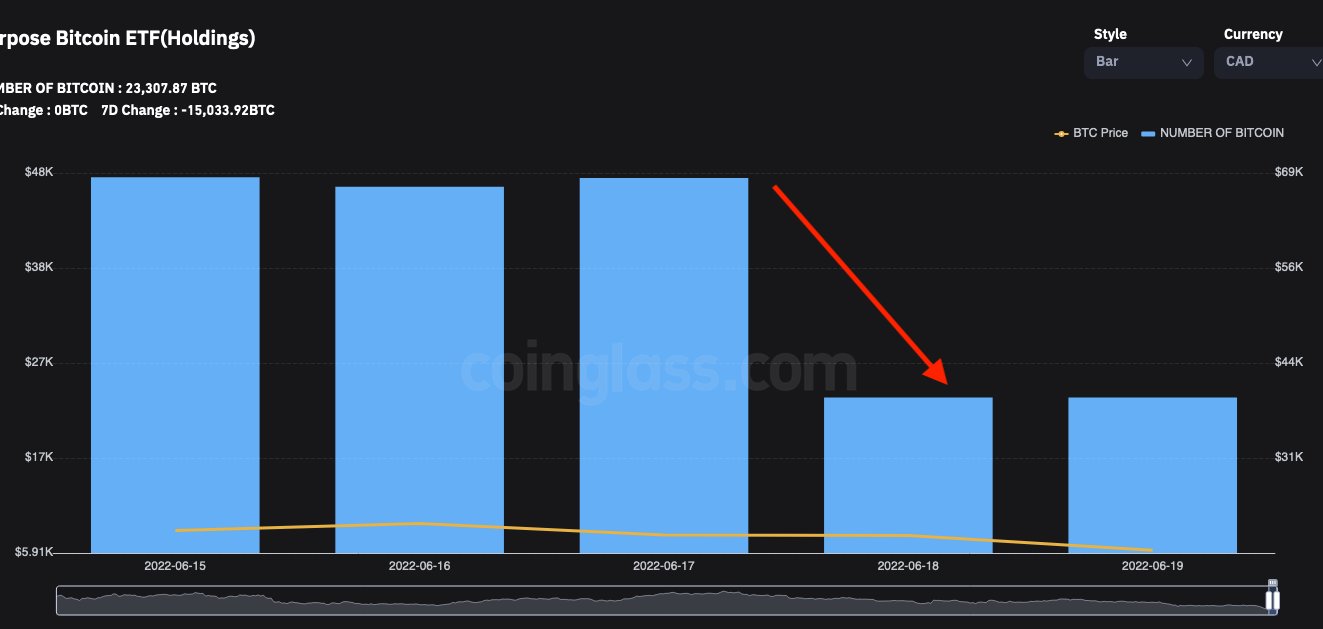

- Purpose Bitcoin ETF sold 24,500 Bitcoin on Friday, increasing selling pressure on the asset and pushing BTC to a low of $18,000.

- Leading American economist Paul Krugman argues that the recent recovery in Bitcoin price is a "dead cat bounce."

Arthur Hayes, the former CEO of BitMEX, believes forced Bitcoin liquidations have increased the selling pressure on the asset and explained the impact on BTC price. The bloodbath in crypto triggered a slew of liquidations by crypto lenders, forcing Bitcoin selling to push BTC lower.

Miners sit on $1.5 billion worth of Bitcoin

Bitcoin miners typically sell BTC to cover their operating costs. Based on data from CoinMetrics, public wallets of miners currently hold $1.5 billion worth of Bitcoin. Experts believe there is a likelihood of a BTC dump and a resulting rise in selling pressure on the asset.

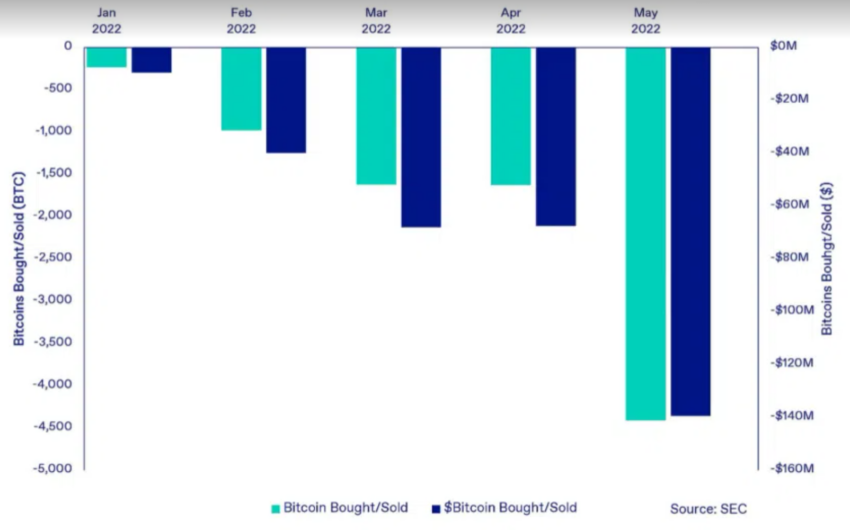

At the end of May, about 46,500 BTC were stored in the wallets of public miners, and these companies would have to sell their holdings to finance their operations. CoinMetrics has noted an increase in the sale of Bitcoin by miners over the past six months.

Bitcoin miners shed their holdings

With rising electricity prices, miners' profitability has reduced, and companies are being forced to exchange their BTC to cover operating costs.

Canada's Purpose Bitcoin ETF liquidated 50% holdings overnight

Canada's Purpose ETF is the world's first actively managed crypto ETF that sold 50% of its Bitcoin holdings overnight. The firm sold 24,500 Bitcoin on June 17, 2022, as the price plummeted to a low of $17,600 on Friday.

Arthur Hayes, the former BitMEX CEO, commented on Purpose Bitcoin ETFs BTC sale. Hayes was quoted in a recent tweet,

Smells like a forced seller triggered a run on stops. Given the poor-risk mgmt by crypto lenders and over-generous lending terms, more pockets of forced selling of BTC and ETH.

Hayes believes a sale of 24,500 BTC is a lot of physical Bitcoin to sell in a small time frame.

Purpose Bitcoin ETF sale on June 17, 2022

Hayes warned the crypto community that cryptocurrency lenders' poor state of risk management could result in more pockets of forced selling of Bitcoin and Ethereum.

Beware of the forced seller …

An interesting stat someone pointed out to me.

— Arthur Hayes (@CryptoHayes) June 19, 2022