- Ethereum price continues to consolidate after recording a new all-time high but is preparing to take off.

- There are three major reasons why ETH supply is quickly decreasing, which could propel prices higher.

- The governing technical pattern suggests that Ethereum is aiming to tag $6,300 next.

Ethereum price has been consolidating after the second-largest cryptocurrency registered a new all-time high on November 10. Although ETH has been moving sideways, a few factors suggest that the token may be preparing for a massive take-off.

Ethereum circulating supply depleting at rapid pace

Here are a few factors that are currently limiting the overall circulating supply of Ethereum, which could continue to drive ETH price higher to target bigger aspirations.

Over the past few years, Ethereum became the major player in terms of smart contract development on its network. A large majority of Ether is placed in smart contracts on the network, with nearly 27% of its supply, reaching $143 billion or nearly 32,000,000 ETH. Of the 27% of coins placed in smart contracts, 77% are locked in decentralized finance (DeFi).

ETH in smart contracts

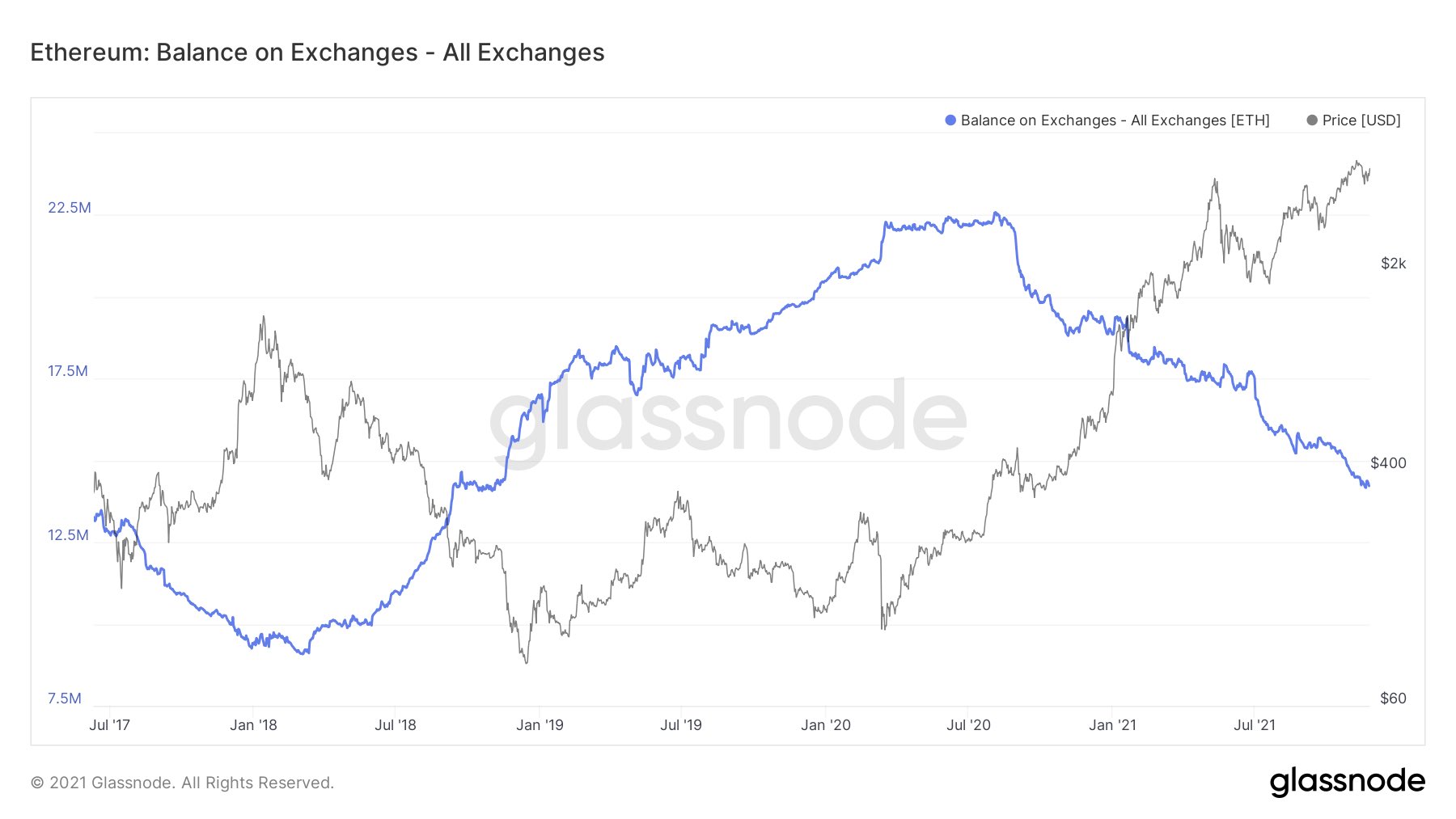

The supply of Ether on exchanges is nearly reaching a three-year low, a trend that started in late 2020. Only 12% of the total supply of Ethereum is on exchanges, down from 17.3% at the start of the year. The low balance on exchanges suggests that investors are not planning to sell, which could dry liquidity and volatility for ETH.

ETH on exchanges

The actual circulating supply of Ethereum is fairly lower than commonly believed. Over 50% of the total supply of Ethereum has not been moved in over a year. Only 20% of ETH supply has been recorded as active since October 1.

ETH HODL waves

EIP-1550, which introduced a fee-burning mechanism removed over 1 million ETH in circulation in just three months after it was initiated, resulting in nearly 1% of the total supply burnt.

Ethereum price set sights on $6,300

Both the underlying fundamentals and technicals of Ethereum point to a bullish future. Ethereum price presented a cup-and-handle pattern, with a measured move of a 58% upswing toward $6,340 from the neckline of the governing technical pattern.

While ETH sliced above the neckline at $3,971 on October 20, the token has faced challenges with reaching the optimistic target. As long as Ethereum price stays above the neckline, the bullish forecast remains on the radar.

Investors should note that Ethereum price recently reclaimed the 21-day Simple Moving Average (SMA) at $4,373 as support, adding fuel to a potential recovery. The next obstacle for ETH to overcome is at the November 16 high at $4,553, then at the November 15 high at $4,757 before attempting to reach its record high at $4,880.

ETH/USDT daily chart

If a spike in sell orders occurs, Ethereum price will discover immediate support at the 21-day SMA at $4,373, then at the 50-day SMA at $4,279. Additional foothold will emerge at the 78.6% Fibonacci retracement level at $4,211, then at the November 23 low at $4,050.