- Sales forecast to rebound to 0.8% from May’s 0.3% loss.

- All categories of Retail Sales have tumbled in the last three months.

- Real wages declined 1% in June, down 3.6% on the year.

One thing every economist agrees on is that if the US consumer stops spending, a recession is nearly inevitable.

Retail Sales have dropped sharply in the last three months. March’s gain was a robust 1.4%, that fell by two-thirds to 0.5% in April and then May unexpectedly tumbled to -0.3%. The consensus forecast was 0.2%. Sales ex-autos dropped from 2.1% in March to 0.5% in May and the control group that mimics the consumption component of GDP, sank from 1.1% to flat. Have eroding incomes forced consumers to cut back on discretionary spending as they struggle to afford necessities?

Retail Sales are forecast to rebound to 0.8% in June with the ex-autos to 0.6% and control rising to 0.3%.

If sales revive the concern over consumer spending will abate for a month. Should sales prove weak or negative, a second quarter recession will become the default scenario.

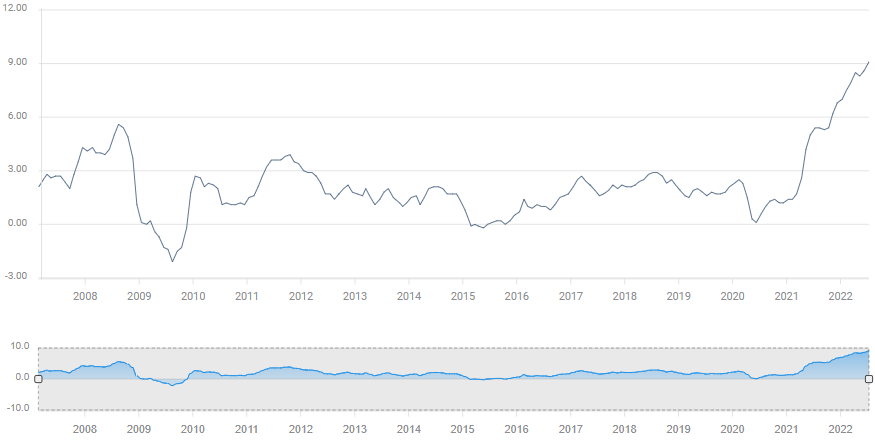

American households are losing the contest between inflation and wages. The impact is cumulative and the ledger has been in the red for 14 months.

Labor markets, inflation and real wages

Hiring is not the problem. Nonfarm Payrolls have averaged 457,000 new positions for the last six months. The number of unfilled positions has been over 11 million and the unemployment rate has been 3.7% for the period. Anyone who wants work can find it.

Wages increases have averaged 5.4% annually this year, the best gains in over a decade.

Inflation, however, has far outstripped rising income.

The Consumer Price Index jumped 9.1% in June, over the last six months it has averaged 8.3%.

CPI

fXStreet

Analysts at the Bureau of Labor Statistics (BLS) produce a gauge of inflation adjusted worker compensation. In June, this measure, real hourly earnings, dropped 1% and was down 3.6% for the year for the fifth negative month in a row.

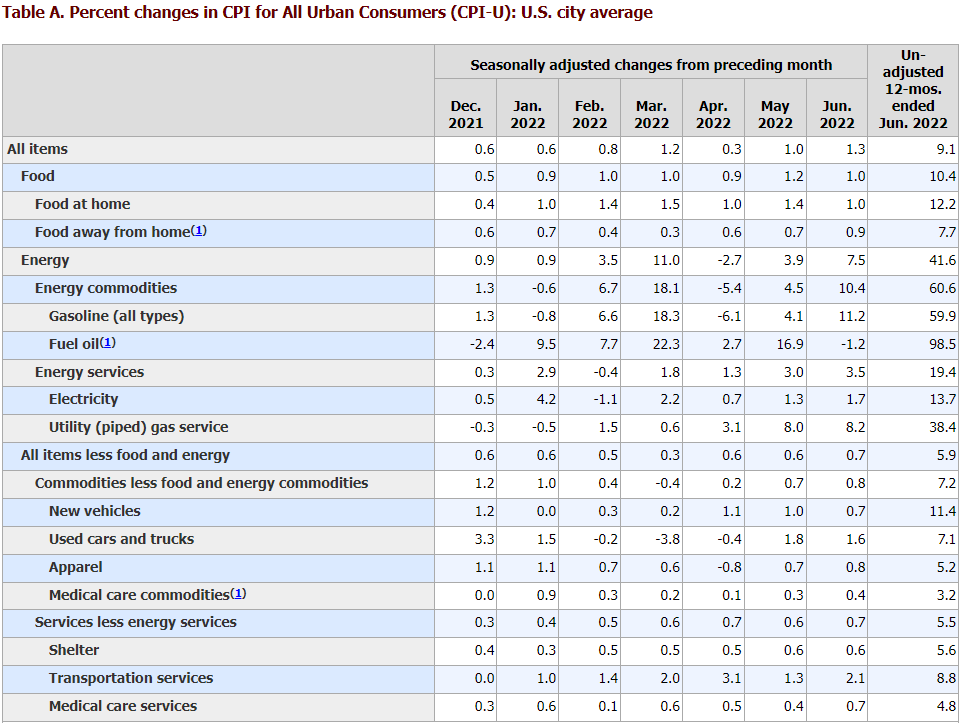

A more pressing concern for family budgets is the prices of necessities, food, housing and transportation are rising even faster than overall inflation.

Overall food prices jumped 1% in June and are up 10.4% on the year, the largest annual increase since February 1981. Food for home consumption, the largest category, jumped 1.0% in June and has soared 12.2% in 12 months.

Burean of Labor Statistics

The shelter index, which includes ownership and rentals, rose 0.6% in June and contributed about one-third of the CPI increase. For the year shelter expenses are 5.6% higher, the greatest increase in over four decades.

Energy prices soared 7.5% in June and contributed about half of the general inflation increase. The gasoline index rose 11.2% and natural gas added 8.2%. For the year auto fuel costs are 60% higher and piped natural gas has climbed 38.2%. Electricity rose 1.7% in June, 13.7% in the last year. Fuel oil is 98.5% pricier than 12 months ago. New cars were up 0.7% in June, 11.4% for the year.

For families struggling with inflation, the rocketing costs of necessities means there is less and less income left over for discretionary spending. Even for households with sufficient resources, the psychological impact is daunting, prompting saving for a worrisome future.

Federal Reserve Policy

Federal Reserve policy devolves to one question. Can the Fed continue its anti-inflation campaign if the economy begins to contract? Chair Jerome Powell has not answered the specific question, noting that a soft-landing, lower inflation with continued growth, is difficult but possible.

In the immediate term, the Fed will increase rates as long as it can, a 100 basis point hike at the July 27 meeting is a near certainty. The Bank of Canada (BoC) did just that yesterday. Beyond that horizon, the policy future is unclear.

It is difficult to see how the governors persist in raising interest rates if the US economy slides into recession in the second quarter. The Atlanta Fed GDPNow model’s latest estimate is -1.2% for last quarter’s annualized GDP. A new forecast is due after the sales numbers. If the numbers are poor, that prediction is sure to sink.

Conclusion: Market responses

The credit and equity markets will respond in a linear fashion to the Retail Sales numbers. Currency traders and the dollar could have an inverse relationship.

Results at or better than the 0.8% headline forecast will support Treasury yields. The dollar may fade as the immediate fears prompting the safety trade diminish. Equites will find relief but the overall negative economic atmosphere will not change.

Sales figures worse than forecast or negative will reverse market aspects. Treasury yields will fall, regardless of the pending 1.0% fed funds hike. Equites will assume a recession has already started and continue their descent. Paradoxically, the dollar is likely to rise as the safety-trade and fears of a global recession dominate markets.